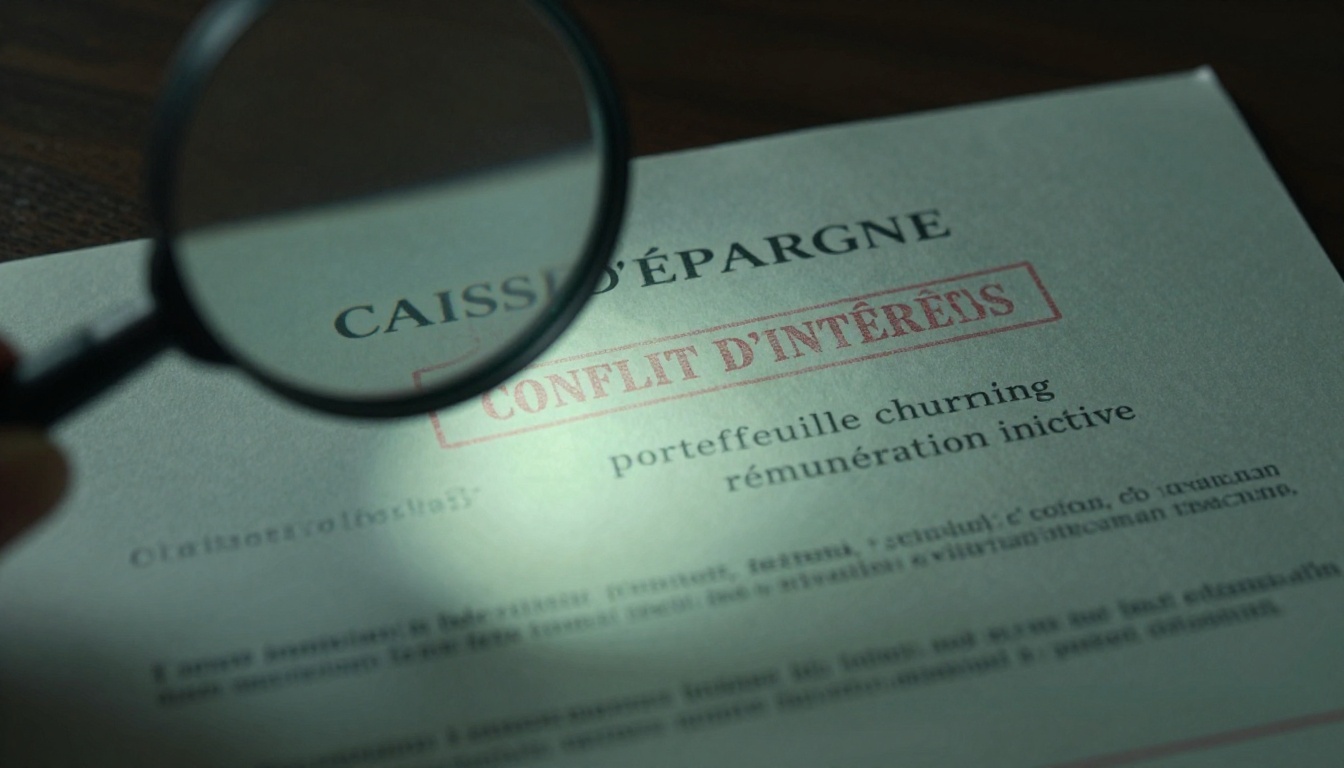

A Caisse d’Épargne customer recently discovered something unusual while reading the pricing brochure for their managed portfolio service. Tucked away in the fine print was a warning that most investors skim over: a direct admission that the remuneration structure between the bank and its asset manager could incentivize excessive trading. This isn’t theoretical, it’s a concrete example of how the French banking system builds conflicts of interest into everyday investment products.

The document explicitly states that the compensation scheme between Caisse d’Épargne (the distributor and account holder) and VEGA IS (the mandated manager) may strengthen the incentive for the manager to increase portfolio turnover rates for the benefit of the group. In plain terms: the more they trade, the more the bank profits, and you foot the bill.

The Mechanics of French Portfolio Churning

Portfolio churning, excessive buying and selling of assets to generate commissions, isn’t new. But in France’s tightly regulated market, it’s rarely stated so bluntly. The typical setup involves gestion pilotée (managed portfolio services), often wrapped inside assurance-vie (life insurance contracts), where multiple parties take their cut.

Here’s how the fee stack works against you:

- Insurance company fee: 0.5% to 0.75% annually on assets

- Management company fee: 0.5% to 1% annually

- Fund/ETF fees: 0.1% to 2% depending on the underlying assets

- Transaction costs: Embedded but rarely itemized

Each trade generates revenue for someone in this chain. When a manager rotates positions, they might capture spreads, retrocessions, or simply justify their management fee through “active” decision-making. The Caisse d’Épargne case is particularly telling because VEGA IS isn’t independent, it’s part of the same corporate ecosystem, creating what regulators call liens capitalistiques (capitalistic ties).

