Corum AM just did the financial equivalent of a vegan butcher opening a steakhouse. After years of publicly trashing no-entry-fee SCPIs (real estate investment trusts) as a “tour de passe-passe” (sleight of hand) that creates “volages” (fickle) investors, the company has filed paperwork for its own zero-fee product, Corum Start. The filing landed at the AMF (Autorité des marchés financiers, France’s financial markets regulator) in late January, and the irony isn’t lost on anyone who follows French real estate.

The Opponent Becomes the Convert

Frédéric Puzin, president of Corum L’Epargne, wasn’t just skeptical, he was the attack dog. In a 2022 interview with Investir, he argued that eliminating entry fees removes the “financial effort” that forces investors to hold for at least a decade to justify their investment. He doubled down later that year in L’Agefi, calling the model a clever trick where managers “recover a large part of their economic balance” through hidden acquisition commissions.

Now his company is asking regulators to approve exactly what he denounced. What changed? Not the math, just the market.

Seven no-fee SCPIs now operate in France, managing billions since Novaxia Neo pioneered the model in 2019. Traditional players like Swiss Life’s Mistral Selection and Advenis Reim’s Eden have already converted. Corum, with €9.6 billion in assets under management, was losing ground to competitors who could advertise “no fees” in bold letters while burying the complicated truth in fine print.

The Fee Shell Game Nobody Talks About

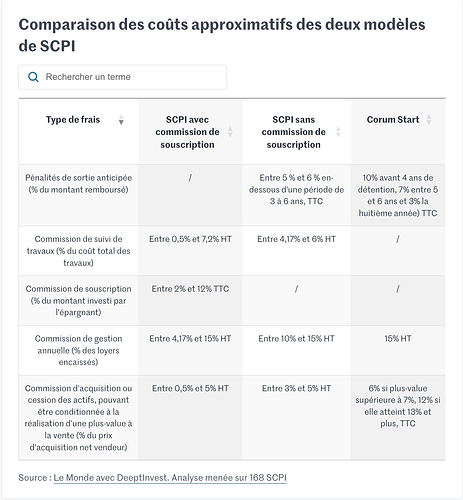

Here’s where things get interesting. Traditional SCPIs charge 2-12% upfront in frais de souscription (subscription fees). The no-fee camp? They simply moved the charges elsewhere.

Corum Start’s structure reveals the sleight of hand Puzin once criticized:

- Annual management fee: 15% of rental income (hitting the top range of both models)

- Exit penalties: 10% if you sell before 4 years, 7% between years 5-6, 3% in year 8

- Acquisition fees: 6% on profits above 7%, jumping to 12% if profits exceed 13%

Compare this to a traditional SCPI like Corum’s existing funds: you pay upfront, but annual fees might be lower and exit is typically more flexible. The no-fee model just delays the pain, and sometimes increases it.

The comparison table from Le Monde shows how these costs stack up across 168 SCPIs analyzed by DeeptInvest:

Notice how the “no-fee” column isn’t actually free? The exit penalties essentially function as deferred entry fees, with the added twist that you can’t escape them early without a significant penalty.

The Hidden Leverage Problem

One of the sharpest criticisms Puzin leveled, and it remains valid, concerns acquisition fees on leveraged purchases. When a no-fee SCPI buys a building, it typically borrows money. The acquisition commission applies to the total purchase price, not just investor capital.

Take Remake Live, which carries 27% debt. Its 5% acquisition fee effectively costs investors 6.35% when you factor in the borrowed portion. You’re paying fees on money you didn’t invest, which is exactly the kind of opaque math that makes experienced investors wary.

Marc Sartori of Deeptinvest clarifies this nuance: only subscription fees are paid directly by investors. Other fees “impact the SCPI’s profit” and “reduce its net result used to calculate dividends”, making them less visible but equally damaging to returns.

Liquidity: The Real Wolf in Sheep’s Clothing

Here’s what keeps me up at night about these products. No-fee SCPIs were supposed to democratize real estate investing. Instead, they’ve created a potential liquidity crisis that market participants are only starting to acknowledge.

Novaxia Neo, the pioneer, recently had to reduce its délai de jouissance (waiting period for dividend payments) to zero just to attract new money. Why? Because 4% of its shares were queued for redemption in Q4 2025, with 3.1% waiting in Q3. When early investors hit their penalty-free exit date, they want out.

This isn’t just theoretical. The SCPI liquidity crisis and market challenges we documented last year showed how supposedly “safe” real estate investments turned into traps when everyone rushed for the exit. No-fee structures, with their deferred penalties, might actually accelerate this problem by creating a cliff of investors all waiting for their penalty window to close.

The Wealth Advisor Incentive Problem

Let’s be blunt: SCPIs are pushed heavily by conseillers en gestion de patrimoine (wealth advisors) because they earn up to 10% commissions on sales. That’s a massive incentive to recommend these products, often before clients have maxed out their PEA (Plan d’Épargne en Actions, stock savings plan) or CTO (Compte-Titres Ordinaires, standard brokerage account).

Many investors on French finance forums express confusion after opening assurance-vie (life insurance) policies to invest in SCPIs, only to learn they should have prioritized their PEA first. The standard advice from independent analysts remains consistent: fill your PEA with diversified equity ETFs before touching SCPIs. The tax advantages and lower fees make it mathematically superior for most people.

Should You Even Care About Corum Start?

Probably not. Here’s the uncomfortable truth: most French households are already over-exposed to real estate through their résidence principale (primary residence). Adding an SCPI, fee-free or not, concentrates risk further.

The risk-adjusted returns of SCPIs have been mediocre at best, especially after accounting for:

– Management dependence (your investment lives or dies by one company’s decisions)

– Illiquidity (selling can take months or years)

– Market concentration (office and retail space facing structural challenges)

– Hidden fees (regardless of model)

Corum’s reversal tells us more about market trends than product quality. It signals that investor demand for fee transparency has reached a tipping point where even the staunchest critics must adapt. But adaptation doesn’t mean improvement, it just means repackaging.

Reading Between the Regulatory Lines

The AMF approval process for Corum Start will be worth watching. French regulators have been increasingly scrutinizing retail investment products, especially those marketed as “innovative” fee structures. The fact that Corum is proceeding despite Puzin’s public record of criticism suggests they believe the regulatory environment has shifted in favor of these products.

Or perhaps they simply ran the numbers and realized that losing market share to no-fee competitors was more expensive than eating their words. In the asset management business, AUM (assets under management) is oxygen, and no-fee SCPIs have been stealing breath.

What Actually Matters for Your Money

If you’re considering Corum Start or any SCPI, ask these questions:

-

What’s my total cost over 10 years? Calculate entry fees + annual management + potential exit penalties. The “free” product might cost more.

-

Can I lock up capital for 6-8 years? If not, the exit penalties will sting.

-

Am I already over-invested in real estate? If you own property, the answer is likely yes.

-

Have I maxed my PEA? Until you’ve contributed the full €150,000 limit, SCPIs shouldn’t be on your radar.

-

Who’s managing this? Research the track record. With SCPIs, management quality trumps fee structure every time.

Corum’s pivot proves that in French finance, yesterday’s heresy is today’s necessity. But as an investor, your job isn’t to applaud strategic reversals, it’s to follow the money and understand where it actually goes. In this case, the fees haven’t disappeared. They’ve just put on a disguise and learned to speak with a different accent.

The real innovation would be true fee transparency and liquidity, not clever rearrangements of when and how you pay. Until then, the best move for most investors is to watch this battle from the sidelines, PEA fully funded, popcorn in hand.