You’ve mastered the art of dollar-cost averaging into CSPX and SPPW. You’ve convinced yourself that Interactive Brokers’ (IBKR) $2 currency conversion fee is the best deal in Switzerland. Then you check your statement and spot it: CHF 152 in “other expenses” on a CHF 6,000 investment. That sinking feeling? It’s not a mistake, it’s the IBKR currency conversion trap that catches nearly every Swiss investor.

The platform praised for its low-cost structure harbors default settings designed for high-frequency traders, not Zurich-based ETF accumulators. While Interactive Brokers cost advantages for Swiss investors are real, the fee structure requires surgical precision to navigate. Let’s dissect where your money is actually going.

The Currency Conversion Illusion

IBKR’s marketing boasts “true market rates” for FX transactions, and they’re not lying. The rate itself is clean. The problem is everything else. When you buy USD-denominated ETFs like CSPX, you face a choice: let IBKR handle the conversion automatically or manually trade currency pairs.

Automatic conversion sounds convenient. You place an order, IBKR spots you don’t have USD, and quietly converts your CHF at 0.03% commission. For small amounts, this feels painless. But that “other expenses” line item? It’s often the accumulation of these silent conversions plus settlement fees you never authorized.

Manual conversion through the FX Trader tool costs $2 per trade (or less on tiered pricing). Savvy investors quickly realize this is cheaper, but only above CHF 6,700. Below that threshold, the $2 flat fee actually costs more than the 0.03% automatic commission. The math flips at exactly CHF 6,666.67, a number that feels suspiciously designed to trap the typical Swiss monthly saver depositing CHF 500-2,000.

The Tiered Pricing Mirage

Many investors discover they can switch from IBKR’s Fixed to Tiered pricing structure, lured by promises of lower fees. Here’s the catch: tiered pricing reduces your FX commission to as low as 0.002% but adds exchange fees, clearing fees, and regulatory charges that often exceed the savings.

For a typical CHF 1,000 monthly purchase:

– Fixed: $2 flat fee = ~CHF 1.80

– Tiered: 0.002% commission (CHF 0.02) + exchange fees (CHF 0.50-1.50) = CHF 0.52-1.52

The savings exist but they’re marginal, pennies that matter only at institutional scale. Most Swiss retail investors waste hours optimizing for tiered pricing that saves them less than a coffee per month. The real optimization lies elsewhere.

The CHF 152 Mystery: What “Other Expenses” Actually Means

That shocking CHF 152 figure from the Reddit post breaks down into several components IBKR buries in fine print:

- Settlement violations: Buying USD ETFs before your CHF deposit clears triggers a forced loan at 6%+ interest

- Residual balances: Tiny currency fragments left after conversion that get auto-exchanged at poor rates

- Corporate action fees: Dividend processing on accumulating ETFs (yes, even when you don’t see the dividend)

- Monthly minimum fees: IBKR charges $10/month if your account balance is below $100,000 and you don’t generate enough commissions

The last point is crucial. Many Swiss investors open IBKR accounts with CHF 5,000-10,000, make one trade per month, and get hit with the inactivity fee disguised as “other expenses.” Your $2 FX trade didn’t generate enough commission, so IBKR extracts the difference.

The Revolut Dead End

The natural instinct is to circumvent IBKR’s FX entirely. Why not deposit EUR or USD directly from Revolut? As one commenter learned, Revolut’s spread markup makes this a false economy. Revolut’s weekend markups (0.5-2%) and transfer fees exceed IBKR’s transparent $2 charge.

Worse, IBKR treats Revolut transfers as third-party deposits, requiring additional verification that can delay your investment by days. During market volatility, that delay costs more than any FX savings. The Swiss investors who win this game don’t look for shortcuts, they master IBKR’s native tools.

