The Swiss housing market just handed residents a reality check. According to fresh data from Wüest und Partner, buying property beats renting in 57% of Swiss municipalities, a figure that jumps to 71% once the Eigenmietwert (imputed rental value) tax disappears. But before you rush to raid your Säule 3a (Third Pillar) for a down payment, the study reveals a geographic split that could reshape how we think about housing wealth in Switzerland.

The Red and Blue Map That Divides Switzerland

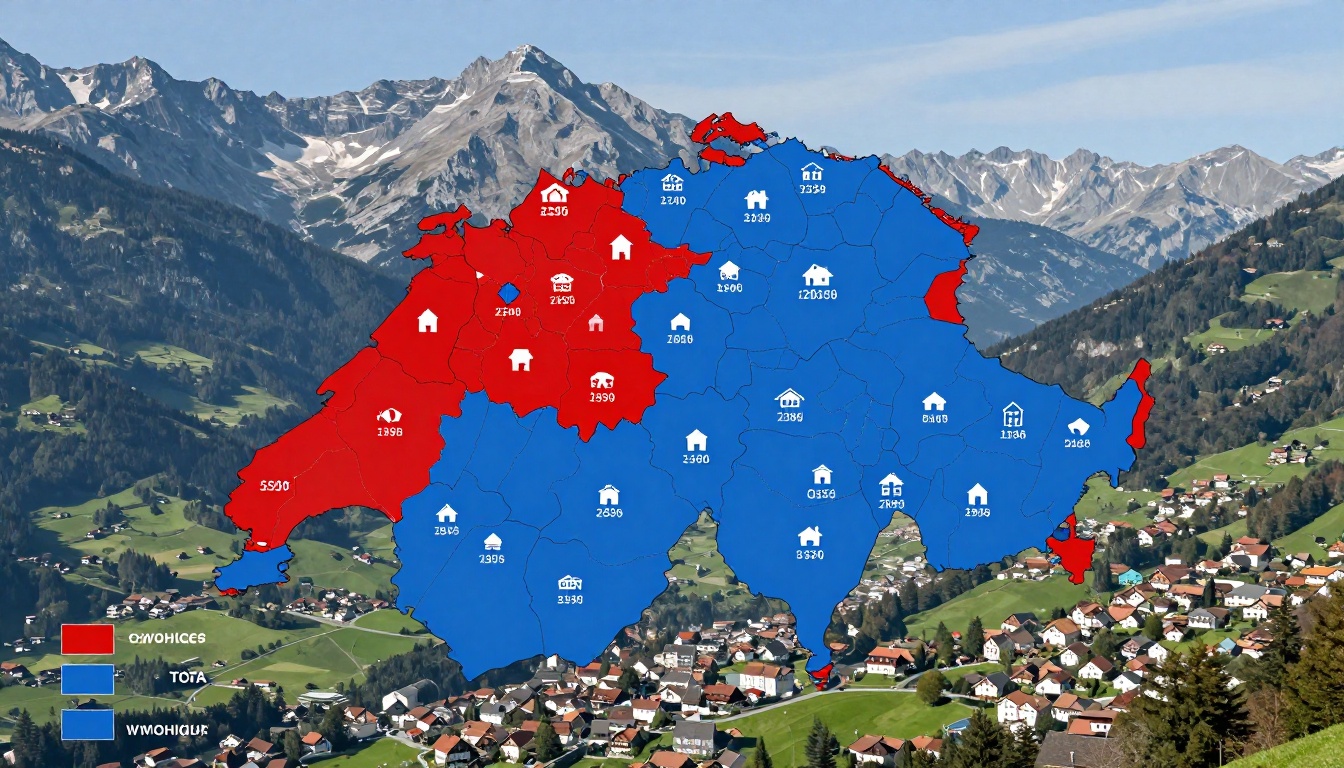

The study’s interactive map paints Switzerland in two colors: red municipalities where renting costs more than owning, and blue zones where renting remains the smarter financial move. The pattern isn’t random. It reflects a fundamental tension between property prices, tax policy, and local market dynamics that varies dramatically from one Gemeinde (municipality) to the next.

