When your neighborhood Edelmetallhändler (precious metals dealer) in Frankfurt starts looking like a Berlin nightclub on a Saturday night, packed with 25-year-olds clutching their smartphones and asking about Krugerrands, you know something unusual is happening. Gold has just blasted through 150€ per gram, a 50% jump in under five months. The question dividing German investors right now isn’t whether to buy gold, but whether anyone buying at these levels is a genius or the last fool standing.

The Numbers That Made Germany Do a Double-Take

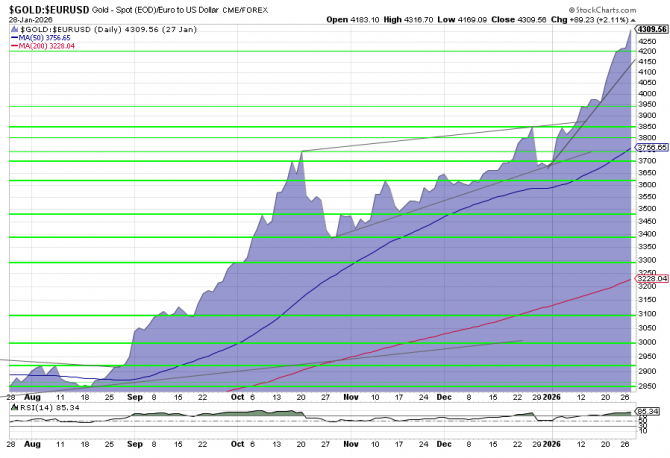

Let’s cut through the noise with hard data. In early October 2025, gold traded around 100€ per gram. By late January 2026, it hit 150€. That’s not a gradual climb, that’s a vertical takeoff that would make the Deutsche Bahn schedule look reliable.

The USD price tells the same story: gold rocketed from $4,386 per Feinunze (troy ounce, 31.1 grams) at year-end 2025 to over $5,555 in January 2026, a 26% surge in weeks. For context, that means Germany’s official gold reserves, stored partly in Frankfurt and partly under the watchful eyes of the Bundesbank (German Federal Bank), gained roughly €105 billion in paper value since January 1st alone.

The Bundesbank sits on approximately 3,350 tons of gold, making Germany the world’s second-largest sovereign gold holder after the United States. At current prices, that’s a half-trillion-euro stash. But before you start calculating your personal share, remember: this gold belongs to the independent central bank, not the federal budget. The German government can’t simply cash in to fund infrastructure projects or tax cuts. It’s a strategic reserve, not a piggy bank.

What’s Actually Driving This Gold Rush?

The research points to five converging forces creating this perfect storm:

1. Inflation That Refuses to Die

Despite official numbers suggesting inflation is “under control”, German consumers feel the squeeze every time they shop at Aldi or pay their Warmmiete (warm rent). Real purchasing power erosion has become impossible to ignore. When savings accounts offer 2% but your grocery bill suggests 8% inflation, gold starts looking less like a barbarous relic and more like basic financial hygiene.

2. Central Banks Gone Shopping

This isn’t retail FOMO driving prices. According to market analysis, Nationalbanken (national banks) and institutional players are the primary buyers. These aren’t speculators, they’re central banks from emerging economies and BRICS nations diversifying away from dollar dependence. They’re not timing the market, they’re implementing decade-long strategic shifts. When the big boys buy with that kind of conviction, it creates a price floor that’s hard to break.

3. The De-Dollarization Trade

Geopolitical tension isn’t just news fodder, it’s restructuring global finance. Discussions about alternative reserve currencies and BRICS-led financial systems make gold attractive as politically neutral money. It can’t be frozen by sanctions or devalued by tweet.

4. Real Interest Rates in the Gutter

The math is brutal: German Bundesanleihen (federal bonds) might pay 2.5% nominally, but subtract actual inflation, and you’re looking at negative real returns. Gold pays no interest, but when bonds guarantee purchasing power loss, zero starts looking pretty good.

5. The Silver Lining (Literally)

Silver has gone even more vertical, up 65% in 2026 alone after a 150% gain in 2025. This isn’t just safe-haven demand, silver’s industrial use in AI, robotics, and green tech creates a dual-demand story that makes gold’s rise look modest.

Technical Analysis: Overheated Engine or Just Warming Up?

