That Reddit post hit a nerve. A user wanted to funnel €250 monthly into gold and silver through Flatex, thinking ETCs were the smart choice. The comments exploded with conflicting advice: "physical only", "ETCs mean 27.5% KEST (Capital Gains Tax) theft", "silver VAT kills returns." Everyone meant well, but the tax reality got lost in the noise. Let’s cut through the confusion and look at what actually works in Austria.

The ETC Illusion: Zero Fees, Maximum Tax Pain

Flatex makes ETCs look irresistible. No savings plan fees, instant execution, and you avoid the hassle of storing physical metal. The platform lists products like Xetra-Gold (ISIN DE000A0S9GB0) and silver ETCs such as IE00B4NCWG09. You click buy, set up your monthly €150 gold/€100 silver split, and watch your digital stack grow.

Then you sell. The Finanzamt (Tax Office) takes 27.5% of every euro in profit. No exceptions, no matter how long you held. This KEST burden turns a solid 5% annual return into 3.6% after tax. Over a decade, that difference compounds into a 20% loss of total gains.

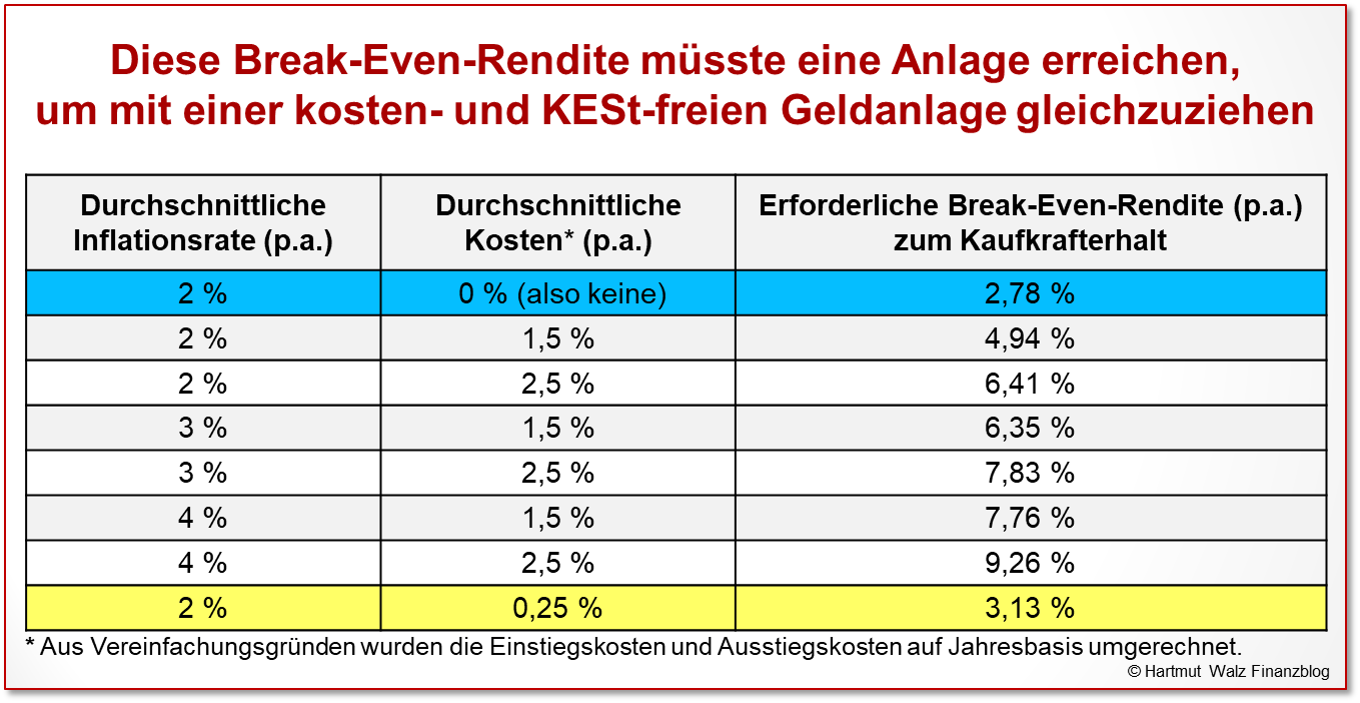

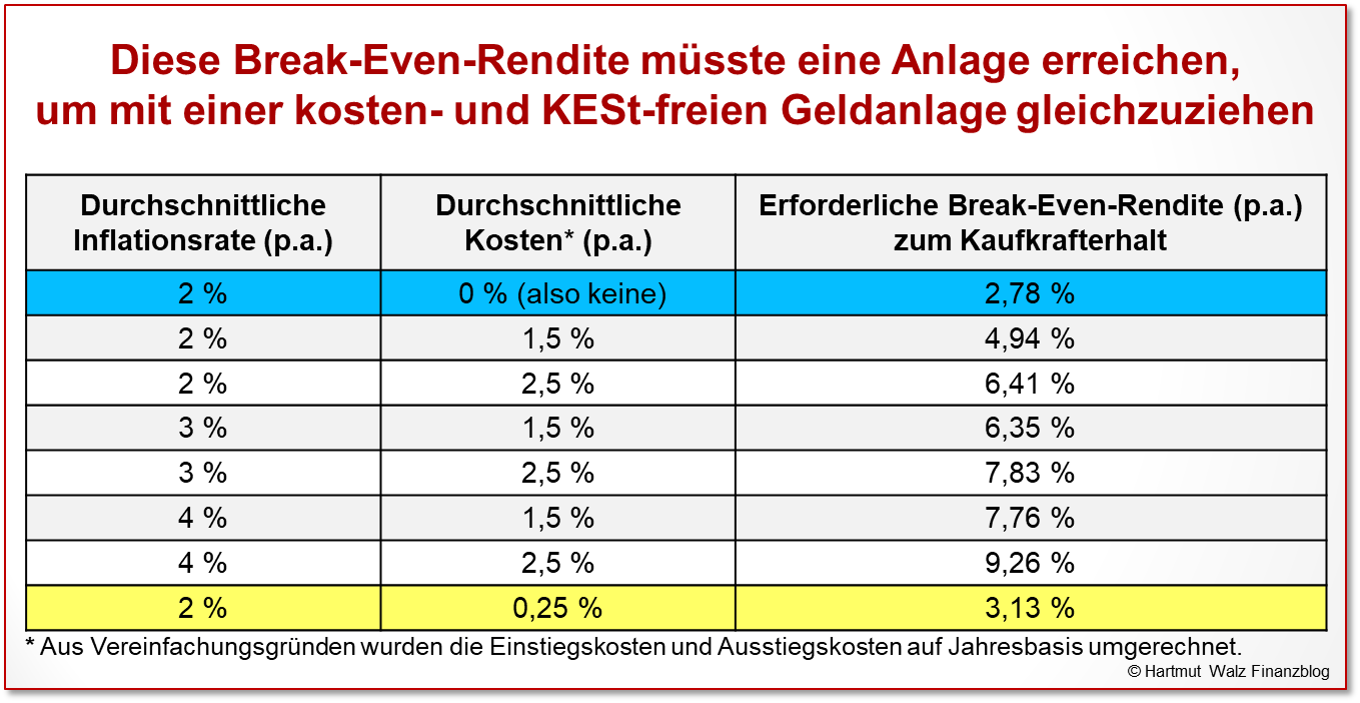

The research from Prof. Hartmut Walz makes this explicit: virtual gold investments without delivery rights face KEST on nominal gains, with no inflation adjustment. His break-even analysis shows you’d need to earn 3.13% annually on a taxable gold ETC just to match the real purchasing power of a KEST-free alternative. That’s before accounting for the 1.5-2.5% annual cost advantage that physical gold holds over financial products.

Many international residents discover this tax trap only after their first sale. The prevailing sentiment among seasoned investors is that banks and brokers rarely warn about KEST because they profit from the product fees while the tax burden sits entirely with the customer.

