The Reddit thread started with a simple question: Should I buy a Europe ETF today or wait because of tariff fears? The answer from seasoned investors was blunt, you’re asking the wrong question.

This captures the current mood among German investors perfectly. With Trump’s tariff threats dominating headlines and the MSCI Europe returning +20.96% over the last year, many face the same dilemma: Is this the right time to invest in Europe-focused ETFs, or are we walking into a trade war trap?

The Tariff Fear vs. Reality Gap

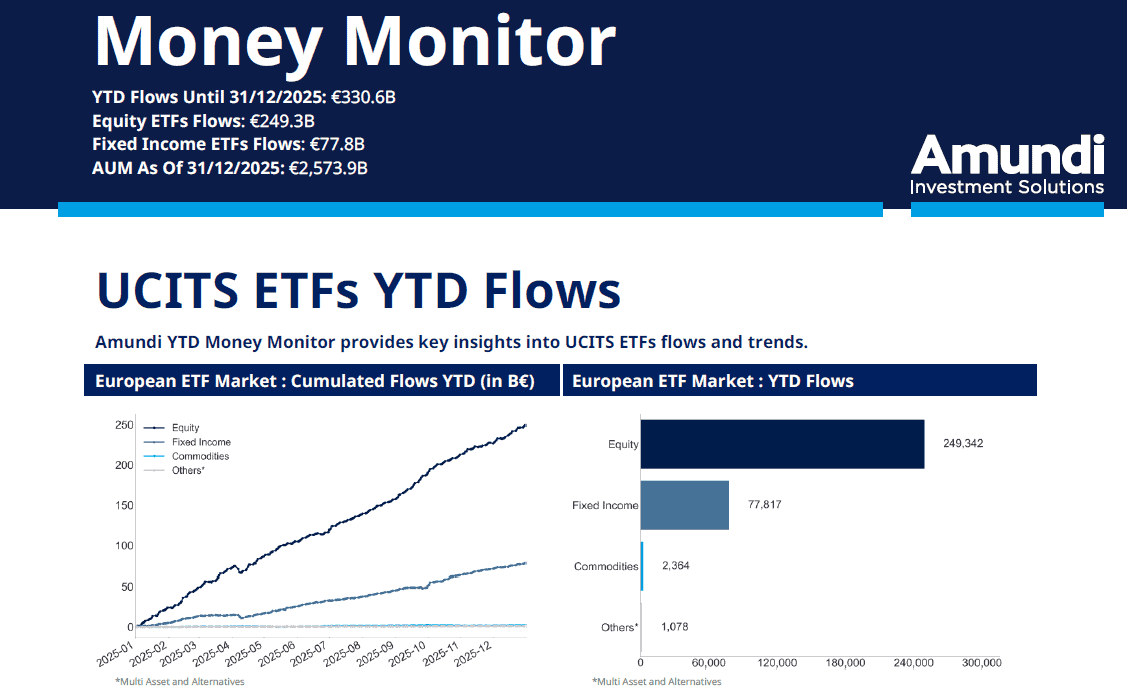

Let’s address the elephant in the room. Yes, Trump has threatened tariffs. Yes, the Supreme Court (Oberstes Gericht der USA) might rule on his authority to impose them without Congress. But here’s what actually happened: European equity ETFs saw record inflows of €249.3 billion in 2025, a 15.9% increase from 2024.

The data from Amundi shows investors aren’t running from Europe, they’re doubling down. While the Reddit commenter who sold €140k in FTSE All World to buy Euro Stoxx 600 during the first tariff panic ended up losing €4k through poor timing, the broader market told a different story. The MSCI Europe gained 18.5% since Trump’s inauguration, outperforming global markets.

What Europe ETFs Actually Hold

Before we panic about tariffs, let’s examine what we’re buying. The MSCI Europe contains 424 companies across 15 countries, with top holdings like Novo Nordisk (3.76%), ASML (3.27%), and Nestlé (2.49%). These aren’t fragile local businesses, they’re global champions that earn revenue worldwide.

The STOXX Europe 600 offers even broader exposure across 600 companies in 18 countries. Both indices are dominated by sectors like financials (18%), industrials (16-17%), healthcare (15%), and consumer goods, precisely the sectors benefiting from Europe’s push for strategic autonomy.

