The German ETF market just witnessed something that would have been unthinkable five years ago: Awumbo (ETF888) hit €100 million in assets under management in under three months. Its predecessor, the Amumbo (A0X8ZS), needed over ten years to reach the same milestone. If that doesn’t make you pause, you’re not paying attention to the tectonic shift happening in German retail investing.

This isn’t just another product launch success story. It’s a flashing neon sign that something fundamental has changed in how Germans approach their financial future, and it’s happening with the same dizzying speed that made the Neun-Euro-Ticket feel like it lasted both forever and just a heartbeat.

What Makes Awumbo’s Growth So Shocking?

Let’s put this in perspective. The Amumbo, Amundi’s previous leveraged ETF offering, limped along for a decade before crossing the psychologically important €100M threshold. Many investors consider this the “survival threshold”, the point where a fund is unlikely to face liquidation due to insufficient assets. The fact that Amundi kept Amumbo alive for ten years despite sub-€100M volume suggests either saintly patience or a strategic loss-leader.

Awumbo, launched in late 2025, didn’t just cross this line, it sprinted past it before most investors had even updated their Finanzblick apps. The fund reportedly gathered assets at a pace that makes traditional ETF launches look like they’re standing still. While the exact strategy behind Awumbo remains opaque, the pattern mirrors broader market movements where novelty and leverage attract capital like moths to a flame.