Physical Gold Through Münze Österreich: The Spread Reality Check

Münze Österreich’s savings plan promises automatic monthly purchases of physical gold coins. Sounds perfect, until you calculate the spreads. For small amounts under €250, you’re paying 15-20% above spot price. A €150 monthly purchase means you’re instantly down €22.50 to €30 on day one.

The Austrian anonymous purchase limit complicates matters further. Since 2020, you can only buy €1,999.99 in physical gold per transaction without identification. While this sounds generous, it means your €150 monthly plan requires 13 months to reach a meaningful quantity where spreads compress to the standard 3-3.5% each way.

Physical storage presents another challenge. Keeping gold at home costs nothing but carries theft risk. A bank safe deposit box runs €80-150 annually at major Austrian banks, erasing your first year’s gains on a €150 monthly investment. The Münze Österreich plan includes storage, but at undisclosed fees buried in their pricing structure.

The tax advantage remains compelling: hold physical gold (or virtual gold with delivery rights) longer than one year and your gains become completely tax-free. Under one year, you get a €1,000 annual tax-free allowance before your personal income tax rate applies. For most investors building wealth gradually, this structure beats the 27.5% KEST hammer every time.

Silver’s VAT Death Sentence

Silver trips up even experienced investors. Unlike gold, physical silver incurs 20% Mehrwertsteuer (Value Added Tax) in Austria. That €100 monthly silver purchase through Münze Österreich starts with a €20 VAT handicap you’ll never recover.

The ETC route avoids VAT but slaps you with KEST instead. The silver ETC IE00B4NCWG09 mentioned in the Reddit thread tracks silver prices without physical delivery, making it a pure financial instrument subject to capital gains tax. You’re choosing between a 20% immediate loss or a 27.5% future loss, neither option builds wealth efficiently.

Some investors argue silver’s higher volatility justifies the tax hit. The counterargument points to the 400% price increase over five years that still left physical buyers behind after VAT. For Austrian residents, silver remains a traders’ market, not a long-term savings vehicle.

The Delivery Claim Loophole: Best of Both Worlds?

