German homeowners who locked in dream mortgage rates below 2% in the mid-2010s are waking up to a financial hangover. As their Zinsbindungen (interest rate lock periods) expire, they face refinancing at rates that have more than doubled. For a typical family with a €400,000 loan, the monthly payment could jump by €500 or more. Yet despite the alarming headlines, this isn’t the subprime crisis replay many fear. The reality is more nuanced, and more German.

The Payment Shock Is Real

Let’s start with the numbers that keep homeowners awake at night. If you financed a €500,000 property in 2016 with a 10-year Zinsbindung at 1.8%, your monthly payment was roughly €1,650. When that lock expires in 2026, refinancing at current Bauzinsen (construction interest rates) of 3.6% pushes your payment to €2,250. That’s €600 more every month, enough to swallow a family’s entire grocery budget.

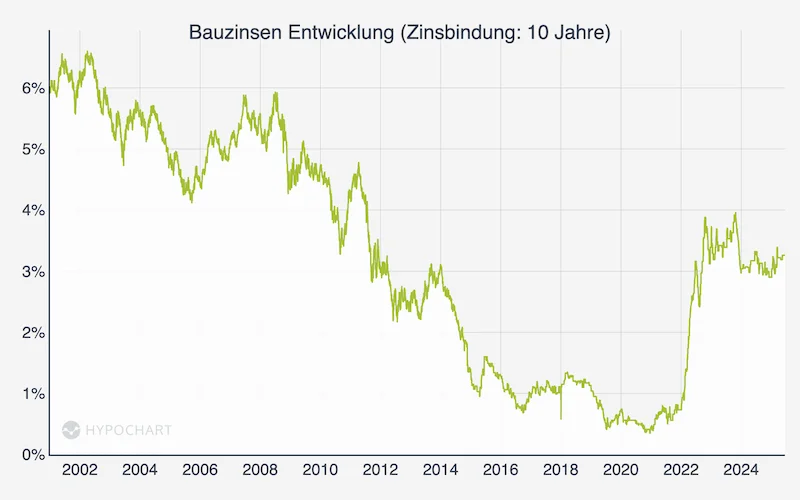

The research data shows this scenario plays out across hundreds of thousands of households. Mortgages originated between 2014 and 2017 typically offered 10-year fixed rates between 1.2% and 2.0%. Those loans are now maturing into a market where the Bundesbank reports average rates of 3.58% for 5-10 year fixes. The European Central Bank’s aggressive rate hikes from 2022 to 2023, while now partially reversed, have permanently reset the baseline.

Why Most Homes Won’t Go Into Foreclosure

Here’s where the panic narrative breaks down. German mortgage lending operates on fundamentally different principles than the pre-2008 American market. The Reddit discussions reveal a common misconception: that payment increases will force mass sales. But several factors blunt the impact.

First, most borrowers have been making substantial Tilgung (principal repayment) for a decade. A €500,000 loan at 2% Tilgung over 10 years reduces the principal to roughly €420,000. The higher payment is calculated on this smaller base, not the original amount.

Second, German banks stress-test borrowers at much higher rates. When you got that 1.8% loan, your bank likely verified you could afford 4% or more. The Bausparkassen (building societies) and Sparkassen (savings banks) are notoriously conservative. They didn’t offer Ninja loans, they demanded solid Schufa scores, stable employment, and substantial Eigenkapital (equity).

Third, the €600 monthly increase, while painful, is absorbable for most middle-class households. As one financial advisor noted in the research, many families can offset this through a combination of higher Tilgung rates, reduced discretionary spending, or modest income growth. German wages have risen nearly 15% in nominal terms since 2016, particularly at the lower end due to minimum wage increases.

The Forward-Darlehen Lifeline

The most powerful tool in the German homeowner’s arsenal is the Forward-Darlehen (forward loan). This instrument lets you lock in today’s rates for a mortgage that starts in 1-3 years. Think of it as insurance against rising rates.

Here’s how it works: If your Zinsbindung expires in December 2026, you can sign a Forward-Darlehen now at 3.6% that activates then. You’ll pay a small premium (typically 0.02-0.05% per month of lead time), but you’re protected if rates spike to 4.5% or 5%.

The research from Sparkasse and Hypochart shows this is precisely what savvy homeowners are doing. In early 2025, when rates dipped slightly, thousands rushed to secure Forward-Darlehen. The product has become so popular that some banks now offer them up to 60 months in advance.

The catch? If rates fall instead, you’re stuck with your locked rate. But in an era of geopolitical uncertainty and persistent inflation around 2%, most homeowners prefer certainty over gambling on lower rates.

Prolongation vs. Umschuldung: The German Choice

When your Zinsbindung ends, you face three paths:

Prolongation means staying with your current bank and accepting their new rate. It’s the path of least resistance, no new paperwork, no property appraisal, no Notar (notary) fees. Banks love it because it’s pure profit. Homeowners like it because it’s simple. But you’ll almost certainly pay 0.1-0.3% more than market rates for this convenience.

Umschuldung (refinancing) means switching banks. You’ll need a new Bewertung (appraisal), must pay Grundbuch (land registry) costs, and spend hours on paperwork. But you can shop for the best rate and might save €15,000-20,000 over a 10-year term. The research shows that homeowners who switch save an average of 0.25% on their rate.

