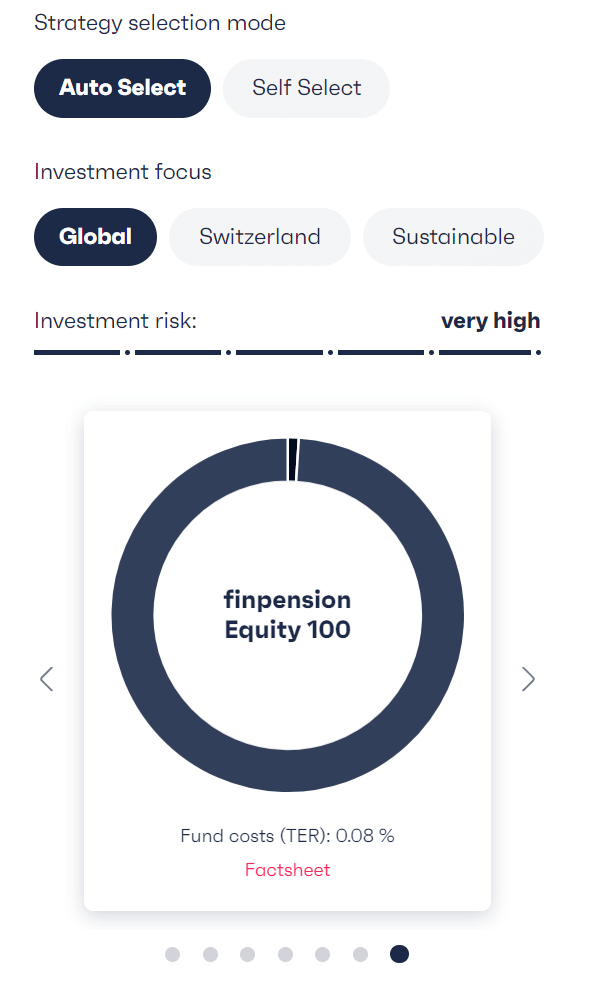

Swiss retirement investing has a dirty little secret: that “Global 100” strategy in your finpension 3a account isn’t as global as you think. Behind the sleek app interface and zero-fee marketing lies a technical decision that could cost you thousands over your working life, currency hedging. The debate raging in Swiss personal finance circles isn’t just for finance nerds, it directly impacts whether your retirement money grows efficiently or gets quietly siphoned away by financial engineering.

The Currency Hedging Puzzle in Your 3a Account

When you invest in international stocks through your Säule 3a (third pillar), you’re buying companies that trade in USD, EUR, GBP, and other currencies. Currency hedging is supposed to protect you from exchange rate fluctuations by using financial contracts to lock in future rates. In theory, this sounds prudent, who wants their retirement savings swinging wildly because of currency markets?

But here’s the catch: hedging isn’t free. While finpension advertises a 0.00% TER (Total Expense Ratio) on some hedged funds, the real cost hides elsewhere. As one astute investor pointed out, the main price of hedging isn’t in the TER at all. The fund needs to buy forward contracts whose costs are based on interest rate differentials between currencies. These costs aren’t a fee per se, but they absolutely impact your returns.

The finpension Global 100 strategy includes several currency-hedged positions, particularly for European and Japanese equities. For a Swiss investor earning in CHF and planning to retire in Switzerland, this seems logical. But the math doesn’t support the conventional wisdom for long-term investing.

The Hidden Cost of “Protection”

Currency hedging acts like insurance, you pay a premium for stability. For bonds, this makes sense. Bonds are supposed to be the stable part of your portfolio, and currency volatility could overwhelm their modest returns. That’s why most Swiss 3a providers hedge foreign bond exposure.

For equities, the calculation changes dramatically. Stocks are already volatile, currency fluctuations are just noise in the larger swings. More importantly, the cost of hedging compounds over time. Interest rate differentials between CHF and other currencies create a drag on returns that can be as significant as a higher management fee.

One investor noted that “if the TER is exactly equal, then the expected return (including the cost of the forward contracts) is also exactly equal.” This is technically true if we assume perfect efficiency. But perfect efficiency doesn’t exist. The hedging process involves transaction costs, bid-ask spreads, and management complexity that creates small frictions. These frictions compound over decades.

Switzerland’s 40% CHF Rule: Mandate or Suggestion?

Here’s where Swiss regulation creates confusion. Many investors believe 3a providers must maintain 40% CHF exposure in their portfolios. This isn’t quite accurate. Providers must offer templates with at least 40% CHF, but users can customize their allocation down to nearly 0% Swiss exposure.

As one user discovered: “They have to. It’s a rule that any 3a provider has at least 40% CHF in their profiles. You as a user can easily adjust that though.” This nuance is crucial. The default Global 100 strategy might have significant Swiss and hedged allocations, but you’re not locked into it.