Why This Violates the Spirit of French Regulations

The Directive sur la Distribution d’Assurance (DDA), the EU insurance distribution directive transposed into French law, requires distributors to act “honestly, impartially, and professionally” in the client’s interest. The Autorité de Contrôle Prudentiel et de Résolution (ACPR) enforces these rules with specific requirements:

- Written conflict-of-interest policies

- Functional separation between product design and sales teams

- Registers of conflict situations

- Periodic controls and management reporting

Yet the Caisse d’Épargne disclosure shows how banks can technically comply while structurally encouraging behavior that harms clients. The warning exists, but it’s buried in tariff brochures that few read. More importantly, the incentive structure remains intact, creating what one industry observer called “the illusion of free management” where retrocessions and internal transfers keep the true costs opaque.

Many international residents report waiting weeks for banking appointments in Paris, despite expectations of streamlined processes. This same opacity extends to investment products, where paperwork complexity masks underlying conflicts.

The Performance Data Tells the Story

Managed portfolios in France face a mathematical challenge. A typical gestion pilotée contract layers 1.5% to 3% in total annual fees. To match a simple passive strategy returning 9% gross with 1% fees (net 8%), the managed portfolio must generate 10% gross returns consistently, just to break even.

Performance data from 2020-2025 reveals how rarely this happens:

| Assurance-vie Contract | 2022 Performance | 2023 Performance | 2025 Performance |

|---|---|---|---|

| MSCI ACWI (benchmark) | -13.0% | +18.1% | +6.3% |

| Ramify Flagship | -14.8% | +19.3% | +12.7% |

| Yomoni P10 Classique | -18.0% | +19.0% | +11.1% |

| Nalo 95% UC | -16.0% | +8.3% | +7.0% |

Most underperform the benchmark, especially after accounting for all fee layers. The few that outperform (like Ramify) typically use quantitative models with minimal human intervention, suggesting that traditional bank-managed portfolios with churning incentives face structural headwinds.

The hidden incentives and profit mechanisms in managed financial products create a system where even mediocre performance can be profitable for distributors, as explored in our analysis of how French insurers outperform risk-free rates.

The Transparency Paradox

French regulators require clear disclosure, yet the system is designed to make costs invisible. As one financial advisor noted: “On paper, banking and insurance are equally transparent when you read the fine lines (like the original poster did). Everything must be presented clearly and non-deceptively.”

The problem? Most clients don’t read the fine print. They never receive clear fee invoices, so costs pass unnoticed, especially when markets rise. One bank even started deducting management fees (0.1% monthly) from clients’ current accounts rather than their investment accounts. Psychologically, this was perceived completely differently, even though it’s identical economically. People pay much more easily when they don’t see explicit flows.

This psychological blind spot is exactly what makes portfolio churning profitable. Each transaction appears minor in isolation, but collectively they erode returns.

Gestion Libre: The Alternative French Investors Should Consider

The antidote is gestion libre (self-directed management). Instead of delegating to a conflicted manager, you select your own supports d’investissement (investment vehicles), typically low-cost ETFs tracking global indices.

Benefits include:

– Total cost reduction: Eliminate the 0.5-1% management layer

– Transparency: See exactly what you own and pay

– Control: No unwanted trading or tax-inefficient moves

– Performance: Match the market instead of underperforming it

The trade-off? You need to spend time understanding asset allocation and resist panic during volatility. But for anyone willing to read a few hours of educational material, the savings compound dramatically over decades.

Debates over active vs passive investing strategies in France increasingly favor the latter, as evidence mounts that active management rarely justifies its costs, especially when incentivized to trade excessively.

What You Can Actually Do

If you’re already in a managed portfolio at Caisse d’Épargne or another French bank:

- Request your complete fee breakdown in writing. They must provide it.

- Calculate your actual total expense ratio including all layers.

- Compare net performance to a relevant benchmark like MSCI ACWI over 3-5 years.

- Check your transaction history for excessive turnover. More than 100% annual turnover warrants questions.

- Consider switching to gestion libre on the same assurance-vie contract if you want to keep the tax wrapper.

- For new investments, open a PEA (Plan d’Épargne en Actions) for stock exposure or a low-cost assurance-vie with free management.

Regulatory tensions in French investment accounts show that authorities are aware of these issues, but change comes slowly. Your best defense is informed skepticism.

The Bigger Picture: Trust and French Finance

This disclosure matters beyond one bank. It reveals how French financial institutions navigate the tension between client interests and profit motives. The system relies on prélèvement à la source (pay-as-you-earn withholding) and complex tax wrappers that make switching costs high and transparency low.

The result? Many investors stay in underperforming, overtraded portfolios for years, unaware that their “trusted” bank profits from their inertia. The Caisse d’Épargne document is valuable precisely because it’s unusually honest, most banks don’t spell out the conflict so clearly.

As France pushes toward more digital financial services and regulatory scrutiny increases, these incentive structures will face pressure. But for now, the burden remains on you to read the fine print, understand the conflicts, and act in your own interest, even when your bank won’t.

The prevailing sentiment among international residents is that French bureaucracy can feel opaque until you learn the key systems. Investment products are no exception. The difference is that here, opacity costs you money directly.