You’ve bought a 2x leveraged MSCI World ETF, hoping to amplify your gains. The market moves sideways, your investment barely breaks even, but suddenly you owe the Finanzamt thousands in taxes. This isn’t a nightmare, it’s the Austrian tax system’s AgE (accrued gains) mechanism in action, and it’s turning leveraged ETFs into a liquidity death trap for unsuspecting investors.

The Core Problem: Taxation Without Distributions

The Austrian investment tax regime operates on a principle that seems logical until you dig into the details: funds must report their internal earnings, and investors pay KESt (capital gains tax) on these “ausschüttungsgleiche Erträge” (distribution-equivalent income) even when no cash actually lands in their account. For leveraged ETFs, this creates a perfect storm.

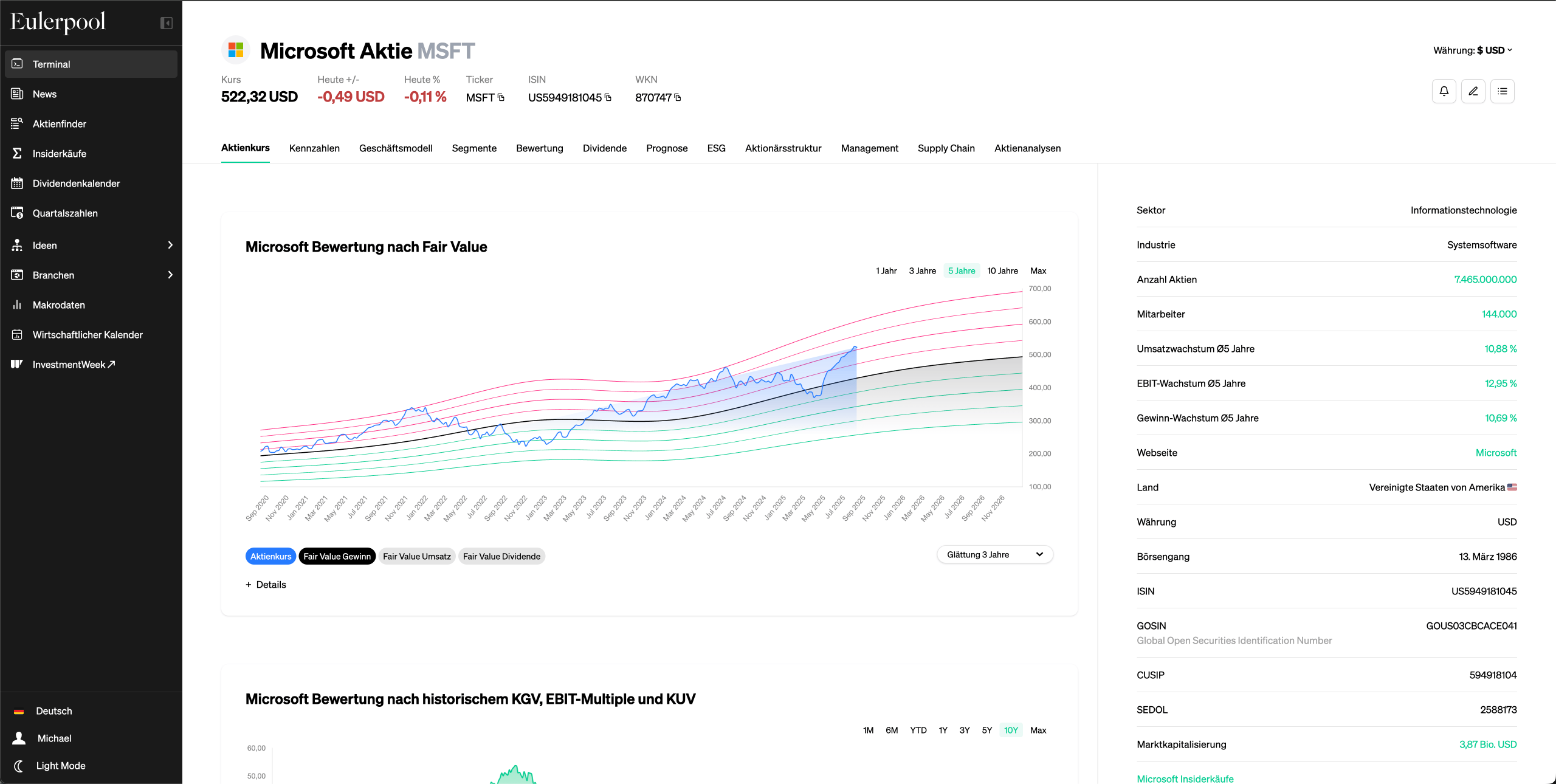

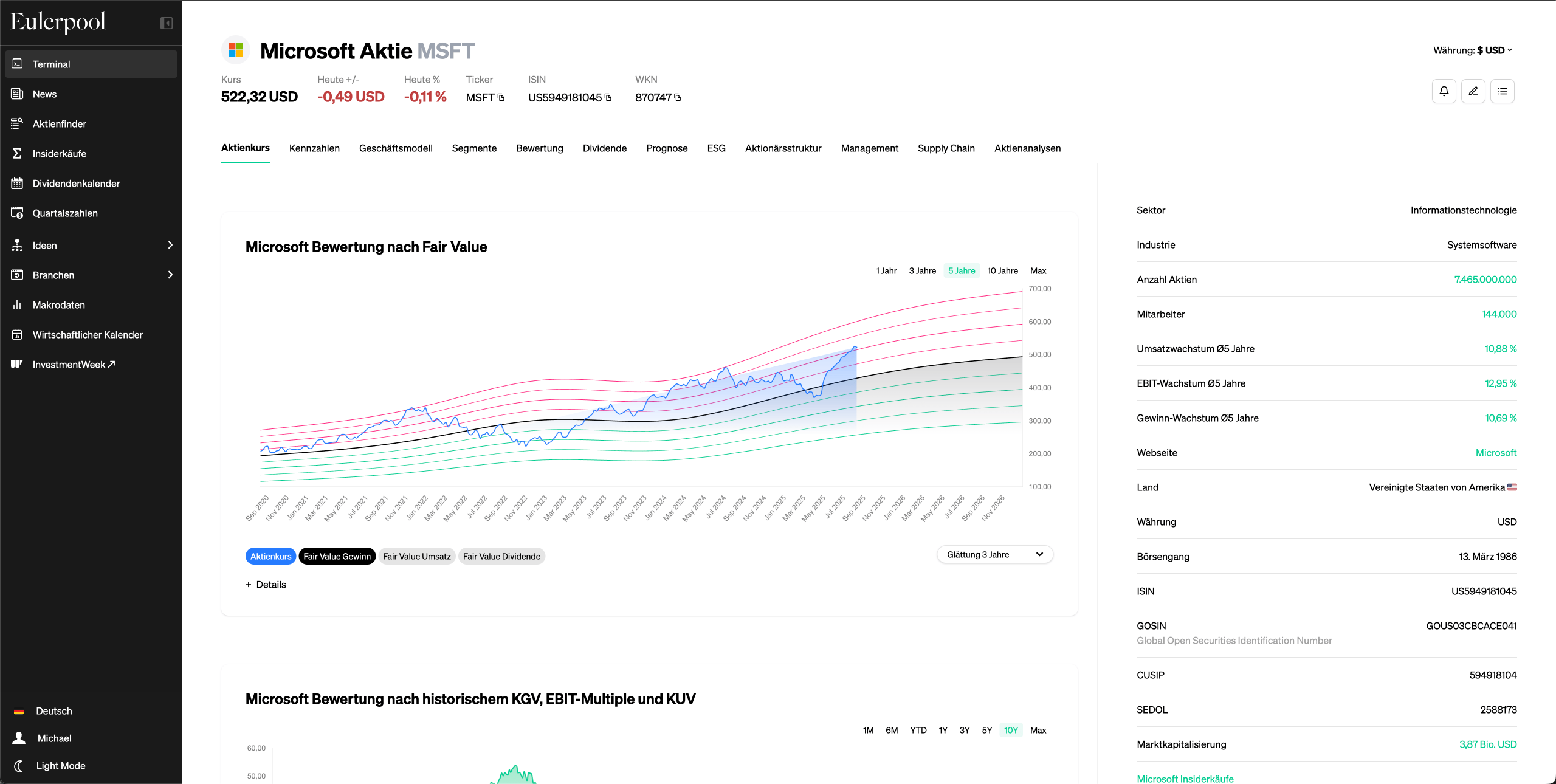

Take the MSCI World 2x leveraged ETF (FR0014010HV4) as a concrete example. These instruments use derivatives to achieve daily leverage, generating complex internal transactions that trigger taxable events. The fund reports accrued gains (AgE) based on its derivative positions, interest costs, and swap agreements. As an investor, you receive a tax statement showing several thousand euros in taxable income. But your brokerage account? It’s silent, no deposits, no dividends, just a growing tax liability.

Three Ways This Breaks Your Financial Plan

1. The Liquidity Squeeze

