Pension Investing vs. Regular Investing: The Box 3 Tax Bomb Forcing Dutch Savers to Choose

The Dutch government just turned long-term investing into a high-stakes chess match. Starting in 2028, the new Box 3 (wealth tax box) system will tax unrealized investment gains, meaning you’ll owe the Belastingdienst (Tax Authority) money on profits that exist only on paper. This shift has transformed a once-boring debate about retirement savings into an urgent financial calculation: should you lock your money in a pension fund for decades, or keep it accessible and pay the price in taxes?

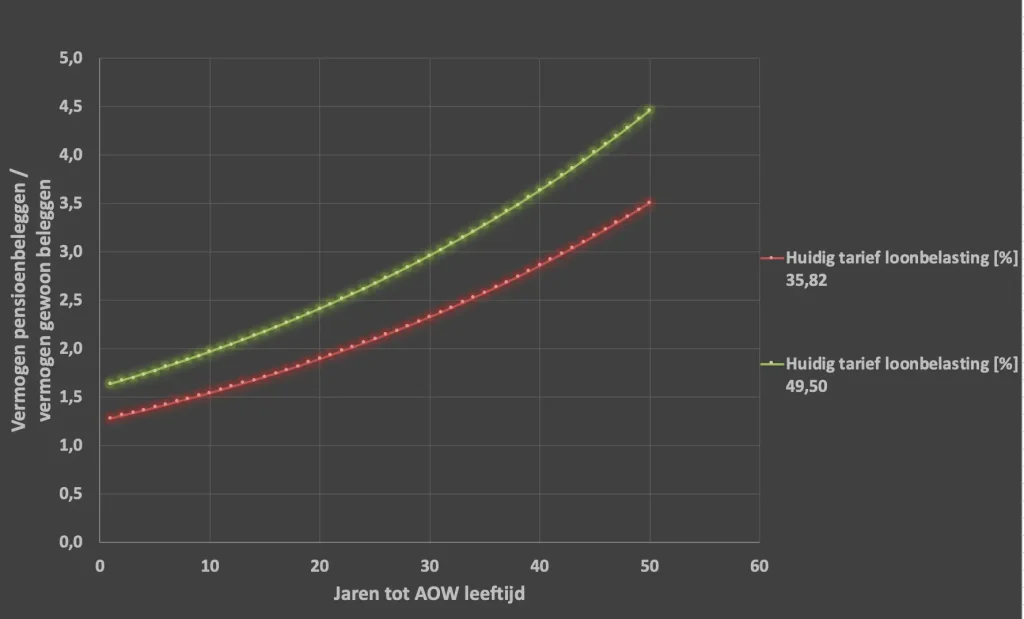

The numbers are stark. Pension investing through platforms like Brand New Day can generate nearly four times the net returns of regular ETF investing over 40 years. But that advantage comes with golden handcuffs: your money remains trapped until you reach AOW-leeftijd (state pension age), currently 67 and rising. For a 32-year-old professional weighing a €30,000 lump sum investment, this isn’t just about optimizing returns, it’s about choosing between financial flexibility and forced long-term discipline.

The Box 3 Tax Bomb Explained

The Netherlands is abandoning its controversial system of taxing “deemed returns” for a model that hits investors with real-world rates of up to 36% on actual investment income, including gains you haven’t cashed out. This creates a fundamental liquidity crisis: you might owe €5,000 in tax on stock gains that evaporate six months later, leaving you with a bill for money you never actually made.

The research shows this isn’t hypothetical. In Denmark, which implemented a similar system, investor Morten Green Hermansen faced a €1 million tax bill on intermediate gains that later disappeared, what he called a “devastated” financial life. The Dutch government, under pressure from the coalition agreement between D66, VVD, and CDA, has promised to eventually move back to taxing only realized gains. But as the political timeline reveals, this “verbouwing” (renovation) could take until 2030 or beyond, leaving investors vulnerable to years of taxation on phantom profits.

