The German financial mindset treats debt like a stubborn cold, something to be rid of quickly and avoided in the future. Paying cash for a car feels virtuous, disciplined, and distinctly German. But here’s the uncomfortable truth: that instinct might cost you thousands of euros in missed opportunity.

Many German finance enthusiasts have started asking a disruptive question. If you can secure an Autokredit (car loan) at 1-2% interest while your capital earns 6-8% elsewhere, why would you ever pay cash? The answer involves German tax law, capital efficiency, and a concept that makes traditionalists squirm: strategic debt.

The Opportunity Cost Trap Most Germans Ignore

The logic seems simple. You have €30,000 saved. The dealer offers 0.99% financing. Your ETF-Sparplan (ETF savings plan) has averaged 7% returns over the past decade. Basic math says finance the car and keep your money working.

But German tax law complicates this straightforward calculation. Your investment returns face the Kapitalertragssteuer (capital gains tax) of 25% plus solidarity surcharge. Thanks to the Teilfreistellung (partial exemption) for equity ETFs, you keep roughly 18.5% more of your gains compared to other investments. This means your 7% nominal return drops to about 5.7% after taxes.

Suddenly that 0.99% loan looks even more attractive. The spread between your after-tax investment return and borrowing cost represents pure profit on capital you never had to deploy. One finance-savvy German put it bluntly: you must calculate the Kapitalertragssteuer (capital gains tax) and lost compounding effects when making this decision.

The Zinseszins (compound interest) effect makes this even more powerful. By leaving your €30,000 invested instead of spending it, you’re not just earning returns on that principal. You’re earning returns on your returns, year after year. Interrupting that compounding engine for a car purchase creates a financial drag that extends far beyond the vehicle’s lifespan.

When German Interest Rates Make Financing a No-Brainer

The threshold question dominates discussions: at what interest rate does financing stop making sense? Opinions vary, but the consensus clusters around 3-4%.

Below 2%, almost everyone agrees financing wins. Between 2-3%, you enter a gray zone where personal risk tolerance matters. Above 4%, most calculations favor paying cash unless you have high-return investment opportunities.

One German investor financed his car at 0.99% and would do it again without hesitation. Another frames the decision mathematically: if your loan interest exceeds what you can realistically earn after taxes and costs, pay cash. If not, finance and invest the difference.

The critical nuance? “Realistic” returns. Many Germans confuse historical performance with guaranteed future results. The expected value for a global ETF might be 6-8%, but that’s not a promise. Secure 2% returns can beat uncertain 4% returns when you factor in risk-adjusted thinking.

The Hidden German Tax Bomb Waiting for Investors

Here’s where German-specific knowledge becomes crucial. The research reveals two looming threats to your investment strategy.

First, Germany’s healthcare financing system operates with the same efficiency as a Deutsche Bahn train, usually predictable, until construction work appears on your line. The proposed health tax affecting disposable income could reduce the money you have available for both car payments and investments.

Second, the SPD’s capital income tax bomb threatens to increase the burden on investment gains. If taxes on your ETF returns rise from the current effective rate to something higher, the math for financing weakens considerably. A 1% loan only makes sense if you’re keeping at least 3-4% after taxes.

The rising tax burden reducing available investment capital adds another layer. With middle-class workers facing marginal rates over 51%, every euro you can keep invested and growing becomes more valuable. Paying cash for a car means not just losing that capital, but also losing its ability to offset your heavy tax load through future gains.

