French investors have a complicated relationship with their financial tracking tools. On one side, you have polished commercial platforms like Finary that sync everything automatically but demand monthly subscriptions and full access to your banking data. On the other, you have endless spreadsheets that stay private but require constant manual updates. Enter sure.am, a free, open-source alternative that splits the difference by letting you self-host your own financial dashboard.

The Privacy Problem with Paid Trackers

The original appeal of tools like Finary is obvious: connect your comptes bancaires (bank accounts), brokerages, and crypto wallets, then watch your net worth update automatically. But this convenience comes at a cost beyond the subscription fee. You’re essentially handing over the keys to your entire financial life, every transaction, every balance, every investment, to a third-party company.

Many international residents in France express discomfort with this arrangement. The prevailing sentiment among privacy-conscious investors is that French bureaucracy already demands enough transparency, voluntarily adding another data processor feels unnecessary. With regulations like RGPD (General Data Protection Regulation) giving you rights over your data, why surrender it to another platform?

What sure.am Actually Is

sure.am positions itself as a Finary clone that runs on your own hardware. It’s a fork of the discontinued “Maybe” project, resurrected by developers who wanted to keep the open-source dream alive. The core promise: complete control over your financial data with zero subscription costs.

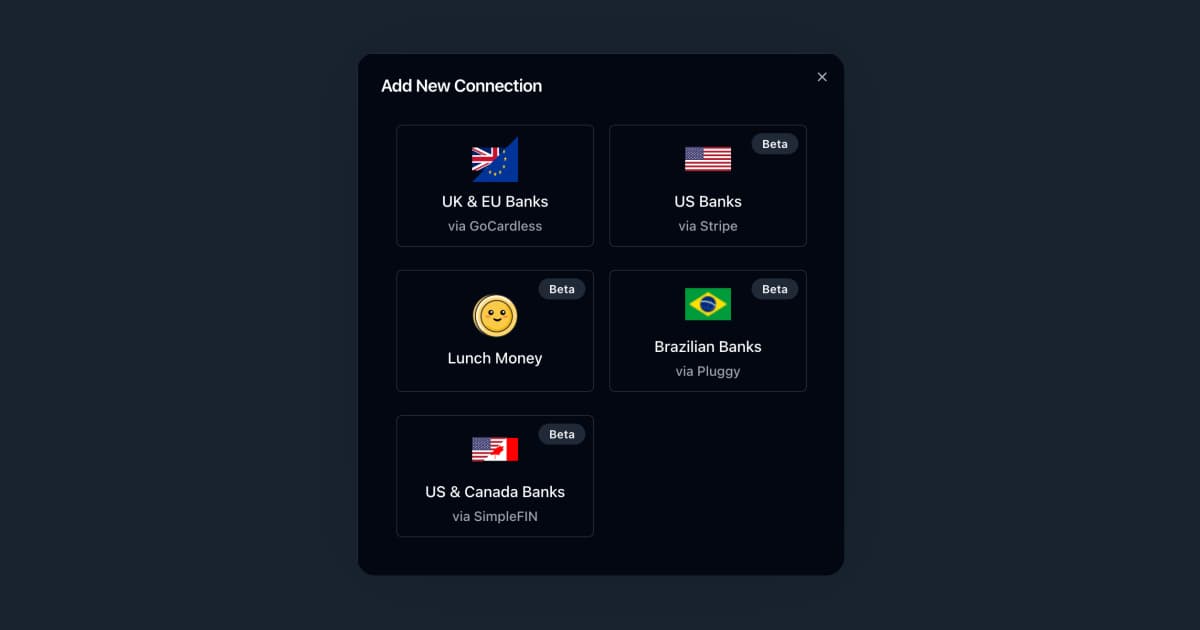

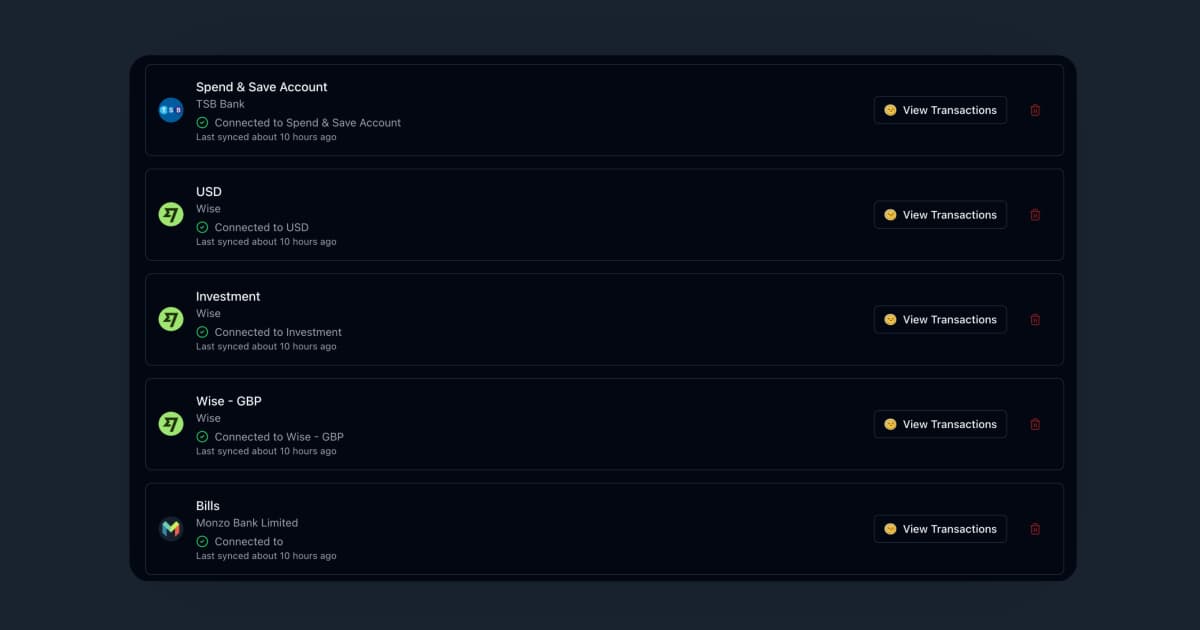

