The Swiss investment community just witnessed its own version of a financial coup d'état. When Mustachian Post, Switzerland's most influential FIRE blogger, announced his shift to a 100% VT portfolio, it didn't just ruffle feathers, it ripped up the Bogleheads rulebook that many Swiss investors had treated as gospel. The age-old formula of "your age in bonds" suddenly looked less like prudent advice and more like a costly mistake in negative interest rate purgatory.

What Makes VT the New Swiss Darling

VT isn't just another ETF, it's a financial product that perfectly captures the lazy-but-smart investing ethos. The Vanguard Total World Stock ETF (VT) holds roughly 9,900 stocks from 49 countries, essentially letting you own a slice of the entire global economy for a measly 0.06% annual fee. For Swiss investors tired of overthinking asset allocation, the appeal is obvious: one transaction, one position, zero complexity.

The math works out brutally simple. Instead of juggling multiple ETFs, MSCI World, emerging markets, Swiss home bias additions, you buy VT and get on with your life. No rebalancing spreadsheets. No quarterly adjustments. Just pure, unadulterated global equity exposure that automatically adjusts as markets shift.

The Swiss Pillar 2 Secret That Changes Everything

Here's where the Swiss context makes the 100% stock strategy actually defensible. Your Säule 2 (Second Pillar) occupational pension isn't just a retirement account, it's a massive, bond-like anchor that most international investors don't have. When MP argues his 100% VT allocation makes sense, he's not being reckless, he's counting his pension as the fixed-income portion of his net worth.

The typical Swiss professional has between 10-20% of their net worth locked in a Pensionskasse (pension fund) that behaves like a conservative bond portfolio. These funds guarantee minimum returns (currently 1% by law, though most pay more) and offer insurance-like protection. For a 40-year-old with CHF 200,000 in their pension and CHF 300,000 in investments, that's already a 40% bond allocation, without owning a single bond ETF.

This is why the Swiss version of "VT and chill" differs from the American one. International critics howl about sequence-of-return risk, but they miss that Swiss investors have a built-in safety net that US investors lack. When you factor in Säule 2 and Säule 3a (Third Pillar) accounts, many Swiss are already at 30-50% fixed income before they even touch their brokerage account.

The Currency Trap Most Expats Miss

But before you rush to dump your life savings into VT, understand the CHF-USD currency dynamics that can turn your returns into Swiss cheese. The USDCHF pair recently hit 0.7768, and projections suggest it could slide toward 0.7382. For Swiss investors, this creates a double-edged sword: your global stocks might rise in USD terms, but currency conversion can erase those gains when measured in francs.

This isn't theoretical. Many Swiss investors report watching their VT position climb 15% in dollar terms, only to see a third of that vanish after currency conversion. The Swiss National Bank (SNB) actively manages the franc's strength, making currency hedging a legitimate consideration, though one that comes with its own costs and complexities.

The debate rages in Swiss investment circles: is currency risk just noise over decades, or should investors hedge their USD exposure? MP himself addressed this, pointing to his analysis on currency hedging trade-offs in Swiss retirement accounts. The consensus remains elusive, but the volatility is real.

The US Estate Tax Bogeyman (And Why It's Overblown)

For years, Swiss investors limited VT exposure to $60,000, terrified of the US estate tax. The fear was simple: die with too many US assets, and Uncle Sam takes 40% above the exemption threshold. This created the absurd situation where investors bought both VT and VWRL (the Irish-domiciled equivalent), complicating their portfolios to avoid a tax that most would never actually pay.

MP finally put this to rest after consulting with tax professionals. The US-Switzerland estate tax treaty gives Swiss residents a pro-rated exemption based on the US portion of their global assets. For most investors, this means you'd need a portfolio well into the millions before owing a single franc in US estate taxes. The result? Swiss investors can now go all-in on VT without the $60,000 mental barrier.

Still, the psychological scar runs deep. Many older investors still hedge with VWRL, despite higher fees and less favorable tax treatment on dividends. The fear of the unknown trumps rational analysis, a classic behavioral finance trap that Swiss investors aren't immune to.

Why Bonds Still Have Defenders (Even at Negative Yields)

Not everyone is sold on the 100% equity gospel. Critics argue that behavioral risk, the chance you'll panic-sell during a crash, outweighs the theoretical benefits. They point to 2022, when both stocks and bonds fell together, as proof that diversification still matters.

The counterargument is uniquely Swiss: with negative yields persisting for years, bonds were guaranteed losers after inflation. Why hold an asset that mathematically loses purchasing power? Better to keep cash in a high-yield Swiss savings account (some now offer 1-2%) and accept the volatility of 100% stocks.

This debate intersects with the Swiss FIRE movement's existential crisis about the 2nd pillar trap. Early retirees face a particular problem: once you quit your job, your Säule 2 moves to a vested benefits account with limited investment options. Suddenly that bond-like anchor disappears, forcing you to rethink your entire allocation.

