French regulators just dropped a bombshell: 359,000 individual investors bought ETFs in Q3 2025, a 45% jump from the previous year. The headlines scream about a passive investing revolution, but dig into the details and you’ll find French retail investors might be repeating classic mistakes, just with fancier products.

The Numbers That Turned Heads

The Autorité des marchés financiers (AMF, France’s financial markets regulator) reported that from July to September 2025, 400,000 individuals traded ETFs through French investment providers. That generated 1.7 million transactions, up 30% year-over-year. Even more striking: 79,000 of these investors were complete newcomers, exceeding the number of new stock investors for the first time.

This isn’t a gradual trend. It’s a surge. BlackRock’s People & Money 2025 study confirms the phenomenon, showing French ETF holders jumped 117% in 2025, the largest increase in Europe. The growth is particularly concentrated among investors under 35, who are adopting these products at unprecedented rates.

The Generational Pivot

What’s driving this? Traditional savings accounts are losing their appeal. The Livret A rate is set to drop to 1.5% in February 2026, down from 2.16% average in 2025. Meanwhile, an ETF tracking the Euro Stoxx 50 in a PEA (Plan d’épargne en actions, a tax-advantaged brokerage account) returned up to 18.63% in 2025. That’s not a typo, €1,863 net gain on a €10,000 investment.

Younger investors see these numbers and ask: why park money in a guaranteed loss to inflation when markets offer double-digit returns? The PEA’s tax advantages, exemption from capital gains tax after five years, make ETFs even more attractive compared to traditional assurance-vie (life insurance) products.

The Active Elephant in the Room

Here’s where the story gets complicated. While the media celebrates “passive investing”, the actual products flying off shelves tell a different story. According to BNP Paribas Asset Management, active ETFs in Europe grew over 60% since early 2024, while truly passive ETFs grew only 18%. Active ETFs captured nearly 7% of total ETF flows in the first seven months of 2025, up from about 1% in 2020.

JPMorgan Asset Management dominates this space with 56% market share, primarily through its “Research Enhanced Index” products, technically active management disguised as ETFs. These aren’t your simple index trackers. They’re quantitative strategies, thematic plays, and sector bets.

Many investors are piling into “speculation” or “theme” ETFs, as market observers note. The problem? They often come with higher fees and performance chasing risks. While passive ETF fees in France can dip below 0.20%, active ETFs average 0.37%, still better than traditional active funds at 1.32%, but a far cry from true passive costs.

