The fantasy is universal: what would you do with 1.5 billion euros? The reality, especially in Germany, is a bureaucratic and financial nightmare that would make your local Sparkasse branch break into a cold sweat. When a US Powerball winner claimed a record-breaking jackpot around Christmas, German forums lit up with a peculiarly Teutonic question, not about yachts or private islands, but about practicalities: Where do you even put that much money without violating Einlagensicherung?

The €100,000 Problem Nobody Talks About

Here’s the first shock: Germany’s deposit insurance system, Einlagensicherung, only protects up to €100,000 per bank, per person. Your massive windfall would need to be spread across 15,000 different banking institutions just to stay insured. Many newcomers express frustration, finding the German banking system nearly impossible to navigate without local contacts when dealing with sums that exceed institutional limits by orders of magnitude.

The practical reality? You can’t just dump €1.5 billion into your Deutsche Bank Girokonto. The bank would likely freeze the transaction, suspecting money laundering, and you’d spend weeks explaining to compliance officers that yes, you really did win the Powerball, and no, you’re not a Russian oligarch circumventing sanctions.

The “Heiliger Gral” and Why Index Funds Become Your Best Friend

The consensus among financially literate Germans points to one solution: the heiliger Gral, the holy grail of passive investing. In this context, that means dumping everything into a globally diversified ETF like the MSCI World or FTSE All World. The logic is brutal and simple: with 1.5 billion generating just 3% annual returns, you’re looking at €45 million per year in passive income. That’s enough to buy a new luxury villa every month and still have change left over.

The t-online financial guide emphasizes that ETFs bundle hundreds of stocks, minimizing risk while maximizing exposure to global economic growth. For a lottery winner, this becomes the only rational approach. Individual stock picking is madness at this scale, and active funds with their 1-2% management fees would bleed you dry, costing €15-30 million annually in fees alone.

The Tax Reality Check: Finanzamt Wants Its Share

Before you start planning your fleet of Teslas, remember: that advertised €1.5 billion is fiction. The US winner faced a brutal choice: 30 annual payments totaling the full amount, or a lump sum of less than half, around $700 million before taxes. After federal and state taxes, particularly in high-tax states like New York, the final payout shrinks to approximately $359 million.

The German Finanzamt would take its own bite if you brought that money home. While Germany doesn’t tax lottery winnings, the moment you start generating investment income, you’re subject to Abgeltungsteuer, 25% plus solidarity surcharge on all capital gains. Your €45 million in theoretical ETF returns? That’s only about €33 million after the tax man cometh.

Lifestyle Creep vs. Carbonara Frugality

One of the most fascinating cultural divides in these discussions is the German obsession with avoiding Lifestyle Creep. Even with billions, many commenters insist they’d continue buying discounted groceries and using four-ply toilet paper as their only luxury. The running joke about continuing to eat Carbonara, but maybe with real Guanciale this time, and only if it’s 30% off, reveals a deep-seated financial anxiety that not even infinite money can cure.