Chart technicians are waving red flags. The Relative-Strength-Index (RSI) for gold hit 86 in late January, deep in overbought territory. The price sits 38% above its 200-day moving average and 18% above the 50-day line. These are stretched conditions that typically precede sharp corrections.

Key technical levels to watch: A drop below €4,150 per ounce (roughly €133/gram) could signal the start of a deeper consolidation. But until then, the trend remains your friend, albeit a slightly manic one.

The German Retail Investor’s Dilemma

Walk into any Goldhändler in Munich, Hamburg, or Berlin right now, and you’ll encounter two distinct customer types:

The Panic Buyer: Usually older, converting savings into physical Goldbarren (gold bars) and Anlagemünzen (investment coins) because “the system is breaking.” They remember the 2008 financial crisis and want tangible assets.

The Strategic Accumulator: Typically 25-30 years old, treating gold as a portfolio component, like crypto, but with 5,000 years of track record. They’re buying monthly, dollar-cost averaging into a 5-10% allocation.

Christian Rauch, CEO of Frankfurt-based precious metals firm Degussa, notes this demographic shift: “Younger people are discovering gold as a portfolio tool, not just a doomsday hedge.” This new blood brings stability to demand, but also raises questions about what happens when TikTok trends change.

Physical Gold vs. Paper Gold: The German Tax Angle

Here’s where German specifics matter. Physical gold bars and investment coins are Mehrwertsteuerfrei (VAT-free) in Germany, a significant advantage over silver, which carries 19% VAT. This makes physical gold more attractive than ETFs for many German investors.

But there’s a catch: ETCs (Exchange Traded Commodities) face Kapitalertragssteuer (capital gains tax) and may be less valuable in a true crisis when counterparty risk becomes real. As one analyst put it: “In a real emergency, an ETC is probably worth as much as the paper it’s printed on.”

For German tax residents, the choice often boils down to:

– Physical gold: No VAT, store at home or in a Tresor (safe), but higher spreads and storage concerns

– Gold ETFs/ETCs: Easier to trade, but subject to 25% capital gains tax plus Solidaritätszuschlag (solidarity surcharge)

Bubble or Baseline? The Verdict Depends on Your Timeframe

The Bubble Case:

- RSI at 86 suggests extreme overbought conditions

- Price has risen too far, too fast, 50% in five months is unsustainable

- Retail FOMO is building, historically a late-stage signal

- Any hint of Fed hawkishness or geopolitical de-escalation could trigger 20-25% correction

The Baseline Case:

- Central bank buying isn’t speculation, it’s structural rebalancing that will continue for years

- Inflation isn’t transitory, it’s become politically convenient to tolerate higher price levels

- De-dollarization is a multi-decade trend, not a headline

- German Goldschmiede (goldsmiths) and industrial users report no demand destruction even at these prices

What Should German Investors Actually Do?

Forget predictions. Focus on process:

If you own zero gold: Start building a position, but use Kostenmittelung (cost averaging). Buy small amounts monthly rather than one large purchase at what might be a top.

If you’re overweight gold (25%+ of portfolio): Consider rebalancing. Take some profits and redeploy into undervalued assets. As Warren Buffett’s rule goes: if you wouldn’t buy at today’s price, you should probably sell some.

If you’re a trader: Watch the €4,150/ounce support level. A clean break below suggests a deeper correction and potential short opportunity. Above €4,900/ounce, momentum could carry to new highs.

Tax optimization: For German investors, keep physical gold holdings below the Veräußerungsgrenze (disposal limit) that triggers reporting requirements, or maintain detailed records for your Steuererklärung (tax return).

The Uncomfortable Truth

Gold at 150€/gram isn’t about gold, it’s about what people think everything else is worth. When a gram of yellow metal costs as much as a nice dinner in Stuttgart, it says more about chronic distrust in currencies and institutions than about gold’s intrinsic value.

The Bundesbank isn’t selling. Central banks keep buying. Young Germans are stacking. That doesn’t guarantee prices won’t correct sharply, they will, eventually. But the floor keeps rising because the reasons people buy gold aren’t going away.

Is it a bubble? Maybe. But calling it that misses the point. We’re watching a slow-motion vote of no confidence in the post-2008 financial system, cast in 24-karat form. Whether you participate depends less on price predictions and more on whether you trust that system more than the people currently fleeing it.

For now, the German gold market operates with the same efficiency as a Deutsche Bahn train, usually impeccable, until there’s construction on the line. And right now, the whole track is under repair.