WPEA vs DCAM: The Hidden Swap Cost Controversy Confusing French ETF Investors

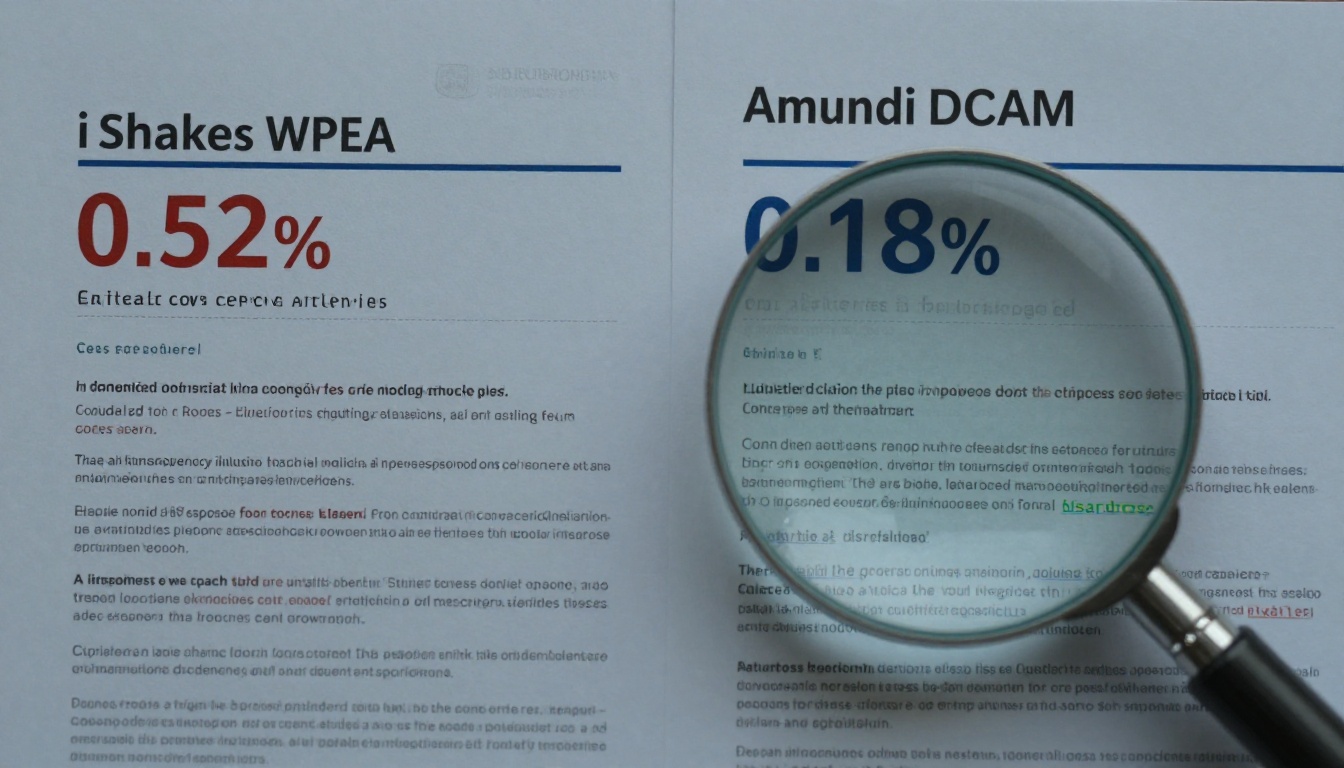

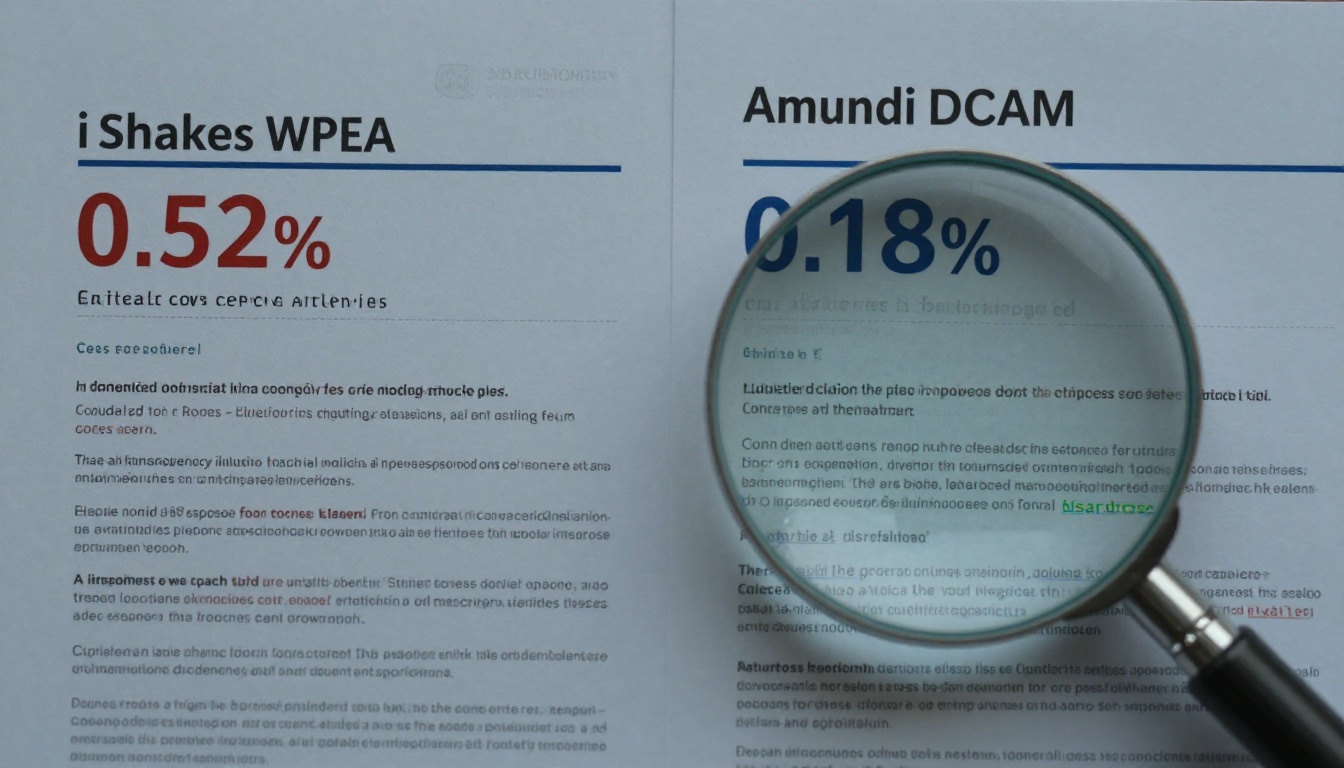

The debate between Amundi’s DCAM and iShares’ WPEA ETFs has become a lightning rod for French investors, not because of massive cost differences, but because of how poorly the fees are communicated. When Boursorama displays a 0.52% annual cost for WPEA while Amundi’s DCAM shows 0.18%, it looks like a slam dunk. The reality is far murkier, and that confusion has sparked heated discussions about transparency in the French ETF market.

The 0.52% Mirage: What Boursorama Actually Shows

If you’ve recently looked at WPEA (iShares MSCI World UCITS ETF) on Boursorama, you’ve likely done a double-take. The platform lists a 0.52% total expense figure, while Amundi’s DCAM (Amundi MSCI World UCITS ETF) sits at 0.18%. On the surface, this suggests iShares is nearly three times more expensive. Many investors have balked, with some switching to Amundi purely based on this number.

The problem? That 0.52% isn’t what you pay annually. It’s a composite figure that includes the TER (Total Expense Ratio) of 0.20% plus an estimated swap cost of 0.32%. The swap cost represents the expense of the synthetic replication method iShares uses to track the MSCI World index. Here’s the kicker: Amundi’s DCAM also uses synthetic replication and incurs nearly identical swap costs, but these aren’t displayed as prominently in the key information documents.

The controversy centers on this disclosure gap. iShares updated its DIC (Déclaration d’Informations Clés) [key information document] to bundle swap costs into the total figure, creating an apples-to-oranges comparison. Amundi’s documentation separates these costs, making DCAM appear cheaper when it’s not. This transparency effort backfired, leaving investors misled rather than informed.

When Fees Are Actually Charged: The Purchase Moment Myth

A persistent misconception fuels this debate: that you pay management fees at purchase. Several investors have reported seeing fee breakdowns on Boursorama’s order screen and assuming the 0.20% or 0.52% gets deducted immediately. This is false.

