The Bundestag has spoken, and for once, the numbers tell a clearer story than the politicians. On December 5th, 2025, Germany’s parliament approved the Rentenpaket 2025 with 319 votes, just barely clearing the threshold for what’s cynically called “Kanzlermehrheit.” The promise: stabilize pensions at 48% of average wages until 2031. The price: a direct raid on young workers’ net income that will make your next pay raise feel like a mirage.

Let’s skip the political theater for a moment and focus on what actually lands in your bank account.

The Math That Shrinks Your Paycheck

If you earn €5,000 gross monthly (Steuerklasse I), here’s what the Rentenpaket does to your net income over time:

| Gesamtbeitragssatz | Jahr | AN-Anteil | Monatl. Mehrbelastung | Jährlicher Netto-Verlust |

|---|---|---|---|---|

| 18,6 % | 2025 | 9,30 % | 0,00 € | 0,00 € |

| 20,0 % | 2030 | 10,00 % | 35,00 € | 420,00 € |

| 21,0 % | 2035 | 10,50 % | 60,00 € | 720,00 € |

| 22,0 % | 2040 | 11,00 % | 85,00 € | 1.020,00 € |

| 22,7 % | 2045+ | 11,35 % | 102,50 € | 1.230,00 € |

These figures, derived from current Rentenkasse projections, show what happens when contribution rates climb but your gross salary stagnates. By the time today’s 30-year-olds hit their peak earning years, they’re losing over €1,000 annually just to pension contributions. That’s not a rounding error, that’s a vacation you won’t take, a rent increase you can’t cover, or a private pension contribution that never gets made.

The “Employer Pays Half” Lie That Refuses to Die

German payroll statements show you pay 9.3% and your employer pays 9.3%. Officially, that’s true. Practically, it’s accounting fiction that generations of workers have internalized as gospel.

The research from multiple economic analyses confirms what labor market realities have always shown: the employer contribution comes entirely from the value you create. If you’re a cleaner whose employer can charge clients €20/hour, roughly €5 covers materials and overhead. The remaining €15 pot gets split:

– €13.50 to you as “gross” salary

– €1.50 as “your” pension contribution

– €1.50 as “employer” pension contribution

Whether the €3 in pension costs gets split on paper or comes entirely from your side, you still end up with €12 net. The only difference? The comforting illusion that your boss is “paying half.” When contribution rates rise as projected, 18.6% to 20.1% by 2030, the burden lands squarely on total labor costs, which directly impacts wage negotiation room.

As one financial analyst bluntly put it: “The employer contribution is invented by political sleight-of-hand to fool workers into thinking they pay less.” Your next raise just got smaller because your total compensation package now carries a heavier pension burden.

Why Young Workers Are the Perfect Target

The demographic trap is springing shut. In the early 1960s, six workers financed one pensioner. Today, it’s two-to-one. By 2030, the ratio drops to 1.5-to-one. By 2050? Just 1.3 workers per retiree.

Older colleagues who’ve “earned their pension points” and still work longer see no increase in their benefits. Young workers, meanwhile, face a triple whammy:

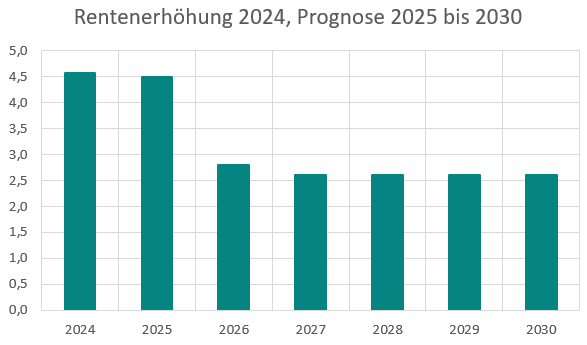

1. Higher contribution rates (18.6% → 20.1% by 2030)

2. Longer contribution periods (67 is the new 65)

3. Lower replacement rates (the 48% level is a ceiling, not a floor)

Bundesbank projections show the contributions-to-pensioner ratio hitting its worst point precisely when millennials and Gen Z should be building wealth. Instead, they’re funding a system that, by design, cannot offer them the same returns.

The Political Theater Masks Deeper Resignation

Finance Minister Lars Klingbeil hailed the vote as “a clear result”, while simultaneously promising a “structural reform commission” for next year. The message is clear: this reform kicks the can so far down the road that current politicians will be retired before the real costs materialize.

Many young professionals have already stopped waiting. Internal surveys show nearly one-third of adults aged 18-30 don’t expect to receive meaningful state pensions. Among those, 83% actively worry about Altersarmut (old-age poverty). The response? Private savings starting in their early twenties and serious consideration of emigration to countries with less punishing demographic math.

What Actually Happens Next

The Rentenpaket 2025 is law, but four critical dates matter for your financial planning:

- January 1, 2026: Stabilization begins. Pension level locked at 48% through 2031.

- 2027: Mütterrente III expands, adding ~€20/month per child for parents (mostly pre-1992 births).

- 2028: Contribution rate jumps to 19.8%, the first sharp increase.

- 2030: Rate hits 20.1%, meaning you lose €420 annually at €60k gross.

The “sustainability reserve” (Nachhaltigkeitsrücklage) will hover around €41.5 billion by end-2025, but that’s a rounding error against projected annual expenditures of €518 billion by 2031. The reserve isn’t a solution, it’s a fig leaf.

Your Real Options

Given this structural reality, young German workers face three paths:

Option 1: Maximize betriebliche Altersvorsorge (bAV)

The reform includes window-dressing for company pensions, slightly higher tax-free allowances and expanded social partner models. But in SMEs without Betriebsräte, implementation is patchy at best. Don’t count on this alone.

Option 2: Emigrate and claim refunds

If you leave Germany permanently, you can reclaim only your employee contributions. The “employer half” vanishes into the system. For someone earning €60k over five years, that’s roughly €12,000 you’ll never see again.

Option 3: Accept the tax and plan around it

Calculate your true all-in social contribution burden (now 41.5% of GDP). Then budget as if your gross salary is 15% lower than advertised. Every financial decision, renting vs. buying, Kinderwunsch, startup plans, must factor in this permanent drag.

The Uncomfortable Truth

The Rentenpaket 2025 didn’t solve Germany’s pension crisis. It institutionalized generational transfer at gunpoint. Young workers aren’t just funding current retirees, they’re guaranteeing benefits that actuarial math proves they cannot receive themselves.

The political class knows this. That’s why debate focused on “securing the 48% level” rather than “why young workers pay 20% for promises that can’t be kept.” When Friedrich Merz demanded a “Kanzlermehrheit”, he wasn’t seeking democratic legitimacy, he needed political cover.

Your response? Internalize the real math, not the political narrative. That pension contribution line on your pay stub isn’t an investment in your future. It’s a wealth transfer that peaks at exactly the moment you need to build your own.

Welcome to the new German social contract: work longer, pay more, get less, and pretend the employer is covering half the pain.