Switching from Eenmanszaak to BV for Investment: Smart or Overkill?

You’re a 32-year-old IT developer in the Netherlands, pulling in €130,000 revenue through your eenmanszaak (sole proprietorship). You’ve built a tidy investment portfolio: €140,000 in VWRL, €55,000 in pension investments, and €20,000 in savings. Your partner’s wealth already exceeds the Box 3 tax-free threshold. The question keeping you up at night isn’t about your next client, it’s whether to kill your eenmanszaak and birth a BV structure to shield your growing wealth from the Belastingdienst (Tax Authority).

This scenario, pulled from real discussions among Dutch freelancers, captures a growing dilemma. As personal wealth climbs and the 2028 Box 3 reforms approach, many self-employed professionals wonder if the administrative headache and costs of a BV (private limited company) are worth the potential tax savings. Let’s dissect the numbers, the strategy, and the hidden pitfalls.

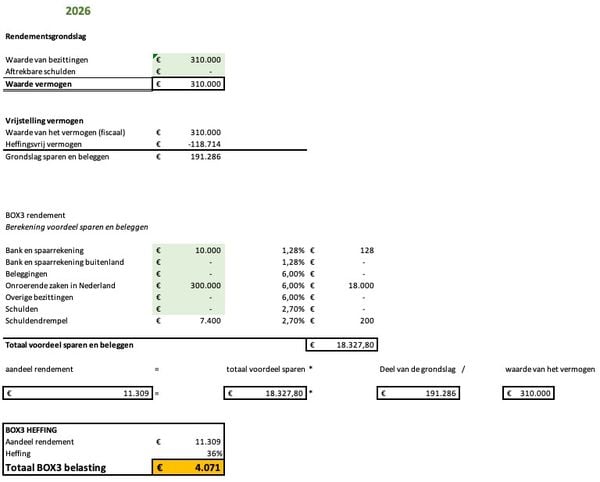

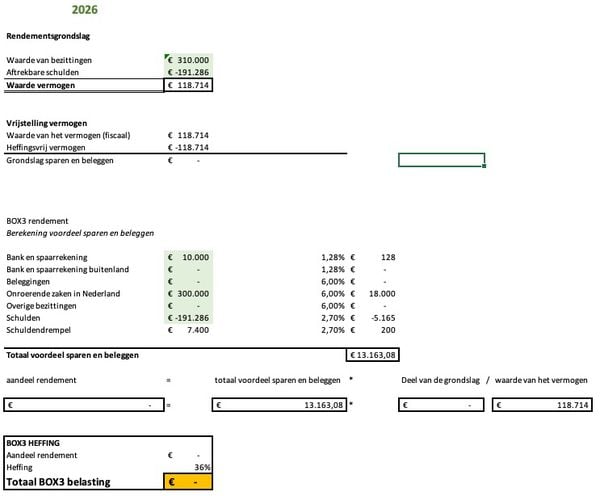

The Box 3 Tax Squeeze: Why 2028 Changes Everything

The Dutch wealth tax system is undergoing its most significant overhaul in decades. Starting in 2028, Box 3 will shift from taxing fictitious returns to targeting actual investment gains, even unrealized ones. This means you’ll pay vermogensbelasting (wealth tax) on paper profits before you cash them out. For someone with €140,000 in ETFs, this creates a potential cash flow problem: you might owe taxes on gains you haven’t realized yet.

Many high-net-worth individuals are already planning their escape routes. As one wealth manager noted, virtually no wealthy Dutch residents hold substantial assets privately anymore, they route everything through BVs to avoid Box 3 exposure entirely. The logic is simple: money inside a BV isn’t subject to personal wealth tax until you withdraw it as salary or dividend.

The 2028 Box 3 tax reform impact on BV formation decisions is forcing freelancers to make a choice that previous generations never faced. The old advice of “stay an eenmanszaak until you hit €150,000 profit” is crumbling under the weight of the new tax reality.

The Dual BV Structure: Your Financial Fortress

Here’s where the strategy gets interesting. The Reddit discussion reveals that experienced advisors don’t recommend a single BV, they insist on two: a holding BV and an operating BV. The operating BV handles your client work (the IT development), while the holding BV owns the operating BV and holds your investments.

This structure serves two critical purposes. First, it ring-fences your wealth. If your operating BV faces liability issues or bankruptcy, the assets in your holding BV remain protected. Second, it gives you flexibility. You can pay yourself the minimum DGA (director-major shareholder) salary of around €56,000 while leaving excess profits in the company to invest.

But this protection comes at a price. Administration costs for a dual BV structure run €225-300 per month, covering bookkeeping, VAT returns, annual reports, corporate tax filings, salary administration, and income tax returns. That’s €2,700-3,600 annually, money you don’t spend as an eenmanszaak.

Crunching the Numbers: When Does the Math Work?

Let’s break down the actual financial trade-off for our IT developer:

- Current Eenmanszaak Situation:

– Revenue: €130,000

– Costs: €20,000

– Taxable profit: €85,000 (after deductions)

– Box 1 income tax: Approximately €35,000 (top rate 49.5%)

– Box 3 tax on €140,000 investments: Approximately €1,200 annually

– Total tax burden: ~€36,200 - Proposed BV Structure:

– Same revenue and costs flow into operating BV

– Pay yourself minimum DGA salary: €56,000

– Operating BV profit before salary: €110,000

– After salary: €54,000 remains in BV

– Personal income tax on €56,000: ~€18,000

– Corporate tax (VPB) on €54,000: ~€10,800

– No Box 3 tax on investments (now held in holding BV)

– Administration costs: €3,000

– Total tax + costs: ~€31,800

At first glance, the BV saves around €4,400 annually. But this calculation hides critical variables. The €54,000 retained in your BV isn’t tax-free money, it’s deferred tax. When you eventually withdraw it as dividend, you’ll pay another 24.5% dividend tax, plus possible Box 2 taxes in the future.

