You bought ABN Amro at €8 during the COVID crash because it felt patriotic. You scooped up ING Groep (ING Group) at a discount that seemed criminal. Now they’re up 40%, maybe 60%, and you’re the genius who beat the market. But here’s the problem: you’re also holding Nokia, Air France-KLM, and something called Solid Power Inc that you barely understand. Your portfolio looks like a Dutch financial supermarket exploded, and you’re starting to wonder if all that “stock picking success” is just luck wearing a convincing disguise.

This is the exact position a Dutch investor recently described on a popular online forum, admitting he and his father were “kruimelaars” (crumb pickers) who sprinkled small amounts into whatever looked cheap during the pandemic. The gains were real, but now the strategy feels like driving a Fiat Panda on the Autobahn, it’s working, but it’s not built for what comes next.

The Dutch Investor’s Dilemma: When Your Winners Become Liabilities

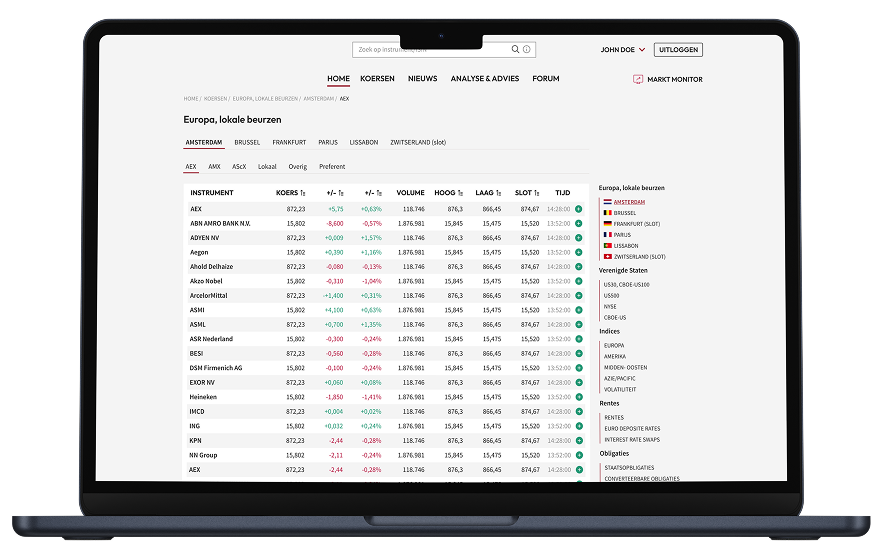

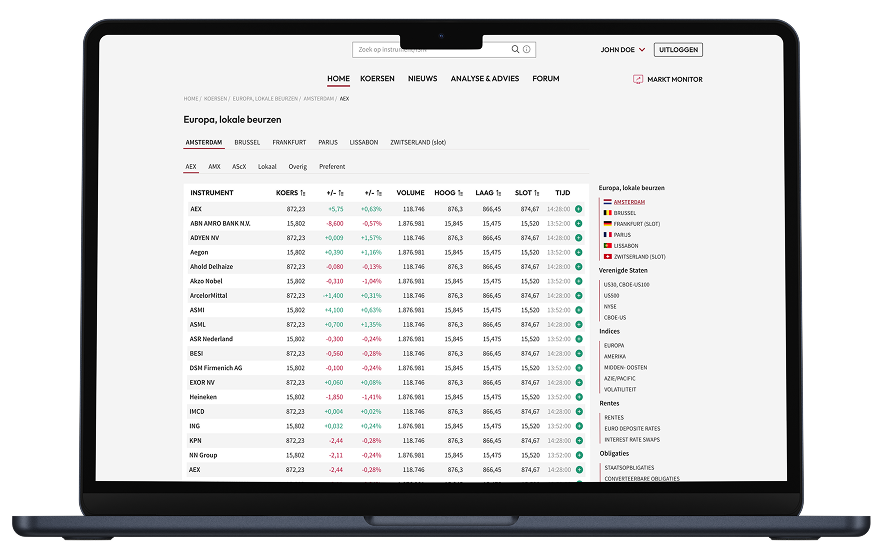

The portfolio in question reads like a greatest hits album of Dutch retail investor favorites: ABN Amro, Aegon, Shell, Philips, KPN, plus some international names like AMD and Nvidia that caught the AI wave. The investor now wants to “shrink” this collection and move predominantly into ETFs like the Vanguard S&P 500 UCITS ETF and sector plays like BE Semiconductor (Besi).