The most immediate impact is a pure cashflow crisis. Austrian tax law requires you to pay KESt on AgE in the year it’s reported, typically by the end of December. If you’re holding €50,000 in leveraged ETFs that generate €3,000 in AgE, you owe €750 in taxes (25% KESt plus solidarity surcharge) with money you never received.

Worse, this hits precisely when you least expect it. During volatile markets, leveraged ETFs often generate significant AgE from derivatives activity while the actual ETF price collapses. You could be sitting on a 20% loss and still face a four-figure tax bill. The only ways out: inject fresh capital from your salary or other investments, or sell part of your position, potentially at a loss, to cover the tax.

2. The Return Disconnect

This isn’t just a timing issue, it’s a fundamental misalignment between tax policy and economic reality. The Austrian system taxes “transparent” fund earnings to approximate direct investment. But leveraged ETFs aren’t transparent in any meaningful sense for retail investors.

The internal mechanics create a surreal scenario: you might hold an ETF for a year, watch its value drop 5%, and still owe taxes on “gains” reported by the fund’s derivative positions. The Bundesfinanzministerium acknowledges this in their responses to investor inquiries, noting that “the decoupling of actual investor returns from taxable components is a consequence of this transparent taxation system.”

The absurdity peaks when you realize you’re paying taxes on interest costs. Leveraged ETFs borrow money or use swaps to achieve their 2x or 3x exposure. These financing costs are treated as taxable income at the fund level, even though they’re purely a cost to you, the end investor.

3. The Timing Arbitrary

AgE taxation attaches to the reporting date, not your personal holding period. Buy an ETF in November, and you’re on the hook for the entire year’s AgE, even if you held for just six weeks. The Finanzamt doesn’t prorate, they simply match the reported figure to your tax ID for that calendar year.

This creates bizarre incentives. Savvy investors now track publication dates from major ETF providers, attempting to sell positions just before AgE reporting to “reset” the tax clock. But this itself becomes a gamble. As one investor noted, trying to time these disclosures feels like “guessing when ETF888 will release their data, it’s a black box.”

Why Reform Isn’t Coming (Despite the Ministry Knowing It’s Broken)

The Austrian Ministry of Finance has explicitly stated they’re “aware of the complexity” and that “further complication should be avoided.” Yet when pressed on reform, they deliver a three-part explanation that essentially says: “It’s broken, but changing it would cost us millions.”

Their official response to investor complaints reveals the political calculus:

Historical Lock-in: The system was designed pre-2012 when thesaurierende (accumulating) funds were rare. The rules assumed funds would eventually distribute earnings. Modern leveraged ETFs break this assumption entirely, but the legislative framework remains frozen.

