VT and Chill? Why Swiss Investors Are Quietly Adding Alternatives

A Swiss investor’s journey from 100% VT into managed futures, commodities, and REITs reveals uncomfortable truths about diversification in Switzerland.

The gospel of Swiss FIRE investing has been simple: buy VT, hold forever, relax. This Vanguard Total World Stock ETF offers unbeatable diversification at a razor-thin 0.07% TER, making it the default answer to nearly every investment question from Zurich to Geneva. But beneath this elegant simplicity lurk questions that increasingly bother younger investors: what if I’m missing something? What if my 100% stock allocation isn’t as diversified as I think?

This is exactly the question driving a growing number of Swiss investors to explore managed futures, commodities, and REITs. The logic seems sound: VT gives you global stocks, but what about asset classes that might zig when equities zag? The problem is that each of these alternatives carries baggage that looks very different from a Swiss perspective than it does in a US-centric Reddit discussion.

The 100% VT Foundation: Solid or Cracking?

The challenges to the long-term dominance of VT in Swiss portfolios are mounting, though not for the reasons you might expect. VT’s brilliance lies in its simplicity: 9,000+ stocks, global exposure, automatic rebalancing. For a Swiss investor, it solves the home bias problem while eliminating the need to pick winners.

But several Swiss-specific factors complicate this picture. First, there’s the US estate tax risks of holding VT for Swiss investors, which becomes relevant once your portfolio exceeds $60,000 and you’re not covered by the US-Switzerland estate tax treaty (a nuance many overlook). Second, currency risk in global equity portfolios like VT means your returns are riding on USD/CHF fluctuations that have nothing to do with business fundamentals.

The rise and potential limitations of 100% VT portfolios has been well documented in the Swiss FIRE community. Yet many investors now realize that being 100% in equities, even diversified global equities, means being 100% exposed to a single risk factor: stock market performance. When everything in your portfolio rises and falls together, are you truly diversified?

Managed Futures: Sophistication at a Steep Price

Managed futures strategies promise equity-like returns with bond-like risk, often showing positive performance during market crashes. They achieve this by trading across asset classes, commodities, currencies, interest rates, using trend-following algorithms. For a Swiss investor, this sounds appealing: a true diversifier that doesn’t correlate with your VT holdings.

The reality is less glamorous. One commenter on a Swiss finance forum, who works in commodities trading, warned: “Don’t try to invest in commodities as retail. You don’t have access to where the real money is made.” The same logic applies to managed futures. The ETFs available to retail investors, like DBMF (iMGP DBi Managed Futures Strategy ETF), carry expense ratios around 0.95%, more than 13 times what you pay for VT.

Worse, managed futures strategies generate significant tax complications in Switzerland. The frequent trading creates taxable events, and the structure of these ETFs often means they don’t qualify for favorable tax treatment. The Swiss tax authorities may classify gains as income rather than capital gains, hitting you with your marginal tax rate instead of the lighter wealth tax treatment.

For most Swiss investors, the costs overwhelm the benefits. Your BVG/LPP (Second Pillar) contributions already function as a diversifier with bond-like characteristics. Adding a 1% fee product on top makes little sense unless you’re managing millions.

Commodities: The Asset Class That Isn’t

Commodities present an even thornier problem. Unlike stocks or bonds, commodities generate no internal return. They don’t pay dividends, they don’t compound, and holding them costs money. When you buy gold or oil, you’re betting that someone will pay more for it later, a pure speculation play.

The commodities trading expert’s warning is stark: “Commodities have no internal return while holding them produces costs, if anything I’d buy miners and refiners instead.” This is particularly relevant for Swiss investors, who can already access commodity exposure through the stocks in VT (which includes mining companies, oil majors, and agricultural firms).

Physical commodities like gold coins, which some Swiss investors hoard, introduce storage and insurance costs that eat into returns. While the Swiss affinity for gold is cultural, as an investment it should represent a small insurance policy, not a core holding. One investor noted they hold “some gold in coins that I buy times to times” but view VT as sufficiently diversified.

If you must have commodities exposure, consider that your Säule 3a (Third Pillar) might offer commodity-focused funds, or that commodity-related equities in VT already provide indirect exposure. The direct route is often the most expensive and least efficient.

REITs: The Swiss Trap

REITs seem like the most logical addition to a VT portfolio. After all, VT includes real estate companies, but not pure-play real estate investment trusts that own and manage properties. Adding a REIT ETF like VNQ (Vanguard Real Estate ETF) would give you direct exposure to property income and potential inflation protection.

