The claim that private investors cannot realistically achieve more than six percent annual returns has become gospel in German financial circles. Finance professor Andreas Hackethal stated it bluntly in a recent SPIEGEL interview: “Mehr als sechs Prozent Rendite sind nicht drin, schon gar nicht für Privatanleger” (More than six percent return is not feasible, especially not for private investors). This assertion, echoed across Reddit forums and Bausparkassen (building societies) brochures, deserves a hard look. The data tells a different story, one that could cost you tens of thousands in opportunity costs.

Where the 6% Myth Comes From

The conservative benchmark originates from a specific portfolio assumption: roughly half stocks, 40% bonds, 6% gold, and small allocations to alternatives. This mix, as described in the SPIEGEL piece, expects about four percent above the “safe” base interest rate (currently around two percent on Tagesgeld (overnight money) accounts). Add them together, and you land at six percent.

This reasoning contains two critical flaws. First, it assumes German investors must hold 40% in Anleihen (bonds), an asset class that has delivered negative returns for years. Second, it ignores the power of time and proper asset allocation.

Historical Data Tells a Different Story

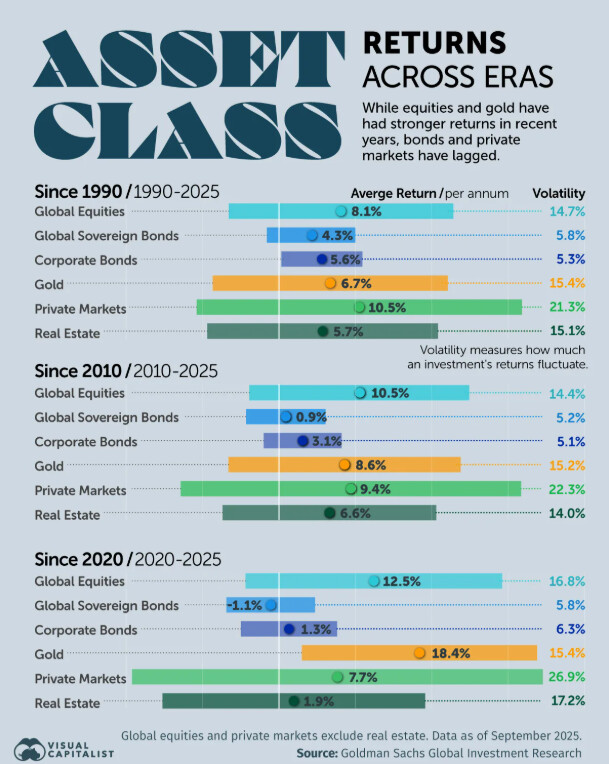

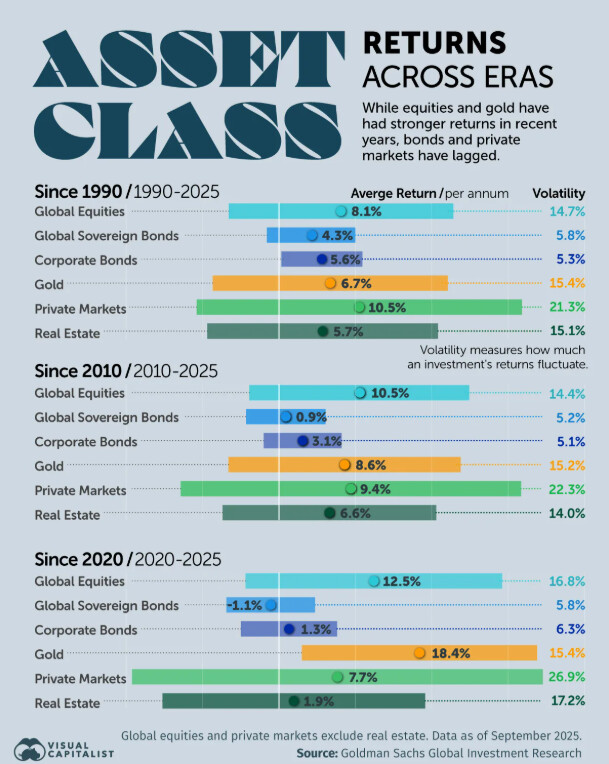

A 35-year analysis from DAS INVESTMENT reveals the stark reality: investors who stayed in Private Markets since 1990 achieved 10.5% annual returns. Global equities delivered 8.1%, while even Gold reached 6.7%. Government bonds? They lost 1.1% annually between 2020-2025.

