Many French investors assume buying obligations d’État (government bonds) should be straightforward. After all, you’re lending money directly to the French state. Why should a simple transaction require bank intermediaries charging layered fees for a product that needs no active management? This frustration surfaces repeatedly among retail investors who discover that direct purchase options appear either nonexistent or suspiciously scam-like.

The core issue isn’t lack of demand, it’s structural. France issues massive quantities of debt to finance public spending, and the distribution system relies entirely on a network of financial institutions. When you buy a French government bond through your bank, you’re not purchasing it from the trésor public (public treasury). You’re buying it on the secondary market or through a fund, with each intermediary taking their cut.

Why You Can’t Buy Directly From the State

The French government doesn’t sell bonds directly to individuals for two practical reasons: scale and compliance. The state issues billions in obligations assimilables du Trésor (OATs, Treasury bonds) each year. Managing millions of individual retail accounts would require an enormous administrative infrastructure that doesn’t exist.

More critically, banks handle the mandatory anti-money laundering (AML) and know-your-customer (KYC) checks. The state has neither the systems nor the personnel to verify that your savings aren’t from illicit sources. Banks already employ compliance teams to meet regulatory requirements, so they effectively outsource this function. If France wanted direct retail distribution, it would need to invest heavily in technology and staff, an expense that seems unnecessary when banks already perform this role.

Many investors point to Treasury Direct in the United States as a model. While technically feasible, the French system would need to be built from scratch. The US program benefits from decades of investment and operates within a different regulatory framework. As one analysis noted, creating a similar platform in France would be extremely costly and time-consuming, while banks already provide the infrastructure.

The Fee Problem: What You’re Actually Paying For

When you purchase through a traditional bank, you’re typically buying into a fond obligataire (bond fund) or paying brokerage fees for secondary market access. These products layer multiple charges:

- Entry fees (frais d’entrée) that can reach 2-3% of your investment

- Management fees (frais de gestion) even though government bonds require minimal active management

- Custody fees (frais de garde) for holding the securities

- Brokerage commissions (commissions de courtage) on transactions

For a product yielding barely 3% annually, paying 2% upfront creates a significant drag on returns. The opacity around these fees frustrates investors who see government bonds as a simple, safe asset class that shouldn’t require complex fee structures. This lack of transparency mirrors broader issues with hidden costs and fee opacity in French investment products, where even sophisticated products like ETFs sometimes bury charges in complex documentation.

The Brokerage Alternative: Cutting Out Traditional Banks

You can bypass traditional banks entirely by opening a compte titres ordinaire (CTO, standard securities account) with online brokers. Platforms like Interactive Brokers (IBKR), Saxo Bank, or Bourse Direct offer direct access to bond markets. However, there’s a catch: you’ll often find better liquidity and tighter spreads on the Milan exchange rather than Paris.

One practical consideration is that some French brokers may not allow access to the Milan market, limiting your options. Additionally, while US Treasury bonds enjoy tax exemptions, French government bonds offer no fiscal advantages. The interest is taxed as revenus fonciers (property income) at your marginal rate, plus prélèvements sociaux (social contributions) of 17.2%.

The secondary market advantage is liquidity. Unlike direct purchase programs where selling can be cumbersome (US Treasury Direct requires transferring to a bank before sale), bonds in a CTO can be sold with a few clicks during market hours.

ETF Solutions: Diversification Without the Hassle

For most retail investors, bond ETFs provide the simplest, cheapest exposure. Two main categories exist:

Global Aggregate Bond ETFs (like AGGH or VAGF) blend roughly 50% sovereign bonds with 50% high-quality corporate debt. This diversification reduces risk while maintaining stability.

Global Government Bond ETFs (like VGGF) hold only sovereign debt, including French OATs alongside German bunds, US Treasuries, and Japanese government bonds.

These ETFs trade like stocks, charge minimal fees (often under 0.10% annually), and eliminate the need to research individual bonds. They’re particularly attractive because they’re hedged in euros, removing currency risk. For pure eurozone exposure, you could choose a dedicated euro government bond ETF like EGOV, but this concentrates your risk in a smaller group of countries. France alone represents 25% of EGOV’s holdings versus just 7.45% in a global fund like VGGF.

The diversification benefit matters during crises. Corporate bonds correlate more with stock markets, while government bonds often act as a portfolio stabilizer when equities tumble. This characteristic makes them valuable for tax efficiency and investment wrapper comparison in France, where strategic asset location can significantly impact after-tax returns.