The Home Bias Problem Swiss Investors Can't Shake

VT allocates approximately 2% to Swiss stocks, roughly matching Switzerland's global market cap weight. But try telling that to a Swiss investor who lives in Zurich, shops at Coop, and sees Roche and Nestlé dominate their economic landscape. The psychological pull toward home bias remains strong.

Some Swiss investors add a CHSPI or UBS SMIM position to capture "Swiss quality" and dividend reliability. MP himself considered this before concluding it added unnecessary complexity. The data supports his view: Swiss stocks have underperformed global markets over the long term, and concentration risk in a tiny market (Switzerland represents ~2% of global GDP) isn't compensated with higher returns.

Yet the urge persists. Financial advisors in Geneva and Zurich consistently recommend 20-40% Swiss equity allocations, citing "currency stability" and "familiarity." This creates a schism: the data says global diversification, but Swiss conservatism says keep money close to home. VT forces you to choose, which is exactly why it makes some investors uncomfortable.

Practical Implementation: Not All Brokers Are Equal

If you're convinced by the 100% VT argument, your next decision is execution. Swiss investors face a broker landscape that ranges from expensive (UBS, Credit Suisse charging 0.5%+ per trade) to bargain basement (Interactive Brokers, DEGIRO).

The DEGIRO temptation is strong: free ETF purchases on certain exchanges. But watch for currency conversion fees that can eat 0.25% per transaction. Interactive Brokers offers interbank rates but has a $10 monthly minimum commission. For smaller portfolios, a Swiss broker like Cornèrtrader might actually be cheaper despite higher headline fees.

MP's site provides detailed broker comparisons, but the key insight is that your choice should depend on portfolio size and trading frequency. A CHF 50,000 portfolio behaves differently than a CHF 500,000 one when it comes to fee optimization.

The Behavioral Reality Check

Here's what the "VT and chill" evangelists don't advertise: during the COVID crash, VT dropped 30% in weeks. In 2022, it fell nearly 20% as inflation spooked markets. The investors who stuck with 100% stocks didn't do so because they were geniuses, they did it because they had the psychological fortitude to ignore the noise.

Swiss investors face unique behavioral pressures. Your neighbor brags about his rental property's steady cash flow. Your parents question why you're gambling on "American stocks." The media screams about franc strength destroying returns. Staying the course requires either ignorance (rare) or conviction (hard-won).

The data from overcoming behavioral hesitation when investing large sums at market highs shows that lump-sum investing beats dollar-cost averaging 70% of the time. But that statistic doesn't help at 3 AM when you're wondering if you should have waited for the "inevitable" crash.

When 100% Stocks Makes Sense (And When It Doesn't)

The VT-only strategy works best for:

– Young professionals with decades until retirement

– Investors with stable pillar 2 coverage they won't touch until age 65

– Those who can stomach 30%+ drawdowns without panic-selling

– People who value simplicity over optimization

It makes less sense for:

– Early retirees who've lost their pillar 2 bond anchor

– Investors within 10 years of needing the money

– Anyone who lost sleep during the 2020 crash

– People with concentrated wealth (company shares, inheritance) they can't diversify

The Swiss twist: if you're planning early retirement, consider how your allocation will shift when you move your Säule 2 to a vested benefits account. You might need to introduce bonds or real estate to replace that lost stability.

The Verdict: A Swiss Revolution With Caveats

Mustachian Post's 100% VT portfolio isn't reckless, it's context-aware. It leverages Switzerland's unique pension system to take equity risk where it makes sense while using pillar 2 as ballast. But it's not a universal prescription.

