SCHUFA’s New 0-999 Credit Score: Why Your ‘Excellent’ Rating Might Suddenly Feel Average

Germany’s most powerful financial gatekeeper is finally opening its black box, but the transparency comes with a catch. SCHUFA, the credit bureau that holds files on 68 million Germans, is scrapping its mysterious percentage-based scoring system for a straightforward 0-999 point model. Early beta testers can already see exactly how their score is calculated, and many aren’t happy with what they find.

The End of the Opaque Percentage Era

For decades, SCHUFA operated as a financial oracle, spitting out percentage scores that seemed to follow no discernible logic. You’d get a “97.XX%” rating labeled “hervorragend” (excellent) and assume you were at the top of the credit food chain. But the math behind it? A trade secret. That changes in March 2026, when the new system becomes freely accessible to all consumers through a digital portal.

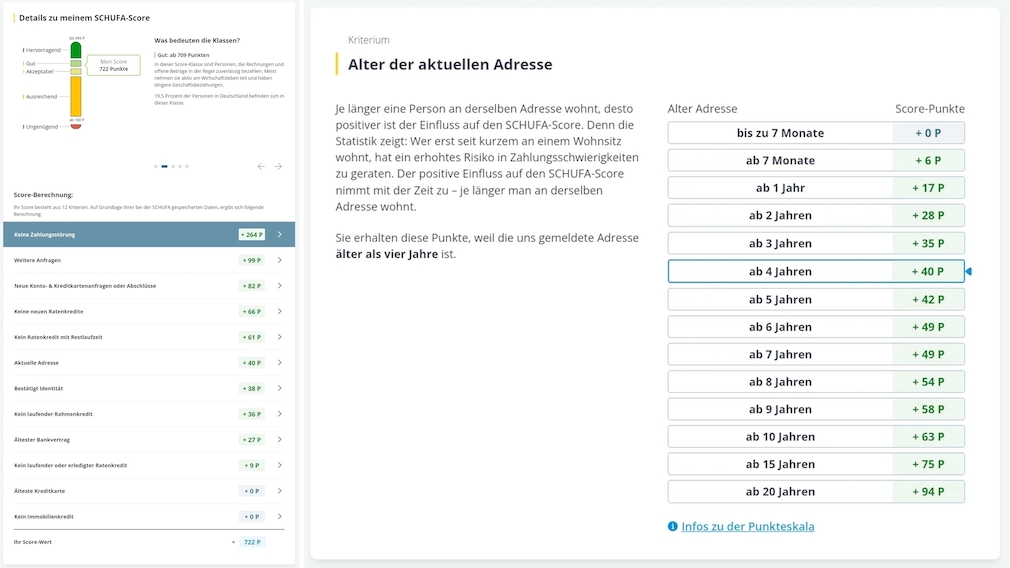

The beta version, currently being tested by a select group, replaces the old percentage with a simplee point total. Twelve criteria determine your score, each contributing a specific number of points. The total range runs from 100 to 999, with higher numbers indicating better creditworthiness. In theory, this makes it easier to understand why your score moves, and how to improve it.

The 12 Factors That Now Control Your Financial Fate

The new transparency reveals exactly what SCHUFA values, and the weighting might surprise you. While the full algorithm isn’t public, beta screenshots show the criteria categories and their relative importance:

-

Length of residence at current address: Stability matters, but the maximum points only accrue after 20 years at the same location. This immediately sparked controversy among younger professionals and immigrants who’ve built excellent credit histories in less time.

-

Account age and history: Your oldest bank accounts contribute points, with the maximum benefit also requiring two decades of history. For expats and young Germans, this creates a structural disadvantage that has nothing to do with payment behavior.

-

Payment history: The core of any credit score, do you pay bills on time? This remains the most significant factor.

-

Credit utilization: How much of your available credit are you using? High utilization drags down your score, even if you pay on time.

-

Number of credit inquiries: Each time a bank checks your score for a loan application, it can cost you points. Multiple inquiries in a short period signal financial distress.

-

Types of credit: A mix of installment loans (like a car loan) and revolving credit (like credit cards) helps your score.

