The silver price just shot past $110 per ounce, more than double its 2025 high. Gold trades above $5,000. Your neighbor who bought silver coins in 2020 looks like a genius. Your portfolio manager who dismissed precious metals as “boomer assets” is suddenly quiet. The question isn’t whether to pay attention anymore. It’s whether this represents the start of a decade-long structural bull market or the final, manic phase of a bubble built on leverage and wishful thinking.

The Numbers That Triggered the Frenzy

Let’s start with what we know for certain. In January 2026, silver broke its previous all-time high of around $50 (set in 1980 and again in 2011) and kept climbing. The move from $70 to $110 took weeks, not months. Gold, meanwhile, punched through $5,000 after spending most of 2025 consolidating around $3,500. The gold/silver ratio compressed from over 80:1 to roughly 50:1, signaling that silver was outperforming its more expensive cousin by a wide margin.

The drivers cited by market participants fall into two camps. The first group points to structural supply deficits. Global silver mining production hovers around 800-850 million ounces annually, while total demand, including industrial uses, jewelry, and investment, exceeds one billion ounces. That deficit isn’t new, but the composition of demand is changing rapidly. Solar panel production, AI data centers, and electric vehicles now consume nearly 30% of annual silver supply. Unlike traditional investment demand, which can vanish when prices spike, industrial buyers must keep purchasing regardless of price.

Two Narratives, One Market

The industrial demand story sounds compelling. Silver isn’t just a monetary metal anymore, it’s a critical industrial material. Each solar panel requires silver paste. Every data center uses silver in its connectors. The green energy transition, the AI boom, and the reshoring of manufacturing all point to higher silver consumption. This narrative suggests silver should trade more like copper or lithium than gold.

But there’s a catch. High prices cure high prices. Chinese solar panel manufacturers, facing margin pressure from expensive silver, have already begun developing alternative materials and processes that use less of the metal. Substitution takes time, but it happens. The oil shocks of the 1970s taught industries to become more efficient. Silver-intensive industries will follow the same path.

The speculative narrative gains traction when you examine who is actually buying. Retail investors in Europe face an 8.1% Mehrwertsteuer (VAT) on physical silver, making it immediately more expensive than paper alternatives. Yet demand for coins and small bars has surged. Many buyers aren’t industrial users, they’re people betting on continued price appreciation. When your Uber driver mentions his silver stack, it’s worth asking if the market has run ahead of fundamentals.

The Gold/Silver Ratio: Historical Context or Red Herring?

Traditional precious metals investors obsess over the gold/silver ratio. Historically, the ratio averaged 60-65:1 over the past century. At 50:1, silver appears undervalued relative to gold. Some analysts even point to geological ratios, silver occurs in the earth’s crust at roughly 10-11 times the frequency of gold, to argue the ratio should be far lower.

But this logic has flaws. Silver’s industrial demand makes it a hybrid asset, not purely monetary. During economic expansions, industrial demand can support prices. During contractions, that same demand evaporates. Gold, with its minimal industrial use, behaves more predictably as a safe haven. The ratio tells you about relative performance, not absolute value.

Moreover, the historical ratio reflects a world where both metals served as money. Today, only gold fills that role for central banks. The Swiss National Bank holds gold, not silver. This distinction matters for long-term value investors.

Physical vs. Paper: The Delivery Crunch

The most intriguing development in 2025 involved COMEX delivery mechanics. Reports indicated that physical delivery requests reached unprecedented levels, with some months showing 100% of contracts settled in metal rather than cash. This suggests a loss of confidence in paper promises.

However, interpreting this data requires caution. Large traders can game delivery systems. A single entity standing for delivery on thousands of contracts creates an optical squeeze without reflecting broad-based industrial shortage. The LBMA (London Bullion Market Association) vaults still hold hundreds of millions of ounces. The question is whether those ounces are already encumbered by multiple claims.

