The question landed like a grenade in Germany’s frugalism community: A 27-year-old with a €100,000 ETF portfolio asked why he should keep saving €1,000 monthly for the next 40 years. His math was simple. Let the existing portfolio compound at 7%, and he’d retire with €1.5 million, enough for €3,000 monthly income plus state pension. Keep saving, and he’d hit €4 million. But then what?

This isn’t just spreadsheet philosophy. It strikes at the heart of a movement that has turned saving into a competitive sport across German-speaking forums. The FIRE doctrine, Financial Independence, Retire Early, has dominated personal finance discourse for years. Yet cracks are showing. More investors are asking whether extreme frugality becomes counterproductive once you’ve secured a comfortable future. The debate has become particularly heated in Germany, where the combination of generous social security, high taxes, and cultural thrift creates a unique calculus.

The Math That Breaks the Dogma

Let’s run the numbers that sparked the controversy. A 27-year-old German investor with €100,000 in a world-equity ETF like the A1JX52:

– Scenario A (Stop Saving): €100,000 compounds at 7% for 40 years = €1.5 million

– Scenario B (Keep Saving): €100,000 + €1,000/month at 7% for 40 years = €3.9 million

Using the classic 4% rule, Scenario A yields €5,000 monthly retirement income including gesetzliche Rente and betriebliche Altersvorsorge. Scenario B delivers nearly €13,000 monthly. The question becomes existential: Why sacrifice four decades of life for money you’ll never spend?

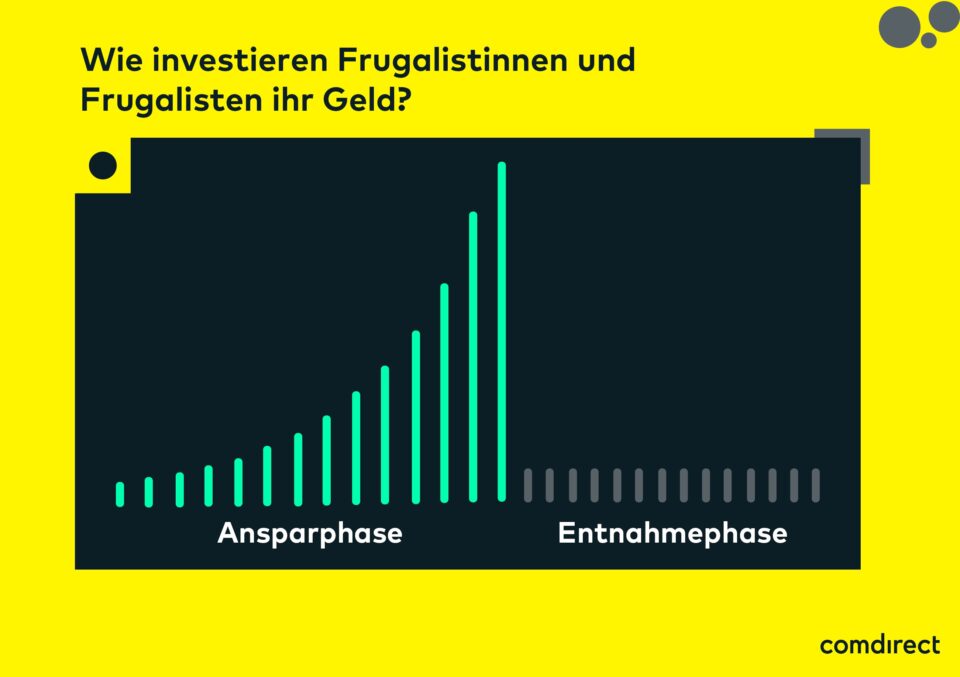

The graph above shows the typical frugalist journey, aggressive accumulation followed by a sudden spending cliff. But what if that cliff is a mirage?

The Inflation Reality Check German Investors Miss

Here’s where the discussion gets technical, and controversial. Many German investors calculate with nominal returns while mentally anchoring to today’s purchasing power. One commenter bluntly corrected the math: €5,000 today becomes €1,500 in real terms after 40 years of 3% inflation. That’s not a detail, it’s a catastrophe for planning.