The taxation of unrealized investment gains under new Box 3 rules means your €140,000 VWRL could generate significant tax bills even in flat market years. If your portfolio grows 10% in a year, you might owe tax on €14,000 of unrealized gains at rates up to 32%, that’s €4,480 in tax without selling a single share.

The Agiostorting (Equity Injection) Strategy

The Manners.nl article reveals a sophisticated technique: agiostorting (equity injection). This involves formally transferring your personal €140,000 investment portfolio into your holding BV as share premium. The BV issues shares at nominal value (say, €100), and you contribute your €140,000 as additional paid-in capital.

Why bother? Because this move transforms your personal taxable wealth into company assets. The €140,000 disappears from your Box 3 declaration, potentially saving €1,200+ in annual wealth tax. Inside the BV, those investments can grow without triggering annual Box 3 bills.

But there’s a catch. The Belastingdienst scrutinizes these transfers. If they suspect you’re just trying to dodge taxes, they can challenge the structure. You need a legitimate business reason, like using the investments as pension reserves or future business expansion. The fact that you might need the money before retirement age is a valid concern many freelancers raise.

Pension Planning: The Overlooked Complexity

Our IT developer has €55,000 in pension investments and mentions receiving advice to contribute up to €30,000 annually to reduce his top tax bracket. But as one commenter wisely noted, maxing out pension contributions can be overkill. The money becomes locked until retirement, and with a paid-off house and low fixed costs (€1,500/month), you might want access to capital earlier.

The BV structure offers more flexible pension options. Instead of traditional pensioenbeleggen (pension investing), you can build wealth inside your holding BV and treat it as a “pension pot” that you control. You decide when and how to withdraw, without strict pension regulations limiting you.

However, the DGA salary requirement complicates this. If comparable IT salaries in your region exceed the €56,000 minimum, the Belastingdienst can force you to pay yourself more, leaving less for corporate investment. For a developer earning €130k revenue, this is a real risk, many employed developers earn €70,000-80,000.

The Liability Question: Real Risk or Paper Tiger?

One of the developer’s stated reasons for considering a BV is “minder privé aansprakelijkheid” (reduced personal liability). For an IT developer working from home, this is largely theoretical. Your biggest liability risk is probably a client dispute over missed deadlines, not personal injury lawsuits.

The KVK notes that a BV does shield your personal assets from business debts. But for low-risk service professionals, this protection is often psychological rather than practical. Your professional liability insurance (beroepsaansprakelijkheidsverzekering) already covers most real risks at a fraction of BV costs.

That said, the psychological value matters. If you’re building substantial wealth and worry about edge-case scenarios, like a client claiming massive damages from a software bug, the BV structure provides peace of mind that an eenmanszaak cannot.

The Verdict: When to Pull the Trigger

So when does switching to a BV for investment purposes make sense? Based on the numbers and community wisdom, here are the clear thresholds:

- Do it now if:

– Your personal investments exceed €200,000 (the Box 3 savings outweigh admin costs)

– You’re comfortable locking up capital until retirement

– Your revenue is stable and likely to grow

– You’re in a high-liability field or plan to hire employees

– You want to optimize for long-term wealth accumulation, not short-term cash flow - Wait or stick with eenmanszaak if:

– Your personal wealth is under €150,000

– You need liquidity for upcoming life changes (house upgrades, children)

– Your income is volatile or might drop below €100k

– You value simplicity and low overhead

– The 2028 reforms might change the rules again (many advisors suggest waiting)

The most pragmatic advice from the community is to wait until 2028 approaches. The Belastingdienst is actively closing loopholes, and new regulations targeting BV structures are expected. As one commenter bluntly put it: “1 BV is geen BV, altijd twee” (1 BV is no BV, always two), but also “wacht tot 2028” (wait until 2028).

Actionable Next Steps

-

Get multiple quotes: Administration costs vary widely. The €225-300/month range is typical, but some firms charge €400+ for the same service.

-

Model your 5-year scenario: Don’t just calculate year one. Factor in dividend taxes when you eventually withdraw retained earnings. The risk-return trade-off between savings and aggressive investing looks different when you account for deferred tax liabilities.

-

Document your agiostorting: If you transfer personal investments to a BV, get a formal valuation and legal documentation. The Belastingdienst loves to challenge these transfers during audits.

-

Review your pension strategy: Before locking money in traditional pension funds, consider whether your BV can serve as a more flexible retirement vehicle. The balancing investment growth against debt repayment in FIRE planning is relevant here.

-

Monitor the 2028 legislation: The risk of having to sell investments to cover wealth tax bills is real. Stay informed about transition rules and grandfather clauses that might protect existing structures.

The BV-for-investment strategy isn’t overkill for everyone, but it’s definitely not a no-brainer. For our €130k-earning developer, the decision hinges on one question: Is the €4,000 annual savings worth the complexity and reduced flexibility? If his wealth continues growing at 8% annually, absolutely. But if AI disrupts his niche market and income drops, that locked-up capital in a BV structure could become a financial straitjacket.

Most Dutch tax advisors quietly admit the truth: for freelancers with under €200,000 in investments, the eenmanszaak remains the pragmatic choice. The real optimization starts when your portfolio threatens to push you into the highest wealth tax brackets, and that’s when the BV structure transforms from overkill to essential financial hygiene.