When Marie checked her bank account on January 28th, she found her balance €404.98 in the red. The charge came from a Leclerc supermarket in Saint-Amand-les-Eaux, a store she hadn’t visited in months. Across France, thousands of banking customers experienced similar shocks as phantom payments from purchases dating back to 2022 suddenly reappeared on their statements. The culprit wasn’t fraud or a cyberattack, but a technical failure at Monext, a payment processing subsidiary of Crédit Mutuel Arkéa that handles transactions for thousands of merchants across Europe.

The Anatomy of a Payment System Failure

Monext isn’t a household name, but it should be. The company processes payments for over 12,000 clients including major e-commerce players like Amazon and popular French platforms like Vinted. On January 27th, a technical error caused the system to reprocess thousands of old Visa transactions with incorrect dates, triggering unauthorized debits from customer accounts in 34 countries. France bore the brunt, representing 67% of all erroneous payments according to Les Échos.

The error exposed a critical vulnerability in France’s payment infrastructure: concentration risk. When one processor fails, the ripple effects spread across multiple banks that rely on its services. Boursorama, Caisse d’Épargne, Banque Populaire, Crédit Coopératif, and BNP Paribas Fortis all reported customers hit with false charges ranging from €66 to over €200. The digital clothing reseller Vinted and menswear brand Devred also found themselves fielding panicked customer calls about mysterious charges for purchases made as far back as 2022.

Why Banks Accepted Phantom Transactions Without Question

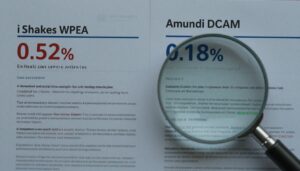

Perhaps more alarming than the error itself was the system’s failure to catch it. As one customer noted on their bank statement, the gap between the transaction date (“effectué le”) and debit date (“débité le”) exceeded four months, a red flag that should have triggered verification. Yet banks processed these anomalous charges automatically.

Industry insiders explain that the sheer volume of daily transactions makes individual verification impossible. Only unusually large amounts typically prompt human review. This “trust-based” system works until it doesn’t. The incident revealed how France’s banking network, built on implicit trust between institutions, can propagate errors at scale. As one former banking professional commented, the system represents a mix of modern and legacy infrastructure where a single corrupted batch file can cascade across networks.

The “stagiaire” (intern) theory, that a junior employee merged test data into production, circulated widely, though Monext hasn’t confirmed the exact cause. What matters more is that such a simple mistake could bypass all safeguards.

The Human Cost of Technical Glitches

For affected customers, the consequences were immediate and stressful. Many found themselves unexpectedly overdrawn, facing potential fees and the hassle of explaining the situation to merchants. Some blocked their credit cards in panic, only to lose access to their own funds for days. The psychological impact shouldn’t be underestimated, customers expressed feeling violated and anxious about the security of their accounts.

BNP Paribas Fortis received 400 calls about the issue in a single day. A spokesperson reassured customers that double-charged amounts would be fully refunded automatically, but the incident exposed how vulnerable everyday financial stability can be to backend technical failures. The bank advised customers to simply verify their refunds appeared within days, but offered little recourse for overdraft fees or related issues.

Systemic Fragility in French Financial Infrastructure

This incident didn’t happen in isolation. It occurred against a backdrop of systemic cash flow fragility exposed by banking errors and infrastructure failures. With 24% of French households going into overdraft every month, unexpected charges can trigger cascading financial problems. A phantom €100 charge could mean the difference between managing and missing rent.

The Monext failure also feeds into broader growing distrust in long-term financial systems, similar to skepticism toward pension sustainability. When young French workers already question whether they’ll ever receive meaningful pensions, watching their bank accounts drained by technical errors hardly inspires confidence in institutional reliability.

Meanwhile, traditional savings vehicles face their own crisis. The Livret A, France’s most beloved savings product, saw its first annual net outflow since 2015, with €2.12 billion withdrawn in 2025. This decline in trust in traditional savings vehicles like Livret A amid financial instability reflects a population increasingly wary of putting faith in financial institutions.

What Actually Happens When Payment Processors Fail

Monext’s role as a critical infrastructure provider means its errors have outsized impact. The company handles payments not just for e-commerce, but for banks and fintechs across Europe. When its systems malfunctioned, they didn’t just affect direct customers, they contaminated the entire payment ecosystem.

The incident mirrors similar failures in other trust-based networks. As one expert noted, banking systems share vulnerabilities with internet infrastructure: if one major operator makes an error, entire countries can experience outages. The difference is that payment networks move actual money, not just data.

French regulators have yet to announce any formal investigation, though the Autorité de contrôle prudentiel et de résolution (ACPR) typically monitors such incidents. The lack of immediate oversight response concerns consumer advocates who argue payment processors should face the same scrutiny as banks themselves.

Your Rights and Protections (Or Lack Thereof)

Here’s what affected customers need to know: under French law, unauthorized transactions must be refunded by your bank. The Monext incident qualifies, and banks have promised automatic reimbursement. However, the timeline remains vague, “in the coming days” isn’t legally binding.

Crucially, banks claim customers don’t need to file formal disputes for these specific errors. But if you incurred overdraft fees or other charges because of the phantom payments, you should document everything and request compensation. Banks aren’t proactively offering this, but you have the right to claim damages from the responsible party, which in this case is ultimately Monext.

For future protection, consider setting up transaction alerts on your banking app. While they won’t prevent backend errors, they’ll give you immediate notice to act. Also, maintain a small buffer in your account, impossible for many, but the only real defense against technical glitches that bypass normal fraud detection.

The Trust Deficit Deepens

The Monext incident reveals a fundamental tension in modern finance: as systems become more complex and interconnected, they become more efficient but also more fragile. France’s banking sector prides itself on security and rigor, yet a single technical error at a third-party processor exposed thousands to financial stress.

For international residents navigating French financial life, this episode serves as a practical reminder: your bank account is only as reliable as the weakest link in the payment chain. The fact that banks processed four-month-old transactions without flagging them suggests verification systems are thinner than advertised.

The real question isn’t whether Monext will fix its technical issues, it will. The question is whether French regulators will treat payment processors as the systemic risks they clearly are. Until then, customers are left trusting that their money is safe in a system where “safe” means “usually works, except when it doesn’t.”

Keep an eye on your statements. And maybe keep some cash under the mattress, just in case.