The math looks seductive. Borrow €30,000 through a Wertpapierkredit (securities-backed loan) at 3.24% interest, dump it into P2P loans yielding 13% pre-tax, and pocket roughly €150 net each month. That’s the strategy making rounds in German investment circles, where aggressive self-directed investors chase yield in a zero-interest world. But behind this seemingly clever Zinsdifferenzgeschäft (interest rate differential trade) lurks a minefield of defaults, margin calls, and behavioral traps that can turn your arbitrage dream into a nightmare.

The Setup: How This “Arbitrage” Actually Works

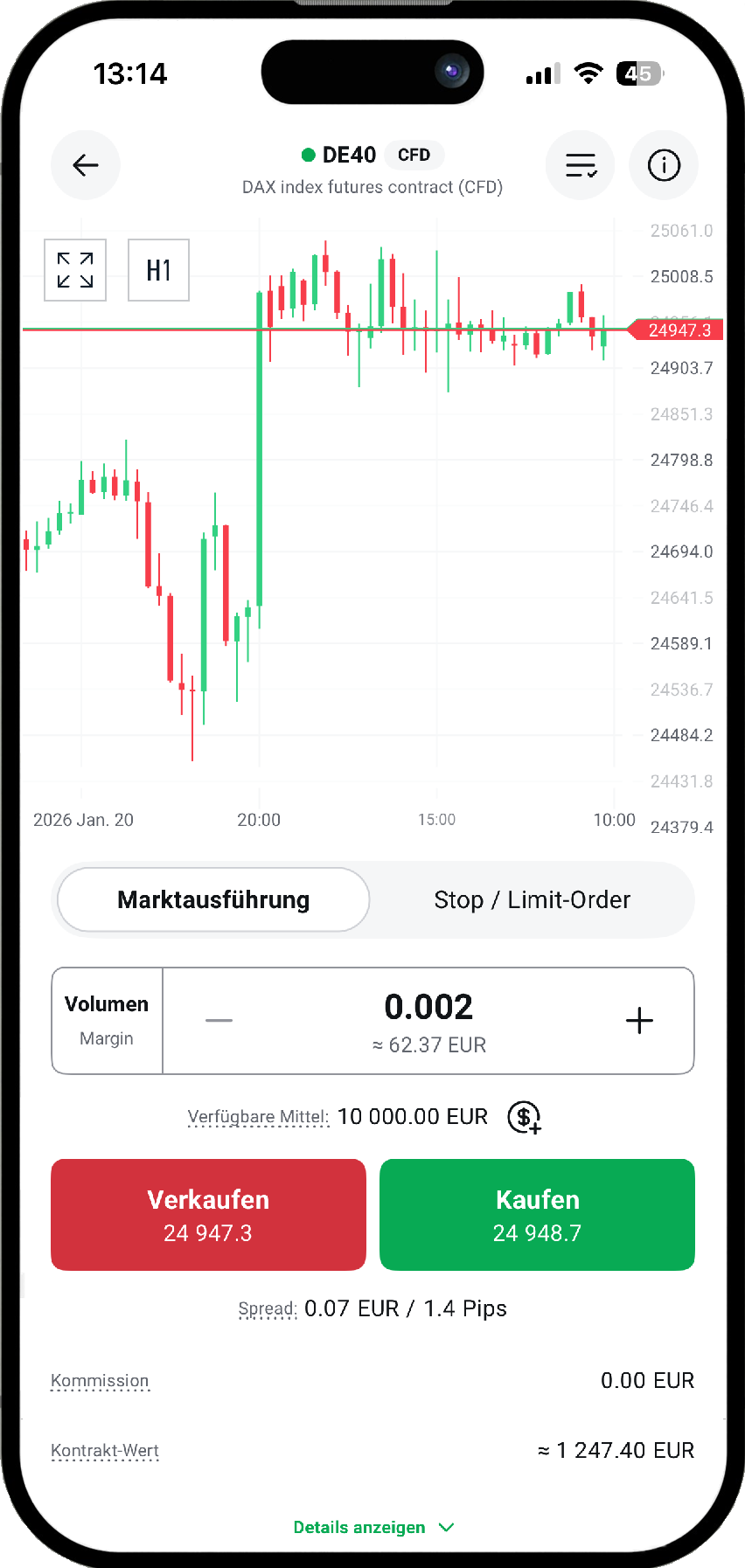

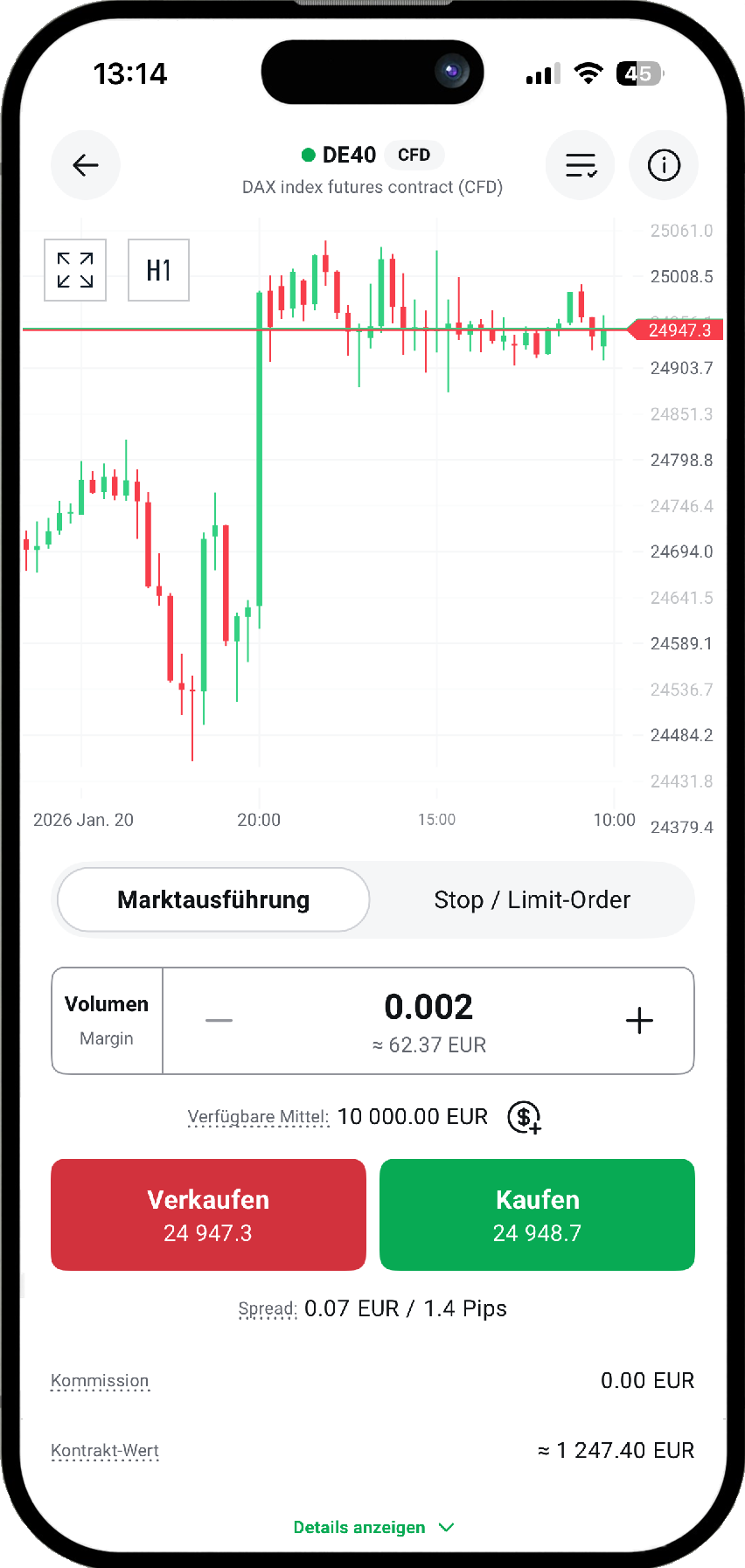

Let’s break down the mechanics. You pledge your ETF portfolio at a broker like Scalable Capital, which lets you borrow up to 50% of your holdings’ value. On €60,000 in ETFs, that’s €30,000 in fresh cash. You then funnel this into P2P platforms, perhaps Mintos, PeerBerry, or the newer Triple Dragon Funding, chasing that juicy 13% average yield.

After Germany’s Kapitalertragssteuer (capital gains tax) of 25% plus Solidaritätszuschlag (solidarity surcharge), your 13% gross becomes roughly 9.6% net. Subtract the 3.24% loan interest, and you’re left with a 6.36% spread on €30,000, about €159 monthly. The investor in our case study reports €150, which likely accounts for platform fees or slight defaults.

The backup plan? A €8,000 overdraft at C24 and €2,000 at Bondora to “stützen” (support) the credit line if markets tumble. Scalable supposedly gives two weeks before a margin call. What could go wrong?

P2P Reality: That 13% Isn’t Guaranteed

Here’s where the fairy tale unravels. P2P lending isn’t a bond. It’s unsecured, or poorly secured, consumer and business debt from borrowers in Latvia, Poland, Turkey, or sometimes Ukraine. When Kreditnehmer (borrowers) default, your money doesn’t just vanish, it gets trapped in multi-year recovery processes.

One investor on Mintos reported waiting five years for €700 from defaulted Turkish and Russian loans. Another noted that “Turkish loan repayments” have been pending for three years. The platforms’ Rückkaufversprechen (buyback guarantees) often prove worthless when loan originators go bankrupt, exactly what happened with multiple Eastern European lenders during recent crises.

Even the “safe” platforms aren’t immune. Bondora’s Go&Grow offers around 6% precisely because it’s more stable. The 13% returns come from riskier Kreditgeber (lenders) like Iute Group or Credifiel, where default rates spike during economic downturns. In 2025, one major P2P blogger wrote off €76.62 with Estateguru and expects “many more” in 2026.