The platform supports over 10,000 financial institutions globally through integrations like EnableBanking, Plaid, and SimpleFin. For French users, this means you can theoretically connect major banks like BNP Paribas, Société Générale, and Crédit Agricole, plus brokers such as Boursorama and BinckBank. The system also handles manual accounts, essential for tracking your PEA (Plan d’Épargne en Actions – French stock savings plan) or physical real estate holdings that don’t sync automatically.

Key features include:

– Automatic transaction sync from linked accounts

– Manual categorization with rule-based automation

– CSV and Google Sheets export for tax reporting

– Multi-currency support for international portfolios

– AI assistant powered by ChatGPT integration

– Debt tracking alongside assets for full net worth calculation

The Technical Reality Check

Here’s where the “free” promise gets complicated. sure.am isn’t a cloud service you sign up for in 30 seconds. It’s a self-hosted application requiring Docker, server management, and basic DevOps skills. One early adopter noted that installation via Dokploy with a Cloudflare tunnel was “fairly quick”, but that’s relative to someone comfortable with infrastructure management.

The setup involves:

1. Configuring Docker containers

2. Setting up a PostgreSQL database

3. Managing environment variables for API keys

4. Securing your instance behind SSL

5. Maintaining updates and backups

For French residents without technical backgrounds, this represents a significant barrier. Compare this to Finary’s one-click OAuth connections, and the trade-off becomes clear: you’re exchanging money for time and technical effort.

Bank Integration: The European Challenge

While sure.am supports Plaid, the documentation reveals a critical limitation: “Plaid integration currently only works for Western users. Plaid Production support is not available to European users.” This creates a significant hurdle for French investors.

