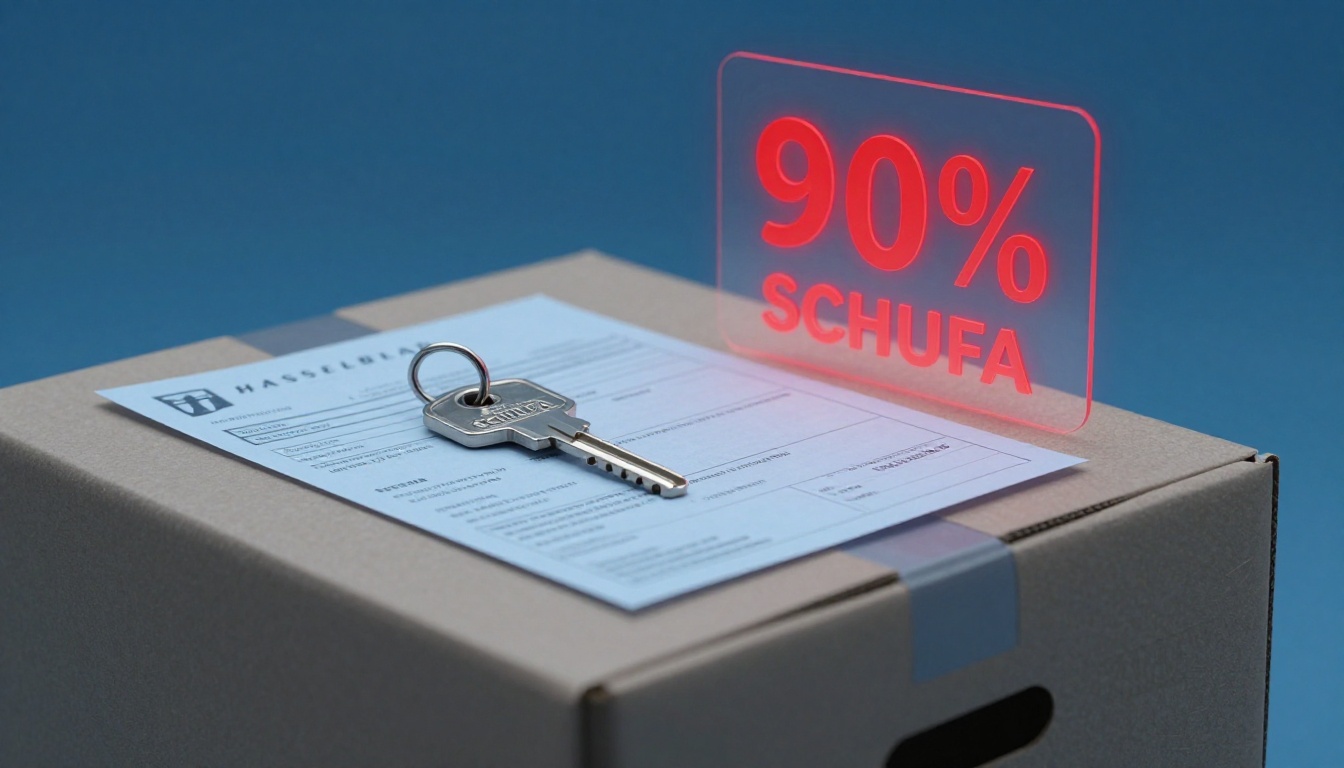

Your Six-Figure Salary Won’t Save You: Why Germany’s Schufa Punishes the Financially Responsible

You earn six figures, own property, and have never missed a payment in your life. Yet when you try to sign up for a DSL contract, Deutsche Telekom demands a €280 security deposit because your Schufa (German credit bureau) score sits at just 90%. This isn’t a hypothetical nightmare, it’s the reality many high earners face in Germany when they discover that income and responsibility matter far less than stability.

The Schufa scoring system operates with the same opacity as a black-box algorithm, and recent changes to your financial life can torpedo your score even when you’re doing everything right. Let’s unpack why your financial excellence might be invisible to Germany’s most powerful credit authority.

The Schufa Paradox: When Stability Trumps Income

Germany’s credit scoring system doesn’t care about your salary. A recent case highlighted in financial communities shows a professional earning over €100,000 annually, dutifully paying a mortgage, yet scoring only 90%, low enough to trigger security deposits and contract rejections. The reason? They opened a new bank account and moved apartments.

This reveals the system’s core logic: Schufa rewards predictability, not wealth. Your score reflects how easily algorithms can forecast your future behavior based on past patterns. A recent address change signals instability. A new Girokonto (checking account) suggests potential financial distress. These “soft factors” can outweigh years of perfect payments.

Many international residents discover this too late. You might assume that paying your Immobilienkredit (mortgage) on time and maintaining a healthy bank balance would guarantee top-tier credit. Instead, you find yourself explaining to a customer service representative why your six-figure income doesn’t translate to trustworthiness.

