Splitting Investments by Risk Level: Smart Strategy or Overcomplication for Beginners?

The question landed in a Swiss personal finance community with the urgency of someone staring at their e-banking screen, cursor hovering over the “execute trade” button. Fifteen thousand francs sat ready to deploy, and the instinct was clear: split it into three buckets, low, medium, high risk. It feels responsible. It feels balanced. It feels like something your Sparkasse (savings bank) advisor would nod approvingly at while charging you 1.5% in hidden fees.

But in Switzerland’s increasingly sophisticated retail investor landscape, this intuitive approach might be the financial equivalent of organizing your wardrobe by color instead of season: satisfying to look at, but impractical when winter hits.

The Psychology of Buckets: Why Your Brain Loves Compartments

The urge to divide capital into risk tiers isn’t random. It’s mental accounting, a cognitive bias that helps us feel in control. A low-risk bucket feels safe. A high-risk bucket feels adventurous. The middle bucket feels… sensible. For a beginner, this framework transforms the intimidating world of global markets into a manageable trio of choices.

Many newcomers express this sentiment when first confronting Swiss investment options. The Börse (stock exchange) seems less threatening when you imagine only one-third of your money is “exposed.” This psychological comfort is real and valuable, up to a point.

The problem? Risk isn’t something you can quarantine. When markets crash, even your “low-risk” Swiss government bond ETF will bleed. When the Swiss National Bank makes a surprise policy move, your carefully separated buckets will all feel the shock. The buckets create an illusion of safety, not actual diversification.

The Swiss Reality Check: What Experienced Investors Actually Do

Scroll past the bucket enthusiasts in any Swiss finance discussion, and you’ll find a different hierarchy. The comment that gets upvoted to the top doesn’t mention buckets at all. Instead, it reads like a checklist for financial adulthood in Switzerland:

- Eliminate high-interest debt (anything above 5%, yes, that includes some Swiss credit cards)

- Build an emergency fund (1-3 months in Switzerland, not the 3-6 months common elsewhere, thanks to our robust social safety net)

- Max out your Säule 3a (Third Pillar) with providers like VIAC or Finpension

- Open an IBKR (Interactive Brokers) account and buy VT

- Automate and repeat

This isn’t bucket strategy. It’s sequential priority. The logic is brutal and effective: tax advantages first, then global diversification, then lifestyle inflation. The “risk level” of your portfolio emerges from your overall asset allocation, not from arbitrary mental partitions.

The evolving portfolio strategies beyond simple indexing show that even the venerable VT (Vanguard Total World Stock ETF) is no longer the default answer for Swiss investors. But for a beginner with 15,000 CHF, it’s still the most efficient starting point.