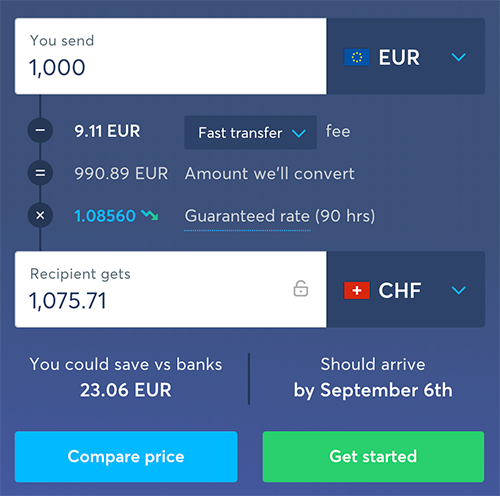

The Wise Workaround (Actually Works)

Here’s the legitimate hack: Use Wise for large currency conversions, then transfer to IBKR.

Wise offers the real interbank rate with transparent 0.43% fees, substantially better than Swiss banks’ 1-2% spreads. For CHF 10,000+ conversions, this saves CHF 50-150. The process:

- Convert CHF to USD/EUR in Wise

- Send to your IBKR account using local transfer details

- Deposit lands as the target currency, no IBKR FX needed

The catch? Wise transfers take 1-2 business days, and you need to plan ahead. But for quarterly lump-sum investors, this beats both IBKR’s automatic conversion and Revolut’s markup.

ETF Selection: The Tax Angle

The original Reddit post mentions CSPX (USD, Ireland-domiciled) and SPPW (EUR, Ireland-domiciled). A commenter suggests VT (USD, US-domiciled) for better tax treatment.

Here’s the reality for Swiss investors:

– Ireland ETFs: 15% US withholding tax on dividends (automatically withheld)

– US ETFs: 15% US withholding tax, but you can reclaim it via DA-1 form in your Steuererklärung (tax declaration)

The Ireland vs US ETF dividend tax implications are complex. VT offers broader diversification (3,800+ stocks vs 500-1,500), but US estate tax concerns make it risky for accounts exceeding CHF 60,000 if you die. For most Swiss investors, Ireland-domiciled ETFs remain the safer choice despite the non-reclaimable 15% tax.

The Settlement Timing Game

The biggest “other expenses” generator is settlement mismatch. IBKR’s T+2 settlement means your CHF deposit must clear two days before your USD purchase. If you buy CSPX on Monday with CHF deposited Monday morning, IBKR lends you USD for two days at 6.33% annual interest (posted rate as of February 2026).

On CHF 5,000, that’s CHF 1.73 in interest. Do this monthly, and you’ve added CHF 20.76 to your annual costs, more than four FX conversions. The solution is simple but requires discipline: deposit CHF three business days before you plan to invest.

Actionable IBKR Optimization for Swiss Investors

- For accounts under CHF 100,000: Stick to Fixed pricing. The complexity of tiered isn’t worth the minimal savings.

- For monthly investments under CHF 6,700: Let IBKR convert automatically at 0.03%. Don’t fight the $2 fee.

- For quarterly lump sums over CHF 10,000: Use Wise for conversion, then deposit native currency.

- Always: Deposit cash three business days before trading to avoid settlement interest.

- Check: Your “other expenses” monthly. If you see recurring charges, you’re likely triggering the $10 minimum commission. Increase trade frequency or accept the fee as your IBKR “membership cost.”

The CHF 152 surprise didn’t happen because IBKR is predatory, it happened because the platform’s defaults serve hedge funds, not Geneva office workers building retirement portfolios. Swiss investors who understand the settlement cycle, the CHF 6,700 threshold, and the Wise workaround can reduce their total costs from 2.5% to under 0.3% annually.

But here’s the uncomfortable truth: these optimizations only matter if you’re investing CHF 50,000+ per year. Below that, the time spent micromanaging IBKR’s settings costs more than the fees you save. Sometimes the best financial decision is to accept a small inefficiency and focus on earning more income instead.

Before you obsess over FX rates, ensure you’ve maxed out your Säule 3a (Third Pillar) contributions and optimized your Quellensteuer (withholding tax) status. The Swiss investor portfolio performance using IBKR shows that asset allocation and tax optimization matter far more than FX fees.

IBKR remains the best tool for Swiss DIY investors, but only when you configure it for Swiss reality, not Wall Street’s trading floor.