Pension Investing: The Math That Makes Heads Spin

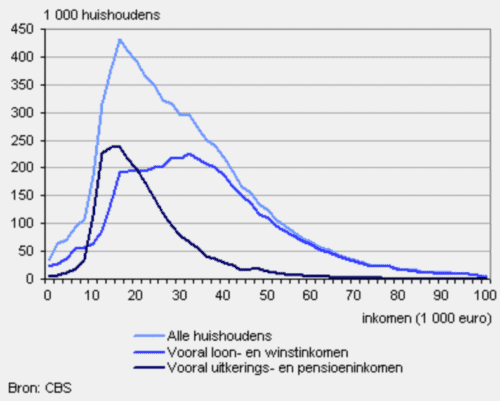

Let’s run the actual numbers. Take a 30-year-old with €10,000 to invest. Through Brand New Day’s pension platform, that contribution is deducted from taxable income at their marginal rate, likely 35.75% to 49.5% for most professionals. The tax refund immediately gives them €3,575 to €4,950 extra to invest, effectively leveraging their capital without borrowing.

That €10,000 then compounds tax-free for 40 years at a historical average of 7% annually, growing to €149,744. Upon withdrawal after AOW age, they pay just 17.85% income tax on the annuity payments, keeping €123,014 net.

Compare this to regular investing: after income tax, that €10,000 becomes only €5,050 to €6,425 of investable capital. Worse, each year the portfolio faces Box 3’s wealth tax drag, reducing effective returns from 7% to 4.88% for those above the exemption threshold. After 40 years, the portfolio reaches just €33,320 to €43,210, a factor 2.8 to 3.7 times less than the pension route.

The fiscale voordelen (tax advantages) extend beyond pure returns. Pension wealth doesn’t count toward means-tested benefits, social housing eligibility, or healthcare contribution calculations. For someone planning early retirement, this can mean the difference between qualifying for subsidies or paying full freight.

The Hidden Costs of “Free” Tax Money

But those returns come with strings attached, chains, really. Pension contributions lock away your capital until AOW-leeftijd, with a maximum early withdrawal penalty of 49.5% plus 20% revision interest. The system forces you to purchase an annuity, and if you start withdrawals before reaching state pension age, you must spread payments over at least 20 years, dramatically reducing monthly income.

This rigidity creates genuine problems. A 35-year-old tech worker who wants to retire at 55 faces a 12-year gap where their pension is inaccessible. If they front-load €30,000 into their pension now, a strategy some Reddit users call “herallocatie” (reallocation), they can’t tap that money when they need it most. The tax benefit might be mathematically optimal, but it requires sacrificing option value.

The jaarruimte (annual allowance) limitation adds another constraint. For 2026, most employees can contribute only around €5,400 annually. While reserveringsruimte (carry-forward allowance) lets you use unused room from the past seven years, this still caps the strategy’s scale. High earners who want to invest €30,000 per year can’t shelter it all in pension wrappers.

Regular Investing: Flexibility at a Steep Price

Keeping money in a standard brokerage account maintains control. You can sell to buy a house, fund a sabbatical, or pivot to new opportunities. But under the new Box 3 regime, this flexibility becomes increasingly expensive.

The wealth tax operates on a vermogensaanwassystematiek (capital growth system). If your €100,000 portfolio grows to €120,000 in a year, you owe 36% tax on that €20,000 gain, even if you don’t sell. If the market crashes the next year, tough luck. You’ve already paid tax on gains that evaporated.

This compounds the already significant drag of Dutch wealth taxation. For portfolios above €57,000 (the 2026 exemption), the effective tax rate on returns reaches 25-30% annually when combined with dividend leakage and transaction costs. Over decades, this transforms market-beating returns into inflation-matching mediocrity.

The FIRE community in the Netherlands has been particularly vocal about this. Many members report they’re seriously considering leaving the country, as the new Box 3 rules make financial independence mathematically impossible for anyone relying on taxable investment accounts. The ability to access capital before traditional retirement age is core to the FIRE philosophy, making pension vehicles’ illiquidity a deal-breaker despite the tax benefits.

