That Instagram post showing someone making €2,000 before breakfast while you’re calculating whether you can afford both butter and bread this week? It’s designed to make you feel stupid. The reality is more boring, more Austrian, and ultimately more profitable.

Let’s address the immediate question: if you’ve only got €20 left at month’s end, you’re not ready to invest, you’re ready to start building the foundation. But that’s not the insult it sounds like. It’s the financial equivalent of learning to walk before you run a marathon through the Vienna Woods.

The 20€ Myth and Why It Matters in Austria

The Reddit generation has internalized a dangerous lie: that investing is about timing the market and picking the next Bitcoin. Austrian reality is different. When someone posts about making thousands overnight, they’re either lying, already wealthy, or about to lose everything.

Here’s what actually happens when you start with small amounts in Austria: you pay KESt (Kapitalertragssteuer) of 27.5% on your gains. That €2,000 profit? €550 goes straight to the Finanzamt. The platforms showing massive wins rarely mention this. They also don’t mention that most day traders lose money, or that Austria’s steuereinfach brokers automatically deduct this tax, making those “huge gains” look suddenly less impressive.

Before You Even Download Trade Republic

The research is brutally clear: if you don’t have more than €20 at month’s end, investing isn’t your problem, cash flow is. Austrian financial wisdom (the kind that actually works) demands four things first:

- Absolute clarity on your finances: Not “I think I spend about…” but actual numbers. The Finanzamt expects precision, and so should you.

- A Notgroschen of 3-4 months’ expenses: For a single person in Vienna, that’s roughly €6,000-9,000. Before you panic, you don’t need it tomorrow. You build it.

- No expensive debt: That 12% consumer loan from Easybank? It’s eating your future returns alive.

- A realistic savings rate: Even €50 monthly is a start. The key is consistency, not amount.

One commenter pointed out the harsh truth: if you’re ending the month with €20, you need to focus on saving first. But there’s nuance here, maybe you’ve just cleared family debts and now have €200 monthly to work with. That’s when the game changes.

The Realistic Austrian Starting Point

Here’s where the €20 fantasy meets Austrian reality: most reputable brokers won’t even let you start with €20. Trade Republic, the app everyone’s downloaded, has a minimum of €1 for one-time investments but realistically expects €25+ for meaningful ETF savings plans. DADAT requires €10 minimum. Flatex.at wants €25.

So that €20? It’s not for investing, it’s for building the habit. Put it in a Tagesgeldkonto earning 2-3% (Consorsbank currently offers up to 3% for new customers), watch it become €20.60, and learn that money can work while you sleep.

Why ETFs Beat Crypto for Austrian Beginners

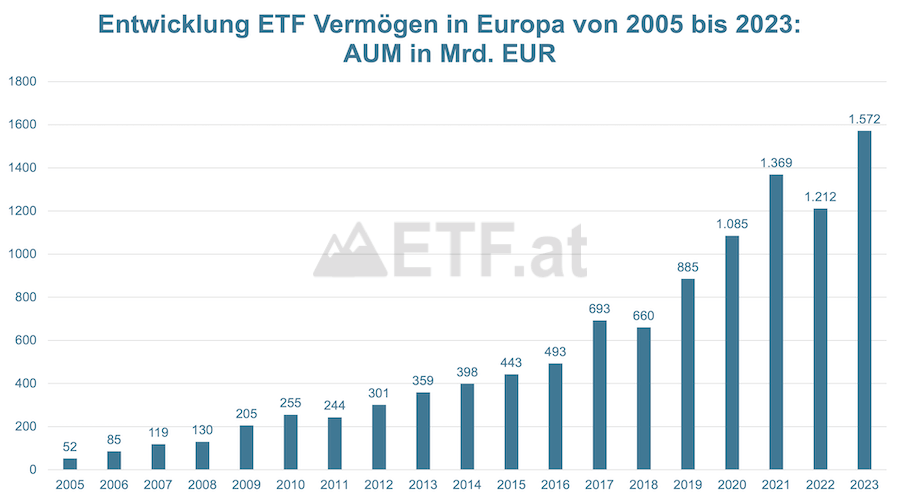

The data from ETF.at shows European ETF assets grew from negligible to over €1.5 trillion between 2005-2023. This isn’t hype, it’s institutional money doing boring, profitable things.

