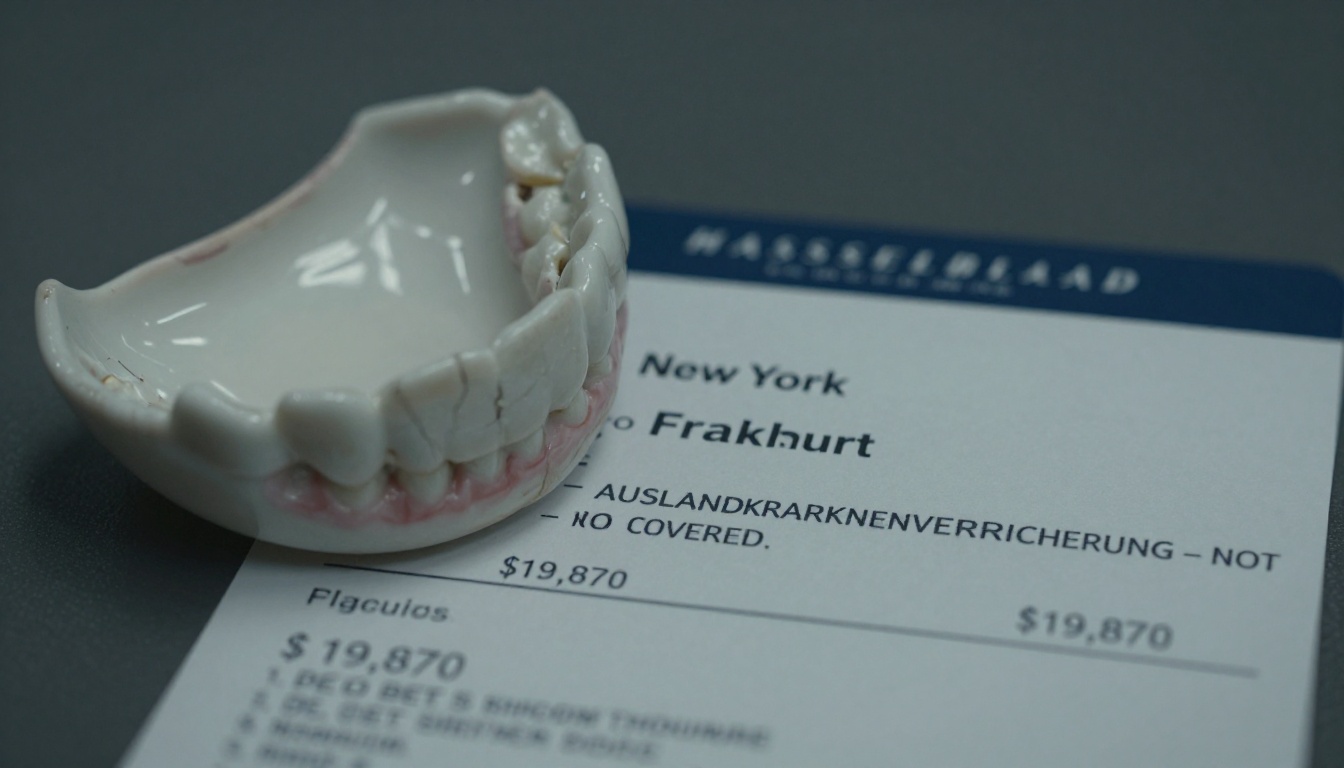

You’re three months into a project in New York when a piece of your veneer cracks. The dentist quotes you roughly the price of a used Volkswagen Golf. Your German supplementary insurance shrugs, “not in the coverage area.” Welcome to the reality of global living that nobody bothers to warn you about.

This exact scenario recently played out for a German professional in Manhattan, whose Reddit post about a $20,000 dental quote exploded into a 63-comment discussion about the gaps in international health coverage. The responses revealed a pattern: Germans abroad, whether on business trips or extended assignments, routinely discover their insurance becomes about as useful as a chocolate teapot the moment they need it.

The Coverage Mirage: Why Your German Insurance Fails You

The problem starts with a fundamental misunderstanding of what German health insurance actually covers abroad. Your GKV (statutory health insurance) offers limited protection even within Europe, and outside the EU, you might as well be uninsured. Private insurers aren’t much better, many cover emergency treatment but stop short of major dental work, and almost none cover the cost of returning to Germany for treatment.

The Reddit discussion exposed a harsh reality: most Auslandskrankenversicherungen (international health insurance policies) are designed for tourists, not expats. As one contributor bluntly stated, your €10-per-month travel insurance isn’t going to cover a dental treatment worth a small car. These budget policies exist to stabilize you enough for a medical flight home, not to fund comprehensive care abroad.

The situation becomes more complex for long-term assignments. If you’re not registered in Germany (abgemeldet), many insurers won’t touch you. The policies that do exist often exclude pre-existing conditions, limit coverage duration to 90 days, or specifically exclude dental work beyond emergency pain relief.

The Math That Makes You Book a Flight

Here’s where the numbers get absurd. A business-class flight from New York to Frankfurt costs around €3,500. Even adding a €500 emergency dental appointment in Germany, you’re looking at €4,000 total. That’s 80% less than the $20,000 quote from a Manhattan dentist.

The Reddit thread quickly became a masterclass in medical arbitrage. Multiple contributors suggested the same solution: fly home. One wrote, “If the dentist quotes €20,000, call your German dentist, book an appointment, and fly back.” Another added, “Even from the West Coast, the flight price difference becomes negligible compared to US treatment costs.”

This isn’t theoretical. Germans are already doing this systematically. Nearly 300,000 German “Zahntouristen” (dental tourists) travel to Budapest annually for procedures, saving up to 70% on major work. The Hungarian clinic Donau Dental has built an entire business model around this, offering packages that include flights, hotel, and treatment for less than the cost of German care alone.