The Broader Context: Germany’s ETF Addiction

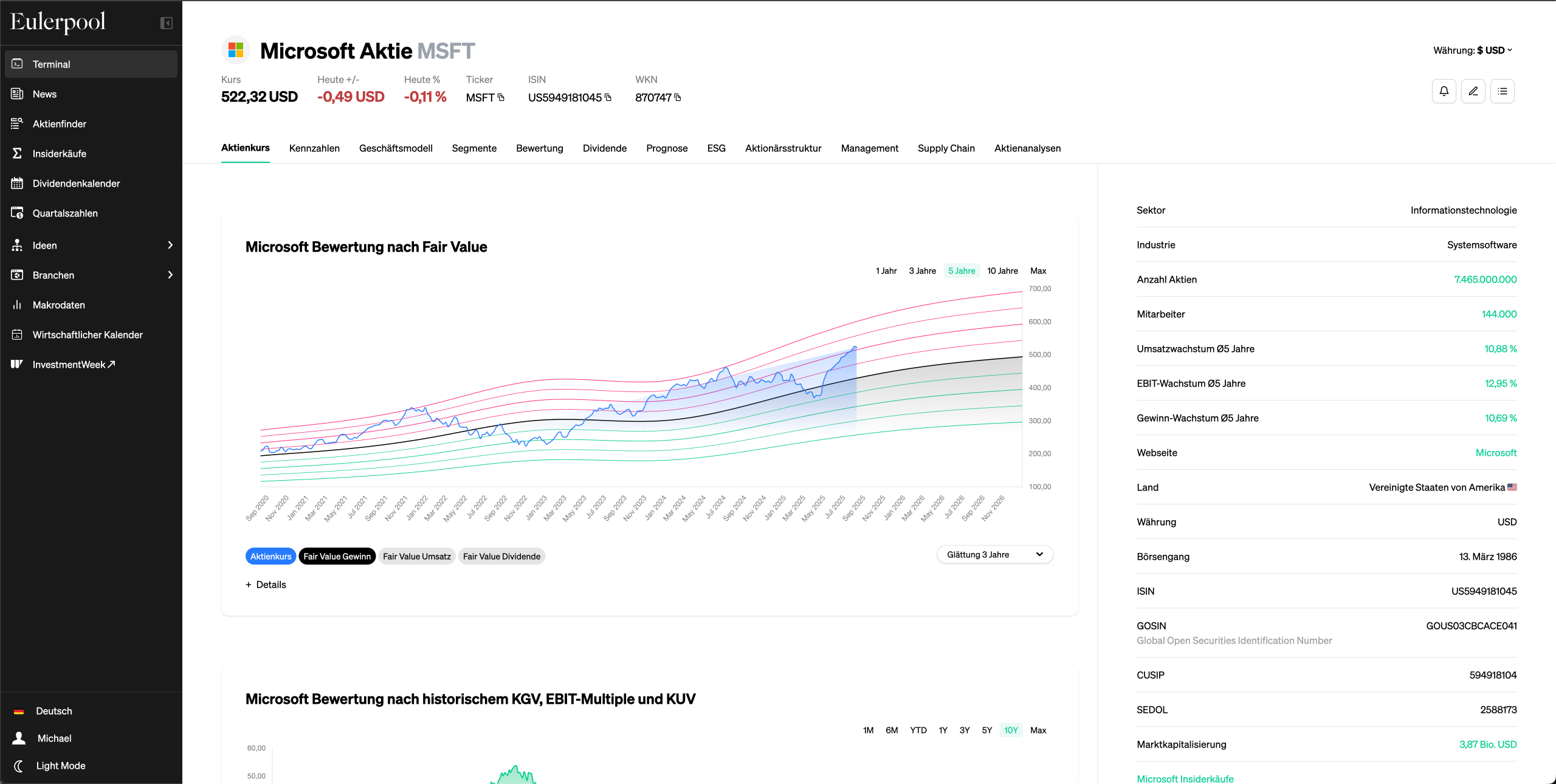

You can’t understand Awumbo’s success without grasping the broader mania gripping German investors. According to Eulerpool’s analysis, German ETF assets hit €184.2 billion by October 2025, a 24% increase since January alone. The number of ETF savings plans (ETF-Sparpläne) executed monthly has ballooned to 5.41 million, with average monthly contributions reaching €177.

That’s nearly €1 billion flowing into ETFs every single month through automated savings plans. And those numbers don’t even include the millions of additional accounts at neo-brokers like Trade Republic and Scalable Capital, which likely push the real figure past 8 million active savings plans.

The transformation is staggering. In 2014, German investors held a mere €7.5 billion in ETFs. Now we’re talking about a twenty-fold increase in just over a decade. ETFs have evolved from a niche product for Sparfüchse to the default investment vehicle for anyone under 40 with a smartphone and a pulse.

The Leveraged ETF Controversy: Genius or Disaster Waiting to Happen?

Here’s where things get spicy. Awumbo is a leveraged ETF (LETF), a product that promises amplified returns, often 2x or 3x the daily performance of an underlying index. These instruments are not designed for buy-and-hold investors, yet they’re increasingly finding their way into long-term retirement portfolios.

The controversy stems from three core issues:

1. The TER Trap

Awumbo carries a total expense ratio of 0.6%, which some investors dismiss as reasonable for a leveraged product. But here’s the dirty math: that 0.6% is just the advertised cost. It doesn’t include the hidden financing costs of maintaining leverage through derivatives, which can eat into returns during volatile markets. For a product designed for short-term trading, these costs compound brutally over time.

Many retail investors don’t realize that LETFs reset daily, creating decay effects that guarantee underperformance versus the promised multiple over longer periods. It’s financial physics, like trying to drive from Hamburg to Munich by only using first gear.

2. The €100M “Safety” Myth

The research reveals a common belief: hitting €100M means a fund is “safe” from closure. But as one astute observer noted, this rule shouldn’t apply to LETFs. Amundi demonstrated remarkable patience with Amumbo’s sub-€100M existence, suggesting the French domicile and its connection to the PEA (Plan d’Épargne en Actions) retirement scheme created a strategic reason to keep it alive.

Awumbo’s rapid ascent to €100M might provide false confidence. If market conditions turn and leveraged strategies fall out of favor, providers have shown they’ll pull the plug without sentimentality. Lyxor’s discontinued Stoxx Europe LETF serves as a cautionary tale, finding information about its final assets is nearly impossible, leaving former investors with a bureaucratic nightmare.

3. The ACWI 2x Tease

The research thread reveals frustrated investors clamoring for an MSCI ACWI 2x leveraged ETF. When Amundi was directly asked about this in an interview, they flatly denied any plans. Skeptics immediately noted this is exactly what you’d say if you wanted to protect your existing product’s market share.