ETFs work differently than some mutual funds. You pay zero management fees at purchase. The only upfront costs are Boursorama’s transaction fees, which for these ETFs are currently free (subject to minimum monthly investment amounts). The TER and swap costs accrue daily within the fund’s net asset value, meaning you’re charged proportionally as you hold the investment, not when you buy.

One investor noted they ultimately chose Amundi because they believed they were paying management fees upfront with iShares. This decision was based on a fundamental misunderstanding of how ETF costs work, potentially costing them more in tracking difference over time.

The Real Cost Difference: Less Than a Coffee per Year

Let’s cut through the noise with actual numbers. On a €10,000 investment over one year, assuming 6% gross returns:

- Amundi DCAM (0.18% TER + ~0.32% swap costs): €10,598 ending value

- iShares WPEA (0.20% TER + ~0.32% swap costs): €10,597.50 ending value

The difference? €0.50. That’s right, fifty cents. Over 20 years of monthly €500 contributions, the gap might reach a few dozen euros, a rounding error in any long-term portfolio.

The hidden swap costs in the WPEA ETF are real, but they’re not unique to iShares. Both funds use nearly identical synthetic structures to optimize tax efficiency within a PEA (Plan d’Épargne en Actions) [French equity savings plan], which is crucial for French investors seeking to avoid dividend withholding taxes.

Boursorama’s Presentation Problem: Adding Confusion to Complexity

Boursorama’s fee display exacerbates the issue. The platform aggregates costs in ways that don’t reflect industry standards. For WPEA, it adds the 0.20% TER and 0.32% swap estimate into a single scary number. For DCAM, it might only show the 0.18% TER, depending on where you look.

This inconsistent presentation makes direct comparison impossible without digging into the funds’ official documentation. Many investors don’t realize that both ETFs have:

– No entry fees on Boursorama (with conditions)

– Similar swap cost structures

– Nearly identical tracking error profiles

– The same MSCI World benchmark

The result is decision paralysis based on flawed data. Investors waste hours comparing fees that are essentially identical while ignoring factors that actually matter.

What Actually Matters: Tracking Difference and Tax Efficiency

If the fees are virtually identical, how should you choose? Focus on what impacts your real returns:

- Tracking Difference: This measures how closely the ETF follows its index after all costs. Both WPEA and DCAM track within 0.05% of the MSCI World, a negligible difference.

- Fund Size and Liquidity: Larger ETFs typically have tighter bid-ask spreads. Both are among the largest MSCI World ETFs in Europe.

- Provider Stability: Amundi and BlackRock (iShares) are both Tier-1 asset managers with deep expertise in synthetic ETFs.

- Personal Preference: Some investors prefer Amundi’s French heritage, others trust BlackRock’s global scale. This is valid but purely psychological.

The broader critique of French ETF selection practices suggests that investors often over-optimize on disclosed fees while ignoring structural advantages. In this case, both funds offer the same tax optimization through swap-based replication, making the fee debate largely academic.

The Transparency Paradox: When More Information Hurts

iShares attempted to be more transparent by including swap costs in their official figures. The market punished them for it. Amundi’s less transparent disclosure appears cheaper, even though costs are similar. This creates a perverse incentive: why would any provider be fully transparent if it costs them market share?

French regulators haven’t standardized how synthetic ETF costs must be presented, leaving brokers and asset managers to interpret rules differently. Until the AMF (Autorité des Marchés Financiers) [French financial markets authority] mandates a uniform approach, investors will continue to face confusing, non-comparable data.

Bottom Line: Stop Overthinking, Start Investing

If you’re torn between WPEA and DCAM for your PEA on Boursorama, you’re focusing on the wrong problem. The fee difference won’t materially impact your wealth. The real wealth destroyer is analysis paralysis and delayed investment.

Choose one based on whatever minor preference you have, provider brand, gut feeling, or even a coin flip. Then set up your automated monthly investment and forget about it. Spend the time you save learning about asset allocation or tax optimization, areas where decisions actually move the needle.

The controversy around these ETFs reveals a deeper truth: the French investment industry still struggles with clear, comparable fee communication. As an investor, your job is to see through the noise and focus on what drives returns, time in the market, consistent contributions, and a diversified portfolio. Everything else is just marketing.