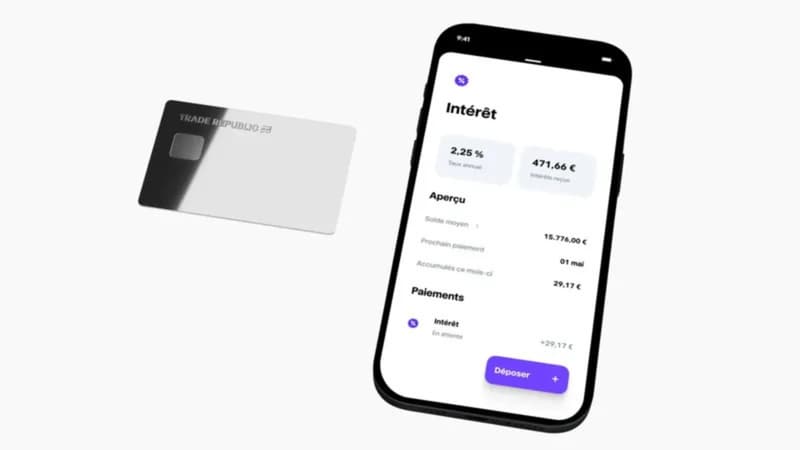

The Trade Republic Model: Fractional Investing Meets Government Debt

German neobank Trade Republic has disrupted traditional brokerage by offering commission-free trading and fractional shares. Their model extends to government bonds, allowing investors to start with as little as €1. The platform automatically invests spare change from everyday purchases into your chosen assets, including French and European government bonds.

This approach solves two problems: high minimum investment amounts and psychological barriers to entry. Instead of needing €1,000 for a single OAT, you can build exposure gradually. The trade-off is that you’re buying fractional shares of ETFs or bond funds rather than individual securities, which suits most retail investors fine.

The platform’s transparency around costs contrasts sharply with traditional banks. No entry fees, no custody fees, and clear disclosure of any product-level charges. For French investors frustrated by opaque banking fees, this represents a welcome shift toward clarity.

Minimum Purchases and Accessibility

Even when using brokers, individual OATs often have high minimum denominations, sometimes €1,000 or more per bond. This automatically excludes smaller investors. ETFs solve this by pooling assets, but some investors prefer the certainty of holding direct government obligations.

The fonds euro (euro-denominated fund) within an assurance-vie (life insurance contract) offers another workaround. These funds invest heavily in French government bonds but wrap them in an insurance contract that provides tax advantages after eight years. However, the underlying fees within these insurance wrappers can be substantial, and the recent SCPI crisis demonstrated how seemingly safe retail investment products in France can hide liquidity risks and opaque fee structures.

Practical Steps to Avoid Excessive Fees

-

Open a CTO with a low-cost broker: Compare Interactive Brokers, Saxo, or Trade Republic. Check for access to European bond markets and fee schedules.

-

Consider bond ETFs: For most investors, a global government bond ETF like VGGF provides adequate exposure with minimal fees. If you want only eurozone bonds, research EGOV but understand the concentration risk.

-

Verify tax implications: Interest is taxable annually. Consider holding bonds in a PEA (Plan d’Épargne en Actions) if eligible, though bond options within this wrapper are limited.

-

Avoid bank-sold bond funds: Traditional banks rarely offer competitive fees. If you must use your bank, negotiate entry fee reductions or look for “clean” share classes without distribution fees.

-

Check minimums: If buying individual bonds, confirm the minimum denomination. For smaller amounts, ETFs remain the only practical option.

-

Read the fine print: Some brokers advertise “free” trading but embed costs in spreads or currency conversion. Verify total costs before committing.

The Bottom Line

French government bonds serve as a portfolio stabilizer and expression of domestic confidence, but the distribution system forces retail investors through expensive intermediaries. Direct purchase isn’t impossible because of technical limitations, it’s blocked by the state’s reliance on banks for compliance and distribution infrastructure.

The good news: you don’t need to accept 2-3% entry fees. Online brokers and bond ETFs have democratized access, offering exposure for fractions of a percent in annual costs. While you can’t replicate the simplicity of Treasury Direct today, you can come close by bypassing traditional banks entirely.

For most investors, the optimal path involves a low-cost CTO holding a global government bond ETF. You gain diversification, liquidity, and transparency while avoiding the fee layers that make traditional bank offerings so expensive. The key is recognizing that patriotism doesn’t require paying premium fees, your money works just as hard for France whether you buy through BNP Paribas or Trade Republic.