West Switzerland: The Ownership Stronghold

The numbers favor buyers most strongly in western cantons. Jura, Neuchâtel, Fribourg, Valais, and many communities in Vaud and Geneva show rental yields above 2.7%, well above the Swiss average of 2.4%. In these regions, a CHF 1 million property might generate CHF 27,000 in equivalent annual rent, making mortgage payments at current 1.8% interest rates look attractive.

The math works because these regions combine relatively high market rents with restrained purchase prices. A 120 m² apartment, the study’s benchmark, costs significantly less in Delémont or Neuchâtel than in Zug or Zurich, while rents haven’t lagged far behind. The result: owning costs families 5-15% less annually than renting equivalent space.

Central Switzerland and Zurich: The Renting Paradox

Flip the map eastward and the colors invert. In Zug, Schwyz, Nidwalden, and Obwalden, plus the entire Zurich metropolitan area, renting beats buying decisively. Here, purchase prices have detached from economic reality. The same CHF 1 million buys a modest 2-room apartment in Zurich’s suburbs, yet rents for comparable units remain relatively contained.

Why? Low tax rates in these cantons attract high-net-worth residents, pushing property prices into bubble territory without pulling rents up at the same pace. The study calculates that in Zug, annual rent equals just 1.9% of a property’s purchase price, making landlords’ returns pitiful but tenants’ lives affordable relative to buying.

The Eigenmietwert Curveball

Switzerland’s upcoming tax reform adds a wild card. The September 2025 vote to abolish Eigenmietwert (imputed rental value) taxation will shift the calculation for millions of homeowners. Under the current system, homeowners pay tax on a fictional rental income but can deduct mortgage interest and maintenance costs. After the reform, that income disappears, but so do most deductions.

Winners and Losers of the Reform

The study models two scenarios: today’s system and the post-reform landscape. The headline number jumps from 57% to 71% of municipalities favoring ownership, suggesting the reform will turbocharge buying incentives. But this average masks important exceptions.

First-time buyers in expensive markets get squeezed. In Zurich, Geneva, and wealthy tourist municipalities, the loss of mortgage interest deductions outweighs the benefit of eliminating Eigenmietwert. A couple buying a CHF 1.5 million apartment in Zurich with an 80% mortgage currently deducts around CHF 21,600 in annual interest at 1.8% rates. After reform, they can deduct only CHF 10,000 in year one, decreasing to zero over ten years.

The result: their tax bill rises by several thousand francs annually, erasing much of ownership’s financial advantage. Wüest Partner calculates that in these high-price zones, the reform actually strengthens the case for renting.

Peripheral regions see a boost. In lower-cost areas where mortgages are smaller, the limited interest deduction doesn’t matter as much. The elimination of Eigenmietwert provides pure tax relief, making ownership 3-8% cheaper overnight. Municipalities in Jura, Valais, and rural Bernese Oberland shift from light red to deep red on the cost-benefit map.

Methodology Wars: Why Expats Disagree with the Data

Online discussions reveal sharp skepticism about the study’s methodology. Critics point to a crucial flaw: the analysis uses average rents across all tenants, including those in decades-old contracts paying far below market rates. New arrivals face a different reality.

As one Zurich-based commentator noted, “They considered rents of everyone including people that have been renting for 30 years who pay less rent. It can be a good indicator for long-term renters, but not for short-term ones.” This matters because Switzerland’s tight rental market means newcomers often pay 20-30% premium over existing tenants.

The study’s authors defend their approach, arguing that long-term cost comparisons must reflect actual housing expenditures across the population, not just the marginal price for new leases. But for anyone currently apartment hunting, the map’s colors may look wishful.

The Leverage Question

Another debate centers on how the study treats mortgage amortization. The analysis excludes principal payments from ownership costs, treating them as “wealth building” rather than expense. This technically correct accounting decision nonetheless irks skeptics who note that CHF 10,000 in annual amortization is still cash leaving your pocket.

The study assumes a 2.6% opportunity cost on equity capital, reasonable for a balanced portfolio, but perhaps optimistic for risk-averse savers who might otherwise park money in a Sparkonto (savings account) earning 0.5%. This assumption significantly influences whether owning appears cheaper than renting.