The alternative is EnableBanking, which explicitly lists French support for institutions like Allianz Banque, Arkéa, and BNP Paribas. However, you’ll need to apply for API access and potentially pay for premium tiers depending on your usage volume. SimpleFin offers another route, but coverage varies by institution.

This fragmented landscape means French users often end up with a hybrid approach: automatic sync where possible, manual CSV imports where necessary. The result isn’t the seamless experience Finary delivers, but it keeps your data on your own server.

Feature Gaps That Matter

Users migrating from commercial platforms notice several missing pieces:

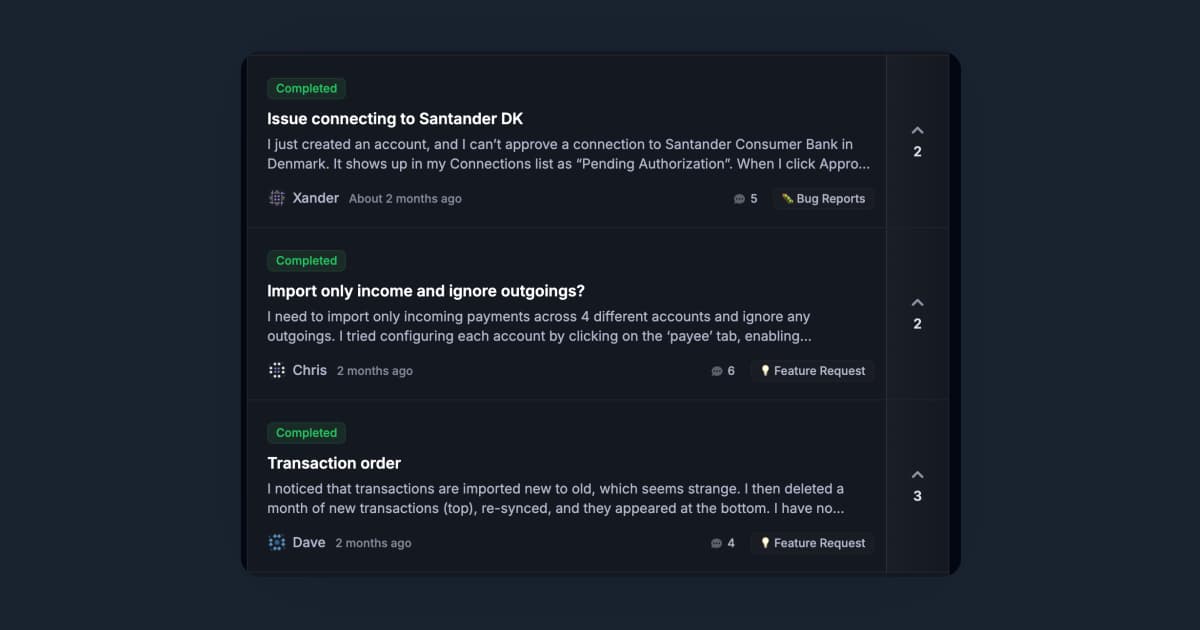

No French Interface: The UI is English-only, though French language support is planned. For non-English speakers, this creates friction.

Limited Investment Tracking: While you can manually add stock positions, the platform lacks sophisticated performance analytics compared to dedicated tools like Portfolio Performance. One user mentioned missing features like APY visualization for fixed-rate investments such as Livret A or assured-regulated savings accounts.

Recurring Transaction Logic: The system can auto-detect patterns, but you cannot manually define recurring transactions. This frustrates users with predictable income or expenses that don’t follow obvious patterns.

AI Assistant Skepticism: The ChatGPT integration feels gimmicky to some. Asking an AI about your spending habits requires trusting OpenAI with your financial data, ironically contradicting the self-hosting privacy benefit.

