French ETF Wars: Why Your PEA Deserves Better Than Popularity Contests

When a seasoned contributor posted their curated ETF list on a forum, they expected quiet approval. Instead, they ignited a firestorm. The crime? Daring to suggest that French investors might want to look beyond the usual suspects and prioritize stability, tracking difference, and manager quality over brand loyalty and short-term performance.

The debate cuts to the heart of a question facing every French investor: in a market flooded with options, how do you separate the genuinely reliable ETFs from the merely popular ones?

The Stability-First Framework

The core philosophy is disarmingly simple: evaluate ETFs based on their tracking difference (how closely they follow their index), manager quality, and likelihood of remaining viable for the next 20+ years. This isn’t about finding the hottest new fund, it’s about building a foundation that won’t crack under pressure.

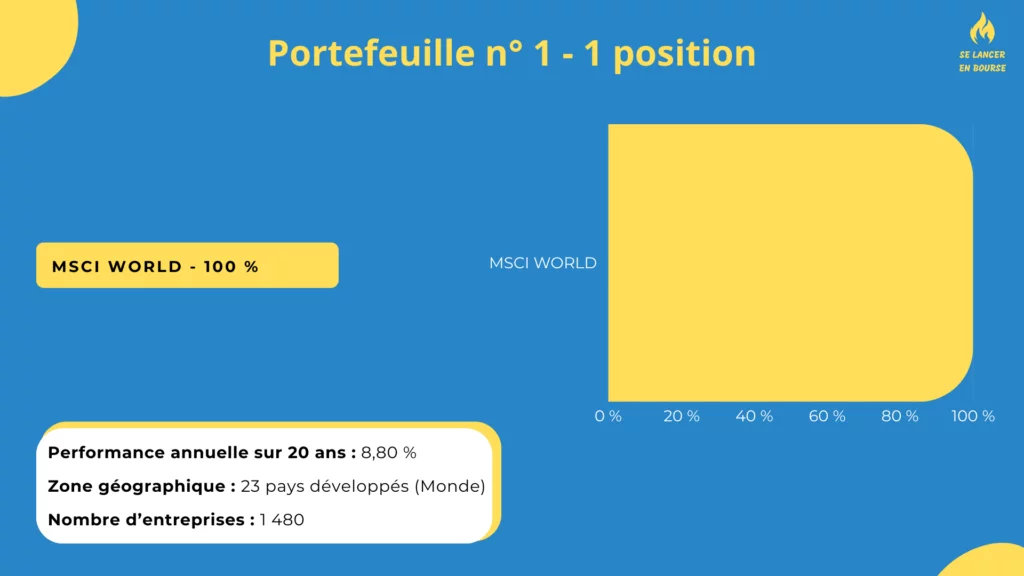

For PEA (Plan d’Épargne en Actions) accounts, the contributor recommended WPEA (IE0002XZSHO1), an iShares MSCI World Swap UCITS ETF. The reasoning? It delivers solid performance with a 0.20% TER and synthetic replication that makes it PEA-eligible. The fund has amassed €1.1 billion in assets since its March 2024 launch, suggesting strong institutional confidence.

The alternative DCAM (FR001400U5Q4) from Amundi sparked immediate controversy. Objectively, it’s nearly identical: same 0.20% TER, same MSCI World focus, same PEA eligibility. But the contributor initially hesitated to recommend it, citing “risque lié au passif d’Amundi” (risk related to Amundi’s liabilities). This single phrase triggered a cascade of responses that revealed deep divisions in the French investing community.

The Amundi Controversy: French Champion or Risk Factor?

The pushback was swift and pointed. Many investors argued that excluding DCAM showed bias against a French champion. After all, Amundi is Europe’s largest asset manager and a point of national pride. As one critic noted, the two ETFs are “équivalents” with identical TERs, making any exclusion purely subjective.

The contributor’s concern about Amundi’s “passif” (liabilities) struck others as “fantasmé” (imagined), a hypothetical risk akin to pricing in the chance that BlackRock might suddenly withdraw from Europe. If you start down that path, you can justify excluding anything.