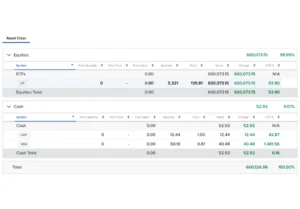

But Swiss investors face a unique trap. Many are tempted by Swiss REIT funds like CH0036599816, which invests in Swiss real estate. At first glance, it looks acceptable with a 0.92% TER. But dig deeper and the numbers become alarming: net returns hover in the 1-2% range, and many CH RE fonds trade at 50% premium over their asset value.

The largest position in one popular Swiss REIT fund is UBS CH Property Fund – Swiss Mixed Sima. Its 6-month report shows 0.54% effective costs, which can climb to 1%. Plus, there are additional costs including 2.5-5.0% for the issuance of new shares, erasing multiple years of returns in a single transaction.

This means you’re paying a 50% premium to buy assets that generate 1-2% returns while charging you 1% in fees. The math doesn’t work. As one analyst put it: “This alone would make CH0036599816 a complete No.”

US REIT ETFs like VNQ aren’t much better for Swiss investors. They carry currency risk, US tax withholding on dividends (30%, though reclaimable), and may not fit cleanly into your Swiss portfolio construction strategy.

The Second Pillar Question

Here’s where Swiss investors have a secret weapon: the BVG/LPP (Second Pillar). Many investors correctly view their second pillar as a bond proxy, but it’s more than that. Swiss pension funds invest heavily in Swiss real estate, meaning your occupational pension already gives you REIT-like exposure.

One commenter noted: “I’m intentionally leaving bonds aside as I consider my 2nd pillar as bonds (could also apply to REIT as my 2nd pillar has a lot in it).” This is astute. Your second pillar is likely already doing the diversification work you’re considering.

Before adding any alternative asset class, analyze what your pension fund holds. You might find you’re already overweight Swiss real estate, making additional REIT exposure redundant.

What Actually Makes Sense for Swiss Investors?

Given the costs, complexities, and tax implications, what’s a Swiss investor to do? Here are practical approaches:

- For commodities: Hold 2-5% in physical gold if it helps you sleep at night, but recognize it as insurance, not investment. Otherwise, trust VT’s 5-10% allocation to commodity-related equities.

- For managed futures: Skip them unless you have a seven-figure portfolio and can access institutional share classes. The 1% fee drag is too high.

- For REITs: If you must, allocate 5-10% to a low-cost US REIT ETF like VNQ in your Säule 3a (Third Pillar) to defer taxes, but only after confirming your second pillar doesn’t already give you sufficient exposure. Avoid Swiss REIT funds with their absurd premiums.

- For bonds: Don’t ignore them completely. While your BVG/LPP provides some bond-like exposure, consider adding 10-20% in CHF-denominated government bonds or a global bond hedged to CHF if you’re approaching retirement or have a lower risk tolerance.

The Currency Hedging Dilemma

A critical factor often missed in these discussions is currency. VT is USD-denominated, and while its underlying assets are global, the USD/CHF exchange rate heavily influences your returns. Adding USD-denominated REITs or commodities ETFs increases this exposure.

Currency hedging and non-US equity exposure considerations become crucial when diversifying beyond VT. Some Swiss investors are exploring currency-hedged versions of asset classes, but these come with their own costs and tracking errors.

The reality is that for a young Swiss investor with decades ahead, some currency risk is acceptable, the long-term returns of global equities should compensate. But as you add satellite positions, consider whether you’re introducing unintended currency concentration.

The Verdict: Keep It Simple, Swiss Style

The most honest answer to “should I diversify beyond VT?” is: probably not, and certainly not with the complex alternatives being discussed. The evidence from Swiss finance forums and professional analysis suggests that for most investors, the costs and complications outweigh the benefits.

VT’s 0.07% TER and global diversification remain hard to beat. The importance of taking equity risk in long-term portfolios is clear, and VT does this efficiently. Your BVG/LPP provides bond-like stability. Your Säule 3a can hold satellite positions if you insist on them.

If you’re determined to add alternatives, do so with your eyes open: understand the total expense ratio (including hidden costs), the tax implications in Switzerland, and whether you’re creating unintended concentration. And always measure any potential addition against the simplest alternative: just holding more VT.

The Swiss investment community’s obsession with precision can sometimes lead to over-engineering. Sometimes the best portfolio isn’t the one with the most asset classes, it’s the one you can stick with through every market cycle. For most Swiss investors, that portfolio is still VT, perhaps with a side of patience.