Forward-Darlehen is the hybrid approach, lock in a switch early while staying with your current bank until the switch date.

German banks, particularly the Sparkassen and Volksbanken, have been aggressively courting Umschuldung clients. They know that once a homeowner leaves, they’re unlikely to return. The competition has kept rate spreads surprisingly tight, even as base rates rose.

The Hidden Losers: Who Really Gets Hurt

While mass foreclosures are unlikely, certain groups face genuine hardship:

Recent buyers with high LTVs: If you bought in 2021-2022 with 90% Beleihung (loan-to-value) at 1.2%, you haven’t built much equity. Refinancing at 3.6% on nearly the same principal hurts badly.

Fixed-income retirees: Pensioners whose Zinsbindungen expire now face higher payments on static incomes. The research notes this group is particularly vulnerable in Bavaria and Baden-Württemberg, where property values are high.

Variable-rate holdouts: Those who chose variable-rate mortgages in 2020-2021 to avoid locking in “high” 1.5% rates have already seen their payments double. They’re in crisis now, not in 2026.

The research from Finanztip highlights a stark example: a borrower with a €220,000 loan at 1.1% whose payment only rose from €751 to €759 after refinancing at 3.7%, because they’d paid down principal aggressively. Contrast this with a newer borrower at 90% LTV who faces a €400+ increase.

The Bank’s Perspective: Why They’re Not Worried

German banks have already provisioned for this transition. They’ve been stress-testing their portfolios since 2022. The Bundesbank’s Q4 2025 data shows that despite rising rates, mortgage default rates remain below 0.5%, lower than pre-pandemic levels.

Why? Because German mortgage underwriting is based on Haushaltsrechnung (household budgeting), not credit scores alone. Your banker calculated that you could afford payments at 5% even when they offered you 1.8%. The system is designed for this shock.

Moreover, banks have profitable solutions ready: Prolongation for the lazy, Forward-Darlehen for the anxious, and Umschuldung for the savvy. Each generates fees and locks in customers. The Sparkassen, with their local monopoly power, are particularly adept at converting expiring loans into long-term relationships.

Your Action Plan: 5 Steps Before Your Zinsbindung Ends

If your mortgage expires in 2026-2028, here’s what to do now:

-

Check your contract today. Know the exact expiry date and whether you need to actively cancel or it expires automatically.

-

Calculate your remaining balance. Don’t guess, request a current Saldo (balance) statement. Know your exact LTV ratio.

-

Stress-test your budget. Can you afford payments at 4%? 5%? If not, consider making a Sondertilgung (extra repayment) now while rates are still relatively low.

-

Get three quotes. Approach your current bank for a Prolongation offer, a rival bank for Umschuldung, and a broker for a Forward-Darlehen comparison. The research shows spreads of up to 0.4% between offers.

-

Decide 12-18 months out. Don’t wait until the final month. Forward-Darlehen premiums increase sharply within 6 months of expiry.

The Bigger Picture: Why This Isn’t 2008

The 2026 refinancing wave differs from past crises in three critical ways:

Equity buffers are massive. German property values rose 40-60% in most cities during the low-rate decade. Even with recent dips, most homeowners have 30-50% equity, far above the 20% threshold where trouble starts.

No teaser rates: Unlike subprime mortgages, German loans were fixed-rate from day one. There’s no payment shock from resetting ARMs, just the reality of higher rates at renewal.

Regulatory oversight: The BaFin (Federal Financial Supervisory Authority) has been warning banks about interest rate risk since 2020. Lenders must hold capital against mortgage portfolios and conduct regular Wohnbaustresstests (housing stress tests).

The research from ImmoScout24 confirms this: while search volume for “Anschlussfinanzierung” has tripled, actual forced sales remain flat. Germans are refinancing, not defaulting.

The Forward Rate Gamble

One final wrinkle: the yield curve. As of January 2026, 10-year Bundesanleihen (German government bonds) yield 2.95%, while 2-year bonds yield 2.08%. This inversion suggests markets expect rates to fall. If that happens, homeowners who locked in Forward-Darlehen at 3.6% might feel foolish.

But the ECB’s cautious stance, cutting slowly while watching core inflation at 2.3%, means rates could stay elevated longer than markets price in. The Sparkassen research suggests that even if rates fall to 3% by 2027, the security of locking in now outweighs the potential savings for risk-averse borrowers.

Bottom Line: Plan, Don’t Panic

The expiring Zinsbindung crisis is real but manageable. It’s a cash-flow squeeze, not a systemic collapse. German homeowners who act early, understand their options, and shop aggressively will pay more, but they’ll keep their homes.

The real story isn’t crisis, it’s normalization. Rates of 3-4% are historically normal. The 1% era was the anomaly. Germans are simply returning to the borrowing costs their parents faced, albeit with much higher property values.

For international residents watching from the sidelines, this creates opportunity. As some over-leveraged owners sell, pressure on prices builds. The research shows Berlin and Frankfurt prices already softening 5-8% in late 2025. If you have cash and patience, 2027 might be your moment.

But for the millions facing refinancing in 2026, the message is clear: call your bank today, run the numbers, and lock in a Forward-Darlehen if you sleep better knowing exactly what you’ll pay. In German finance, certainty has always been worth paying for.