Real-World Scenarios: Three Profiles

The Geneva Professional

Consider a lawyer earning CHF 150,000 considering a CHF 1.2 million apartment in Carouge. Under current rules:

– Annual Eigenmietwert: ~CHF 30,000 (taxed at marginal rate)

– Mortgage interest deduction: ~CHF 17,280 (80% loan at 1.8%)

– Net tax impact: +CHF 12,720 income

After reform:

– No Eigenmietwert income

– Interest deduction capped at CHF 10,000, phasing out

– Net tax impact: -CHF 7,280 to -CHF 17,280 over time

The ownership discount jumps from 3% to 8% cheaper than renting, if you can scrape together the CHF 240,000 down payment.

The Zug Startup Employee

A software engineer in Zug faces different math. That same CHF 1.2 million buys only a small 2.5-room flat. Rent for equivalent space: CHF 2,500/month (CHF 30,000/year). Buying costs, even after Eigenmietwert reform, run CHF 35,000+ annually when including maintenance and lost investment returns on the down payment.

Here, renting wins by 15-20%, freeing capital to invest in the broad equity market where historical returns outpace property appreciation in already-expensive markets.

The Retired Couple in Valais

Empty-nesters in Sion face a clear ownership case. A comfortable 4.5-room apartment costs CHF 600,000. Rents for comparable units run CHF 2,000/month. With pension income taxed moderately, the Eigenmietwert reform delivers pure savings: CHF 3,000-4,000 annually in reduced taxes.

The kicker: at 65+, qualifying for a mortgage requires demonstrating pension income covers payments, a hurdle many face when the bank says “nein” despite solid assets.

The Hidden Costs of “Cheaper” Ownership

Even where the math favors buying, the study acknowledges limitations. Maintenance costs, which renters avoid, average 1% of property value annually, CHF 8,000 on that CHF 800,000 apartment in Biel/Bienne. Special assessments for roof repairs or heating system replacements can add CHF 20,000+ in a single year.

Transaction costs compound the risk. Notary fees, property transfer taxes, and registration costs total 2-5% of purchase price. On a CHF 1 million property, that’s CHF 20,000-50,000 evaporating immediately, equivalent to a year’s rent.

Liquidity risk presents another factor. Swiss properties average 100 days to sell, but in a market downturn that can stretch to 6-12 months. Renters can relocate for a new job with three months’ notice. Homeowners face a painful choice: sell at a loss or turn down opportunities.

What the Data Means for Your Decision

The Wüest Partner study provides a powerful framework, but not a universal answer. Three principles emerge:

1. Location dominates the calculation. Where you want to live matters more than abstract financial optimization. That dream chalet in Grisons might be a financial disaster, but if it enables your lifestyle, the premium may be worth it.

2. Time horizon changes everything. The 16-year ownership assumption matters. Planning to stay less than 10 years? Renting almost always wins due to transaction costs. Staying 20+ years? Ownership’s forced savings component becomes valuable, especially if you lack discipline to invest the difference.

3. Tax reform creates a window. The Eigenmietwert abolition takes effect in 2028 (or later). Current buyers lock in deductions that disappear for future purchasers. This transitional period may temporarily boost demand, pushing prices higher in affected municipalities.

The Bigger Picture: Housing as Wealth Machine

Swiss property has delivered for decades. One commenter noted their Zurich-area home doubled in 13 years, turning CHF 200,000 equity into CHF 800,000. But as another countered, CHF 1 million in a global ETF would have grown to CHF 3.1 million over the same period, CHF 1 million more after accounting for rent paid.

This debate highlights a cultural shift. Younger Swiss increasingly view housing as consumption, not investment. They’d rather rent in the city and invest surplus income globally than tie wealth to a single illiquid asset. The study’s data supports this strategy mathematically in high-price regions, even if it contradicts traditional Swiss financial wisdom.

For those wrestling with the decision, the study’s municipal-level granularity offers a starting point. Plug your target Gemeinde (municipality) into the Wüest Partner calculator. Then layer on your personal variables: job mobility, down payment size, risk tolerance, and whether you can stomach watching your property value fluctuate while your landlord handles the boiler replacement.

The map shows where ownership wins on paper. Only you can decide if it wins in your life.