Currency Headwinds Expose Investor Naivety

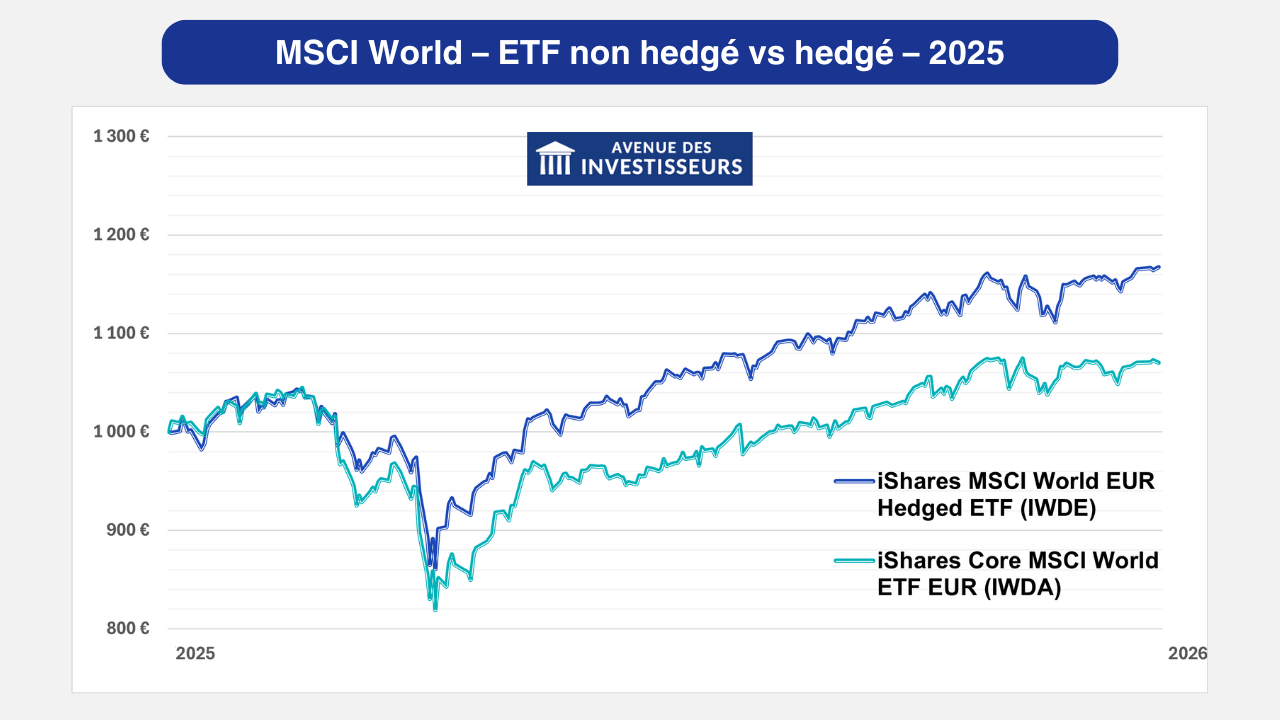

The euro’s 13% appreciation against the dollar in 2025 created a harsh lesson for new ETF investors. An MSCI World ETF returned 6.77% in euro terms, but the underlying index gained more in local currencies. Investors who didn’t understand currency hedging saw their returns artificially suppressed.

The difference between hedged and unhedged versions of the same ETF reached significant levels in 2025. Yet how many of those 79,000 new investors understood this nuance? The data suggests few asked about hedging strategies before clicking “buy.”