The Fine Print That Destroys Your Finances

TravelSecure, one of Germany’s top-rated international insurers with a “SEHR GUT” (very good) rating from Finanztest 2025, offers policies that look comprehensive on paper. Their coverage includes worldwide protection, 24-hour emergency service, and unlimited coverage amounts. But dig into the details, and the limitations appear.

Standard policies cover “medically necessary” treatments, but cosmetic dental work like veneers exists in a gray area. Even when emergency treatment is covered, insurers often require pre-authorization for anything beyond basic care. Try getting that from a German insurer at 2 AM on a Saturday in New York.

The long-term policies designed for expats and students offer better coverage but come with their own traps. Many require you to maintain German residence or limit coverage to specific time periods. The Work & Traveller policies, while extending up to 36 months, often exclude major dental work entirely.

When Your Employer Leaves You Hanging

The Reddit discussion revealed another gap: employer coverage. While some German corporations provide comprehensive international insurance for business travelers, it’s far from universal. One contributor assumed a German employer would automatically provide coverage, but others quickly corrected this misconception. For many, insurance remains a private responsibility even when traveling for work.

This creates a bizarre situation where a German employee might be fully covered for a two-week business trip but completely exposed during a three-month project assignment. The distinction between “business travel” and “temporary assignment” becomes a costly technicality.

The Political Squeeze on Dental Coverage

The timing of this issue coincides with mounting pressure on Germany’s dental coverage system. The GKV already offers minimal support for major dental work, typically covering only the cost equivalent to basic treatment. For implants or cosmetic procedures, patients face substantial out-of-pocket costs even in Germany.

Political developments threaten to worsen this situation. Recent proposals suggest trading dental care coverage for corporate tax relief, which would leave Germans with even less support at home. This makes the lack of international coverage doubly problematic, not only are you uncovered abroad, but your domestic safety net is fraying.

the limitations and high costs of Germany’s statutory health insurance system

Medical Tourism: The Workaround That Works

Hungary has positioned itself as the go-to solution for Germans facing dental sticker shock. The Donau Dental clinic in Budapest offers a complete package: German-speaking staff, equipment from German manufacturers like Siemens, and costs up to 70% lower than German prices. A full set of 26 zirconia crowns costs €13,275 instead of €26,725, a 50% savings.

The clinic even handles insurance paperwork. German statutory insurers provide the same fixed subsidy for treatment abroad as they would for domestic care, meaning your €1,000 implant subsidy applies whether you get the work done in Munich or Budapest. This makes the effective savings even higher.

The quality argument doesn’t hold up. Hungarian dentists train to EU standards, and clinics catering to Germans use the same materials and equipment as their German counterparts. The price difference stems from lower labor costs, rent, and state support for medical tourism, not from cutting corners.

The Expat’s Insurance Checklist

If you’re planning extended time abroad, standard travel insurance won’t cut it. You need to address several specific points:

- Coverage duration: Does the policy extend beyond 90 days? Many don’t.

- Dental specifics: Does it cover major dental work, or just emergencies? Get this in writing.

- Pre-existing conditions: Will it cover issues like existing veneers or crowns?

- Medical evacuation: Does it cover transport back to Germany for treatment, or only emergency evacuation?

- Residence requirements: Does it require you to maintain German residence or registration?

For long-term assignments, consider a proper expat health insurance policy. These cost significantly more, think €200-500 per month rather than €20, but actually provide comprehensive coverage. Companies like Cigna, Allianz Worldwide Care, and Axa offer policies designed for this scenario.

The Future of Cross-Border Care

The dental emergency scenario highlights a broader issue: health insurance hasn’t kept pace with remote work realities. As more Germans work from anywhere, the gaps in coverage become more dangerous. The current system assumes you’re either a tourist (briefly abroad) or a permanent resident (insured locally). The growing cohort of digital nomads and long-term remote workers falls into a coverage no-man’s-land.

German policymakers have been slow to address this. While some proposals exist for portable social security benefits within the EU, there’s no framework for global coverage. This leaves individuals to navigate a complex insurance market alone.

how German political decisions may reduce dental care coverage domestically

Practical Steps Before You Pack

Before your next extended trip, take these actions:

Verify your current coverage: Call your insurer and ask specifically about dental work abroad. Record the conversation or get written confirmation.

Get a pre-trip dental check: Fix potential problems before departure. A €200 cleaning beats a €2,000 emergency root canal.

Research local costs: Use sites like Fair Health Consumer in the US to understand typical prices. This helps you spot inflated quotes.

Identify care options: Locate English-speaking dentists at your destination. Expat forums often have recommendations.

Consider medical evacuation membership: Services like Medjet or Global Rescue transport you to your home hospital, not just the nearest adequate facility. This matters if you want your German dentist.

Budget for the worst case: Set aside €5,000-10,000 for medical emergencies if your coverage is uncertain. It’s painful but beats going into debt.

The Bottom Line

The German professional in New York ultimately faced a choice: pay $20,000, fly home for €4,000, or find a third option. Their story serves as a warning for the millions of Germans who travel for work or live abroad temporarily.

Your German health insurance, whether GKV or private, was designed for a world where people stayed put. In an era of global mobility, it leaves dangerous gaps. The solution isn’t just better insurance, it’s a fundamental rethink of how health coverage follows people across borders.

Until that happens, the smartest move is treating international health insurance as a core part of your relocation budget, not an afterthought. That €20-per-month travel policy might satisfy visa requirements, but it won’t save you when your teeth decide to test the system.

The real cost of global living isn’t the expensive dentist, it’s the false confidence that your insurance has your back.