Digital Autokredite: How Germany Made Strategic Debt Easier

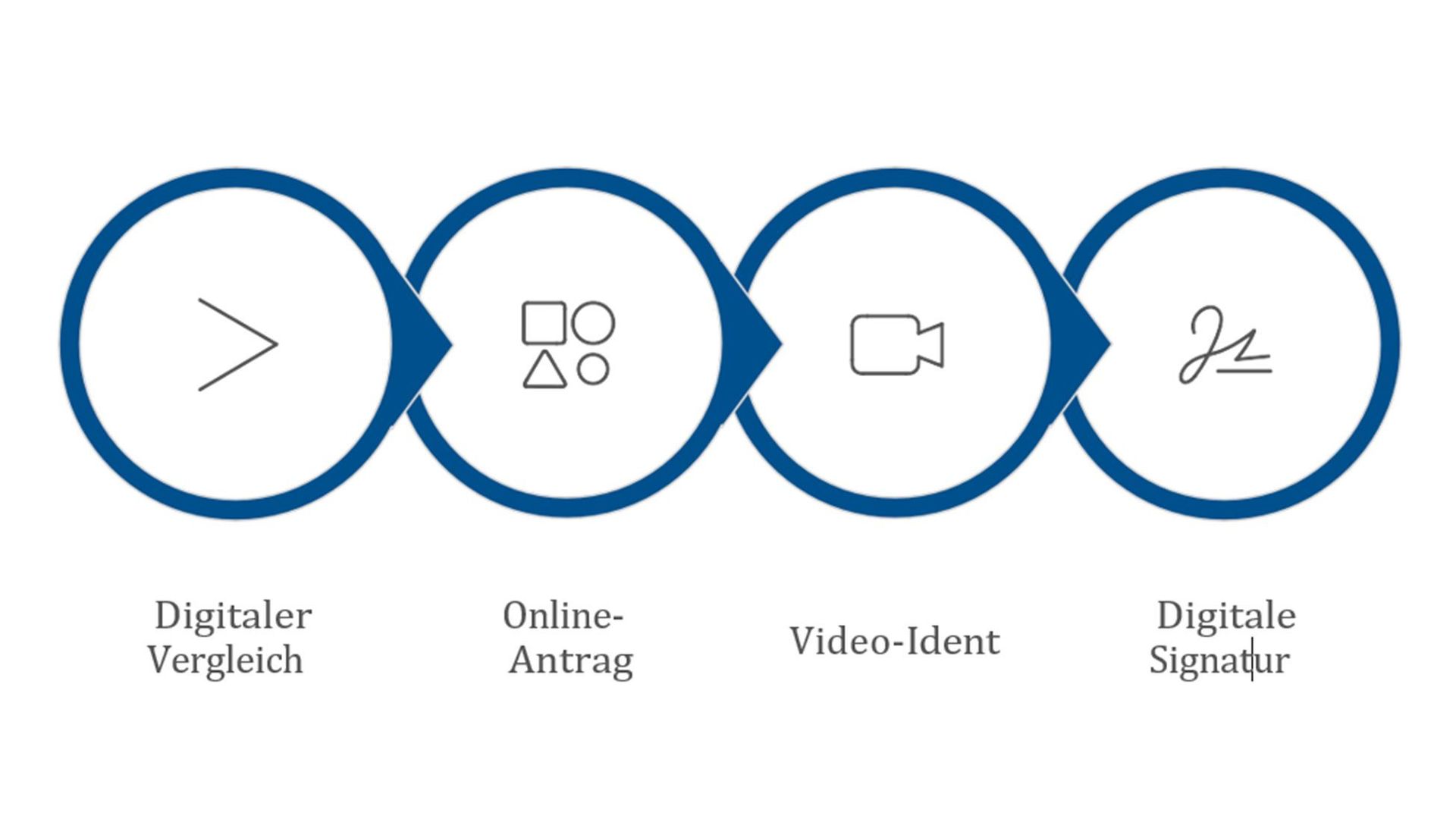

The digital transformation of car financing in Germany has removed friction from this strategy. The entire process, from comparison to signature, now happens online through Video-Ident (video identification) and digital signatures.

This matters because speed and convenience reduce the psychological barrier to financing. You can secure a zweckgebundener Autokredit (purpose-bound car loan) at 1.49% within days, often with better terms than a general consumer loan since the vehicle serves as collateral.

The key steps have become nearly frictionless:

1. Online comparison platforms show real rates based on your Schufa score

2. Digital applications upload income proof and bank statements instantly

3. Video-Ident replaces the PostIdent (post office identification) trip

4. Electronic signatures eliminate paperwork delays

This efficiency means you can treat financing as a tactical decision rather than a bureaucratic nightmare. The time cost of securing cheap debt has collapsed, making the opportunity cost calculation more relevant than ever.

Bank vs. Händlerfinanzierung: Where the Real Savings Hide

German car buyers face a choice: Bankfinanzierung (bank financing) or Händlerfinanzierung (dealer financing). Each path offers distinct advantages for the cash-rich buyer.