When Buckets Actually Make Sense: The Freizügigkeitskonto Exception

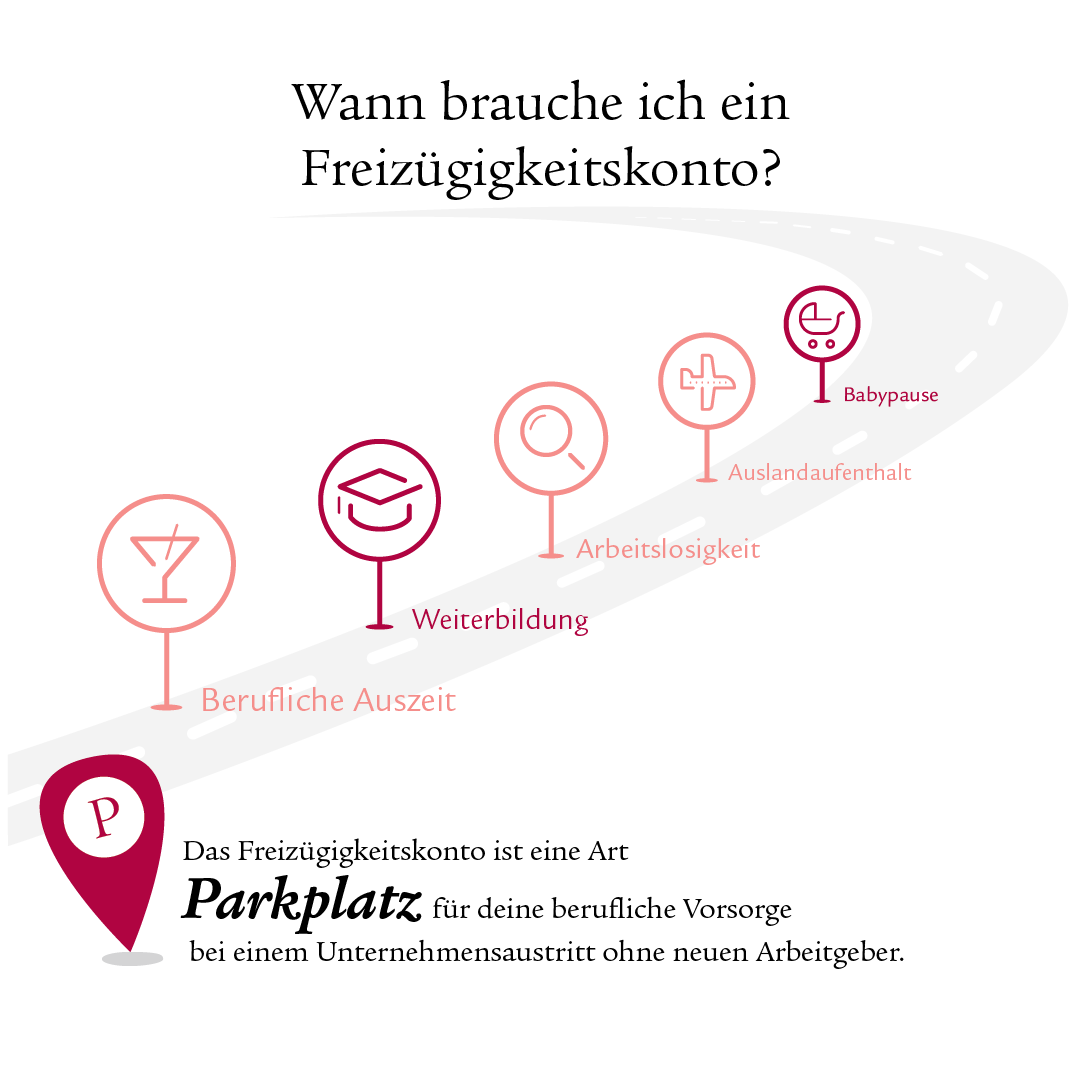

Here’s where the bucket approach isn’t just valid, it’s legally mandated. When you leave a Swiss employer and park your Pensionskasse (pension fund) money in a Freizügigkeitskonto (vested benefits account), you must choose an investment strategy. Swiss Life and other providers offer precisely the kind of risk-tiered options beginners intuitively seek: conservative (mostly bonds), balanced (mixed), and growth (mostly equities).

This works because the Freizügigkeitskonto has a specific purpose: preserve retirement capital during employment gaps. The risk level you choose should match your time horizon. Taking a six-month sabbatical? Conservative. Moving abroad for five years? Growth makes sense.

The key difference: this is a holistic decision for a specific account with a clear goal. It’s not splitting money arbitrarily, it’s matching risk to timeline within a single portfolio.

The Hidden Tax Trap of Arbitrary Buckets

Here’s what bucket strategists miss: Swiss tax efficiency. When you split 15,000 CHF across three different accounts, you’re potentially tripling your administrative burden and complicating your Steuererklärung (tax declaration).

Your Säule 3a contributions? Tax-deductible. Your VT in IBKR? Subject to wealth tax and dividend withholding. That “low-risk” Swiss bond ETF? The interest is taxed as income. Without a unified view, you might optimize each bucket individually while destroying overall portfolio efficiency.