The MSCI World data is equally compelling. The Deutsche Aktieninstitut’s return triangle shows that investors who held a simple MSCI World ETF for 15 years or more were never in the red, regardless of when they started. Those who began in 2001 and held until 2025 captured 10.7% annually, surviving both the Dotcom crash and the 2008 financial crisis.

The Portfolio Composition Trap

The Reddit discussion that sparked this debate featured a user questioning the 6% ceiling. One commenter correctly noted: “Wer 40% Anleihen und 6% Gold hat, wird es wohl tatsächlich schwer haben, mehr als 6% Rendite zu erzielen” (Anyone with 40% bonds and 6% gold will indeed struggle to exceed 6% returns).

This is the core issue. The 6% expectation is a self-fulfilling prophecy based on overly conservative allocation. German investors often cling to Anleihen (bonds) out of habit, but since 2010, global equities have returned 10.5% annually while government bonds returned less than 1%.

German Tax Advantages You’re Probably Ignoring

German tax law actually favors higher-return equity investments through several mechanisms:

- Teilfreistellung (partial exemption): Equity ETFs enjoy 30% tax-free gains (only 70% taxed)

- Sparerpauschbetrag (saver’s allowance): €1,000 tax-free per person annually

- Thesaurierende ETFs (accumulating ETFs): Defer taxes until realization, maximizing compounding

A €10,000 gain on an equity ETF costs you only €1,846 in Abgeltungsteuer (capital gains tax) instead of €2,638, saving €792 that continues compounding.

Real-World Performance Examples

Sustainable ETFs demolished the 6% barrier in 2021, with the UBS MSCI World SRI delivering 16.1% returns. Even during turbulent periods, focused strategies outperform:

- Emerging Markets SRI ETFs: 859 million Euro in assets, strict ESG criteria, 0.27% TER

- Technology-focused climate ETFs: Tech giants’ low carbon footprint drives outperformance

- Equal-weight strategies: Avoid the concentration risk of cap-weighted indices

The Handelsblatt’s ETF selection guide emphasizes that “langfristig tatsächlich gute Chancen auf beeindruckende Renditen” (long-term chances for impressive returns exist) when you choose the right funds and avoid common mistakes like over-diversification into low-yield assets.

The Opportunity Cost of Being Too Conservative

Let’s quantify the damage of settling for 6%. With €300 monthly contributions over 30 years:

- At 6%: €303,219

- At 8%: €440,677

- At 10%: €648,947

The difference between 6% and 10% is €345,728, enough to fund several years of retirement or buy a second property. This is the true cost of following overly conservative advice.

The €153,000 mistake in overpriced German real estate illustrates this principle perfectly. Capital stuck in underperforming assets can’t compound in equity markets.

Why Time Horizon Changes Everything

The SPIEGEL article’s shortcoming is its failure to distinguish between short-term volatility and long-term returns. While markets fluctuate yearly, the probability of positive returns increases dramatically with time.

The MSCI World return triangle proves this: 15-year holding periods eliminated all negative outcomes. This isn’t speculation, it’s 35 years of historical data. The Reddit commenter who noted Gold outperformed world ETFs in recent periods missed the point: over decades, equities consistently beat inflation and deliver real wealth creation.

Practical Strategies for German Investors

- Reassess your Anleihen (bond) allocation: In a low-interest environment, 40% bonds is wealth suicide

- Maximize your Sparerpauschbetrag: Use it annually for rebalancing

- Focus on thesaurierende ETFs: Let the Zinseszinseffekt (compound interest effect) work tax-free

- Consider Private Markets: While volatile, they delivered 10.5% over 35 years

- Extend your horizon: Plan for 15+ years, not 5-10

The 15-year MSCI World holding period analysis provides concrete evidence for this approach. German investors who adopted this strategy historically never lost money.

The Mortgage vs. Investment Trade-off

Many Germans prioritize paying off their mortgage over investing, viewing debt as morally burdensome. The pay-off-your-house debate reveals this often costs hundreds of thousands in opportunity cost. With mortgage rates historically low and equity returns averaging 8-10%, every extra payment toward your Hausdarlehen (home loan) instead of an ETF is a losing proposition.

Don’t Let German Conservatism Cost You

The 6% return expectation reflects Germany’s risk-averse culture, not market reality. It’s a psychological comfort blanket that leaves wealth on the table. Historical data, tax advantages, and proper asset allocation all point to higher achievable returns.

The question isn’t whether private investors can beat 6%, it’s whether they can afford not to. Your Finanzamt (tax office) will thank you for the extra capital gains, and your future self will thank you for the financial security.

Bottom line: Stop building portfolios for your grandparents. Build them for the 21st century.