You’ve just been handed power of attorney over your grandmother’s €170,000 investment portfolio. She trusts you. The bank advisor who sold her this collection of active funds twenty years ago trusts you to leave it alone. But the numbers? They tell a different story, one where 1.5% annual fees are quietly confiscating nearly half her returns while everyone nods approvingly about “sichere Anlage.”

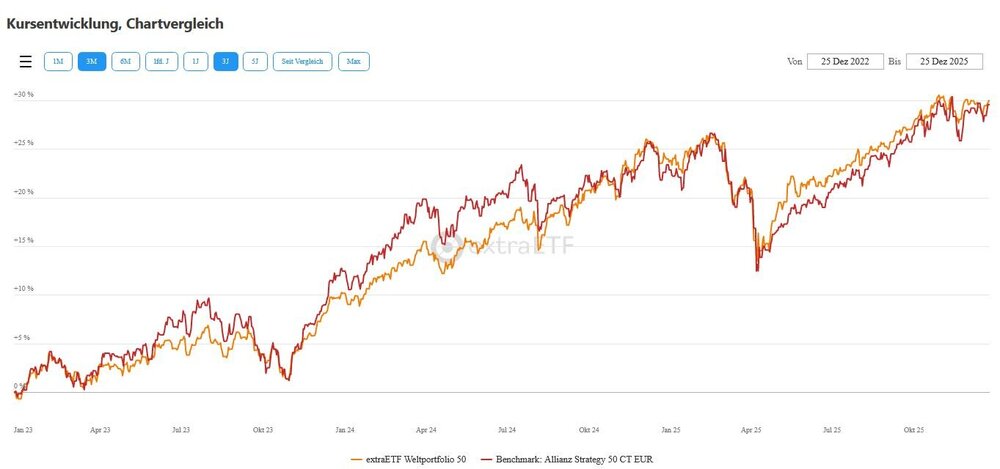

This isn’t a hypothetical. This exact scenario played out recently in Austrian financial circles, where a grandson confronted a portfolio stuffed with legacy funds like Allianz Strategy 50 (charging 1.5% annually for mediocrity) and KEPLER Vorsorge Mixfonds, products that made sense in a pre-ETF era when bank advisors actually earned their commissions. The portfolio had become a museum of outdated financial products, each silently bleeding value through fees that compound into real money.

The Legal Minefield: Vollmacht vs. Erwachsenenvertretung

First, understand what kind of power you actually have. Many assume a Vollmacht (power of attorney) gives them free rein to optimize. Not so fast. If your grandmother has been declared legally incapacitated and you’re acting as her Erwachsenenvertreter (adult representative), Austrian law shackles you with mündelsichere Anlage requirements. This means ETFs and individual stocks are off-limits without court approval. You’re essentially forced into Sparbuch or Bundesschatz, products guaranteeing wealth erosion after inflation.

But here’s the critical distinction: A standard Vollmacht, signed while she’s still mentally competent, operates under different rules. As one legal voice in the community pointed out, if she signed the Vollmacht herself and remains capable of saying “I don’t want that”, you’re likely in the clear for restructuring. The grandson in question had a Doppelvollmacht requiring both signatures for transactions, this isn’t Erwachsenenvertretung, but it’s also not a blank check. Know your legal instrument before you touch a single position.

The 1.5% Wealth Destruction Machine

Let’s examine what “leaving it alone” actually costs. The Allianz Strategy 50 fund in this portfolio charges 1.5% annually. Over a decade, that fee consumed roughly half the returns the investor actually received. Performance data shows the fund delivered 3.07% annual return after taxes over ten years, meaning Allianz pocketed nearly as much as the beneficiary for the privilege of underperforming the market.

The math is brutal: On €170,000, that 1.5% fee costs €2,550 annually. Over a typical 10-year holding period during grandmother’s late retirement, that’s €25,500, enough to fund a year of quality nursing care or a substantial inheritance boost. And that’s before accounting for the opportunity cost of not being in low-cost index funds.

This is where fiduciary duty gets twisted. The law might consider “safe” investments prudent, but what’s safe about guaranteed underperformance? Inflation in Austria hovers around 2-3%, meaning these “conservative” active funds risk negative real returns after fees. The grandson’s hesitation, “I don’t want to change anything until I’ve fully understood it”, is noble but expensive. Every month of delay costs another €200+ in avoidable fees.

