Bitcoin just did it again. The digital asset that won’t die just smashed through the $125,000 mark, hitting $125,426 on Bitstamp before settling slightly below that psychological barrier. And in case you’re wondering – yes, that’s an all-time high in both USD and EUR.

But here’s the thing – while everyone’s popping champagne corks and screaming “to the moon”, the real story isn’t just about price. It’s about how we got here, and more importantly, whether any of this makes sense in a world where the US money supply looks like a hockey stick on steroids.

The Perfect Storm of Institutional FOMO

Let’s cut through the noise. Bitcoin’s latest surge isn’t just about retail investors hyping each other up on Telegram anymore. The big boys are playing now, and they’re playing with serious money.

BlackRock’s IBIT ETF alone now holds over 777,000 Bitcoin worth more than $90 billion. That’s not chump change – that’s enough Bitcoin to make Satoshi Nakamoto blush. The cumulative inflows into US Bitcoin Spot ETFs just crossed $60 billion for the first time ever. In one week alone, these ETFs sucked in $3.2 billion.

What’s driving this? Partly it’s the “debasement trade” – fancy Wall Street talk for “oh god, the Fed is printing money again.” With the Federal Reserve cutting rates and political pressure mounting to keep the money printer going hot, institutional investors are hedging their bets. They’re not buying Bitcoin because they suddenly believe in decentralized finance – they’re buying because they’re scared of what happens to their dollars.

The “Uptober” Effect That Won’t Die

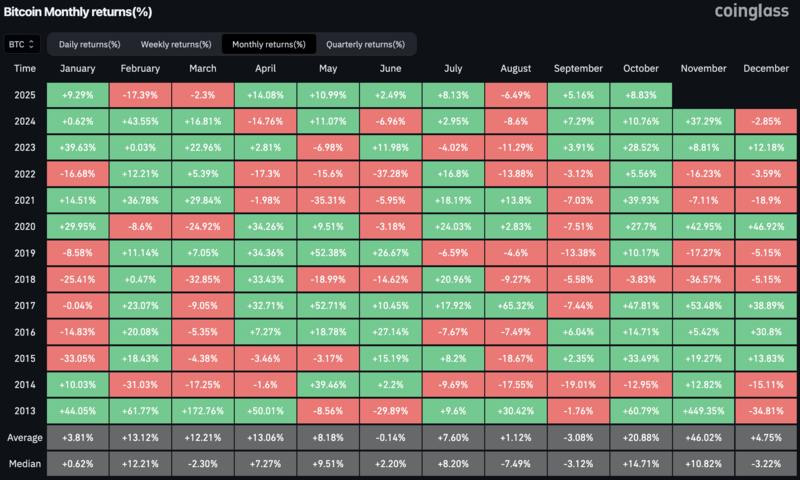

Here’s where it gets interesting. October has historically been Bitcoin’s month. We’re not talking about vague astrology-level predictions here – we’re talking about hard data. Since 2013, Bitcoin has posted gains in ten out of twelve Octobers. The community calls it “Uptober”, and it’s becoming so predictable it’s almost boring.

This October is already delivering with over 8% gains in just five days. And if history repeats itself, November – the “Moonvember” – could bring even bigger fireworks. The seasonal patterns are so strong that you’d think someone would have arbitraged this away by now. But here we are.

The Geopolitical Bitcoin Arms Race

What’s really fascinating is how this is playing out on the world stage. While your average German is still trying to figure out how to declare their Bitcoin on their Steuererklärung, countries are quietly building strategic reserves.

El Salvador started this madness, but now Bhutan, the UAE, Pakistan, Kyrgyzstan, and Kazakhstan are all piling in. Even the US under Trump created a strategic Bitcoin reserve. It’s starting to look less like a quirky experiment and more like a new form of geopolitical currency warfare.

The irony? While Germany debates whether Bitcoin should be in institutional portfolios, other countries are treating it like digital gold 2.0. Typical Germany – always fashionably late to the party.

So Is This Real Value or Just Speculation?

Let’s be honest with ourselves. Bitcoin is still the asset that produces nothing, pays no dividends, and has a real-world use case that’s still… questionable. But then again, so is gold when you think about it.

The US M2 money supply is at an all-time high, climbing faster than a politician’s approval rating during a crisis. Against this backdrop, maybe Bitcoin doesn’t need to produce anything – maybe it just needs to not be dollars.

The Greater Fool Theory is alive and well, but with central banks debasing currencies like it’s going out of style, who’s really the greater fool here?

What This Means for the Average Joe

If you’re sitting in Berlin wondering whether to jump in, here’s the uncomfortable truth: you’re already late to the party. The institutions that were calling Bitcoin a scam five years ago are now the ones driving up prices.

But here’s the thing – this isn’t 2017 anymore. The infrastructure is better, the regulatory clarity is improving (slowly, but it’s happening), and the adoption is real. The question isn’t whether Bitcoin will survive – it’s whether you’ll still be able to afford a whole one when this cycle plays out.

The volatility is still insane. One day you’re a genius, the next you’re an idiot who bought at the top. Welcome to crypto – the only investment where your emotional state swings more violently than the price.

The Bottom Line

Bitcoin at $125,000 is both a triumph and a warning sign. It’s a triumph for everyone who believed in decentralized money when it was just a weird internet project for cypherpunks. It’s a warning sign about the state of our traditional financial system when “digital gold” becomes a safer bet than actual dollars.

Is this sustainable? Probably not in a straight line. But with institutions, countries, and your grandma all getting interested, the game has changed. This isn’t just speculation anymore – it’s becoming a legitimate asset class.

Whether that’s good or bad for society is a debate for another day. For now, the only thing certain is that Bitcoin will continue doing what it does best: making everyone question everything they thought they knew about money.