You’re asking €449,000 for your 4-room flat 45 kilometers outside Munich. Two years later, reality hits, you slash the price to €375,000 just to get rid of it. Painful, sure, but at least you finally sold. Except you didn’t just “lose” €74,000 on the price drop. The real damage is far worse, and it’s the kind of wealth destruction that happens quietly while you’re busy arguing with potential buyers about the kitchen fittings.

The Munich Property Math That Should Keep You Up at Night

Let’s run the numbers from that Wertpapier Forum discussion that got every German investor’s attention. The seller who finally accepted €375,000 after two years of market stubbornness didn’t just eat a €74,000 price cut. During those 24 months of wishful thinking, the MSCI World gained 41%. If they had simply sold at the original €375,000 two years earlier and parked the money in a basic global equity ETF, they’d be sitting on €528,000 today.

That’s a €153,000 difference. Gone. Not from a market crash, not from tenant hell, but from the simple act of believing their Immobilie was worth more than the market was willing to pay.

The forum discussion revealed something even more sobering: even accounting for a generous €1,000 monthly net rental income over those two years (€24,000 total), the seller would still be €129,000 poorer than if they’d cut their losses early and invested in global markets. The math is relentless. The property generated €24,000 in rent but cost €153,000 in missed market returns.

Opportunity Cost: The German Real Estate Investor’s Blind Spot

This is where German property owners, especially the buy-and-hold crowd, tend to get defensive. “But my Immobilie is a real asset! It generates Mieteinnahmen! It’s not some casino ETF!”

Fair point. But here’s the problem: Illiquidity is not a feature, it’s a bug that masks bleeding.

When your ETF portfolio drops 20%, you see it immediately. The pain is visible. You can act, sell, rebalance, buy more, whatever. When your property is overpriced by €74,000, you don’t see the daily hemorrhaging. You just notice fewer Besichtigungen. The wealth destruction is invisible until you finally capitulate.

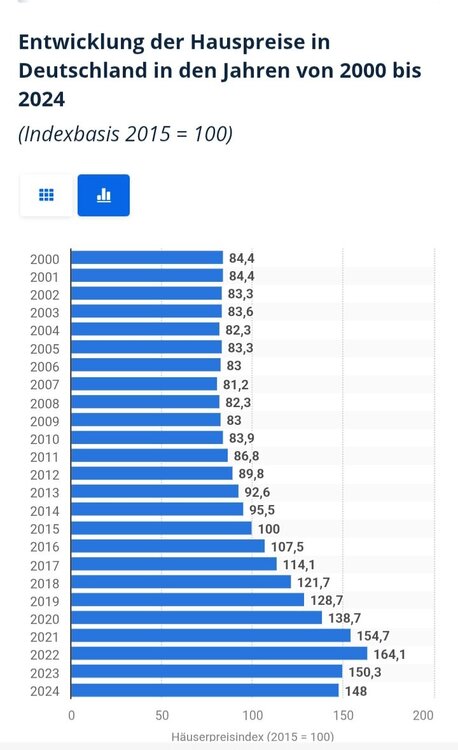

The Wertpapier Forum analysis cut through this emotional defense mechanism with brutal clarity. One commenter calculated that over 30 years, German residential real estate delivers a real return of -1.3% to +3.8% annually after inflation, maintenance costs, and taxes. The MSCI World? Historical data shows 7-9% gross annual returns, even accounting for periodic crashes.

Hindsight Bias vs. German Stubbornness

Of course, the critics immediately jumped in with the classic counterargument: “Hätte hätte, Fahrradkette.” Hindsight is 20/20. You can’t know the MSCI World will return 41% over the next two years any more than you can know if your property will find a buyer.

But this misses the point entirely. The issue isn’t about perfect foresight. It’s about recognizing when an asset has become a liability.

Many German property owners suffer from what forum participants called “Ahnungslosigkeit”, a blissful ignorance of opportunity cost. They anchor to their desired price, convinced the market is wrong. Meanwhile, their capital sits frozen in an illiquid asset that’s not only failing to appreciate but actively preventing them from participating in global growth.

The recency bias is strong in German real estate. Years of rising prices created a belief that patience pays. But as one forum member noted, “Immobilien hatten nicht ohne Grund über Dekaden einen bescheidenen Wertzuwachs”, real estate had modest appreciation for decades for good reason. The recent boom was the exception, not the rule.