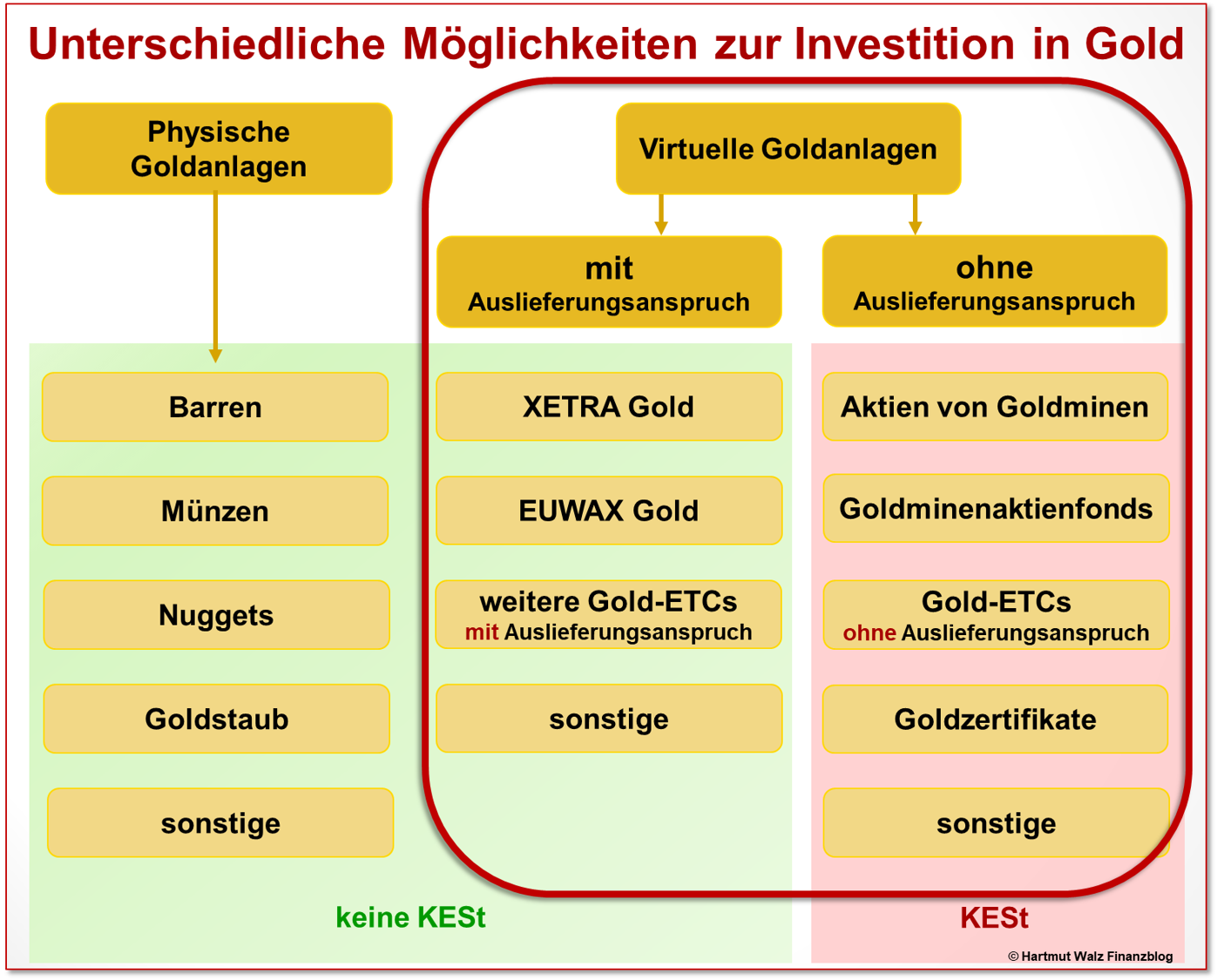

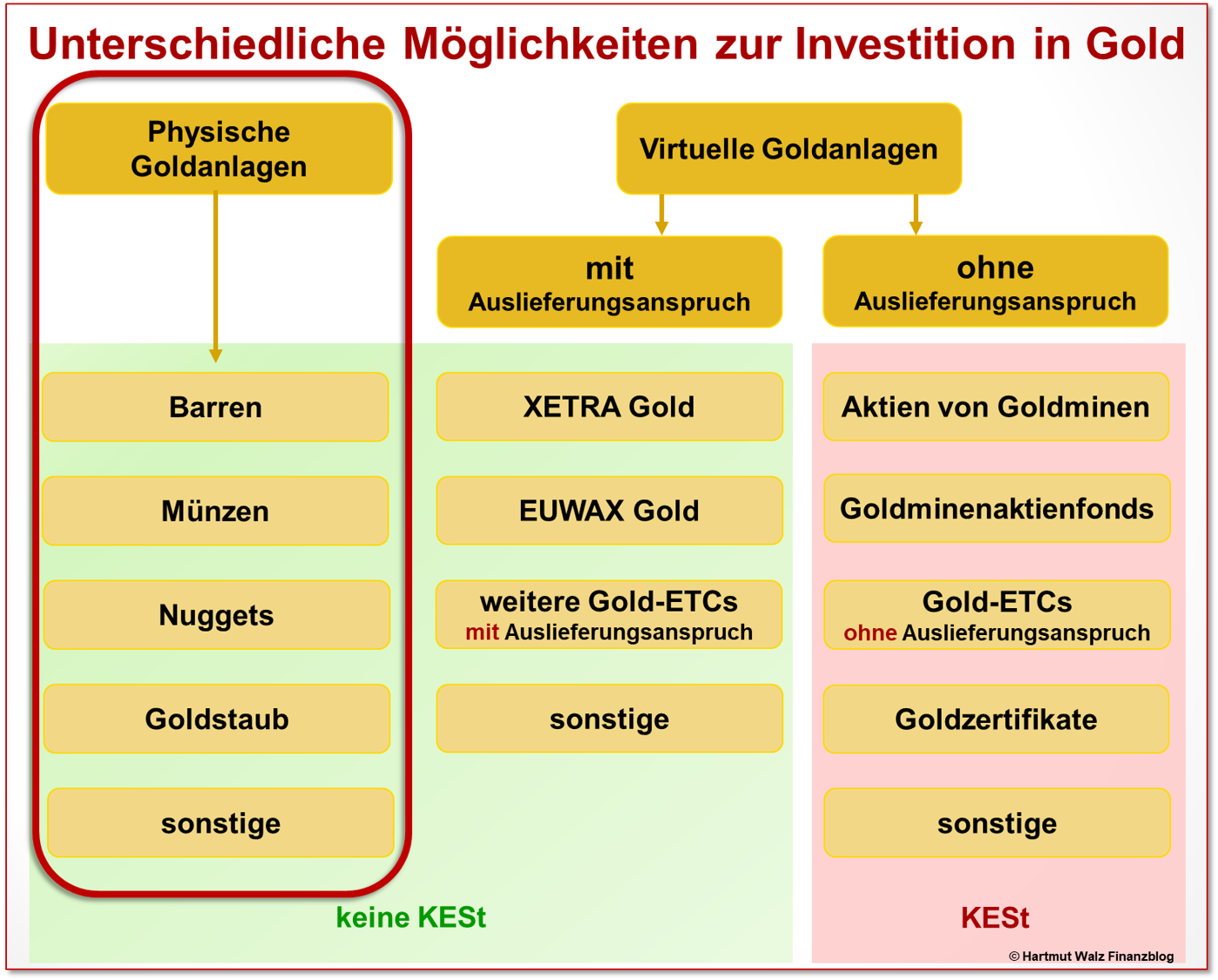

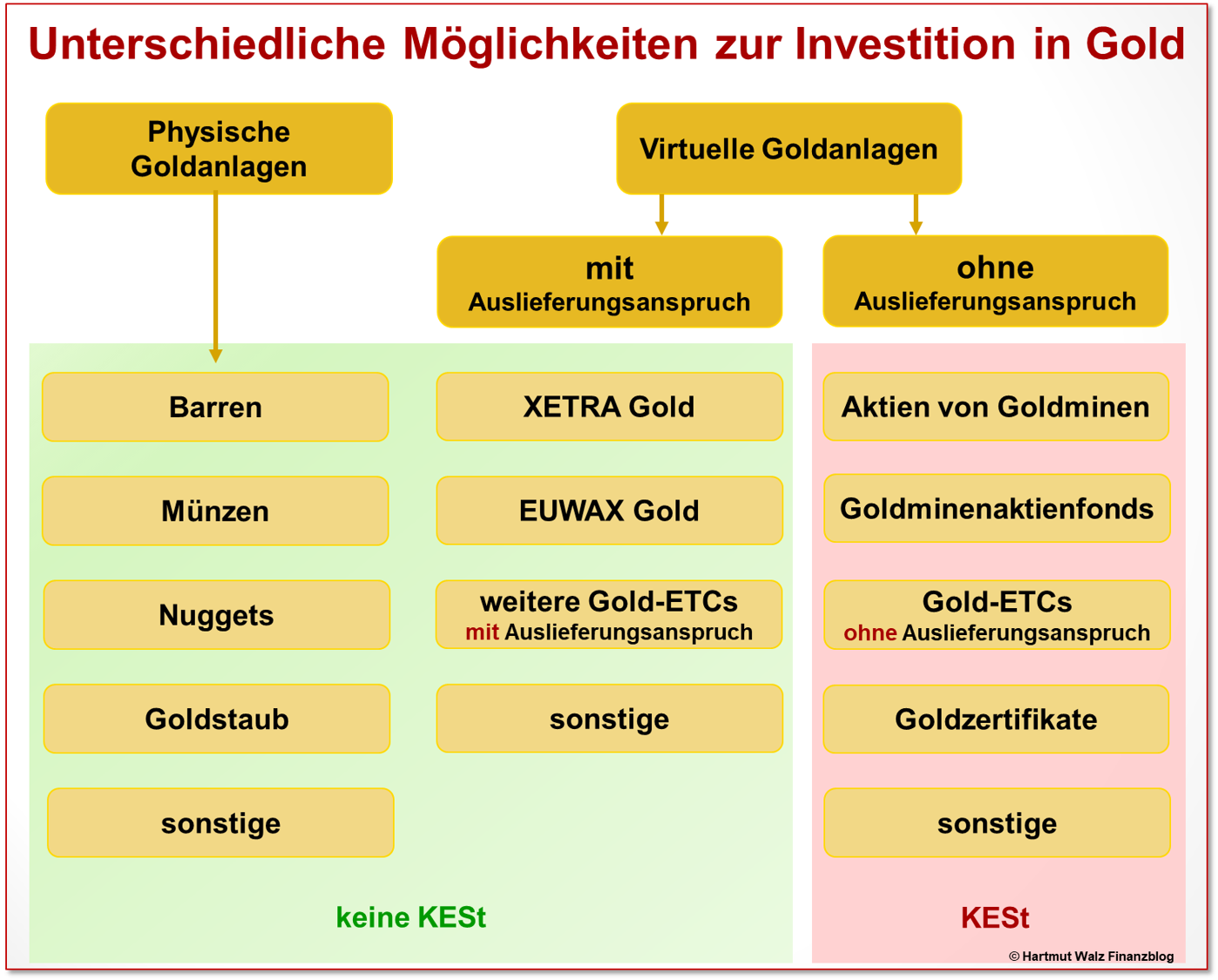

Here’s where the strategy gets interesting. Products like Xetra-Gold and EUWAX Gold II combine the convenience of ETCs with the tax treatment of physical gold. These virtual instruments maintain a delivery claim, you can request physical gold bars at any time. Austrian tax law treats them as physical holdings regardless of whether you ever take delivery.

You get zero storage costs, tight spreads (0.5-1% each way), and the same tax-free status after one year as holding a Krügerrand in your safe. The annual management fee of 0.15% on Xetra-Gold pales next to the 27.5% KEST burden on standard ETCs.

