The Dutch wealth tax system stands at a critical juncture. As the Netherlands prepares to shift from its controversial fictional return system (forfaitair rendement) to a real return model in 2028, investors face a narrow window where market timing could trigger devastating tax consequences. New simulation data reveals that the transition period itself creates a hidden risk: the possibility of paying substantial taxes on wealth recovery that exists only on paper.

The Box 3 Transition Explained

Currently, the Belastingdienst (Dutch Tax Authority) taxes wealth in Box 3 based on assumed returns rather than actual performance. For 2026, this means you’ll pay 36% tax on a presumed 6% return for investments, regardless of whether your portfolio actually gained or lost value. The system[Box 3 wealth tax] essentially pretends you made money, then demands its cut.

The new system planned for 2028 promises fairness by taxing actual returns. However, the Supreme Court ruling in June 2024 forced the government’s hand, creating transitional legislation that will govern the period until the new system takes effect. This interim period is where the danger lies.

The Recovery Tax Trap

Here’s the scenario that keeps tax advisors awake at night: Imagine you have €100,000 invested on January 1, 2026. By January 1, 2028, when the new system takes effect, your portfolio has plummeted 57% to €43,000, mirroring the 2008 financial crisis. In 2028 and 2029, markets recover, bringing your portfolio back to €100,000.

From your perspective, you’ve broken even. But the Belastingdienst sees it differently. Under the transitional rules, losses before 2028 cannot be offset against gains after 2028. The tax authority records a €57,000 gain and sends you a bill for €20,520 (36% of the “gain”). Your actual return is zero, but you’re left with just €79,480 after taxes, a permanent 20% loss of your capital.

This isn’t theoretical. Simulations using 155 years of Shiller US market data show this scenario occurs in real market conditions. The research, conducted by a Dutch investor who modeled various tax systems in Python, demonstrates that the transition risk is both quantifiable and significant.

Simulation Results: The Numbers Behind the Risk

The analysis compared multiple strategies across different time horizons, using rolling returns from 1871-2025. For a 5-year investment of €100,000, the results reveal stark differences:

5-Year Performance (Compound Annual Growth Rate):

– Market (no tax): 10.66% average return

– Box 3 2026 → Box 3 2028: 7.86% average return

– Savings Account → Box 2 (post-2028): 4.77% average return

The “Box 3 2026 → Box 3 2028″ scenario specifically models the transition risk, showing a nearly 3 percentage point drag compared to the untaxed market return. Over longer periods, this gap compounds dramatically.

20-Year Performance:

– Market: 10.22% CAGR, ending balance €700,603

– Box 3 transition scenario: 6.81% CAGR, ending balance €373,660

The simulation shows that staying in Box 3 throughout the transition period cuts your potential wealth nearly in half over two decades.

Strategic Alternatives: Do They Work?

The research examined three main escape routes:

-

Shift to Box 2 (Corporate structure): Moving investments into a BV (private limited company) allows loss carryforward, eliminating the transition risk. However, this comes with corporate tax (VPB) at 19% and Box 2 dividend tax at 24.5%. The simulation shows Box 2 with cost price valuation (kostprijs waarderen) outperforms Box 3 over 20+ years, but requires setup costs and administrative burden.

-

Switch to savings: Holding cash until 2028 avoids the risk entirely, but sacrifices potential returns. The data shows this strategy “wins” against Box 2 in only 27.9% of 5-year simulations and 28.5% of 10-year scenarios. For most investors, the opportunity cost exceeds the tax risk.

-

Pension investments: These remain exempt from Box 3 taxation and offer tax advantages, but contribution limits (jaarruimte) restrict their usefulness for larger portfolios.

The All-Time High Complication

Some investors argue that since markets currently trade near all-time highs, the risk of a 57% crash before 2028 seems remote. The simulation tested this by limiting start points to periods within 5% of market peaks. Surprisingly, the results barely changed, the cash strategy still underperformed in 68-72% of scenarios.

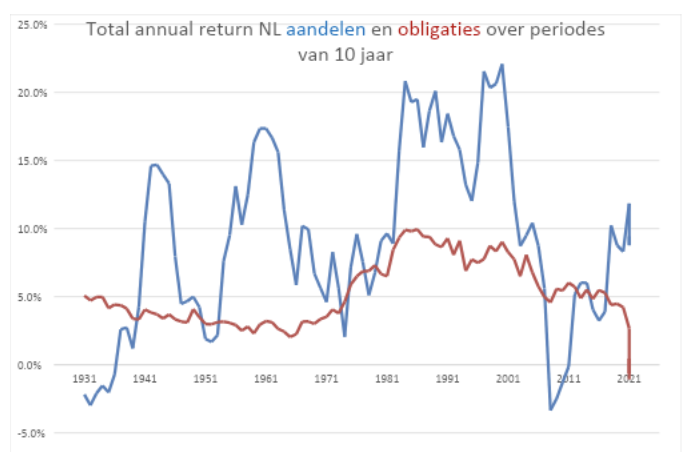

Historical data shows that of 155 years of market history, the market traded at all-time highs for 48 years and within 5% of peaks for 88 years (57% of the time). Peak markets still experience volatility, and the risk of a significant downturn before 2028 cannot be dismissed.

The Box 2 Advantage for Entrepreneurs

A crucial insight emerged for business owners: If you generate income within your BV, the tax equation changes. One commenter modified the simulation to account for entrepreneurs who can offset Box 2 tax against corporate profits. This “Box 2 Kostprijs BV-income” scenario significantly outperformed all other strategies, especially over 10+ years.

For non-entrepreneurs, however, the standard Box 2 route remains less attractive until investment horizons exceed 20 years, when tax deferral benefits compound sufficiently to overcome the higher combined tax rate.

Practical Implications: What Should You Do?

The research concludes that for most investors, the transition risk is real but not catastrophic enough to warrant drastic action. The probability-weighted impact suggests:

- Don’t panic-sell to cash: The opportunity cost of missing market gains outweighs the transition risk in approximately 72% of scenarios.

- Consider Box 2 for long-term capital: If you won’t need the money for 20+ years and have substantial assets (>€200,000), the one-time cost of setting up a BV may pay off.

- Wait for legislative clarity: The new Box 3 law must pass by March 2026. Premature restructuring could be unnecessary if the proposal changes.

- Maintain liquidity: Keep 10% of your portfolio in cash to handle tax payments without forced selling during downturns.

The controversial conclusion? The current Box 3 system, despite its flaws, actually benefits many investors through its fictional returns. The Supreme Court-mandated shift to reality-based taxation will, paradoxically, make long-term wealth building harder for the average Dutch saver.

The Bottom Line

The Box 3 transition creates a narrow window where tax law and market volatility intersect dangerously. While the risk of paying taxes on phantom gains is genuine, simulations suggest it’s not extreme enough to justify extreme defensive moves for most investors. The real winners will be those who understand the nuances: entrepreneurs who can leverage Box 2 structures, and possibly those who reach Financial Independence Retire Early (FIRE) status under the new system’s lower wealth requirements.

As one analyst noted, “FIRE isn’t about dying with maximum wealth, but about having enough to stop working sooner.” The new Box 3 system may slow wealth accumulation but also lowers the target needed for early retirement, a nuanced trade-off rarely discussed in the panic about rising taxes.

The complete simulation code and data are publicly available, allowing investors to model their specific situations. In Dutch tax planning, as in investing, emotion is the enemy of good decisions. The numbers suggest: stay calm, stay invested, but stay informed.