The German tax system compounds this problem. Kapitalertragssteuer at 25% plus Solidaritätszuschlag hits your 4% withdrawals. Inflation-adjusted returns are closer to 4% than 7%. Yet countless German FIRE calculators ignore this, showing moonshot projections that crumble under scrutiny. The Trinity Study, origin of the 4% rule, only modeled 30-year retirements and ignored taxes entirely. For a German aiming to retire at 40, that’s not just optimistic, it’s reckless.

Swetlana Ewald, head of the finanz-heldinnen initiative, notes that Altersarmut in Deutschland makes some frugalism principles sensible. But she warns the movement often underestimates longevity risk and overstates achievable returns. The comdirect analysis of frugalism highlights that while 70% savings rates sound impressive, they require incomes most Germans simply don’t have.

When Frugalism Becomes Identity, Not Strategy

The psychological dimension is where German investors get truly uncomfortable. Many discover that after years of aggressive saving, they can’t stop. Frugalismus becomes a core identity. Spending feels like failure. One investor described it as “learning to spend again”, a skill as difficult as learning to save.

This manifests in bizarre ways across German forums. People debate whether a €3 coffee constitutes “Lifestyle-Inflation.” Others calculate the “ROI” of relationships. The movement that promised freedom often delivers anxiety. Investors report chronic health issues from stress, missed family events, and friendships strained by constant refusal to spend.

The tragic stories resonate most. A father saved obsessively for 40 years, retired at 67, received an ALS diagnosis one month later. Another entrepreneur worked 80-hour weeks, accumulated millions, got cancer at 62. These aren’t edge cases, they’re the statistical reality of betting everything on a future that might not arrive.

The German-Specific Escape Hatch: Coast FIRE

German social security actually provides a unique off-ramp. Unlike US FIRE adherents who need massive portfolios, Germans can leverage:

– Gesetzliche Rentenversicherung: Even with gaps, provides baseline income

– Betriebliche Altersvorsorge: Employer contributions reduce needed savings

– Inflation-indexed annuities: Rürup and Riester provide hedge against inflation

This enables “Coast FIRE”, a concept gaining traction in Germany. You save enough that compound growth alone reaches your target, then stop contributing and “coast.” The math works: €100,000 at 27 is precisely the Coast FIRE threshold for a €3,000 monthly retirement at 67.

The WalletBurst Coast FIRE calculator shows German investors exactly when they’ve hit this inflection point. Yet the frugalism community often ignores it, treating any reduction in savings as heresy.

The Balance: Relearning to Live

The most sophisticated German investors now advocate for “balanced frugalism.” They maintain high savings rates until hitting Coast FIRE, then consciously shift. One described it as training two skills: the saving skill and the spending skill. Both require discipline.

This means:

– Calculate your real Coast FIRE number using German tax rates and realistic 4-5% returns

– Automate everything through German brokers like comdirect or Trade Republic

– Set a “spending goal”

alongside your savings goal, budget for experiences, not just accumulation

– Use Vermögenswirksame Leistungen and Frühstart-Rente to supplement without extra sacrifice

The goal isn’t to stop saving entirely. It’s to stop saving compulsively. €1,000 monthly savings might become €300 automated savings plus €700 for life, language courses, weekend trips to the Alps, dinners with friends.

The Verdict: Enough Is Knowable

The German frugalism debate reveals a uncomfortable truth: The movement’s most vocal proponents are often those who haven’t yet reached “enough.” They preach infinite sacrifice because they haven’t experienced the diminishing returns.

But the math is clear. For a 27-year-old with €100,000, enough is already in sight. Even with conservative 5% real returns and German taxes, €3,000 monthly retirement income is achievable without another 40 years of deprivation. The question isn’t whether to save, it’s whether to live.

The answer lies not in spreadsheets, but in values. What does financial independence enable? If it’s more life, then at some point, saving more means living less. And in Germany’s system, that point arrives sooner than the FIRE gurus admit.

Actionable framework for German investors:

1. Calculate your Coast FIRE number using realistic German parameters

2. Automate your ETF-Sparplan until you hit that number

3. After Coast FIRE, redirect 50% of your former savings to life enrichment

4. Review annually, your “enough” number changes with marriage, kids, health

The myth of infinite saving dies hard in Germany’s risk-averse culture. But recognizing when enough is enough might be the most financially sophisticated move of all.