The catch? During extreme market stress, your delivery claim becomes "an Abholschein für ein Rettungsboot" (a pickup ticket for a lifeboat, still not a lifeboat). If the financial system seizes up, that paper claim may prove worthless. The product prospectuses explicitly warn about this risk, which is why Prof. Walz emphasizes these instruments suit investors seeking inflation protection, not doomsday insurance.

For most Austrian investors building a monthly savings plan, this represents the optimal middle ground. You avoid the brutal spreads of small physical purchases and the tax death of pure ETCs, while maintaining enough flexibility to sell without storage logistics.

Flatex vs Direct Dealer: Execution Costs Matter

Flatex users face an additional hidden cost: some banks charge extra custody fees for gold ETCs with delivery rights. The DKB, for example, levies a special fee for Xetra-Gold holdings while treating EUWAX Gold II as a standard security. This can add 0.2-0.5% annually, narrowing the cost advantage.

Direct purchases from dealers like Philoro or Ögussa offer better pricing for lump sums above €5,000. Their spreads drop to 2.5-3% each way, and you can negotiate storage fees if you buy enough volume. For the €250 monthly investor, however, the logistics of coordinating direct dealer purchases overwhelm the marginal savings.

The practical rhythm most investors adopt: accumulate cash for 3-6 months, then execute a single larger purchase through a low-cost dealer or via a delivery-right ETC. This minimizes spread damage while maintaining the tax advantage.