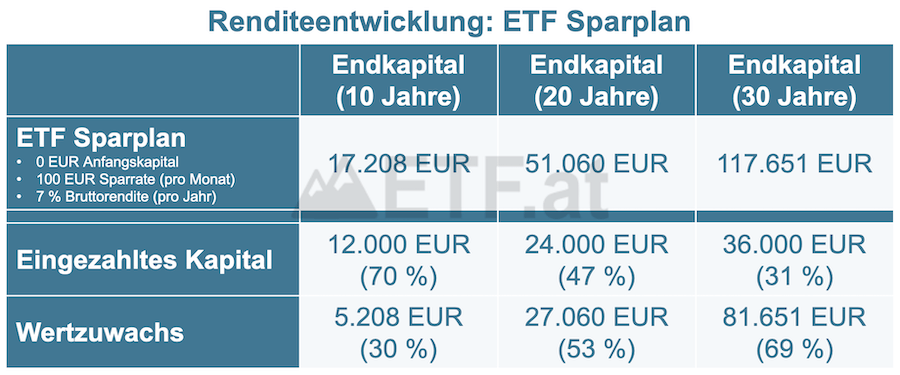

A €25 monthly ETF savings plan on the MSCI World (which you can get through Trade Republic or finanzen.net zero) buys you microscopic shares in 1,500+ companies. In 10 years at average returns, that’s around €3,500. In 20 years, €10,000. In 30 years, €25,000. Not Lambo money, but actual wealth.

Compare that to crypto: the same €25 in Bitcoin in January 2022 would be worth about €8 today. The volatility that makes for exciting Instagram stories makes for terrible actual returns.

The Austrian Tax Trap No One Mentions

Here’s what makes Austrian investing fundamentally different from US-centric Reddit advice: steuereinfach brokers. These platforms automatically handle your KESt, but they also limit your options.

If you use a German broker that isn’t steuereinfach, you’re responsible for calculating and paying KESt yourself. Miss a payment? The Finanzamt has questions. One user recommended Fynup for Austrian-specific tax handling, while another correctly noted that Finanzfluss offers excellent Austrian-specific videos on broker selection.

The best brokers for Austrian beginners:

– Trade Republic: €1 minimum, steuereinfach, 2,700+ free ETFs

– finanzen.net zero: €1 minimum, completely free, but German-based (tax implications)

– DADAT: €10 minimum, Austrian, steuereinfach, excellent app ratings

The 90/10 Strategy That Actually Works

Michael Beutel from Geldanlage-digital suggests the Kerndepot-Spieldepot strategy: 90% in a boring, automated portfolio (Robo-Advisor like quirion or scalable capital), 10% for learning.

With €200 monthly, that’s €180 into a MSCI World ETF and €20 into “play money” where you learn how markets actually work without destroying your future. Even with €50 monthly, the split is €45/€5. The point isn’t the amount, it’s building the discipline.

The research shows investors who try to pick winners consistently underperform those who buy the entire market and hold. Your 10% play money is tuition, not investment.

What €20 Actually Gets You in Austria

Let’s be brutally honest: €20 invested in a global ETF at 7% average return becomes €27 in five years. That’s one mediocre lunch. But €20 invested monthly for five years becomes €1,400. That’s a emergency fund. In 10 years, it’s €3,400. In 20 years, €10,000.

The math is clear: consistency beats amount. The Austrian brokers offering savings plans from €1 understand this. They’re betting on you staying for decades, not getting rich next week.

The Action Plan for Austrian Beginners

Stop watching crypto TikToks. Instead:

- This month: Open a Tagesgeldkonto. Transfer €20. See how it feels to have money you don’t touch.

- Next month: Calculate your actual spending. Use a banking app that categorizes automatically (many Austrian banks offer this).

- Month 3: Set up a €25 automatic transfer to your savings account for your Notgroschen.

- Month 6: Once you have €500 saved, open a Trade Republic account. Set up a €25 monthly savings plan on the iShares Core MSCI World.

- Month 12: Review. If you’ve stuck with it, increase to €50. If not, figure out why.

The goal isn’t to get rich. It’s to stop being the person who has €20 left at month’s end. Austrian financial independence isn’t about yachts, it’s about being able to afford a decent apartment in Graz without panic, or handling a €500 car repair in Innsbruck without borrowing.

The Bottom Line

Your Instagram feed is lying because truth doesn’t get likes. The truth is that Austrian wealth is built slowly, boringly, and with automatic tax deductions. It’s built with €25 monthly transfers that you barely notice, in ETFs that track companies you’ve never heard of, through brokers that handle your KESt so you don’t have to.

That peer who made €2,000 overnight? Ask them again in a year. The one who started with €25 monthly in 2020? They’ve got €1,600 and zero stress. That’s the Austrian way. It’s not sexy, but it works.

Your move: Download your banking app, not another trading app. Check where your money actually goes. Then, and only then, think about where it should grow.