You’ve been banking with ING for years, your salary lands there every month, and now you want to start investing. The logical step? Open an ING Beleggingsrekening (investment account) and buy their famous Northern Trust funds. After all, everyone in the Dutch FIRE community keeps hammering on about dividendlekkage (dividend leakage) and how these NT funds are the holy grail for avoiding it.

But here’s the uncomfortable question that keeps experienced investors up at night: Is the dividend leakage argument strong enough to justify staying with ING’s ecosystem, or are you leaving serious money on the table through hidden costs and missed opportunities?

The Dividend Leakage Problem (And Why Dutch Investors Obsess Over It)

Let’s start with the basics. When you buy a typical Irish-domiciled ETF like VWRL or IWDA, you’re subject to dividend leakage of approximately 0.25-0.30% annually. This happens because the fund pays withholding tax on dividends from underlying stocks (especially US stocks at 15%), but you can’t fully reclaim this tax in your Dutch tax return because the fund structure doesn’t allow for it. The money simply vanishes into the fiscal ether.

Northern Trust funds, domiciled in the Netherlands, avoid this issue through fiscal transparency and tax treaties. In theory, this saves you that 0.25-0.30% drag on your returns. For a €100,000 portfolio, that’s €250-300 per year. For a €500,000 portfolio, you’re looking at €1,250-1,500 in annual savings. Real money, no doubt.

But here’s where the Reddit discussion gets spicy: many international residents report that the practical benefits get murky when you’re starting small and ING’s cost structure enters the picture.

What You’re Actually Buying at ING

The original poster planned a classic three-fund portfolio:

– NT World (NL0013654742): 81.9% allocation

– NT Small Cap (NL0013474307): 8.0% allocation

– NT Emerging Markets (NL0014040289): 10.1% allocation

This mirrors the standard advice for global diversification. The funds follow MSCI indices with ESG screening, which means they exclude certain companies based on sustainability criteria. The screening is more aggressive on the Small Cap fund (19.53% exclusion) compared to the World fund, something many investors don’t realize until they’ve already committed.

The minimum order amount is €10 per fund, which forces you into roughly 80/10/10 splits if you’re investing less than €300 per month. Not a dealbreaker, but it shows how the platform constraints shape your allocation.

The Cost Structure Reality Check

Here’s where ING’s convenience starts showing cracks. As of January 2026, ING changed their pricing for “Zelf Beleggen op de Beurs” (self-directed investing). They removed the €20 annual basic fee, but introduced transaction costs of €1 + 0.10% for funds not in their ETF Topselectie.

The Northern Trust funds? Not in the Topselectie. So every monthly purchase of your three-fund portfolio costs you €3 + 0.10% of your investment amount. On a €100 monthly investment, that’s €3.10 in costs, or 3.1% of your investment. That’s not an expense ratio, that’s a transaction tax that obliterates any dividend leakage benefit for decades.

Compare this to Interactive Brokers, where you’d pay cents rather than euros for the same transaction. Or DEGIRO, where you could buy VWCE (which has dividend leakage, yes) for €1 per transaction with zero ongoing service fees.

The math gets painful at small balances. If you’re investing €100/month, you need roughly €12,000 invested before the annual dividend leakage savings (0.25% = €30/year) outweigh your transaction costs (€37.20/year). And that’s before considering ING’s service fees on the investment account itself.

The Alternatives That Make ING Sweat

Let’s run through what the data actually shows about alternatives:

1. Vanguard VTI + VXUS via Interactive Brokers

– Total expense: ~0.12% annually

– No dividend leakage (US funds, US tax treaties)

– Can only be bought via options or with professional status

– The cheapest option if you can access it, but complex

2. Amundi Prime All Country World (WEBG/WEBN)

– Total expense: ~0.31% annually via DEGIRO/IB

– Has dividend leakage (~0.25%)

– But: zero transaction costs, simple to buy

– Net cost: ~0.56% vs NT’s ~0.43% at ING (including transaction costs)

3. Meesman or Brand New Day

– Both use Northern Trust funds internally

– Meesman: 0.58% total cost, 0.25% transaction costs

– Brand New Day: 0.58% total cost, zero transaction costs

– Key advantage: automatic rebalancing, no manual orders

4. The Threshold Where NT Wins

According to cost calculations, NT funds via Saxo Bank (not ING) become cheaper than Amundi around €1,000,000 invested. Yes, you read that correctly. For accounts under half a million, the difference is measured in hundredths of a percent.

The Behavioral Economics Trap

The Reddit thread reveals something crucial: the poster admits they’ll check their portfolio “30 times a day” when starting out. This is why starting with €100/month is psychologically sound, you’re testing your risk tolerance before committing real money.

