The headlines are triumphant: “Recession Over!” they declare, as if Austria just won some grand economic battle. But scratch beneath the surface of the latest WIFO and IHS reports, and you’ll find a recovery so anemic it barely has a pulse.

The Great Non-Boom

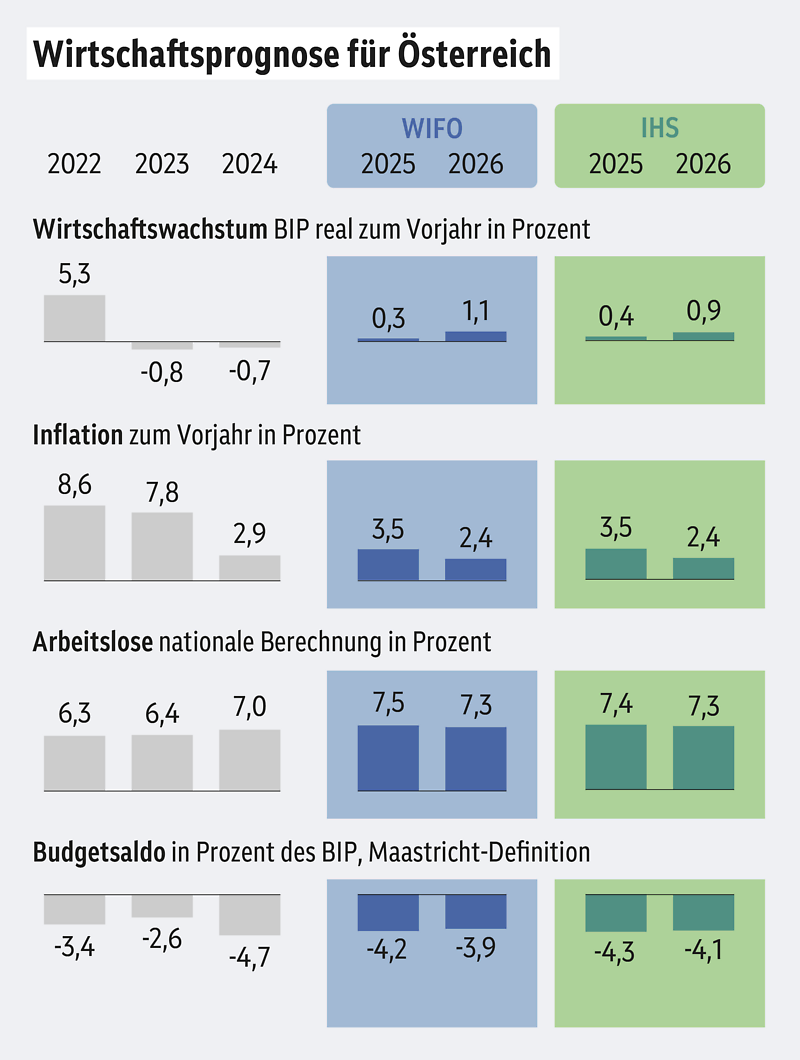

Let’s start with the “good news.” After two years of economic contraction – the longest downturn since World War II – Austria’s economy is technically growing again. The WIFO and IHS institutes have upgraded their 2025 projections from stagnation to a whopping 0.3-0.4% growth. Break out the champagne, right?

Not so fast. This isn’t so much a recovery as it is the economy simply ceasing to actively collapse. Both institutes are calling it exactly what it is: a “limp” recovery that falls “deutlich hinter früheren Erholungsphasen” (significantly behind previous recovery phases).

The Numbers Behind the Narrative

WIFO Director Gabriel Felbermayr didn’t mince words: “Das Bild ist düster” (The picture is bleak). His counterpart at IHS, Holger Bonin, agreed there’s “kein Anlass für Entwarnung” (no reason for all-clear).

Here’s the reality check:

– Real GDP per capita won’t return to 2019 levels until 2030. That’s not a recovery, that’s a lost decade.

– Inflation remains stubbornly high at 3.5% for 2025, driven by service costs and food prices that “kräftig zugelegt” (increased sharply).

– Unemployment is still rising, expected to hit 7.5% this year before maybe inching down to 7.3% in 2026.

– Budget deficit sits at around 4.2-4.3% of GDP, still well above the EU’s 3% limit.

The Structural Rot

The most alarming part isn’t the weak recovery – it’s what’s happening beneath the surface. Austria’s industrial base has been decimated, losing nearly 10% of real value added since 2019. The industrial share of GDP has dropped from 17% to just 15%.

This isn’t just cyclical pain – it’s structural decline. As WIFO economist Josef Baumgartner put it: “In der österreichischen Industrie ist ein struktureller Wandel im Gang, der sich noch verstärken wird” (A structural change is underway in Austrian industry that will intensify).

The Consumption Paradox

Here’s where it gets particularly grim. The supposed “recovery” is being driven by private consumption, not exports or investment. But this consumption comes with a dark side – it’s happening as unemployment rises and real wages stagnate after a brief period of growth.

The irony is thick enough to cut with a knife. The government’s austerity measures – like cutting the Klimabonus and suspending educational leave – are simultaneously damping the very consumption that’s supposedly driving this fragile recovery.

The EU Deficit Procedure Shadow

Lurking in the background is the EU’s deficit procedure, formally opened against Austria in July. With the deficit stuck around 4%, there’s immense pressure for further consolidation. But as WIFO projects, even by 2030, the deficit will only shrink to 3.7% – still above the Maastricht limit.

This creates a vicious cycle: weak growth requires stimulus, but high debt forces austerity, which further weakens growth. Welcome to the Austrian economic trap.

The Lost Decade Reality

What we’re witnessing isn’t a recovery in any meaningful sense – it’s stabilization at a lower level. The 2020s are shaping up to be what economists ominously call a “verlorenes Jahrzehnt” (lost decade).

For international residents watching this unfold, the implications are clear: don’t expect a return to Austria’s robust economic performance anytime soon. The structural problems – industrial decline, high energy costs, labor shortages – aren’t going away.

As Felbermayr starkly noted, between 2019 and 2029, Austria will see “null Zuwachs bei der realen Wirtschaftsleistung pro Kopf” (zero growth in real economic output per capita). That’s not recovery, that’s stagnation by another name.

The recession may technically be over, but Austria’s economic malaise has just found a new, less dramatic name.