The Real Cost of “Free”

Running sure.am incurs hidden expenses:

– Server costs: €5-15/month for a VPS

– API fees: EnableBanking or Plaid may charge based on sync frequency

– Time investment: Setup, maintenance, troubleshooting

– Backup responsibility: You’re the IT department

For a French household tracking a few accounts, this might total €100-200 annually, not zero, but often less than Finary’s family plan. The difference is you’re paying infrastructure providers rather than a financial SaaS company.

Who Should Actually Use This

sure.am fits specific profiles:

The Privacy Purist: You refuse to share banking credentials with third parties and accept technical complexity as the price of data sovereignty.

The Tinkerer: You enjoy self-hosting services like Nextcloud or Plex and view financial tracking as another infrastructure project.

The Cost-Conscious Power User: You manage complex multi-currency portfolios across French and international institutions, making commercial subscription costs add up.

The FIRE Community Member: Following the French FIRE movement, you need granular control over expense tracking and net worth calculations that generic tools don’t provide.

For casual investors with a simple PEA and checking account, the setup overhead likely outweighs the benefits. Traditional French banks’ built-in dashboards, while clunky, suffice for basic monitoring.

Comparison with Established Alternatives

The open-source finance space includes mature competitors:

Ghostfolio: Offers more sophisticated investment analytics and a cleaner UI, but less emphasis on daily budgeting. Many French investors use it alongside Actual Budget for a complete picture.

Portfolio Performance: German-developed tool with unparalleled investment tracking depth, but steeper learning curve and no native cloud sync. One user runs it via Docker for web access, similar to sure.am.

Actual Budget: Superior for envelope budgeting and transaction management, but lacks investment portfolio visualization.

sure.am attempts to be the all-in-one solution, but currently excels at none of these specialized tasks. It’s the jack-of-all-trades in a field of masters.

Getting Started: A French User’s Path

If you’re committed to trying sure.am, here’s a practical roadmap:

- Assess your technical comfort: Can you follow Docker installation guides in English?

- Choose your hosting: A cheap VPS from OVHcloud or Hetzner works, or use a Raspberry Pi at home.

- Test bank connections: Start with EnableBanking’s free tier to see which of your French institutions connect smoothly.

- Plan your manual workflows: For accounts that won’t sync, establish a monthly CSV import routine.

- Secure your instance: Use a VPN or Cloudflare Tunnel, never expose your financial dashboard directly to the internet.

- Maintain religiously: Set up automated backups and update schedules.

The community around sure.am is active on Discord, with French speakers among the contributors. This peer support network proves invaluable when troubleshooting bank-specific sync issues.

The Verdict: Replacement or Complement?

sure.am cannot fully replace Finary for most French users today. The technical barrier, incomplete French bank integration, and feature gaps make it a specialist tool rather than a mass-market solution.

However, it serves as a powerful complement for privacy-conscious investors who:

– Maintain complex portfolios requiring custom tracking

– Want to avoid subscription costs for large families

– Prefer keeping sensitive data off commercial servers

– Enjoy the flexibility of open-source software

The platform’s trajectory is promising. As French language support arrives and EnableBanking expands its institution coverage, the gap with commercial alternatives will narrow. For now, consider it a project for financially savvy technophiles rather than a plug-and-play Finary killer.

Actionable Takeaways

If you’re managing a simple PEA with ETF investments, commercial tools remain the pragmatic choice. The time saved justifies the subscription cost.

If you’re deep into the DIY investing culture and already self-host other services, sure.am offers a compelling privacy-respecting alternative. Budget 5-10 hours for initial setup and expect ongoing maintenance.

For those concerned about digital banking risks, the self-hosted approach provides peace of mind that no commercial platform can match. Your financial data stays in France (or wherever you host it), subject only to your own security practices.

The rise of tools like sure.am reflects a broader shift toward independent financial decision-making among French investors tired of traditional advisory models. Whether this particular platform becomes a mainstream solution or remains a niche project depends on its ability to lower technical barriers without sacrificing its core privacy principles.

Until then, most users will find happiness in a hybrid approach: commercial tools for convenience, sure.am for sensitive accounts, and a good old spreadsheet as the ultimate backup.