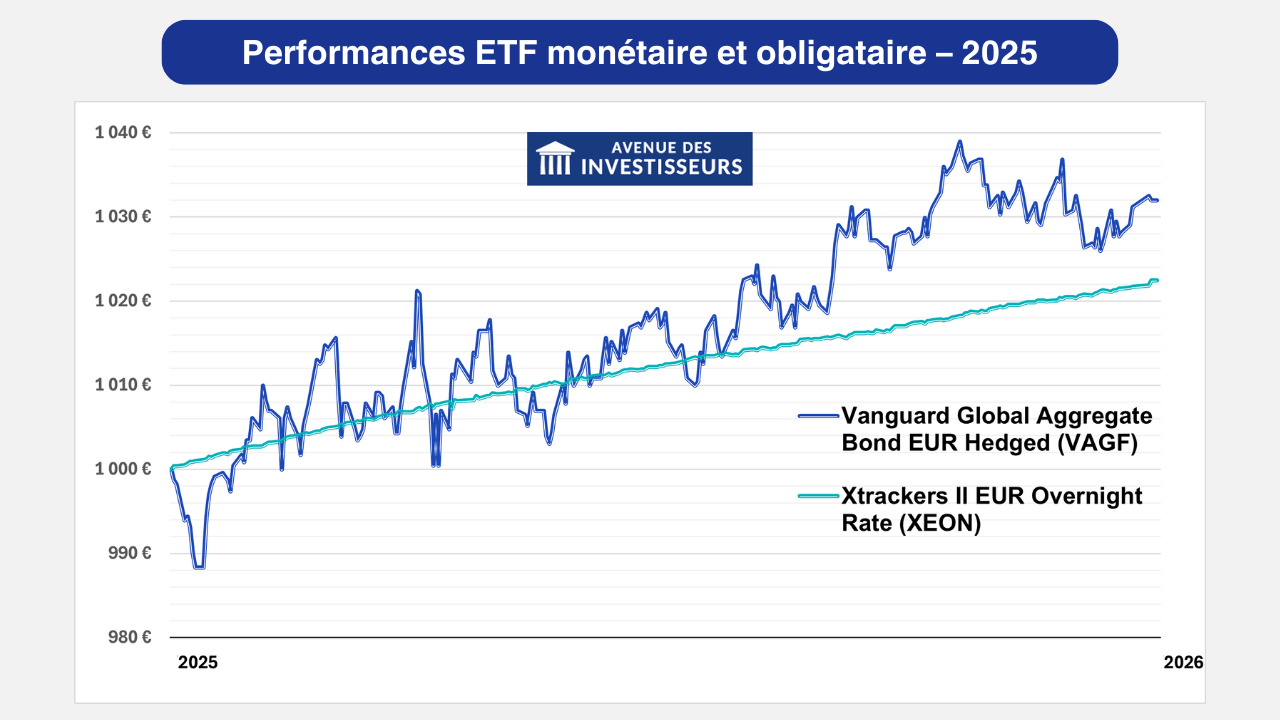

Bond ETFs: The Stealthy Success Story

While equity ETFs grab headlines, bond and money market ETFs quietly delivered solid results. An ETF tracking European bonds returned around 3% in 2025, while money market ETFs linked to the €STR (Euro Short-Term Rate) yielded about 2% with much smoother trajectories.

These products attracted institutional money first, but retail investors are catching on. As Livret A rates fall, the 2-3% available from high-quality bond ETFs starts looking attractive, especially when held in tax-advantaged wrappers.

The Fee Compression Reality Check

The good news: competition is driving fees down. Active ETF management fees fell from 0.43% in early 2022 to 0.37% in 2025. For context, that’s still 37 basis points more than many passive ETFs charging 0.10% or less.

The bad news: French retail investors often pay more than necessary. Many still buy ETFs through traditional banks rather than low-cost brokers, adding layers of custody fees and transaction costs that can exceed 1% annually.

Regulatory Tailwinds and Headwinds

The European Commission’s planned “consolidated tape”, a centralized database of trading prices and volumes, should improve price transparency and competition between trading platforms. This could further reduce costs for ETF investors.

However, France’s unique tax system creates complications. While the PEA offers excellent tax treatment for European equities, it restricts non-European ETFs. Many global thematic ETFs don’t qualify, pushing investors toward less diversified or more expensive European equivalents.

What This Means for Your Portfolio

The ETF boom isn’t inherently good or bad, it’s a tool. The key questions are:

Are you actually passive? If you’re buying thematic, sector, or “smart beta” ETFs, you’re making active bets. Own that decision.

Do you understand currency risk? A global ETF without hedging means you’re betting on both stocks and forex movements.

Are you optimizing taxes? Using a PEA for European equity ETFs can save you thousands in taxes over time compared to a regular brokerage account (compte-titres ordinaire, CTO).

Have you checked the fees? That 0.25% difference in TER (Total Expense Ratio) compounds dramatically over decades.

The Verdict

France’s ETF surge represents genuine financial democratization. Young investors embrace market-based returns over guaranteed but insufficient savings rates. The infrastructure, PEA accounts, improved broker platforms, better financial education, supports this shift.

But the growth in active ETFs, thematic products, and potential performance chasing suggests many investors misunderstand what made passive investing successful. They’re bringing old habits (chasing hot themes, overtrading) to new wrappers.

The 45% growth number tells us ETFs are winning. It doesn’t tell us if investors are winning with them. That depends on whether they stick to low-cost, diversified, long-term strategies, or whether they turn ETFs into the new casino chips.

For now, the smart money is watching those fee trends and currency exposures while the crowd piles into whatever “disruptive innovation” ETF launched last week. In French investing, as in French cuisine, quality ingredients matter more than fancy presentation.