Revenue Protection: The Ministry admits that exempting AgE would create a “tax advantage for funds compared to direct investment”, which they view as unacceptable. More critically, they note that changing the system would cause “immediate revenue losses in the millions, with recovery only gradual over years.” In plain terms: the budget can’t handle fixing the problem.

Foreign Fund Helplessness: Domestic funds must make minimum distributions to cover KESt liabilities, but Austria can’t force foreign ETF issuers (like those listing in Paris or Frankfurt) to do the same. The result: Austrian investors in foreign leveraged ETFs bear the full brunt, while domestic fund investors are protected.

The Workarounds (And Why They Mostly Fail)

Faced with this system, investors have developed flawed coping strategies:

Sell Before Reporting: Theoretically, selling your position before the AgE publication date means you’re only taxed on actual capital gains. But this requires precise timing, incurs transaction costs, and may trigger capital gains tax anyway. Plus, you might miss a sudden market rally.

Use Tax-Loss Harvesting: Some investors deliberately realize losses elsewhere to offset AgE tax. Financial platforms show this becoming more common, but it’s a reactive solution that doesn’t address the core dysfunction.

Hold in Tax-Deferred Accounts: While Austria doesn’t have true tax-deferred retirement accounts like the US 401(k), company pensions can sometimes shield investments. For most retail investors, this isn’t an option.

Switch to US ETFs: American-domiciled leveraged ETFs often have different tax treatment, but they’re increasingly hard to access due to PRIIPs regulation and KID requirements. Plus, they introduce currency risk and US estate tax complications.

The Silent Portfolio Killer

What’s particularly insidious is how this erodes compound returns over time. A 2x leveraged ETF might generate 8% annual AgE tax liabilities while delivering zero actual returns in a choppy market. Over five years, you’ve paid 40% of your principal in taxes for nothing.

Analysis from financial data providers confirms this: leveraged ETF underperformance in Austria is significantly worse than in Germany or Switzerland, where different tax treatments apply. The gap isn’t due to fund management, it’s purely the Austrian tax drag.

What Needs to Change (And Won’t)

The Ministry’s response to reform proposals is telling: they appreciate the feedback, might consider it in future “de-bureaucratization initiatives”, but have “no concrete measures” planned. This is bureaucratic code for “we’re not touching this.”

Real reform would require:

- Exempting derivative financing costs from AgE calculation

- Prorating tax liability based on actual holding periods

- Deferring tax until realization (like the US system)

- Forcing foreign funds to make minimum distributions or provide Austrian tax shields

None of these are politically palatable. The first three cost revenue, the fourth is legally complex and would face EU resistance.

Practical Takeaways for Austrian Investors

If you’re still considering leveraged ETFs:

- Budget 25-30% extra liquidity to cover AgE tax on top of your investment

- Track reporting dates and consider tactical selling (with all its risks)

- Prefer German-domiciled funds if possible, they sometimes have better reporting transparency

- Calculate the total cost of ownership: AgE tax drag often exceeds the leverage benefit

- Document everything: The Finanzamt will demand proof of cost basis adjustments

For most investors, the math simply doesn’t work. A standard MSCI World ETF with its straightforward dividend tax treatment will likely outperform its 2x leveraged counterpart after AgE drag and volatility decay. The leverage promise of “more returns” becomes a tax nightmare of “more problems.”

The Austrian tax system has created a modern equivalent of the medieval “tax on windows”, a levy that punishes a specific structure without regard to actual benefit derived. Until political priorities shift from short-term revenue to long-term investment incentives, leveraged ETFs will remain a trap for the uninformed and a costly puzzle for the savvy.

The information provided is based on publicly available tax guidance and investor reports. For personalized advice on your specific situation, consult a Steuerberater familiar with investment fund taxation.