The Leverage Trap: Margin Calls in a Crisis

Your Wertpapierkredit is a Call Money loan. If your ETF portfolio drops 30% in a market crash, your borrowing capacity shrinks from €30,000 to €21,000. Scalable will demand you post €9,000 within two weeks or liquidate your holdings at fire-sale prices.

Those backup credit lines? They’re illusionary safety nets. A Dispokredit (overdraft facility) at C24 comes with 8-12% interest, instantly turning your arbitrage negative. Bondora’s €2,000 is tied up in illiquid P2P loans that take months to withdraw. When you need liquidity most, it evaporates.

This is precisely why leveraged ETFs have crushed retail investors in volatile markets. The instruments themselves aren’t the problem, it’s the forced selling during downturns that locks in catastrophic losses.

Tax and Regulatory Blind Spots

German tax law treats P2P interest as Kapitalerträge (capital income), taxed at 26.375% including solidarity surcharge. But here’s the kicker: you can’t offset P2P defaults against your ETF gains. When a €1,000 Ukrainian loan defaults, you lose the principal and the tax benefit.

Meanwhile, your securities loan interest isn’t fully deductible. If you use the loan for taxable investments, you can deduct interest, but complex Einkünfteüberschussrechnung (income surplus calculation) rules apply. Many investors discover too late that their effective tax rate is higher than projected.

The Finanzamt (tax office) also scrutinizes leveraged strategies. If they deem your P2P lending a Gewerbe (commercial activity) rather than Vermögensverwaltung (asset management), you’ll owe trade tax and social security contributions on profits, destroying the arbitrage entirely.

The Psychology of Leveraged P2P

Leverage doesn’t just amplify returns, it weaponizes your emotions. Watching your €30,000 P2P portfolio drop 15% when defaults spike triggers panic. The monthly €150 income feels like pennies when you’re down €4,500.

This mirrors the dangers of overconfidence that wiped out €40,000 for one German trader. The initial success breeds recklessness. You might reinvest that €150 into more ETFs, increasing your leverage ratio from 50% to 60%, then 70%, until a minor market hiccup triggers a margin cascade.

Professional traders manage this through strict Positionsgrößen (position sizing) and stop-losses. But P2P loans have no stop-loss. When they default, you’re stuck. The only exit is selling at a 50-70% discount on secondary markets, if they exist.

Better Alternatives: What Experienced Investors Actually Do

Instead of this leveraged house of cards, consider these German-specific strategies:

-

Unleveraged P2P with Quality Filters: Invest directly in P2P using only risk capital. Stick to platforms with real Besicherung (collateral) like EstateGuru’s property loans or Triple Dragon’s gaming receivables. Limit exposure to 5% of your portfolio.

-

Leveraged ETFs with Risk Management: If you must use leverage, explore regulated leveraged ETFs where you can’t lose more than invested and liquidity is instant. The 2x MSCI World ETF carries risks, but no margin calls.

-

Tax-Efficient Securities Lending: For high-net-worth individuals, securities-backed loans can work in retirement to avoid realizing gains, but only for short-term liquidity needs, not to chase yield in risky assets.

-

Focus on Opportunity Cost: The real question isn’t whether this arbitrage works, but whether paying off debt beats speculative investing. That 3.24% loan could instead finance a Wohnungskauf (property purchase) with tangible collateral.

The Verdict: Smart Arbitrage or Reckless Gamble?

This strategy fails the professional trader’s smell test for three reasons:

Concentration Risk: You’re layering credit risk (P2P borrowers) on top of market risk (ETF collateral) on top of liquidity risk (margin calls). That’s a triple-decker disaster sandwich.

Asymmetric Payoff: Your maximum gain is €150/month. Your maximum loss is €30,000 plus your ETF portfolio if forced liquidation occurs. The risk-reward ratio is catastrophic.

No Edge: You’re not a credit analyst with access to P2P borrower data. You’re retail investor #4,237 buying the same loans as everyone else. The 13% yield already prices in the risk you’re ignoring.

The German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) would classify this as inappropriate for unsophisticated investors. The fact that platforms like Scalable make it easy doesn’t make it smart.

Final Word: The House Always Wins

In finance, if something looks too good to be true, it’s either illegal or about to blow up. This €150/month strategy is a slow-motion train wreck. You’re earning peanuts to underwrite subprime debt with leverage that can be called at any moment.

The coming mortgage crisis from expired Zinsbindungen shows how German borrowers underestimate rate risk. Apply that lesson here: fixed P2P returns won’t save you when your variable-rate margin loan spikes.

Want real passive income? Build a diversified ETF portfolio, add small P2P exposure with unleveraged cash, and let Zinseszins (compound interest) work over decades. Chasing arbitrage with borrowed money is how you become the next cautionary tale, not how you achieve financial freedom.

The bottom line: Close the loan, sell the P2P loans, and sleep soundly. That €150 isn’t income, it’s danger money.