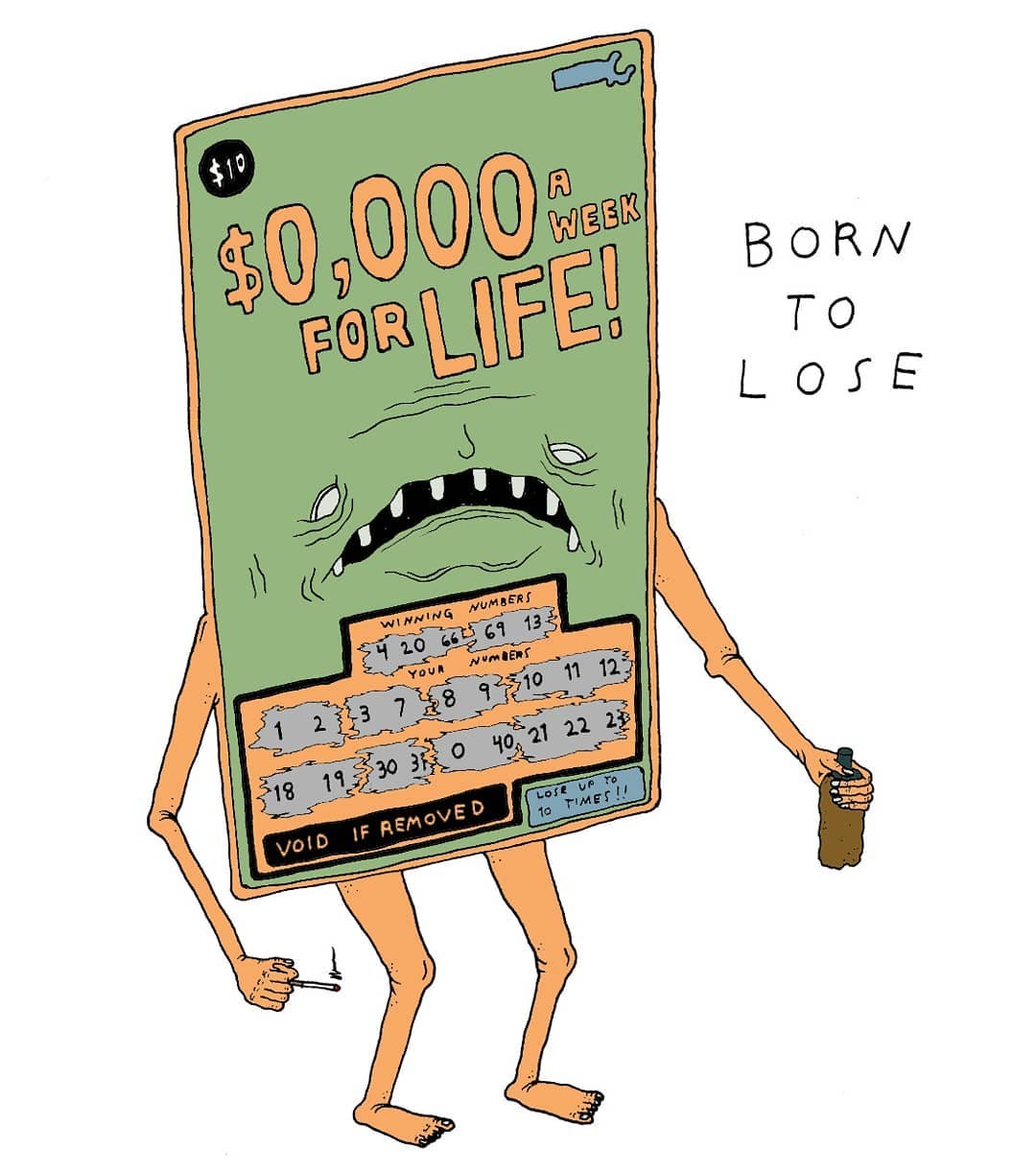

This isn’t entirely irrational. Studies show most lottery winners go bankrupt within years. The German approach, maintaining frugal habits while letting compound interest work, might be the only thing standing between you and becoming a cautionary tale. As one analyst noted, systematic wealth destruction is the default outcome for sudden fortune.

The Job Question: Why Quitting Immediately Is a Mistake

The first instinct is to quit your job. But financially savvy Germans suggest a more nuanced approach: reduce hours, switch to part-time, or claim you’ve landed a remote position. This preserves your public health insurance coverage, private Krankenversicherung would cost a fortune at this age, and maintains social connections while giving you freedom.

The smarter move? Keep working for six months to a year while you plan. Use the time to consult with tax advisors, set up proper asset protection structures, and figure out which relatives you actually want to share wealth with. Because the moment you quit, everyone knows you’ve come into money, and the requests for “investments” in dubious business ideas start flowing.

Asset Allocation: Beyond the ETF

While the heiliger Gral ETF strategy dominates discussions, proper diversification at this scale requires more:

- Real Estate: Buying property in Berlin, Munich, or Hamburg provides tangible assets and rental income. But Germany’s property transfer tax (Grunderwerbsteuer) of 3.5-6.5% means you’re instantly down €50-100 million on a €1.5 billion property spree.

- Gold: Some suggest physical gold bars stacked in your apartment. This is legally complicated, Germany has strict reporting requirements for large precious metal holdings, and insurance would be astronomical. Plus, gold generates no income, only storage costs.

- Alternative Investments: Art, classic cars, or venture capital become viable at this level. But these require expertise. As one commenter wryly noted, the only thing money can’t buy is time to learn how to manage it properly.

The Bank Run Problem

Here’s a scenario few consider: if word gets out that you’ve deposited even a fraction of your winnings in a local Sparkasse, you could trigger a bank run. Not because the bank is insolvent, but because locals might panic about the institution’s liquidity with such a massive single depositor. It’s absurd, but in the age of social media, financial rumors spread faster than the Bundesbank can issue denials.

Practical Steps for the Implausible Scenario

- Hire a specialized Vermögensverwaltung firm immediately. Not your local Sparkasse advisor, these firms charge 0.5-1% annually but handle everything from tax optimization to estate planning.

- Distribute across multiple banks. Use the €100,000 Einlagensicherung limit strategically, but also consider that amounts above this aren’t automatically lost, just uninsured. Spread across Germany’s top 20 banks and you’re reasonably safe.

- Max out your ETF-Sparplan, but not all at once. Dollar-cost average over 12-24 months to avoid buying at a market peak. Even with billions, timing matters.

- Establish residency in a more favorable tax jurisdiction before claiming the prize. This is legal but complex, requires moving before you win, which defeats the point of planning.

- Create a Stiftung (foundation). Germany allows you to establish a charitable foundation that can hold assets, providing tax benefits and protecting wealth from future claims.

The Bottom Line: Why This Fantasy Is Useful

Most Germans will never face this problem, but discussing it reveals real financial literacy gaps. The Einlagensicherung limit, the superiority of ETFs over active funds, the tax implications of capital gains, these apply whether you have €1,500 or €1.5 billion. The scale just makes the stakes visible.

The real lesson isn’t about managing billions, it’s about recognizing that even modest wealth requires strategy. Your Sparkasse Girokonto is a checking account, not an investment vehicle. The 0.01% interest it pays is a slow-motion wealth destruction machine. And the Finanzamt will take its share of your investment returns, no matter how small.

So while you probably won’t win the Powerball, you can apply the same principles: diversify globally, minimize fees, avoid lifestyle inflation, and treat your finances like they matter, because they do, even without the extra zeros.