The Invisible Score Killers Hiding in Plain Sight

Recent Address Changes: The Stability Penalty

Moving within Germany, even for a better job or to buy property, can slash your score. Schufa’s algorithm interprets a new address as increased risk. The system lacks context: it doesn’t know you moved for a promotion, not because you couldn’t afford rent.

The penalty persists for months or even years. Some users report that it takes up to three years for an address change to stop negatively impacting your score. If you’ve moved recently, expect a temporary dip regardless of your financial health.

New Bank Accounts: The Trust Deficit

Opening a new Girokonto triggers a Schufa inquiry, which itself can lower your score slightly. But the real damage comes from having an account without a long history. Schufa values accounts that have been active for years, preferably a decade or more. A brand-new account at a digital bank might offer better rates, but it tells Schufa you lack established banking relationships.

Worse, some banks don’t report mortgages to Schufa at all. Your Immobilienkredit might be invisible to the system, meaning you’re getting no credit (literally) for your largest and most consistent payment. The bank that approved your €500,000 mortgage knows you’re reliable, but Schufa never receives that data.

The New Schufa Model: More Transparent, Still Puzzling

This transparency is legally mandated after EU pressure and a 2023 European Court of Justice ruling that challenged automated scoring decisions. However, the twelve factors remain partly secret, and the algorithm’s exact weighting is still a trade secret.

What we know: the new model will continue penalizing recent moves and new accounts but may weigh them differently. It will also supposedly reduce discrimination based on address or name, issues that have plagued the old system.

The DSGVO Weapon: How to See What Schufa Actually Knows

You have a legal right to see what data Schufa stores about you. A DSGVO (GDPR) request, free and recommended annually, reveals all entries in your file. This isn’t just about curiosity, errors happen frequently.

One user discovered a bank had reported someone else’s debt to their file simply because they shared a name and had a power of attorney on an account. Without requesting their data, they might never have known why their score tanked. The DSGVO request lets you spot and dispute false entries before they cost you an apartment or loan.

Request your free copy at meineschufa.de. Do this yearly, especially after any major life change.

High Earners’ Hidden Financial Burdens in Germany

Your Schufa score is just one piece of Germany’s complex financial puzzle for high earners. The system often punishes those who should be most secure.

If you’re earning well but feeling financially squeezed, you’re not alone. Many high earners face income instability fears despite healthy salaries. The German social contribution system can consume over half your gross income through taxes and mandatory insurance.

Health insurance alone presents a trap: statutory insurance costs can exceed €1,000 monthly, while private insurance premiums rise unpredictably, eroding your net income. These fixed costs make your Schufa score even more critical, when you’re locked into high mandatory expenses, any credit barrier can create a cash flow crisis.

The income threshold for real financial security in Germany is higher than most expect, and a damaged credit score can push that threshold even further out of reach.

Practical Steps to Rebuild Your Score

1. Stop the Bleeding

Avoid opening new accounts or applying for credit unless absolutely necessary. Each inquiry dings your score. Plan major financial moves at least six months apart.

2. Age Your Accounts

Keep your oldest Girokonto active, even with a minimal balance. Long-standing banking relationships are gold. If you must switch banks, keep the old account open for a year or two.

3. Optimize Your Credit Mix

Keep credit cards to a maximum of two. Use them regularly but pay in full each month. Consider a Dispokredit (overdraft facility) on your main account, used responsibly, it can actually improve your score by showing you manage credit.

4. Register and Wait

After moving, register your new address immediately with the Einwohnermeldeamt (residents’ registration office). Then wait. The score penalty diminishes over time, typically improving after 12-24 months at the same address.

5. Check for Errors

Submit a DSGVO request to Schufa annually. Look for:

– Incorrect address entries

– Accounts you don’t recognize

– Outdated information (should be deleted after 3-4 years)

– Duplicate entries

6. Leverage Your Mortgage

If your bank doesn’t report your Immobilienkredit to Schufa, ask them to start. Provide proof of consistent payments. Some banks will manually add positive data if requested.

The Bottom Line: Stability Over Wealth

Germany’s Schufa system doesn’t reward financial success, it rewards predictability. A high earner who moves frequently, switches banks, or maintains multiple credit cards appears riskier than a modest earner who’s lived in the same apartment with the same bank for a decade.

This creates a perverse incentive: the more financially optimized you are, hunting for better rates, moving for better jobs, the more you’re punished. The system favors inertia.

For expats and mobile professionals, this is particularly brutal. Your international career moves, which should demonstrate success, instead brand you as unstable. The score will recover, but it requires patience and a strategy that prioritizes appearing static over appearing prosperous.

Your six-figure salary might pay the bills, but only time and stability will convince Schufa you’re worth the risk. Until then, keep that DSGVO request handy, minimize financial changes, and remember: in Germany’s credit system, standing still is often the fastest way forward.