The Liquidity Premium You’re Not Getting

Here’s the dirty secret of German property investment: you’re not being compensated for illiquidity. In efficient markets, illiquid assets should offer higher expected returns to compensate for the inability to sell quickly. German residential real estate does the opposite, it locks up your capital for lower expected returns.

The Finanztip forum discussion about opportunity costs of holding cash versus investing in ETFs highlights the same principle. Money sitting in a Tagesgeld account earning 2% while markets return 6-8% is a slow-motion wealth transfer from you to more disciplined investors. An overpriced property is just a more expensive version of the same mistake.

The MSCI World data from 2023-2025 shows that even with volatility, global equity exposure would have dramatically outperformed the typical German rental property stuck on the market. While your flat sits unsold, you’re missing exposure to the 1,500 companies in the MSCI World, companies like Apple, Microsoft, and Novo Nordisk that don’t care about Munich’s suburban rental market.

When “Sicherheit” Becomes Risk

German investors love the perceived safety of brick and mortar. “Aktien sind Kasino”, they say, while their overpriced Immobilie bleeds them dry through invisible opportunity cost.

But let’s be honest about what that “Sicherheit” actually means:

- Price risk: Your property value can drop 20% just like stocks

- Tenant risk: Mietnomaden, payment defaults, legal battles

- Maintenance risk: Every 15-20 years, you’re dropping €400-700 per square meter on Sanierung

- Regulatory risk: Mietendeckel, energy efficiency mandates, property taxes

The Wertpapier Forum analysis calculated that a typical 70m² apartment costing €3,500/m² with €10/m² monthly rent might generate 2% real annual returns in a best-case scenario. The MSCI World? Even conservative estimates expect 5-7% real long-term returns.

The 30-Year Reality Check

One forum member asked the crucial question: “Warum ist denn eigentlich die Renditeerwartung für die nächsten 30 Jahre so interessant?”

Because that’s your actual investment horizon. The property you can’t sell today is capital you can’t deploy for decades. The 2% annual drag compounds into massive wealth destruction over 30 years.

The math from the forum was sobering: even if you manage to avoid major repairs, find perfect tenants, and benefit from moderate price appreciation, your real estate investment will likely underperform global equities by 3-5 percentage points annually. Over 30 years, that’s not a small gap, that’s the difference between financial independence and working an extra decade.

What German Investors Should Actually Do

Stop treating your property like a family heirloom and start treating it like the financial asset it is. Here’s the uncomfortable truth from the data:

-

Price it to sell, not to dream: If you’re not getting serious interest in 3 months, you’re 5-10% overpriced. Every additional month costs you 0.5-1% in opportunity cost based on historical MSCI World returns.

-

Calculate true opportunity cost: Use a simple ETF-Sparplan calculator. That €375,000 property you can’t sell? If it’s sitting for a year while markets gain 8%, that’s €30,000 gone. Not theoretical, real money you don’t have.

-

Separate emotion from Kapitalanlage: The forum discussion revealed that many Germans hold properties for “Sicherheit” while complaining about low returns. That’s cognitive dissonance. Safety without return is just slow poverty.

-

Consider the 10-year rule: Professional investors like the one mentioned in the forum often hold new builds for exactly 10 years to maximize tax benefits (Abschreibungen) then sell. They’re not romantic about it, it’s a financial calculation. Private investors should learn from this.

-

Diversify properly: If more than 50% of your net worth is in a single German property, you’re not diversified, you’re concentrated. A global ETF portfolio spreads risk across 1,500 companies in 23 countries. Your flat is one asset in one location.

The Final Verdict

The €153,000 lesson from Munich isn’t about perfect market timing. It’s about recognizing when stubbornness becomes expensive. German property owners have been conditioned to believe patience is virtue, but in financial markets, patience without strategy is just expensive procrastination.

The MSCI World won’t wait for you to find the perfect buyer. Global companies don’t pause revenue growth while you debate whether €375,000 is “acceptable” for your flat. Every month of overpricing is a month of missed compound returns.

The data from multiple German finance forums is unanimous: Opportunitätskosten sind real, and they’re devastating when your capital is trapped in an illiquid, overpriced Immobilie. The seller in Munich didn’t just lose €74,000 on price, they lost €153,000 in missed wealth.

Your property is not special. Price it right, sell it fast, and put your capital to work in markets that actually reward patience. The math doesn’t care about your emotional attachment.