-

Negative entries: Missed payments, defaults, and collections remain the fastest way to destroy your score.

The exact point values per category remain proprietary, but the transparency represents a seismic shift for a company that has faced multiple lawsuits over its opaque methodology.

The Age Factor Controversy

The most heated debate centers on the 20-year requirement for maximum points in several categories. Critics argue this systematically disadvantages younger adults, immigrants, and anyone who has moved for career opportunities. As one financial expert noted, “A 35-year-old who has paid every bill perfectly for 15 years is still scored lower than someone with the same payment history who never left their hometown bank.”

This structural bias raises questions about whether the new system truly measures creditworthiness or simply rewards demographic stability. For expats in Germany, who already struggle to build credit from scratch, this could mean waiting until their 40s to achieve top-tier scores, even with flawless financial behavior.

The Downgrade Problem: When “Excellent” Becomes Average

Early beta testers report a psychological shock when converting their old percentage to the new scale. Someone with a 97.XX% “excellent” rating might discover they score 750-800 points, still good, but not the top tier they assumed. The old system compressed the scale at the top, making it impossible to differentiate among the truly creditworthy. The new 0-999 range spreads scores more logically, but the emotional impact feels like a demotion.

This creates practical problems. If you’ve been telling landlords and lenders you have an “excellent” SCHUFA for years, what happens when your new score shows 820 points? Is that still excellent? Good? The lack of established benchmarks for the new scale means confusion for both consumers and the banks trying to interpret the numbers.

What This Means for Your Next Loan

Despite the transparency improvements, the fundamental power dynamic hasn’t changed: SCHUFA still controls access to credit, housing, and sometimes even employment. The new score will determine:

- Loan approval decisions: Banks set their own thresholds, but most will likely require 700+ points for favorable rates.

- Interest rate pricing: The difference between 750 and 850 points could mean thousands of euros in interest over a mortgage term.

- Rental applications: Landlords increasingly demand SCHUFA checks, and a lower-than-expected score could cost you that perfect Berlin apartment.

- Credit card limits: Your score directly influences how much credit banks are willing to extend.

The transparency might help you optimize your score, but it also gives SCHUFA a defense against criticism: “We told you exactly how it works.”

How to Access Your New Score

Starting March 2026, you can view your score for free through SCHUFA’s digital portal, but there’s a catch. You must:

- Join the waiting list: Visit meineschufa.de and register for the SCHUFA Account waiting list. Access is being rolled out gradually.

- Verify your identity: Currently, you must use your Personalausweis with activated online function. A mail-in option is promised for the future.

- Accept the terms: You’ll need to consent to data processing, though you can request deletion under GDPR.

The identification requirement creates a barrier for those without an eID-enabled ID card, though SCHUFA promises alternative methods eventually.

Actionable Steps to Navigate the New System

While you can’t change the 20-year stability requirements overnight, you can optimize other factors:

- Keep old accounts open: Even if you switch banks, maintain your oldest accounts with minimal activity.

- Time your credit applications: Cluster loan shopping within a two-week window so multiple inquiries count as one.

- Monitor your utilization: Keep credit card balances below 30% of your limit, even if you pay in full monthly.

- Check for errors: With transparency comes the ability to spot mistakes. Review your data annually and dispute inaccuracies immediately.

- Plan your moves: If you’re considering relocating, factor in the credit score impact. Staying put for another year might be worth thousands in better loan terms.

The Bigger Picture: Transparency as a Shield

SCHUFA’s move comes amid mounting regulatory pressure and competition from open banking initiatives. By revealing its methodology, the company protects its market dominance while appearing consumer-friendly. The transparency deflects criticism but maintains the core business model: selling your financial data to banks and businesses.

For consumers, the real win isn’t just seeing the algorithm, it’s understanding that SCHUFA scores are not destiny. The new system makes it clearer than ever that factors like age and stability matter as much as payment history. This knowledge lets you plan accordingly, whether that means staying in your current flat for the credit boost or accepting a slightly lower score as the price of career mobility.

The 0-999 system doesn’t eliminate SCHUFA’s power, but it does demystify it. And in Germany’s opaque financial bureaucracy, that counts as progress, even if your first look at your new score stings.