Yet the contributor doubled down: they want to see Amundi demonstrate real commitment to the DCAM product. Lower fees, perhaps, or a gesture that shows they’re not just reacting to iShares’ moves. This tension, between supporting a domestic champion and demanding objective quality, defines the modern French ETF landscape.

For CTO (Compte-Titres Ordinaire) accounts, the recommendations were clearer. IWDS (IE000F9IDGB5) for MSCI World exposure offers an even better 0.12% TER. For true global coverage including emerging markets, VWCE (IE00BK5BQT80) from Vanguard provides physical replication of the FTSE All-World index with a 0.19% TER and massive €28.5 billion in assets.

Beyond the Basics: When “Good Enough” Isn’t Enough

The list didn’t stop at mainstream options. It ventured into “situationnels”, ETFs that aren’t perfect but are the best in their niche.

Vanguard’s V80A, V60A, and V40A offer automated equity/bond splits (80/20, 60/40, 40/60) without leverage. These funds appeal to investors wanting diversification beyond stocks but reluctant to manage rebalancing themselves. The catch? They include corporate bonds, which some purists avoid.

For the more adventurous, NTSG (IE00077IIPQ8) from WisdomTree delivers a 90% MSCI World ESG / 60% government bond mix with leverage. This “all-in-one” approach aims for equity-like returns with bond-like stability, though the ESG overlay and synthetic structure add complexity that gives some investors pause.

The Diversification Paradox

One commenter challenged the entire premise of adding more ETFs for diversification. Their data showed that a simple 90/60 equity/bond mix (like NTSX, the US version) actually delivered better risk-adjusted returns over 56 years than a traditional All-World portfolio.

This sparked a deeper debate: is 100% stocks ever truly diversified? The evidence suggests that adding leveraged bonds can create more robust portfolios than simply adding more equity markets. It’s counterintuitive but mathematically sound, diversification works best when you mix genuinely uncorrelated assets, not just different flavors of the same thing.

Broker Politics and Hidden Costs

The discussion revealed how broker choice influences ETF selection. One investor noted that at Bourso (Boursorama), iShares products trade without management fees while Amundi incurs costs, making WPEA an obvious choice over DCAM. Another countered that at Fortuneo, the reverse might be true.

This broker-specific pricing creates artificial preferences that have nothing to do with fund quality. It’s a reminder that the “best” ETF depends not just on the fund itself, but on where you hold it. The French brokerage landscape is fragmented enough that these micro-optimizations matter.

The Tracking Difference Reality Check

While TER gets all the attention, tracking difference tells the real story. It measures how much an ETF actually deviates from its index after all costs, replication method, and securities lending are accounted for.

The contributor’s focus on tracking difference over TER represents a maturation of French investor thinking. Low fees mean nothing if the fund fails to deliver index returns. Unfortunately, this data isn’t always readily available, forcing investors to rely on provider reputation and historical performance.

iShares and Vanguard have built their brands on tight tracking, while some investors remain skeptical of Amundi’s commitment to maintaining that precision across all products.

Practical Portfolio Construction

For investors wanting to implement these ideas, the research suggests several approaches:

- Simple PEA: 100% WPEA or DCAM (MSCI World)

- Diversified PEA: 85% MSCI World + 15% MSCI Emerging Markets

- US-Europe Split: S&P 500 + Euro Stoxx 600 combination

- All-Weather: 90/60 equity/bond mix for true diversification

The Verdict: Stability Requires Skepticism

The controversy around this ETF list reveals a healthy evolution in French investing culture. Investors are moving beyond marketing hype and national pride to demand objective quality metrics. They’re willing to challenge assumptions, debate methodology, and acknowledge that even “safe” choices like Amundi require scrutiny.

The key takeaway isn’t which specific ETFs to buy, though the recommendations are solid, but rather the framework for evaluation. Prioritize tracking difference over TER, manager commitment over brand size, and long-term viability over short-term performance. And always, always consider how your broker’s fee structure warps the playing field.

Your PEA deserves this level of analysis. The tax advantages are too valuable to waste on suboptimal funds. As the debate shows, French investors are getting smarter, more demanding, and less sentimental about their choices. That’s not controversy, that’s progress.