Elster vs. WISO vs. Zasta: The Real Cost of Convenience in German Tax Filing

The German tax system operates with the same efficiency as a Deutsche Bahn train, usually impeccable, until there’s construction on the line. And right now, there’s massive construction happening in the world of tax software. With Elster (the official government portal) going “one-click” in July, third-party providers like WISO Steuer pushing AI assistants, and Zasta offering hybrid human-digital support, the choice isn’t just about price. It’s about how much money you’re willing to leave on the table.

The Tax Software Paradox: Free Isn’t Always Cheap

Every year, millions of Germans face the same question: Spend €0 on Elster or €35.99 on WISO Steuer? The answer seems obvious, until you run the numbers. According to WISO’s own data, their users receive an average of €502 more in refunds than those using other methods. That figure should set off alarm bells, but not for the reason you think.

The uncomfortable truth? For roughly 60-70% of German employees, the standard deduction (Pauschale) of €1,230 already covers their actual work-related expenses. This means that even if you meticulously document every train ticket, work meal, and home office pen, you might not exceed the threshold that makes itemizing worthwhile. In these cases, Elster’s free interface, clunky as it may be, delivers the exact same refund as premium software.

But here’s where it gets controversial: The tax software industry thrives on this uncertainty. They profit from our collective anxiety about “missing something”, even when that something doesn’t exist for most filers.