This speculation points to a deeper hunger among German investors for increasingly exotic leveraged products. The demand for a global equity leveraged tracker suggests many are seeking the investment equivalent of a performance-enhancing drug, maximum gains with minimal effort.

Why This Matters for Your Finanzplanung

Awumbo’s success story masks a troubling trend: financial innovation is outpacing financial literacy. The German retail market is absorbing complex derivatives wrapped in ETF packaging with the same enthusiasm previously reserved for Bausparverträge and Riester-Renten.

The regulatory framework hasn’t caught up. While the Finanzamt happily collects taxes on realized gains, there’s minimal oversight about whether these products are suitable for the investors buying them. Your neo-broker won’t stop you from adding a 3x leveraged NASDAQ ETF to your retirement savings plan, even if it’s about as appropriate as using a Formula 1 car for grocery shopping.

The Tax Trap Waiting to Spring

German investors face a particularly nasty surprise with LETFs. The Vorabpauschale (advance lump-sum tax) calculation becomes Byzantine with daily-resetting leveraged products. If you hold these in a taxable account rather than a Steuer-Depot, you could owe taxes on phantom gains while your actual investment bleeds value due to volatility decay.

Worse, the Sparerpauschbetrag (€1,000 tax-free allowance) gets burned through faster because leveraged products generate more taxable events. Many investors won’t realize this until their Steuerbescheid arrives and they’re facing a four-figure tax bill on a losing position.

The Bigger Picture: Are We in an ETF Bubble?

Awumbo’s meteoric rise doesn’t happen in isolation. The global ETF industry is on track for $1.4 trillion in inflows in 2025 alone, according to State Street’s projections. That’s up from $1 trillion in 2024, which itself was a record.

Gold ETFs have seen inflows of $42 billion, with the SPDR Gold Trust gaining 68%. Defense ETFs, like the VanEck Defense product holding €6 billion, have become mainstream holdings. Even the WisdomTree Europe Defence ETF, launched in March 2025, already commands €3 billion.

The parallels to past manias are uncomfortable. When every product launch becomes a “record-breaking success”, and when investors pile into increasingly complex instruments they don’t understand, history suggests we’re approaching a turning point. The question isn’t whether the ETF boom will end, but how messy the unwind will be.

What Should You Actually Do?

First, stop treating Awumbo’s success as investment advice. A product gathering assets quickly tells you nothing about its future performance, it only reveals current marketing effectiveness and herd behavior.

If you’re considering leveraged ETFs:

- Limit allocation to 5% of your total portfolio. Treat it as Vegas money, not retirement core.

- Hold only in tax-sheltered accounts (Steuer-Depot or Riester-Rente if compatible) to avoid the Vorabpauschale nightmare.

- Set a strict exit strategy. Leveraged products are trades, not investments. Define your loss threshold before buying.

- Understand the underlying index. A 2x leveraged product tracking a volatile index decays faster than one tracking a stable index.

For your core portfolio, stick to broad-market, low-cost ETFs with TERs below 0.2%. The iShares Core MSCI World or Xtrackers MSCI World are boring, reliable, and won’t give your Steuerberater an aneurysm.

The Bottom Line

Awumbo’s €100 million achievement in 90 days isn’t a revolution, it’s a symptom. It shows that German investors, starved for returns during years of negative interest rates, are now chasing performance with the desperation of someone who missed the last S-Bahn home.

The real revolution happened quietly: the transformation of ETFs from niche products to mainstream default. Awumbo is just the flashy afterparty, complete with leveraged cocktails and a hangover guaranteed.

The smart money isn’t asking “How can I get in on Awumbo?” It’s asking “What comes after the leveraged ETF boom?” Because if history teaches us anything about German financial innovation, it’s that what rises at Deutsche Börse speed often falls at Deutsche Bahn speed, slowly, painfully, and with plenty of construction delays along the way.

The ETF boom shows no signs of slowing, but investors should question whether volume equals value.

Actionable Takeaway: Before clicking “buy” on the next hot ETF, ask yourself: “Would I still want this if it took ten years to double its assets?” If the answer is no, you’re buying the hype, not the product. In Germany’s current market, patience remains the only true leverage.