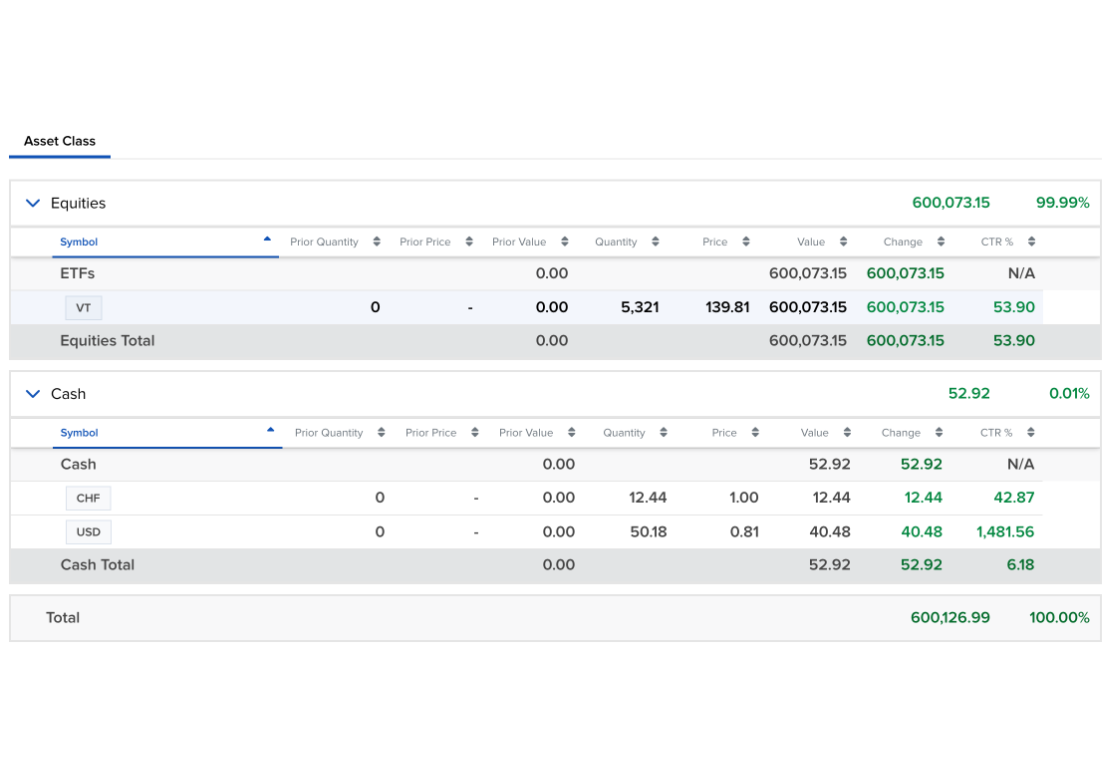

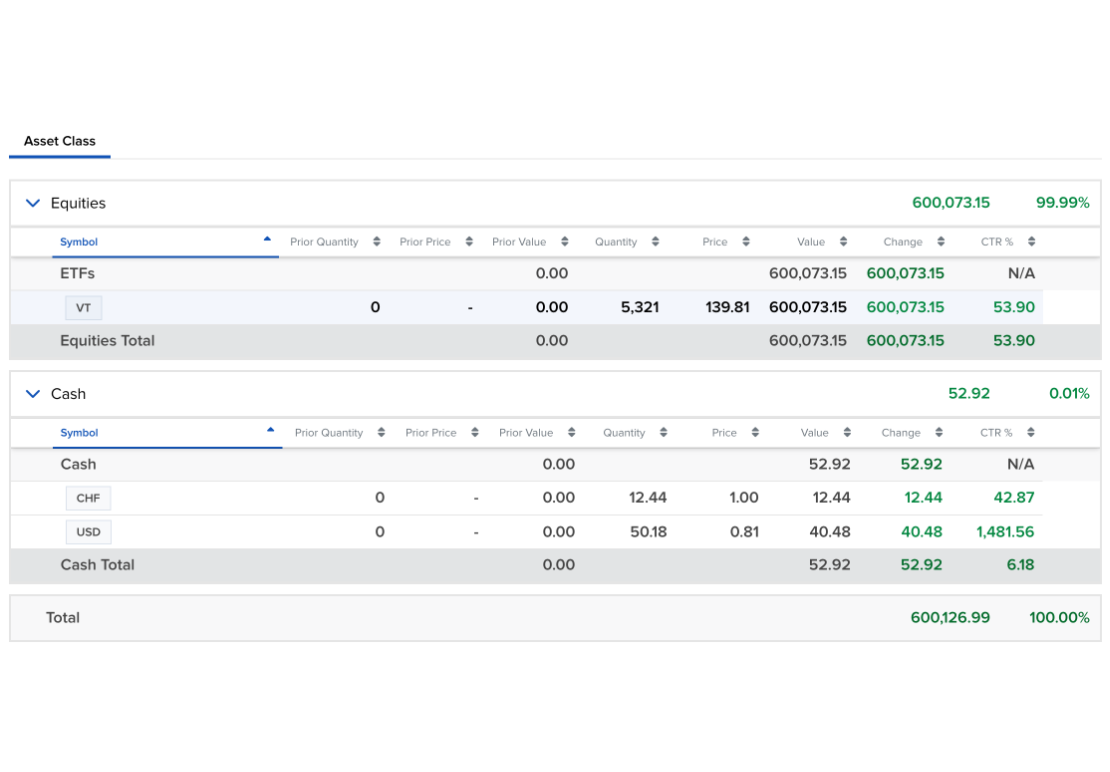

The controversy stems from misunderstanding this nuance. International critics see a retiree with 100% stocks and scream irresponsibility. They miss the CHF 500,000 sitting in a pillar 2 account, behaving like a government-backed bond. They miss the Swiss social safety net that makes catastrophic outcomes less likely.

For Swiss investors, the real question isn't "Should I go 100% VT?" but rather "What does my total net worth picture look like, including pensions?" If your pillar 2 represents 30-50% of your wealth, you're not really 100% in stocks, you're 50-70% stocks, which is perfectly conventional.

The revolution isn't about abandoning diversification. It's about recognizing that for Swiss investors, diversification happens across your entire financial life, not just your brokerage account. VT is simply the most efficient way to handle the equity portion of that larger puzzle.

Before you join the "VT and chill" movement, run your numbers. Map your pillar 2, pillar 3a, real estate, and taxable investments. Understand your true asset allocation. Then, and only then, does the 100% stock strategy make Swiss sense.