But ING’s platform practically encourages this behavior. Their mobile app integrates your investment account with your daily banking, making it effortless to obsess over every fluctuation. More experienced investors note that separating your investment account from your daily bank (using Meesman, BND, or a standalone broker) creates a healthy psychological barrier.

There’s also the automation question. ING allows periodic investments, but you must manually choose whether deductions come from your current account or investment account. Dividend payments land in your investment account by default. It’s flexible, but not as “set and forget” as dedicated platforms.

The ESG Complication Nobody Talks About

Here’s a spicy detail: Northern Trust funds exclude companies based on ESG criteria. The World fund excludes about 4.1% of the market, but the Small Cap fund excludes a whopping 19.53%. This isn’t just avoiding oil companies, it materially changes your exposure to entire sectors.

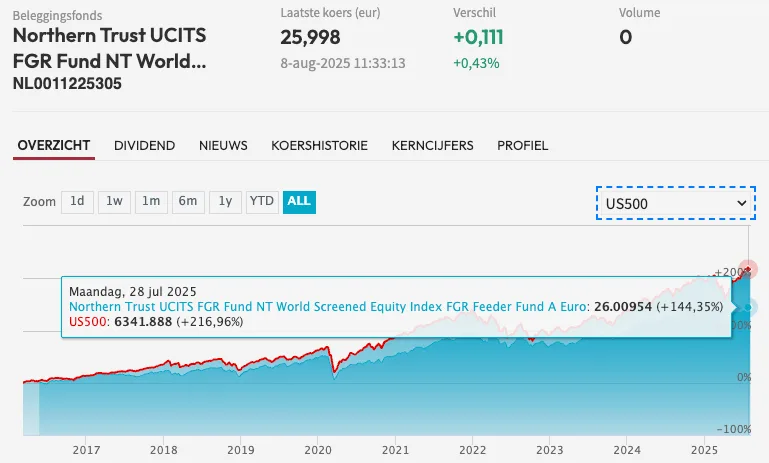

Some investors call this “stock picking lite.” If your goal is true market-cap weighted global exposure, NT funds deliberately deviate from that strategy. The performance impact has varied between -1.0% and +1.9% annually since 2008, averaging +0.3% in favor of ESG. Past performance doesn’t guarantee future results, and many suspect the ESG premium has already been arbitraged away.

Verdict: Is the Dividend Leakage Argument Strong Enough?

The honest answer: It depends on your investor profile.

For the €100/month beginner: No. The transaction costs dwarf any leakage benefit. Start with VWCE at DEGIRO or Meesman’s mixed fund until you hit €10,000. Then reassess.

For the €500/month committed investor: Maybe. After 2-3 years, your balance reaches €12,000-18,000 and the leakage savings start covering costs. But you’re still paying a convenience premium.

For the €100,000+ investor: Yes, but not at ING. Move to Saxo Bank or another broker offering NT funds without transaction fees. Or embrace the complexity of Interactive Brokers and VTI/VXUS for maximum efficiency.

For the true optimizer: The dividend leakage argument is sound, but ING is the wrong vehicle. The combination of transaction fees and platform limitations makes it a mediocre execution of a good strategy.

The real value of NT funds shines at scale. Below €50,000, you’re better off prioritizing low transaction costs and simplicity. Above €200,000, the leakage savings become material and warrant platform optimization.

Actionable Next Steps

- If you’re starting small: Open a DEGIRO account, buy VWCE monthly, and ignore dividend leakage for now. Focus on building the habit.

- If you’re committed to ING: Consolidate to monthly investments of at least €500 to dilute transaction costs. Set up automatic transfers to your Beleggingsrekening (investment account) and enable dividend reinvestment.

- If you have €50,000+: Calculate your actual costs including all fees. Compare Saxo Bank’s NT offering (0.43% total) against sticking with ING. The math likely favors Saxo.

- If you value simplicity above all: Use Meesman or Brand New Day. You get NT funds without the manual overhead, for a modest 0.15% annual premium.

The dividend leakage argument isn’t wrong, it’s just oversold to beginners who can’t yet benefit from it. Don’t let perfect be the enemy of good. The best investment strategy is the one you’ll actually stick with, even if it costs you 0.2% more than the theoretical optimum.

And if you’re checking your portfolio 30 times a day? Maybe the real leakage isn’t fiscal, it’s your time and mental energy draining away. That’s a cost no tax treaty can fix.

Performance comparison: Northern Trust funds vs S&P 500 index over time. While NT funds solve the dividend leakage issue, the total cost picture requires careful analysis.

Disclaimer: This analysis is for informational purposes. Investment risks apply, and past performance doesn’t guarantee future results. Always verify current fee structures before making decisions.