Austrian investors looking to hedge against inflation with precious metals walk into a regulatory minefield disguised as a simple investment choice. The promise of easy gold exposure through Exchange Traded Commodities (ETCs) collapses the moment the Finanzamt (Tax Office) takes its 27.5% slice. Yet the alternative, buying physical gold and silver, comes with its own financial hemorrhaging through spreads, storage fees, and for silver, a brutal 20% Mehrwertsteuer (value-added tax). This isn’t a choice between good and bad options. It’s a choice between getting stabbed or shot.

The KESt Hammer: Why Your Paper Gold is Taxed to Death

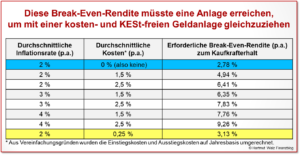

Austria’s Kapitalertragssteuer (capital gains tax) doesn’t discriminate between stocks and commodities. When you hold a gold ETC like IE00B4NCWG09, you’re not holding gold, you’re holding a debt instrument that tracks gold prices. The Finanzamt treats this as any other security, meaning every price increase triggers a 27.5% tax liability upon sale. For a long-term investor, this transforms a potential inflation hedge into a guaranteed wealth erosion tool.

The real kicker? This tax hits you even if gold merely keeps pace with inflation. While your purchasing power stays flat, the Finanzamt demands its quarter of your “gain.” Many international residents report discovering this only after receiving unexpected tax bills, finding Austria’s reputation for financial precision doesn’t extend to clear tax communication. The system creates a perverse incentive: you’re better off holding foreign currency cash than gold ETCs, despite gold’s historical safe-haven status.

This phantom taxation problem mirrors issues in other synthetic investment products. The phantom taxation on synthetic ETFs shows how Austria’s tax code aggressively pursues paper gains while ignoring the economic reality behind them. Your gold ETC might never touch actual metal, but the tax collector treats it as if you’ve mined a vein in the Alps.

Physical Gold: The “Simple” Alternative That’s Anything But

The most common advice from seasoned Austrian investors is blunt: buy physical. Walk into Philoro, Ögussa, or Münze Österreich (the Austrian Mint) and exchange cash for coins or bars. Simple, direct, no KESt on purchase. But this simplicity masks a spread nightmare that makes the 27.5% tax look almost reasonable by comparison.

For small investors wanting to invest €100-150 monthly, the numbers are crushing. A €100 gold purchase might net you less than one gram, with spreads reaching 15-20% above spot price. You’re immediately underwater by nearly a fifth of your investment. As one experienced buyer noted, “Bei Gold wirds mittlerweile schwierig mit 100€” (With gold, €100 becomes difficult these days). The consensus among precious metal buyers is clear: accumulate larger amounts, perhaps half an ounce every six months, to make the spread pain tolerable.

Storage adds another layer of cost and risk. Home storage means insurance headaches and security concerns. Professional vaulting through services like Schatzkammer.at eliminates these worries but introduces custody fees and the unsettling reality of “paper gold” all over again. As sceptics point out, during a genuine crisis when everyone wants physical delivery, these services might face liquidity issues. Your allocated gold could become very unallocated, very quickly.

Silver’s Double Whammy: KESt Plus VAT Equals Financial Suicide

Silver ETCs face the same 27.5% KESt treatment as gold, but physical silver carries an additional executioner: 20% Mehrwertsteuer. This immediately makes any physical silver purchase a 20% losing bet before spreads even enter the equation. The argument that “spreads don’t matter because you get them back on sale” collapses when you realize the VAT is gone forever, it’s a consumption tax, not an investment cost.

Yet silver’s 400% price surge over recent years has some investors claiming the VAT pain was worth it. This logic is dangerous. It’s like saying paying 20% extra for a lottery ticket was justified because you won. The tax system’s design actively punishes physical silver investment, pushing small investors toward ETCs where they then face the KESt trap. It’s a pincer movement with no escape.

The 2011/2012 silver crash taught painful lessons to those who held ETCs without stop-losses. Prices collapsed nearly 50% in months. With physical silver, you can’t set automatic sell orders. You’re left holding depreciating metal you’ve already paid 20% VAT on, with spreads widening as dealers demand higher risk premiums. The ETC’s advantage, liquidity and risk management, gets nullified by the tax code.

The Policy Contradiction: Why Austria Wants You to Fail

This entire system reeks of contradictory policy goals. The government offers Bausparen (building savings contracts) with tax incentives to encourage long-term saving, then slaps a 27.5% tax on gold ETCs that serve the same inflation-hedging purpose. They maintain a world-renowned mint selling investment-grade coins, then tax alternative ownership methods punitively.

The taxation of unrealized gains in leveraged ETFs demonstrates similar schizophrenia. Austria’s tax code aggressively pursues paper profits while offering no relief for paper losses until realization. This creates a heads-I-win-tails-you-lose scenario for investors. With precious metals, the contradiction is starker: they want you to buy from Münze Österreich but punish you for choosing more convenient alternatives.

Who benefits? Gold dealers certainly do. The spread margins on small purchases are obscene, and the tax-advantaged status of physical ownership drives traffic their way. The banks offering ETCs also profit, charging management fees while investors shoulder the KESt burden. The only loser is the ordinary Austrian trying to protect their wealth.

Escaping the Trap: Strategies That Actually Work

Is there a way out? For gold, yes, if you have patience. Accumulate cash for 4-6 months, then make larger physical purchases to minimize spread impact. A half-ounce Krugerrand every six months costs less in percentage terms than monthly gram purchases. Store them in a home safe for amounts under €10,000, upgrading to professional vaulting only for larger holdings.

For silver, the math is brutal. Either accept the 27.5% KESt on ETCs and treat it as the cost of liquidity, or make large enough physical purchases that the 20% VAT gets amortized over significant price appreciation. The latter requires confidence in a multi-year bull market, essentially timing the market, which defeats the purpose of systematic investing.

Some investors explore foreign storage options in Switzerland or Germany, but this introduces currency risk, customs complications, and the nightmare of cross-border tax reporting. The Finanzamt has become increasingly aggressive about tracking foreign assets, making this a solution that creates bigger problems.

Conclusion: The Uncomfortable Truth

Austria’s precious metal tax policy doesn’t have a good option, only less terrible ones. The 27.5% KESt on ETCs is transparent but punitive. Physical gold is tax-efficient but spread-inefficient for small buyers. Physical silver is tax-poisoned through VAT. The system is designed to make precious metal investing painful regardless of method.

The uncomfortable truth? For monthly investments under €250, you’re better off with inflation-linked bonds or diversified stock ETFs despite their own tax quirks. Precious metals only make sense in Austria for larger, less frequent purchases where spreads become manageable and the tax advantages of physical gold outweigh the convenience of ETCs.

Until the Finanzamt recognizes precious metals as distinct from securities, a change that would require legislative action, Austrian investors remain caught in a tax trap that turns the oldest wealth preservation tool into a modern financial frustration. Your gold ETC isn’t fool’s gold because the underlying asset is fake. It’s fool’s gold because only a fool would accept that 27.5% haircut when the system offers no fair alternative.