That moment when you plug €4,000 gross into the official Brutto-Netto-Rechner and get two different net amounts for the same salary. The only variable you changed? Clicking “Wien” instead of “Oberösterreich.” Suddenly you’re down €5 per month, €60 a year vanished because of a dropdown menu. This isn’t a bug. It’s the quiet rollout of regional payroll variations that most Austrians never knew existed.

The confusion started when the Finanzministerium updated its official calculator for 2026. Users noticed a new mandatory field: Bundesland. The difference isn’t massive, typically €2 to €10 monthly depending on income level, but it’s enough to trigger a wave of online bewilderment. Why should your workplace location cost you money?

The Wohnbauförderung: Austria’s Stealth Regional Tax

The answer lies in the Wohnbauförderungsbeitrag, a mouthful that translates to “housing construction promotion contribution.” Every employee in Austria pays this, but the rate varies by federal state. Vienna increased its WBF contribution in recent years, and the new calculator finally makes this visible.

Here’s how it works: The contribution is calculated as a percentage of your gross salary. While most states charge around 0.5%, Vienna’s rate is higher. The calculator now reflects this directly in your net figure. It’s not technically a tax, it’s a “contribution”, but functionally, it’s money deducted from your payslip that you can’t spend.

The Standard reported on Vienna’s changes, noting the city “greift für Wohnbauförderbeitrag künftig stärker auf Bruttolöhne zu”, meaning Vienna is leaning more heavily on gross incomes to fund its housing policies. For a city struggling with affordable housing, it’s a politically expedient way to raise revenue without calling it a tax increase.

Location, Location, Location: Employment vs. Residence

Crucially, the calculation depends on your employment location, not where you live. A Viennese resident working in Lower Austria pays Lower Austria’s rate. A Graz native commuting to Vienna pays Vienna’s rate. This creates bizarre incentives:

- That job offer in Vienna might pay €2,000 more annually, but after the higher WBF contribution, the real advantage shrinks

- Employers just outside state borders can advertise “no WBF surcharge” as a hiring perk

- Remote workers need to clarify which state’s rules apply, their home office location or company’s registered address

The Arbeiterkammer calculator and Finanz.at tool both confirm this: they ask explicitly for your Beschäftigungsort (place of employment). Get it wrong and your calculation is fiction.

The Numbers Behind the Confusion

Let’s run actual figures through the updated Finanz.at Brutto-Netto-Rechner:

For a €3,500 monthly gross salary (€49,000 annual):

– Vienna: Net €2,765.60 monthly (13th/14th month averaged)

– Upper Austria: Net €2,771.20 monthly

– Styria: Net €2,770.80 monthly

The €5-6 monthly difference comes entirely from the WBF contribution variance. Over a career, that’s thousands of euros, enough to fund a decent vacation or cover a year’s worth of public transport tickets.

Why Now? The 2026 Calculator Transparency

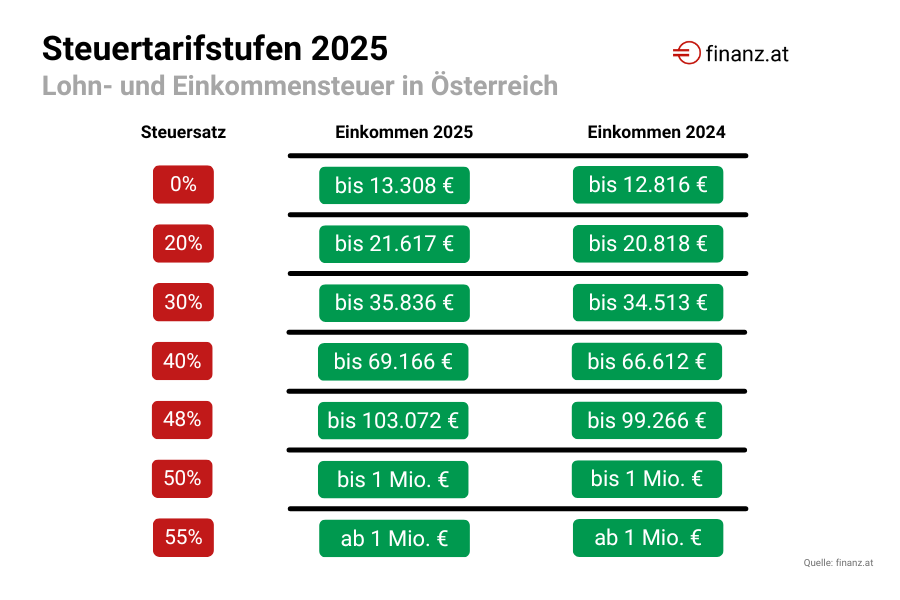

The Finanzministerium’s updated calculator for 2026 didn’t create these differences, it just exposed them. Previous versions used an average or default rate, hiding the regional variations. The new version, launched in December 2025, includes:

– Valorized tax brackets (1.73% increase in thresholds)

– Higher Pendlerpauschale (commuter allowance) at €6/km

– Explicit Bundesland selection for accurate WBF calculation

Finance Minister Markus Marterbauer called the tool “transparent”, but transparency feels different when it reveals you’re paying more than your cousin in Salzburg for the same work.

The Political Silence

What’s remarkable is how quietly this landed. Many residents report learning about it only through the calculator change. The Standard’s article on Vienna’s WBF increase didn’t trigger major public debate. As one observer noted, “Dass der Aufschrei bei dieser de facto Steuererhöhung auf die arbeitende Bevölkerung nicht größer war, wundert mich immer noch.”

Another pointed out: “Die Leute oft keine Kraft mehr haben. Es wird sich so lang weiterdrehen, bis es wirklich ordentlich mal rummst.” Translation: people are exhausted from constant small deductions, it’s death by a thousand cuts.

Your Payslip Reality Check

Look at your next Gehaltsabrechnung. Find the line labeled “WBF” or “Wohnbauförderung.” The amount varies, but the principle is universal: you’re funding regional housing policy directly from gross pay. If you work in Vienna, you’re paying into the city’s massive social housing system, even if you can’t get an apartment in it.

The Dienstgeber (employer) also pays a share, which is why some argue “it’s not your money.” But as payroll costs rise, employers factor it into total compensation. Your gross salary is negotiated with these contributions in mind. It’s absolutely your money, just diverted before it reaches your Konto.

Practical Steps for 2026

- Use the right calculator: Always select your employment location, not residence. The official BMF calculator now requires this.

- Check your payslip: Verify the WBF rate matches your workplace state. Errors happen when companies have employees across multiple Bundesländer.

- Negotiate smart: If comparing job offers across states, calculate the real net difference. A €500 gross difference might net to only €300 after state-specific contributions.

- Remote work clarity: If working from home in a different state than your employer, clarify which WBF rate applies. The legal default is usually the employer’s location.

- Tax return time: The WBF contribution is partially tax-deductible. Don’t forget it in your Arbeitnehmerveranlagung.

The Bigger Picture

This isn’t just about a few euros. It’s about the fragmentation of Austria’s payroll system. We’re seeing the emergence of regional payroll “taxes” that create invisible borders in the labor market. Vienna’s housing crisis gets funded by Viennese workers, fair in principle, but messy in practice when the metro area spans multiple states.

The calculator change forces honesty about a system that was always there but never visible. For employees, it’s a reminder: your net pay isn’t just about your performance, your negotiation skills, or even federal tax policy. It’s about where your desk sits, and which Bundesland’s financial needs your salary supports.

Next time you use a Brutto-Netto-Rechner, stare at that Bundesland dropdown. It’s not just geography. It’s a direct line to your wallet.