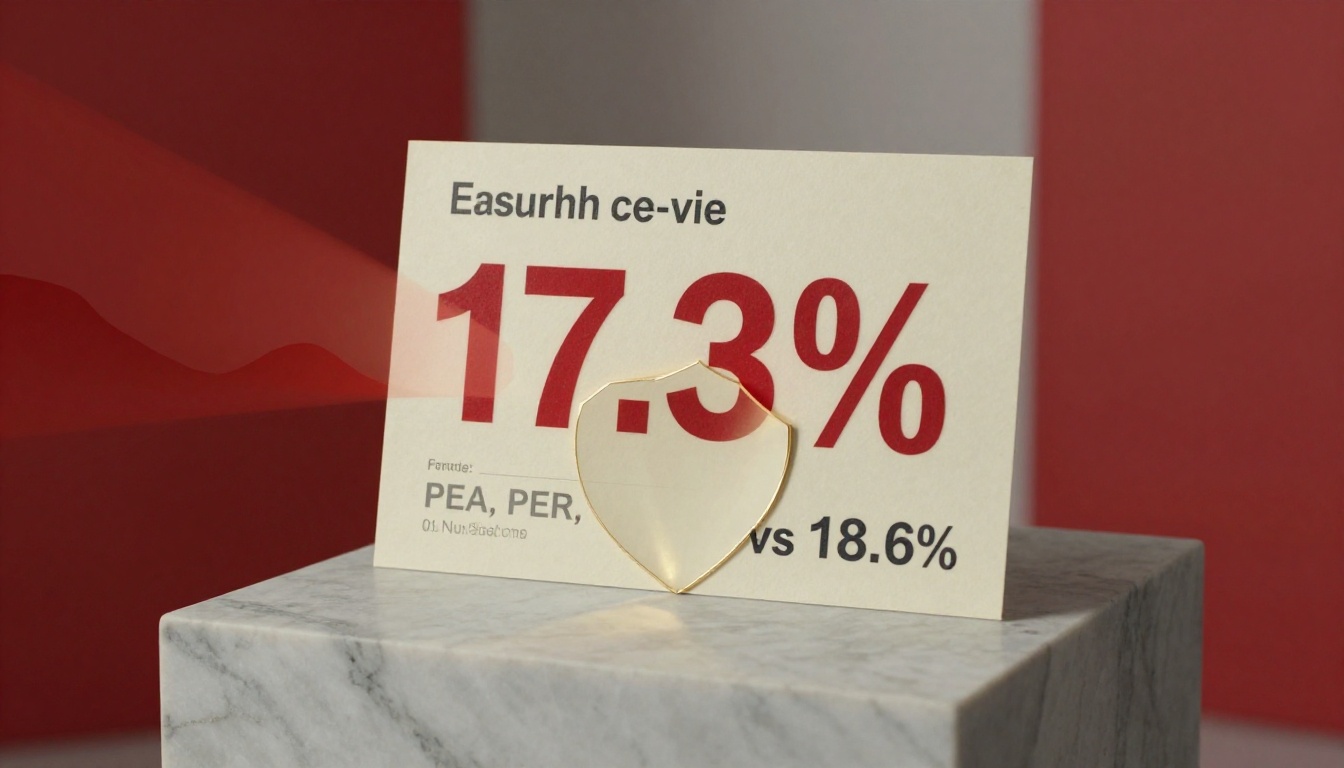

When France’s social security budget passed last year, most investors braced for impact. The numbers were clear: prélèvements sociaux (social levies) would jump from 17.2% to 18.6% on nearly every financial product imaginable. PEA (stock savings plan)? Hit. PER (retirement savings plan)? Hit. Ordinary bank accounts and securities holdings? Hit. But buried in the fine print, one product emerged unscathed: assurance-vie.

This wasn’t a typo. It was a deliberate choice that turned an already generous tax wrapper into something approaching a fiscal superweapon. The question isn’t whether assurance-vie got better, it’s why everything else got worse, and what that means for your money.

The Tax Bomb That Landed Everywhere Else

Let’s start with the damage report. As of January 1, 2026, the contribution sociale généralisée (CSG) rose from 9.2% to 10.6% on capital income. Since CSG forms the bulk of social levies, this single change pushed the total rate to 18.6% on:

- PEA withdrawals (after the five-year exemption period)

- PER distributions

- Employee savings plans (PEE, Perco)

- Unregulated bank savings accounts

- Term deposits

- Securities accounts (comptes-titres)

- Rental income from furnished properties

The math hurts. On a €50,000 gain, you’re now paying €700 more in social charges than last year. On €150,000, the surcharge hits €2,100. And unlike income tax, these levies apply regardless of your overall tax bracket. Even retirees with modest pensions get hit if they have investment income.

Why Assurance-Vie Gets Special Treatment

The official explanation involves administrative categories and legislative timing, but the real reasons are more interesting. French insurers hold roughly 10% of the country’s sovereign debt through their fonds en euros (euro-denominated funds). When Bercy (the French finance ministry) considered extending the levy hike to assurance-vie, the industry reportedly made a simple point: “Fine, but we’ll shift from French bonds to German ones.”

That conversation, whether apocryphal or not, highlights the delicate balance. The government needs institutional buyers for its debt, and assurance-vie contracts provide a stable, captive audience. It’s not quite financial repression, but it’s close.

There’s also the demographic reality. Retirees love assurance-vie. They vote. They complain to their deputies. Taxing their favorite savings vehicle more aggressively would be political kryptonite, especially when inflation is already eroding purchasing power.

