That moment you check your Familienkonto and see it’s in the red for the first time? That’s not just a personal failure, it’s a national crisis wearing a sensible German disguise. The carefully constructed budget that worked perfectly last year has suddenly become worthless paper, and you’re left wondering if you accidentally moved to Switzerland instead of Germany.

The Silent Budget Massacre

One family recently discovered their meticulously planned three-account system, his, hers, and the shared Familienkonto for household expenses, had spectacularly imploded. Despite shopping “gesund aber im Angebot” at Lidl, Aldi, and Edeka, where Bio products supposedly cost “kaum Mehrkosten”, their system collapsed. The culprit? A staggering €200+ monthly increase in everyday costs that somehow slipped past Germany’s legendary efficiency watchdogs.

This isn’t just about groceries anymore. It’s about the slow erosion of financial security that happens while you’re busy following all the rules. The German approach to budgeting, with its emphasis on precision and planning, works brilliantly, until the entire economic landscape shifts underneath your carefully calibrated spreadsheet.

Why Traditional German Budgeting Fails Now

The classic German budgeting method, detailed categorization, fixed monthly transfers, and religious tracking, assumes a stable economic environment. But when inflation hits German households harder than official statistics suggest, your “effizient” system becomes a beautifully organized disaster.

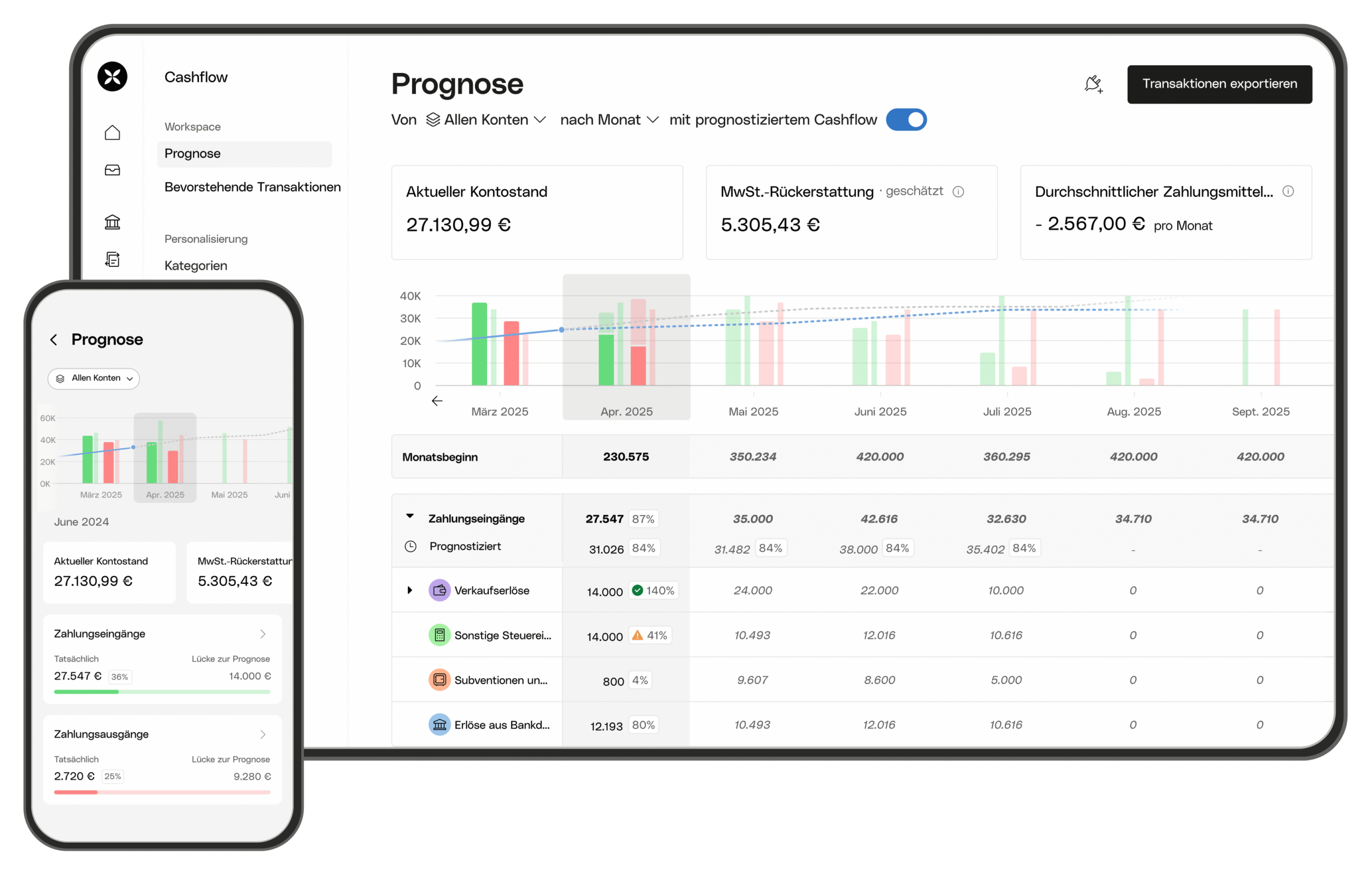

The problem isn’t your math skills. It’s that German budget planning traditionally relies on historical data and predictable patterns. As the budget planning experts at Qonto point out, even business budgeting struggles when “die Zahlen des Vorjahres um allgemeine Vorgabe wie die ‘Steigerung um x %’ erhöht” doesn’t match reality anymore.

The €200+ Monthly Black Hole

Let’s talk specifics. That €200+ monthly shortfall isn’t coming from luxury spending or financial irresponsibility. It’s bleeding out through:

- Grocery inflation: Even discount chains like Aldi and Lidl have seen price hikes that make “Bio bei kaum Mehrkosten” a nostalgic memory

- Energy costs: The “Energiewende” isn’t free, and those costs trickle down to everything

- Hidden inflation: Shrinkflation where products get smaller but prices stay the same

- Subtle service fee increases: Banking, insurance, and administrative costs creeping upward

Many families report that their previously sufficient monthly contributions to the Familienkonto now require constant adjustments. The “Dauerüberweisung” that once covered everything now needs regular increases just to maintain the same standard of living.

The New German Budget Reality

So what’s the solution? Do you abandon the German approach to family finance entirely? Not quite. Instead, you need to evolve it:

1. Build in Inflation Buffers

Your budget needs breathing room. That 5% buffer you thought was generous? Double it. German economic planning has always been conservative, but current conditions demand paranoia-level preparation.

2. Track Variable Costs Aggressively

The Qonto budgeting guide recommends tracking variable expenses meticulously, but now you need to track them weekly, not monthly. Those small increases compound faster than German bureaucracy processes paperwork.

3. Question Every “Fixed” Cost

Those “Fixkosten” aren’t as fixed as they used to be. Review your insurance, subscriptions, and regular payments quarterly. German companies are quietly increasing fees, hoping your famous German efficiency means you won’t notice.

4. Implement Account Alerts

One savvy Redditor suggested setting up “Kontoalarm bei <1000€” for automatic notifications. It’s not just about avoiding overdrafts, it’s about early warning system for cost increases.

When Your Budget Isn’t Enough

Sometimes, despite perfect planning, the numbers don’t work. This is where understanding German social systems becomes crucial. For families really struggling, options like Bürgergeld exist, though navigating them requires the same patience as assembling German furniture without instructions.

The key is recognizing when “sparen” isn’t enough and when you need to adjust your expectations. As one budget crisis survivor noted, “Mir ist Qualität wichtiger ist als jeden Cent zu sparen”, but that requires accepting a higher monthly transfer to the Familienkonto.

The German Paradox

Germany’s obsession with planning and efficiency creates a false sense of security. We believe that if we follow the system correctly, everything will work out. But the current economic reality is breaking that promise, leaving families who did everything “richtig” wondering where they went wrong.

The truth is, you didn’t go wrong. The system changed, and like most things in Germany, the official communication about it arrived fashionably late. Your Familienkonto isn’t failing because you’re bad with money, it’s failing because the German economic model is undergoing a seismic shift that nobody wants to admit in public.

Moving Forward

Your budget needs to become more German, not less. That means more precision, more tracking, and more conservative planning. But it also means accepting that the old rules no longer apply and that flexibility, traditionally not a German strong suit, has become your most important financial tool.

Set up those account alerts. Review your budget quarterly instead of annually. And most importantly, stop blaming yourself when your carefully planned Familienkonto suddenly needs more input. In today’s Germany, that’s not a failure, it’s just the new normal wearing sensible shoes.