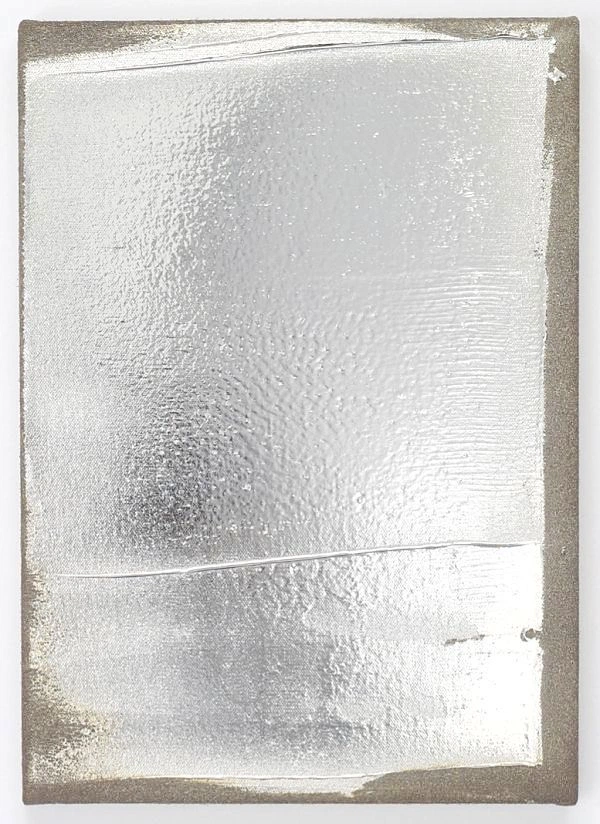

Swiss investors have an advantage here. The country’s refineries and private vaults offer direct access to physical metal without the derivatives layering. For those concerned about counterparty risk, Swiss gold coins as traditional safe-haven assets remain a straightforward option, albeit with higher premiums than kilo bars.

Swiss Practicalities: VAT, Storage, and Strategy

For residents in Switzerland and Liechtenstein, the mechanics of precious metals investing involve specific considerations. Physical silver incurs 8.1% Mehrwertsteuer (VAT), making it immediately less attractive than gold, which is VAT-free for investment-grade products. This tax treatment reflects silver’s classification as an industrial metal rather than a monetary asset.

Wealthy investors increasingly use Liechtenstein-based structures to hold physical metal. The so-called “Wealth-Police” structure, technically a life insurance wrapper, offers tax deferral and estate planning benefits while storing metal in non-EU vaults. This setup protects against potential future EU wealth taxes or gold-specific levies. The Vienna-Life Lebensversicherung AG structure mentioned in recent press releases allows institutional-grade pricing without retail premiums.

But these structures come with costs. Insurance wrappers charge annual fees. Vaulting costs money. The benefits compound over decades, not months. For someone buying silver today at $110 hoping for a quick flip, these structures make no sense. They’re designed for generational wealth preservation, not speculation.

What Could Go Wrong: The 1980 Parallel

Veteran metals investors remember 1980. The Hunt brothers attempted to corner the silver market, driving prices from $6 to nearly $50 before the COMEX changed margin rules and halted new buying. Prices collapsed back to single digits within months.

Today’s situation differs in important ways. The Hunt brothers represented a concentrated, leveraged position. Current ownership is more diffuse. Industrial demand provides a floor that didn’t exist in 1980. Regulators learned lessons from that episode and would likely intervene earlier.

But the risk of intervention remains. If silver prices continue rising at the current pace, expect:

– Increased margin requirements on futures exchanges

– Potential export controls from major producing countries

– Talk of windfall profit taxes in consuming nations

– Central bank sales to calm markets

The Swiss tradition of stability and rule of law provides some protection, but no investor lives in a vacuum. A global margin call on precious metals would hit everyone.

Bottom Line: Actionable Steps for Swiss Investors

If you’re considering adding precious metals to your portfolio, separate the decision into two questions:

1. Are you hedging or speculating?

– Hedgers should allocate 5-10% of net worth to gold, perhaps via Swiss gold coins as traditional safe-haven assets or VAT-free bars. Silver’s volatility makes it a poor hedge for most.

– Speculators should recognize they’re betting on continued momentum. Set stop-losses. Consider using options or leveraged ETFs rather than physical metal. And remember that silver’s 8.1% VAT means you start underwater.

2. What’s your time horizon?

– Long-term holders (10+ years) benefit from Liechtenstein structures and institutional pricing. The tax deferral and estate planning features outweigh costs for large positions.

– Short-term traders should stick to liquid paper markets. The bid-ask spread on physical metal and VAT make quick trades expensive.

The current rally has elements of both fundamental repricing and speculative excess. Industrial demand provides a genuine floor. But the speed of the move suggests leveraged hot money is involved. For Swiss investors, the key is matching your strategy to your goals. Wealth preservation requires patience and structure. Speculation requires discipline and exit plans. Mixing the two approaches usually ends badly.

The precious metals market is telling us something important about currency debasement and geopolitical stress. Listen to that message, but don’t let the noise of a parabolic price chart drown out the need for careful planning.