The Dutch pechgeneratie (bad luck generation) has been crying foul since 2015, when the government replaced basic student grants with loans. But here’s the twist: that €60,000 study debt might actually be a stealth wealth-building tool, at least until the clock strikes 2028.

The Accidental Tax Shield Nobody Talks About

Let’s run the numbers. You graduated with €60,000 in study debt under the SF35 regime. Your monthly repayment? A laughable €68. Meanwhile, you’re pumping €1,000 monthly into ETFs averaging 10% returns. While your friends panic about their debt, you’re quietly exploiting a quirk in the Dutch tax system.

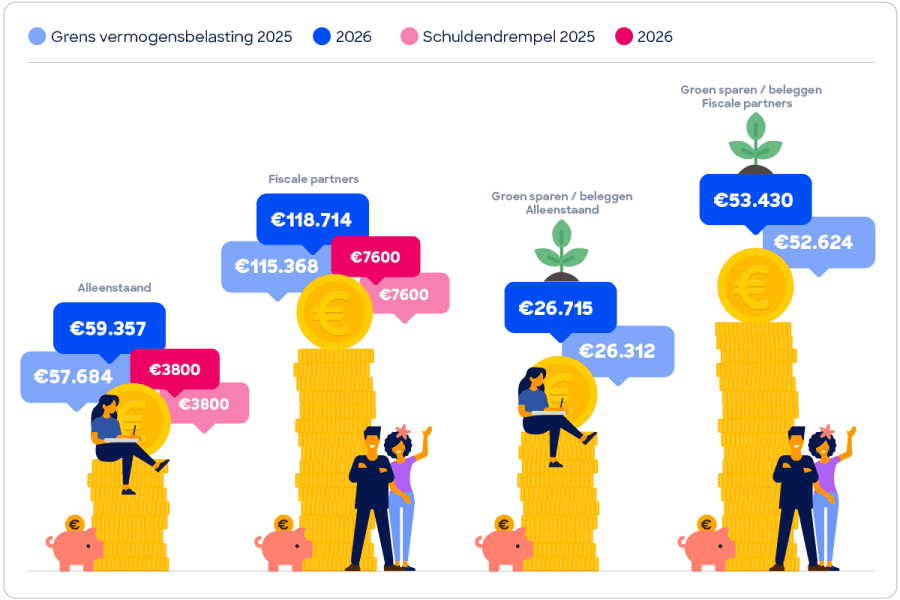

Here’s the mechanism: under current Box 3 (wealth tax) rules, your study debt functions as a vermogensbelasting korting (wealth tax discount). The Belastingdienst (Tax Authority) lets you deduct that €60,000 from your total assets before calculating wealth tax. In practice, this means you get an extra €60,000 in heffingsvrij vermogen (tax-free wealth) above the standard €57,684 exemption.

The math is brutal for your debt-free peers. If they have €117,684 in investments, they pay wealth tax on the amount above the exemption. You? With the same investments plus €60,000 debt, your taxable base drops to zero.

Why the Math Works (For Now)

The current Box 3 system, known as the Overbruggingswet (Bridging Law), calculates tax on fictional returns. For 2025, the Belastingdienst assumes you earn 5.88% on investments and 1.44% on savings. But you can also choose to pay tax on your werkelijk rendement (actual return), whichever is lower.

Your study debt carries an interest rate that barely keeps pace with inflation, currently around 1.5%. The repayment terms are income-dependent, not debt-dependent. And the kicker: after 35 years, whatever remains gets kwijtgescholden (forgiven).

Many international residents report waiting weeks for banking appointments in Amsterdam, despite the Netherlands’ reputation for efficiency. The same bureaucratic complexity that delays your DigiD activation creates these tax loopholes that savvy graduates can exploit.

The 2028 Cliff Edge

But here’s where the party ends. As several financial experts point out, in 2028 the entire Box 3 system transforms. The heffingsvrij vermogen disappears, replaced by a belastingvrije voet (tax-free base) of approximately €1,800 in annual investment income.

Under the new Wet werkelijk rendement (Actual Return Law), you’ll only deduct the actual interest paid on your study debt from your actual returns. With current low interest rates, that deduction shrinks to a fraction of today’s advantage. The magical €60,000 tax shield vanishes overnight.

This shift represents a fundamental change in Dutch wealth taxation. The current system taxes fictional returns, creating opportunities for arbitrage. The 2028 system moves toward a vermogenswinstsystematiek (capital gains system), aligning tax liability more closely with actual profits.

The Hidden Costs: Mortgage Pain

The most significant drawback? Hypotheekvermindering (mortgage reduction). Dutch lenders factor your study debt into their calculations, typically reducing your maximum mortgage by roughly 75% of the debt amount. That €60,000 debt could slash €45,000 off your home-buying power.

For many in the pechgeneratie, this creates a brutal trade-off: optimize for wealth tax now, or prepare for homeownership later. The prevailing sentiment among financial planners is that this mortgage penalty often outweighs the Box 3 benefit, especially in overheated markets like Amsterdam where every thousand euros counts.

The Investment Strategy That Actually Works

The controversial approach involves minimum repayment while investing aggressively. Since your monthly payment is income-based, you can keep it artificially low by staying under certain salary thresholds or leveraging tax deductions. Meanwhile, your investments compound at market rates.

One commenter noted that historical market crashes require decade-long recovery periods. But with a 25+ year horizon and continuous monthly investing, the pechgeneratie can ride out volatility. The strategy only fails if you panic-sell during downturns.

Political Reality Check

The Tweede Kamer (Second Chamber) has already approved the 2028 reforms, and the mood in The Hague suggests no turning back. While some politicians debate the details, the core principle remains: the current Box 3 arbitrage opportunities are closing.

This creates urgency. If you’re in the pechgeneratie, you have roughly two years to maximize this loophole before it seals shut. Some investors are even exploring Beleggings BV (investment corporations) as a more permanent escape route from Box 3, though this comes with its own complexity and costs.

The Verdict: Tactical Advantage, Not Strategic Wealth

Is study debt a secret financial weapon? Temporarily, yes, but with critical caveats. The Box 3 advantage is real and significant, potentially saving thousands annually in wealth taxes. Combined with low interest and eventual forgiveness, it creates a genuine opportunity cost for aggressive repayment.

However, the mortgage impact cancels much of this benefit for aspiring homeowners. And the 2028 deadline makes this a short-term play, not a lifelong strategy. The Dutch tax system operates with the same precision as a Delta Works sluice gate, until you try to navigate the labyrinth of transitional rules.

Bottom line: If you’re debt-averse and planning to buy property soon, prioritize repayment. But if you’re a long-term renter with investment discipline, that study debt might be the most lucrative loan you’ll ever get, just don’t forget to thank the Belastingdienst before the loophole closes.

For more on the upcoming changes, see our analysis of Box 3 wealth tax changes affecting financial planning and the transition from flat tax to realized capital gains in Box 3. If you’re worried about the potential tax burden from Box 3 ‘recovery tax’ under new rules or considering investors using Beleggings BV to avoid Box 3 wealth taxes, we’ve got you covered.