The €250 Monthly Action Plan

Based on the numbers, here’s what actually works:

For gold (€150/month): Open a Flatex account and set up a savings plan on Xetra-Gold (DE000A0S9GB0). Let it run for 12 months to cross the tax-free threshold. After one year, you can sell tax-free if needed, or continue holding. The 0.15% annual fee costs you €2.70 on a €1,800 position, trivial compared to KEST.

For silver (€100/month): Accept that Austria’s tax structure makes silver inefficient. Either accept the 20% VAT hit for physical coins (only if you plan to hold decades), or use a KEST-liable ETC for short-term trading. For genuine savings, redirect this portion to gold or a diversified commodity ETF with Austrian tax reporting.

For lump sums: When you accumulate €2,000+, consider a direct purchase from Münze Österreich or a Vienna dealer. The spread compression makes physical ownership worthwhile, especially if you have secure storage.

The research shows that investors obsessing over perfect execution often wait years without starting. The cost of delay exceeds the cost of suboptimal spreads. As one experienced investor noted: "Perfekt ist der Feind von fertig" (Perfect is the enemy of done).

Regulatory Headwinds and Reporting

Austrian banks now automatically report securities transactions to the Finanzamt under the Zinsabschlagsteuer (Withholding Tax) system. Your Flatex ETC sales trigger immediate KEST withholding, no way to defer or optimize. Physical gold purchases remain outside this reporting net, though dealers must report cash transactions over €1,999.99.

The anonymous purchase limit dropped from €15,000 to €1,999.99 in 2020, reflecting EU anti-money laundering directives. This change pushed many small investors toward traceable ETCs, inadvertently exposing them to KEST they could have avoided with physical metal.

For residents filing an Einkommensteuererklärung (Income Tax Return), KEST-paid investments require no additional paperwork. Physical gold sales above the €1,000 allowance need manual declaration under "Private Veräußerungsgeschäfte" (Private Disposal Transactions). The extra effort deters many, even when tax-free.

The Verdict: Choose Your Tax Poison Wisely

Austrian precious metals investing boils down to three options, each with a tax burden:

-

Standard ETCs: 27.5% KEST on all gains, no matter the holding period. Simple but costly long-term.

-

Physical gold: 3-3.5% spread each way, zero tax after one year. Best for amounts above €5,000 where spreads compress.

-

Delivery-claim ETCs: 0.5-1% spread each way, zero tax after one year, minimal storage costs. The sweet spot for monthly savings plans.

Silver remains problematic. The 20% VAT makes physical painful, while ETCs face KEST. Most Austrian investors treat silver as a tactical trade, not a strategic holding.

The controversy in the Reddit thread stemmed from conflicting priorities. Traders prioritized liquidity and accepted KEST. Long-term savers wanted tax efficiency and pushed physical. Both perspectives hold validity, but they serve different financial goals.

For the original poster’s €250 monthly plan, the math points clearly toward Xetra-Gold for the gold portion and a strategic reconsideration of the silver allocation. The tax savings alone justify the product choice, while the delivery claim provides an exit ramp to physical if holdings grow large enough to justify direct dealer relationships.

The Austrian system, despite its bureaucratic reputation, actually offers a legal tax avoidance path for patient gold investors. You just need to know which product checkbox to tick, and refuse the bank’s default suggestion.

When evaluating platforms, consider how automatic KEST taxation impacts your returns across different investment types. The withholding system leaves no room for tax optimization, making product selection at purchase the only lever you control.

Similarly, Flatex’s fee structures may appear identical across ETCs, but the custody cost variations for delivery-claim products can shift the total expense ratio by 0.2-0.5% annually. Always confirm the full cost breakdown before launching your savings plan.

For investors considering broader commodity exposure beyond precious metals, understanding why Austrian investors are shifting away from US ETFs provides context on how geopolitical concerns influence product selection. While gold remains politically neutral, the vehicles you use to access it carry regulatory and counterparty risks worth evaluating.

The key insight from the break-even analysis: most investors overestimate the impact of spreads while underestimating the long-term damage of KEST. A 3% spread paid once matters less than 27.5% tax paid on every gain, year after year. Choose accordingly.