The home country bias argument, famously supported by influencers like Ben Felix, suggests overweighting your home market because you spend in that currency. For Swiss investors, this means loading up on Swiss stocks and hedged international exposure. The logic: your future liabilities (living costs) are in CHF, so your assets should match.

But Swiss investors already have massive CHF exposure through:

– Their salary (100% CHF)

– Their BVG/LPP (second pillar) pension (typically heavily Swiss)

– Property or rental costs

– The Swiss economy’s impact on their job security

Adding 40% Swiss allocation on top creates a concentration risk that dwarfs any currency risk from global equities.

The Auto-Rebalancing Trap That’s Quietly Draining Your Account

Finpension’s auto-rebalancing feature triggers when any position drifts more than 1% from its target. With weekly checks, this creates frequent trading in a volatile market. Each transaction incurs:

– Swiss stamp duty (0.15% for domestic funds)

– Bid-ask spreads

– Market impact costs

One experienced investor warned: “Finpension will rebalance weekly if one of your positions is 1% away from its target, which happens pretty frequently. And on every transaction, you lose a little bit to fees.” While another countered that domestic index funds avoid stamp duty, the bid-ask spread cost remains.

For a portfolio with many small positions, like the fragmented Global 100 strategy, this rebalancing creates dozens of micro-transactions annually. Each one bleeds a tiny amount. Over 30 years, these drops become a river of lost returns.

The “World ex CH” Strategy That Swiss Investors Are Actually Using

Savvy investors are bypassing the complexity entirely. The solution? A simple custom allocation to a single MSCI World ex Switzerland fund.

Popular choices include:

– UBSCHIF3 (UBS ETF MSCI World ex Switzerland)

– CH0117044948 (Swisscanto IPF I Index Equity Fund World ex CH NT CHF)

This approach gives you:

– 99% global equity exposure (1% must remain in cash per regulations)

– Zero Swiss home bias

– No currency hedging costs on equities

– Minimal rebalancing needs

– Simplicity that reduces behavioral mistakes

The argument against this, missing emerging markets and small caps compared to VT (Vanguard Total World Stock ETF), is valid but overstated. You can add a small emerging markets allocation if desired, or accept the minor omission for the sake of simplicity. For most investors, the difference is negligible compared to the certainty of hedging costs and Swiss over-concentration.

What About VIAC? The Competitor’s Approach

VIAC, finpension’s main competitor, follows similar principles but with key differences. Their Global 100 strategy also includes hedged positions, but their custom strategy options are more limited than finpension’s. Until recently, VIAC capped foreign exposure at 60% in custom strategies, though this restriction has been lifted.

VIAC charges slightly higher fees (0.41% vs 0.39% for finpension) but offers free life/disability insurance worth a few dozen francs annually for large portfolios. The insurance is nice but doesn’t offset the fee difference for most investors.

The critical advantage for both providers: they allow customization. You’re not stuck with their defaults.

Practical Action Steps for Your 3a Strategy

If you’re using finpension 3a or VIAC today:

-

Audit your current allocation: Log in and check exactly what percentages you hold in Swiss equities and hedged vs unhedged international funds.

-

Consider a custom strategy: For finpension, create a custom portfolio with:

- 89% World ex CH fund

- 10% Emerging Markets (optional)

-

Turn off auto-rebalancing: Instead, set a calendar reminder to rebalance manually once per year. This cuts transaction costs dramatically.

-

Keep bonds hedged, not stocks: If you hold bonds in your 3a (most shouldn’t until near retirement), ensure they’re hedged to CHF. Bond volatility is low enough that currency swings could dominate returns.

-

Calculate your true Swiss exposure: Add up your BVG/LPP second pillar, Swiss property equity, and Swiss stock allocation. If it’s over 50% of your net worth, you have a concentration problem.

The Verdict: Hedging Is a Flawed Strategy for 3a Equities

For long-term retirement investing in Switzerland, currency hedging in equity portions of your 3a is an expensive solution to a problem that doesn’t need solving. The costs, both explicit and hidden, compound over decades and create a drag that can cost tens of thousands of francs in lost growth.

The regulatory 40% CHF rule is a template requirement, not a personal mandate. Modern 3a providers give you the freedom to construct a globally diversified, unhedged equity portfolio that serves your long-term interests better than their defaults.

The Swiss obsession with stability is culturally understandable but financially counterproductive when applied to decades-long equity investing. Your 3a isn’t a bank account, it’s a growth engine for your retirement. Let global currencies fluctuate. Let global companies thrive. Your future self will thank you for the extra zeros in your retirement account.

The simplest strategy remains the best: World ex CH and chill.