Bank financing makes you a Barzahler (cash payer) at the dealership. This unlocks negotiation power that can slash the vehicle price by €1,000-2,000. You then repay the bank separately. The dealer gets their money immediately, you get a discount, and the bank earns interest.

Dealer financing often advertises teaser rates, sometimes 0% or 0.9%. But these rates are subsidized through a higher vehicle price or tied to specific packages. The dealer’s partner bank profits, and you lose negotiating leverage.

Savvy Germans play both sides. They secure a bank loan pre-approval, then ask the dealer to beat that rate. If the dealer offers 0.9% while the bank offers 1.49%, they’ll take the dealer financing, but only after negotiating the cash price first. This hybrid approach captures the best of both worlds.

The Risk Scenarios Where Cash Still Reigns

Financing only makes sense with stable income and investment discipline. Several German-specific risks can torpedo this strategy:

- Job insecurity: If you work in a volatile industry or have a limited work contract, that monthly payment becomes a millstone. German employment protection is strong, but not absolute. Arbeitslosengeld I (unemployment benefit I) replaces only 60% of prior income.

- Liquidity traps: The money you “saved” must actually remain invested. Many Germans mentally account for it as “car money” and let it sit in a Tagesgeld (daily money) account earning 0.5%. At that point, you’re losing money on the spread.

- Behavioral leakage: The biggest risk isn’t mathematical, it’s psychological. That €30,000 you kept invested can suddenly look like a nice kitchen renovation or a luxury vacation. Financing only works if you treat the invested capital as truly locked away.

- Tax law changes: The risks of unrealized capital gains taxation show how quickly the equation can shift. If Germany follows the Netherlands in taxing paper gains, your compounding strategy faces new headwinds.

The Hidden Car Costs That Destroy Your Calculations

Here’s the fatal flaw in most financing decisions: they ignore the true cost of car ownership. German drivers systematically underestimate monthly vehicle costs by 50%, focusing only on fuel while forgetting depreciation, repairs, and taxes.

That €30,000 car doesn’t just cost your loan payment. It loses €3,000-5,000 in value annually. Insurance runs €800-1,200. The Kraftfahrzeugsteuer (motor vehicle tax) adds hundreds more. Suddenly your “cheap” financed car costs €500+ monthly in real terms.

When you understand the hidden car ownership costs in Germany, the financing decision becomes secondary to the purchase decision itself. The real question isn’t how to pay, it’s whether you should buy that car at all.

Making the German Car Financing Decision in 2026

So when should you finance despite having cash? Follow this decision tree:

- Finance if:

– Interest rate is below 3% (after all fees)

– You have stable employment and emergency savings

– You’ll invest the full amount in a diversified ETF portfolio

– You understand and accept the investment risk

– You can claim the car as a business expense (special case) - Pay cash if:

– Interest rate exceeds 4%

– You lack investment discipline or financial stability

– The car purchase is emotional, not practical

– You’re nearing retirement and capital preservation matters

– You can negotiate a substantial cash discount exceeding the financing benefit

The sweet spot? That 0.99-1.99% range where German banks and dealers compete aggressively. Here, financing transforms from a necessity into a wealth-building tool, assuming you have the psychological fortitude to leave that capital invested through market swings.

The Bottom Line for German Car Buyers

The old rule “never finance a depreciating asset” dies hard in Germany. But in a world of cheap debt, reasonable investment returns, and digital convenience, that rule belongs in the museum next to the Deutschmark.

Your banker isn’t offering low rates out of generosity. They understand that capital efficiency separates the wealthy from the merely comfortable. By financing at 1% while earning 5% after taxes, you’re not taking reckless risk, you’re making your money work twice.

Just remember: this strategy works for the disciplined few, not the tempted many. If that €30,000 will burn a hole in your investment account, pay cash and sleep well. But if you can treat it as what it truly is, productive capital that happens to be collateralizing your transportation, then German car financing becomes less about debt and more about intelligent leverage.

The question isn’t whether you can afford to pay cash. It’s whether you can afford the opportunity cost of not financing. In Germany’s current economic landscape, that answer might surprise you.