Germany’s increased defense and infrastructure spending isn’t just political posturing, it’s driving real capital flows. Sector ETFs collected over €35.5 billion, with industrials leading at +€13.3 billion, followed by IT (+€8.9 billion) and financials (+€7.3 billion). Defense sector ETFs alone attracted €10 billion.

The Supreme Court Wildcard

One Reddit comment highlighted a crucial point: the Supreme Court was set to rule on whether Trump can impose tariffs without congressional approval. The betting markets gave Trump a 70% chance of losing this case.

But here’s the kicker, even if the Court rules against him, the practical outcome remains uncertain. As one analyst noted: “SCOTUS can decide Trump loses, but the US Customs and Border Protection might ignore the ruling. Companies would need to sue to recover paid tariffs. My crystal ball says: SCOTUS votes against Trump, but no tariff refunds happen.“

This legal uncertainty creates volatility, not fundamental economic damage. For short- to medium-term investors, this means price swings, not broken companies.

The Market Timing Trap

The most valuable lesson from the research comes from an investor who admitted: “I sold €140k during the first tariff dip, switched to Euro Stoxx 600, then managed to sell everything so poorly I lost €4k, when simply staying in FTSE All World would have cost me nothing.”

Another respondent distilled this into wisdom: “The best strategy would have been early diversification into Stoxx Europe 600. The second-best was staying with All World. The worst was switching based on news.”

Time in the market beats timing the market. This isn’t just a slogan, it’s mathematically proven by your fellow German investors’ expensive mistakes.

Diversification: The Real Reason to Consider Europe ETFs

Here’s the uncomfortable truth: most German investors are overweight US assets. Many world ETFs allocate over 70% to American companies. A Europe ETF isn’t just a tariff play, it’s a rebalancing tool.

The extraETF analysis is clear: “Investing in a Europe ETF restricts your investment to a single continent. Your diversification isn’t global, which can increase risk.” But used as a 10-20% portfolio allocation, a Europe ETF reduces US concentration risk while capturing different economic cycles.

Think of it as insurance against a potential US slowdown, not a bet on tariffs.

Practical Strategy for Short- to Medium-Term Investors

-

Start small: Allocate 10-15% of your equity portion to MSCI Europe or STOXX Europe 600 ETFs. This isn’t your core holding, it’s a diversifier.

-

Use Sparpläne (savings plans): Set up a monthly ETF savings plan. This smooths out volatility from tariff announcements and Supreme Court decisions.

-

Focus on sectors: The data shows industrials, IT, and defense are attracting capital. Consider sector-specific Europe ETFs if you want targeted exposure.

-

Avoid the news cycle: The Reddit thread is full of investors who lost money reacting to headlines. Check your portfolio quarterly, not after each Trump speech.

-

Remember currency effects: A strong Euro can dampen returns from European stocks. Some ETFs offer currency hedging (Währungsabsicherung).

The Bigger Picture: Record Flows Tell the Real Story

While individual investors panic about tariffs, institutional money tells a different story. European equity ETFs saw €65.8 billion in net inflows in 2025, up 23.1% from 2024. Total assets in European ETFs reached €2.57 trillion.

This isn’t speculation, it’s strategic repositioning. Investors are diversifying away from US concentration, betting on Europe’s push for strategic autonomy, and pricing in the continent’s defense and infrastructure spending.

The tariff noise? It’s just that, noise. The fundamental shift is real.

Bottom Line

Should you invest in Europe-focused ETFs amid rising tariff fears? Yes, but with the right structure.

Don’t make it a directional bet on trade policy. Use it as a diversification tool to reduce US overweight. Don’t try to time Supreme Court decisions. Use Sparpläne to average in. Don’t check daily headlines. Review quarterly.

The German export economy faces real challenges from Trump’s policies, exports to the US dropped 9% in 2025. But the companies in MSCI Europe and STOXX 600 have been dealing with geopolitical uncertainty for decades. They’re built for this.

The chart shows market development, exactly what tariff-fearing investors missed while waiting on the sidelines.

The question isn’t whether to invest in Europe ETFs. It’s whether you have enough Europe exposure relative to your US holdings. For most German investors, the answer is clear: you’re underweight. Tariff fears are just the excuse you’ve been waiting for to finally rebalance.