The Tax Trap That Isn’t

The most common objection to restructuring is “but I’ll pay taxes!” This psychological anchor sinks many portfolios. Yes, selling those old funds triggers Kapitalertragssteuer (KeST) at 26.38%. On a €2,000 gain, that’s €527 in tax. Painful? Perhaps. But compare that to paying €2,550 annually in fees to avoid it.

Financial communities have debated this extensively, and the consensus is clear: Tax considerations should never override investment quality. As one experienced investor noted, “What use is tax savings if the funds perform terribly?” The tax is a one-time event, the fee is forever. Even more pointedly: “Money paid in taxes can grow again. Money paid in fees is gone.”

The grandson’s portfolio held €11,000 in Allianz Strategy 50 with €2,000 in gains. Selling would cost ~€527 in tax. Keeping it costs €165 annually just in fees. The break-even point is 3.2 years. After that, staying put is pure loss.

The Family Dynamics Time Bomb

Here’s where it gets emotionally radioactive. The grandson mentioned his grandmother says “it’s all mine” but might change her mind last-second. This is the unspoken risk in family wealth management. Until inheritance, it’s legally her money, and acting against her wishes, even mathematically justified, can spark family warfare.

Never restructure without explicit, documented consent. The community advice was blunt: “If she says it’s yours, she can transfer it now. Until then, it’s hers, and everything you do can backfire, not legally, but through family conflict.” This is particularly true in Austria, where Schenkungssteuer (gift tax) and inheritance expectations create minefields.

If she genuinely wants you to inherit, consider a partial gift now, leveraging the €20,000 tax-free gift allowance per grandparent every ten years. Or establish a clear Vermächtnis (bequest) in her will. But don’t confuse Vollmacht with ownership. Your legal duty is to act in her best interest, not your inheritance’s best interest.

The Practical Exit Strategy

So what should the grandson actually do? Follow this sequence:

1. Verify Your Legal Standing

- Confirm you’re operating under Vollmacht, not Erwachsenenvertretung

- If the latter, consult a Notar about court approval for restructuring

- Document grandmother’s capacity and consent in writing

2. Analyze Each Position Ruthlessly

- List all funds with ISIN, fees, and performance

- Compare against equivalent ETFs (e.g., MSCI World at 0.2% TER)

- Calculate fee drag over expected holding period

3. Execute a Staged Transition

- Stop all Sparpläne in old funds immediately

- Sell worst offenders first (highest fees, poorest performance)

- Use Freistellungsauftrag to minimize KeST impact

- Transfer cash to low-cost broker like Smartbroker+ or Traders Place (both offer free ETF purchases)

4. Master the Depotübertrag

- Initiate transfer at the new broker using their form

- Specify “Übertrag ohne Gläubigerwechsel”

- Secure all Kaufabrechnungen and Steuerunterlagen first

- Plan for 2-6 weeks of transition time where you can’t trade

5. Document Everything for Family

- Create a simple report showing fee savings

- Share the math: “This saves €2,500 annually”

- Get written approval for each major change

The Bottom Line: Redefining Fiduciary Duty

Your fiduciary responsibility isn’t to preserve the status quo, it’s to preserve and grow wealth for the beneficiary’s actual needs. In 2025 Austria, that means acknowledging that “mündelsicher” is often code for “guaranteed mediocrity.” The grandson’s €170k situation isn’t unique, it’s replicated in thousands of Austrian households where loyalty to bank advisors and fear of taxes paralysis decision-making.

The spicy truth? Your banker wants you confused. They want you fixated on tax implications while ignoring fee hemorrhaging. They want you worried about “complexity” while they collect 1.5% for doing nothing. The moment you realize fiduciary duty means mathematical optimization, you’ve already won.

The inheritance your grandmother wants to leave isn’t a collection of 1990s mutual funds. It’s financial security. And sometimes, securing that future means killing the sacred cows, however “mündelsicher” they claim to be.

Expert analysis confirms: The best fiduciary decision is often the one that feels most uncomfortable to make.