The Herallocatie Strategy: Gaming the System Legally

Savvy investors are combining both approaches. One Reddit user described depositing a €30,000 lump sum into their Brand New Day pension at year-end, immediately receiving a €15,000 tax refund, and investing that refund in regular ETFs. This “herallocatie” moves capital from Box 3 to Box 1 (income tax) while recycling the tax benefit into liquid assets.

The strategy works best for those in the 49.5% marginal tax bracket, generally earning above €73,031 annually. At that rate, every €1,000 pension contribution costs only €505 in net income. If you have sufficient cash reserves and won’t need the money before AOW age, front-loading multiple years of contributions can be optimal.

But this requires precise planning. The Belastingdienst only allows pension deductions up to your total jaarruimte plus reserveringsruimte. Over-contributing triggers penalties and interest. Moreover, this strategy concentrates risk: you’re betting that future governments won’t raise the withdrawal tax rate above the current 17.85% or further restrict access rules.

Political Roulette: Why Timing Matters

Here’s where the calculation becomes speculative. The current coalition has promised to abandon the unrealized gains tax, but the timeline remains murky. State Secretary Heinen admitted he “doesn’t want to govern beyond his grave”, suggesting reforms won’t happen before 2028. Some VVD members doubt the changes will occur at all during the current term.

This uncertainty creates a perverse incentive: contribute heavily to pension now to avoid Box 3, but hope the system becomes less punitive later, potentially making your locked-in capital less advantageous. If the government does shift to taxing only realized gains, regular investing’s flexibility becomes more valuable, while pension money remains unnecessarily trapped.

The political pressure against Box 3 is mounting, with petitions gathering thousands of signatures. But until legislation passes, investors face a prisoner’s dilemma: optimize for the current punitive system and risk over-committing to illiquid pension funds, or maintain flexibility and pay confiscatory taxes.

Real-World Decision Frameworks

Your optimal choice depends on three factors: income level, time horizon, and liquidity needs.

- High Earners (€75k+): Max out your jaarruimte first. The 49.5% immediate tax benefit is too large to ignore. Use the refund to fund regular investments, creating a hybrid approach. Consider this a form of tax arbitrage that shields your capital from Box 3’s wealth tax grab.

- Mid-Career Professionals (€50k-75k): Split contributions 50/50. The tax benefit is still substantial (35.75% marginal rate), but you need accessible capital for housing, family, or career changes. Prioritize pension contributions in high-income years and scale back during parental leave or sabbaticals.

- Young Investors (under 35): Favor regular investing unless you’re certain about staying in the Netherlands until retirement. Your biggest asset is optionality. The FIRE movement’s emphasis on early access to capital matters more than tax optimization when your life path remains uncertain.

- Near Retirement (55+): Front-load pension contributions aggressively. With less than 12 years to AOW age, the lock-in period is short and the tax arbitrage is immediate. Use reserveringsruimte to catch up on missed years.

The Verdict: A Temporary Truth

Pension investing currently offers superior returns for most Dutch residents, but this advantage is artificially inflated by a broken Box 3 system. The 4x return multiple assumes the current punitive wealth tax regime continues indefinitely, a bet on political dysfunction.

If you believe the coalition will reform Box 3 as promised, maintain more liquidity. If you’re skeptical, and given the Dutch government’s track record on tax reform, you should be, prioritize pension contributions while keeping 20-30% of your portfolio in taxable accounts as a hedge against both political change and personal emergencies.

The most sophisticated approach? Execute the herallocatie strategy for two years, building a substantial pension base while the Box 3 threat looms. If reforms materialize by 2028, shift new contributions back to regular investing. If not, you’ve secured tax-free growth for decades.

Either way, understand that this decision isn’t permanent. Pension rules change. Tax systems evolve. The only constant is that the Dutch government will continue finding creative ways to tax your wealth. Your job is to stay flexible enough to adapt when they do.