The hidden costs in investment products discussion reveals how Swiss investors obsess over TER (Total Expense Ratio) while ignoring the tax drag of poor structure. Buckets amplify this problem. You might hold a dividend-paying stock in your “high-risk” bucket while paying 15% Quellensteuer (withholding tax) you could have reclaimed with proper documentation, if you hadn’t been distracted by bucket management.

The Overcomplication Spiral: From Three Buckets to Thirty ETFs

The bucket approach has a dark side: it legitimizes tinkering. What starts as “low/medium/high” quickly becomes:

- Swiss equities bucket

- European dividend bucket

- US tech bucket

- Emerging markets bucket

- Gold bucket (because inflation!)

- Crypto bucket (because FOMO)

Before you know it, you’re paying 50 CHF in transaction fees to rebalance eight different ETFs, each containing the same underlying mega-cap stocks. You’ve become a collector, not an investor.

This is where the diversification beyond global ETFs into alternative assets debate becomes relevant. Yes, sophisticated Swiss investors are exploring managed futures and REITs. But they’re doing it from a position of understanding, not as a reaction to bucket anxiety.

The Swiss Beginner’s Actual Roadmap

So what should you do with that 15,000 CHF? Ignore the buckets. Follow this instead:

Step 1: Emergency Fund Check

Do you have 3-6 months of expenses in a Sparkonto (savings account)? In Switzerland, with unemployment insurance covering 70-80% of salary, you might need less. But if you’re on a B-permit or in a volatile industry, err on the side of caution.

Step 2: Säule 3a Maximization

If you haven’t contributed this year’s maximum (7,056 CHF for 2025), do that first. Use VIAC’s 97% equity strategy or Finpension’s similar offering. The tax deduction alone is a guaranteed return of 20-40% depending on your marginal rate.

Step 3: Open IBKR

Interactive Brokers is the Swiss investor’s platform of choice. Low fees, access to global markets, and acceptable for Steueramt (tax office) reporting.

Step 4: Buy VT (or similar)

One purchase. One ETF. Total world stock market exposure. Cost: 0.07% TER. Complexity: near zero.

Step 5: Automate

Set up a monthly purchase from your salary. This is your real risk management, not buckets, but consistent investment through market cycles.

The Risk Level Is in the Ratio, Not the Buckets

Your portfolio’s risk isn’t determined by how many buckets you have, but by your overall stock-to-bond ratio. If you want lower risk, allocate more to bonds globally. Want higher risk? Increase equity exposure. But do it across your entire portfolio, not within silos.

The aggressive stock-only investing and portfolio construction movement in Switzerland shows that some investors go 100% equities. Others hold 20% in bonds for stability. Both approaches are coherent because they’re portfolio-wide decisions, not bucket-based tinkering.

The Real Answer to the 15,000 CHF Question

Back to our beginner. Here’s the non-bucket answer:

- 7,000 CHF into Säule 3a (World 100 strategy)

- 8,000 CHF into IBKR, buy VT

- Done.

Total time: 30 minutes. Total ETFs: 2. Tax efficiency: maximal. Psychological comfort: lower, initially. But you’ll thank yourself when your Steuererklärung takes 10 minutes instead of 2 hours.

The bucket approach isn’t wrong because it’s simple, it’s wrong because it feels simple while actually adding complexity. It’s a organizational system that masquerades as an investment strategy.

Final Verdict: Buckets Are Training Wheels

If you need buckets to start investing, use them temporarily. But recognize them for what they are: a psychological crutch, not a financial principle. Your goal should be to outgrow them within six months.

The real-life investment behavior of young Swiss investors shows that success comes from consistency, not complexity. The 26-year-old who automates 500 CHF monthly into VT beats the tinkerer with three buckets every time.

Switzerland’s financial system is already complex enough with its AHV/AVS (Old Age and Survivors’ Insurance) contributions, BVG/LPP (Occupational Pension Plan) deductions, and Säule 3a limits. Don’t add bucket management to the list of things that can go wrong.

Your portfolio should be as clean as a Swiss train schedule: one destination, minimal stops, and no unnecessary compartments. The risk level? That’s determined by when you need the money and how much volatility you can stomach, not by how many buckets you create.