The Hidden Mechanics of the Advantage

Here’s where it gets technical. Assurance-vie’s exemption works differently depending on how you invest:

- During accumulation: You pay no income tax and no social levies on unrealized gains. Your money compounds gross. The exception? Fonds en euros, which face a 17.2% annual levy on interest. But unités de compte (unit-linked funds) grow completely tax-free until withdrawal.

- During withdrawal: The famous “rule of three” applies. If you contributed €100 that grew to €110, a €10 withdrawal is treated as €9 of capital (tax-free) and €1 of gain. Only that €1 faces taxation.

- After eight years: You get an annual allowance of €4,600 for singles or €9,200 for couples on the gain portion. Structure your withdrawals right, and you pay zero income tax indefinitely. The social levy? Still 17.2%, not 18.6%.

- At death: Each beneficiary gets €152,500 completely exempt from inheritance tax. Ten beneficiaries means €1.525 million shielded. A concubin (unmarried partner) or friend who’d normally face 60% tax? They pay nothing.

The Comparison That Matters

Some advisors will tell you the PEA remains better for stocks because of its income tax exemption after five years. They’re not wrong, but they’re missing the full picture.

Consider a €100,000 investment growing at 6% annually. After 10 years, you have €179,000. Withdrawing through a PEA means paying 18.6% on the €79,000 gain, €14,694 in social charges. Withdrawing through assurance-vie (assuming you stay within annual allowances) means paying 17.2% only on the gain portion you withdraw. If you withdraw strategically, you might pay nothing at all.

The fiscal reality and net performance comparison between CTO and assurance-vie becomes even more stark when you factor in this new gap. A compte-titres ordinaire (ordinary securities account) faces the full 31.4% flat tax (12.8% income tax + 18.6% social levies). Assurance-vie, even without the eight-year allowance, caps out at 30% total taxation.

Strategic Implications for 2026

This tax asymmetry creates clear winners and losers:

- Winners:

– Long-term savers who can wait eight years

– Anyone planning inheritance (the €152,500 allowance is per beneficiary, not per contract)

– Retirees needing supplemental income within the annual allowances

– Investors in unit-linked funds who want tax deferral - Losers:

– Short-term traders who can’t wait for allowances to kick in

– PEA holders making large withdrawals

– Anyone with significant cash in taxable accounts

– Investors who didn’t diversify across wrappers

The record inflows into euro funds amid renewed interest in assurance-vie confirm that French savers are catching on. Net collections hit €50.6 billion in 2025, a 77% jump from the previous year. People aren’t just chasing returns, they’re fleeing taxation.

The Administrative Burden Reality Check

Let’s address the elephant in the room. Assurance-vie is bureaucratic. Rachats (withdrawals) require forms. Arbitrages (fund switches) take days. The paperwork can feel like dealing with URSSAF (social security contributions office) or the DGFiP (tax authority).

But here’s the thing: that friction is exactly what makes it work for long-term planning. You can’t panic-sell in a day. You can’t day-trade. The system forces discipline, and the tax code rewards it.

Many international residents report that the administrative complexity deters them from using assurance-vie, preferring the apparent simplicity of a PEA or CTO. That’s understandable, but it’s also expensive. The risk management and fiscal uncertainty advantages of assurance-vie over CTO become clearer when you realize that tax rates can change overnight, but your wrapper’s treatment is harder for politicians to touch.

What About the Critics?

Some argue this creates an unfair intergenerational divide. Older generations who could compound in assurance-vie for decades now enjoy tax treatment younger savers may never see. The shift in French savers’ behavior toward risk within assurance-vie suggests younger investors are moving into unit-linked funds, accepting volatility for higher returns.

Others point to the fee structure. Annual management charges on fonds en euros can reach 0.8-1%, while a PEA might cost 0.1% in custody fees. True, but the tax savings dwarf the fee difference on any meaningful sum.

And then there’s the sovereign debt question. If French insurers are captive buyers of government bonds, are savers indirectly funding the state at below-market rates? The how euro funds deliver high returns despite low risk-free rates analysis suggests insurers use complex derivatives and carry trades to boost yields. The system works, until it doesn’t.

Actionable Steps for Your Portfolio

-

Audit your wrappers: Calculate the effective tax rate on each of your accounts. If you’re sitting on large PEA gains, consider whether you need the money now or can wait.

-

Use the allowance: If your assurance-vie is over eight years old, plan withdrawals to stay under the €4,600/€9,200 annual gain exemption. That’s €70,000-€140,000 of tax-free withdrawals depending on your fund’s performance.

-

Diversify across time: Open new assurance-vie contracts periodically. The eight-year clock starts fresh, giving you flexibility later. Some platforms let you open contracts with €100.

-

Think inheritance: If you’re over 60, the succession advantages outweigh almost any fee disadvantage. Designate multiple beneficiaries to multiply the €152,500 allowance.

-

Watch for boosted rates: Insurers are offering teaser rates to new customers. The how boosted rates for new savers impact long-term policyholders in assurance-vie shows this can mean wealth transfer from old to new clients. Compare before you commit.

The Bottom Line

France just made assurance-vie the most tax-advantaged savings vehicle for anyone with a horizon beyond eight years. The 1.4 percentage point gap in social levies is just the headline. The real story is the compounding effect of tax deferral, the inheritance planning possibilities, and the political economy that makes this product untouchable.

For international residents, this creates a paradox. The product that seems most French, most wrapped in Gallic administrative complexity, is also the one that offers the most powerful shield against French taxation. Learning to navigate the paperwork isn’t just a cultural rite of passage, it’s a financial necessity.

The tax code is a moving target. But for 2026, at least, assurance-vie just became harder to ignore. Your move.