The emotional trap is obvious. Selling ABN Amro at €12 feels like betraying your own insight. But holding it because it might go to €15 is speculation, not strategy. As one experienced commenter bluntly stated: “If you don’t want to dive into company figures or analyst reports, just sell and put it in diversified ETFs.” The subtext: your emotional attachment is costing you money.

The Fiscal Efficiency Factor Most Dutch Investors Miss

Here’s where the Netherlands adds a unique twist to the ETF transition debate. Many Dutch investors focus obsessively on the Total Expense Ratio (TER) but completely ignore dividend leakage (dividend tax inefficiency). This is the silent killer of returns that makes ETF selection more nuanced than simply picking the cheapest option.

Irish-domiciled ETFs, which dominate the European market, face a 15% withholding tax on US dividends that cannot be reclaimed by individual Dutch investors. Accumulating funds automatically reinvest dividends, which can improve fiscal efficiency in the Netherlands by avoiding the Box 3 tax complications of receiving cash dividends. However, the leakage still happens, it’s just hidden from view.

The research data highlights the SPDR S&P 500 UCITS ETF (Acc) with its ultra-low 0.03% TER. At just €3 per €10,000 invested annually, it looks like a steal. But compare it to the Vanguard FTSE Developed World UCITS ETF mentioned in the Eulerpool analysis, which offers broader exposure beyond just US markets for 0.12% TER. The extra nine basis points buy you genuine diversification away from American tech dominance, a hedge that looks increasingly sensible after Ray Dalio’s warnings about US market concentration.

The 90/10 Rule: Warren Buffett’s Wisdom, Dutch Style

The most upvoted advice in the forum discussion was pure Buffett: allocate 90% to a simple S&P 500 ETF and keep 10% for “fun money” individual picks. This works psychologically because it gives you permission to keep a few darlings while forcing the bulk of your wealth into a disciplined strategy.

For Dutch investors, this 10% could be where you keep your ASML or Besi, real Dutch champions with global moats. But here’s the controversial part: even these national heroes might belong in the 90%. The Vanguard FTSE All-World High Dividend Yield UCITS ETF already holds significant positions in Dutch multinationals. You’re not abandoning Philips, you’re just holding it through a vehicle that also owns 1,500 other quality companies.

Timing the Transition: Why “Maxed Out” Stocks Should Scare You

The original investor’s instinct that most of his stocks are at their “max” is actually a red flag. It suggests he’s anchoring to recent highs and suffering from the disposition effect, the tendency to sell winners too early and hold losers too long. The stocks he should sell first are the ones he’s most proud of.

A smarter approach: tax-loss harvesting your losers (sorry, Air France-KLM) to offset capital gains on your winners. In the Netherlands, this is less straightforward than in the US due to the Box 3 system, but strategic selling across tax years can still optimize your overall fiscal position. The key is to stop thinking about individual stock stories and start thinking about portfolio-level outcomes.

The ASML Problem: When Your Best Idea Is Already in Every ETF

Many Dutch investors balk at selling ASML (Advanced Semiconductor Materials Lithography) because it’s “different”, a true monopolist. But this is precisely the stock that appears in every tech ETF, every European quality fund, and most world indices. Holding it separately while also owning an S&P 500 ETF and a defense ETF means you’ve unknowingly created a massive concentration risk.

The data from Belegger.nl shows that quality-focused ETFs often fail at true diversification. The iShares MSCI USA Quality Factor ETF trades at 26x earnings versus 25x for the broad market, paying a premium for the same handful of megacaps. This defeats the purpose of diversification.

Actionable Dutch-Specific Steps for 2026

-

Audit your DEGIRO account for dividend leakage. Check whether your ETFs are Irish-domiciled (most are) and whether you hold distributing or accumulating shares. The latter is usually better for Dutch tax efficiency.

-

Calculate your true sector exposure. If you work in tech, live in Amsterdam, and hold tech stocks, your entire life is a bet on one sector. ETFs can diversify you into healthcare, consumer staples, and financials without forcing you to research Merck’s pipeline.

-

Set a date, not a price target. Decide you’ll complete your transition by July 2026, regardless of whether ABN Amro hits €15. Market timing is what got you into this mess, it won’t get you out.

-

Keep one “kruimelaar” position, but make it 5% max. This satisfies your emotional need to prove you can pick stocks while protecting the other 95% of your wealth from your own overconfidence.

The Dutch have a word for this: “bij de les houden” (keeping yourself in check). Your pandemic stock-picking self was necessary to get started. Your 2026 ETF-holding self is necessary to build real wealth. The only thing standing between them is the courage to admit that luck isn’t a strategy, and that sometimes the smartest move is admitting you’re done being clever.