Elster: The Government’s Digital Tax Office

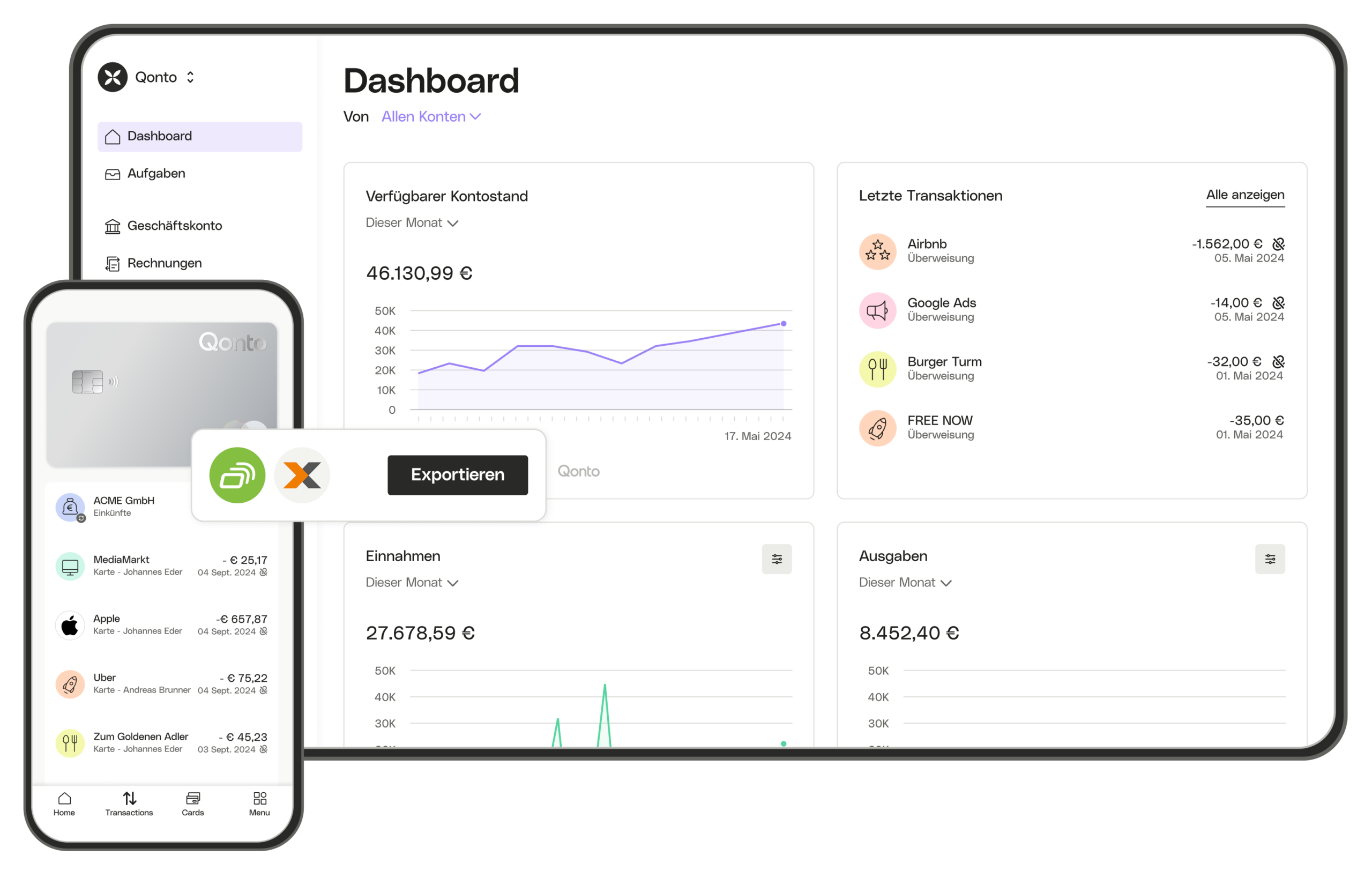

Elster is Germany’s official electronic tax filing system, run by the Finanzämter (Tax Offices). It’s completely free, legally binding, and increasingly sophisticated. The platform now offers a pre-filled Steuererklärung (tax return) that automatically imports data your employer has already submitted.

The upcoming “one-click” feature launching July 1st represents a genuine shift. Single, childless employees and pensioners will receive a fully prepared return that can be submitted with a single tap on their smartphone. With 11.5 million potential users, this could fundamentally disrupt the paid software market.

The catch? Elster still requires you to know what you don’t know. As one long-time user put it: “Beim ersten Mal etwas unübersichtlich und man muss etwas Zeit mitbringen” (The first time is somewhat confusing and you need to invest some time). The interface speaks in pure tax code language, Anlage N for employees, Anlage V for rental income, Sonderausgaben for special expenses. If you don’t know these terms, you’re navigating blind.

Third-Party Tools: Paying for Peace of Mind

The German market offers over a dozen paid alternatives, but they cluster into three camps:

1. The Budget Champions (€5-15)

Aldi Steuer, literally the software sold at Aldi supermarkets, costs €5 and is a rebadged version of Buhl’s Tax software that normally sells for €15-30. It offers guided interviews, automatic plausibility checks, and Elster-compatible data import. For price-conscious filers with moderately complex situations, this hits the sweet spot.

2. The Feature-Rich Workhorses (€35-40)

WISO Steuer dominates this category with 6 million users. Its new SteuerGPT feature provides AI-powered guidance, while photo recognition automatically extracts data from your Lohnsteuerbescheinigung (wage tax certificate). The software syncs across devices and allows up to five tax returns per license, great for families.

The value proposition: WISO claims users get €502 more back on average. But dig into that statistic and you’ll find it’s heavily skewed toward users with complex situations: landlords, self-employed workers, families with multiple income streams. If you’re a single employee renting a flat, your actual advantage might be €0.

3. The Success-Based Models

Taxfix and Steuerbot charge only after you submit, often taking a percentage of your refund. This sounds risk-free, but for a €1,000 refund, you might pay €39.99 plus 2-3%, roughly €60-70 total. That’s more expensive than buying software outright.

Zasta: The Steuerberater (Tax Advisor) in Your Pocket

Zasta occupies a unique position. It’s not just software, it’s a platform connecting you to actual Steuerberater (tax advisors). Pricing is “individual”, which typically means €100-300 depending on complexity. For self-employed individuals or those with rental income, this hybrid approach offers professional oversight without the full cost of traditional advisory services.

The platform’s 4.7/5 rating suggests satisfaction, but the model raises questions: If you need a human advisor, are you better off establishing a direct relationship? And if your case is simple enough for software alone, why pay the premium?

The Hidden Cost: Your Data and the DSGVO Angle

Here’s where the conversation gets legally interesting. When you use third-party tax software, you’re handing over your most sensitive financial data, salary, investments, property details, health expenses, to a private company. While reputable providers encrypt data and host servers in Germany, you’re still granting access.

Under the Datenschutz-Grundverordnung (General Data Protection Regulation), you have the right to know exactly what data these companies store about you. Many international residents don’t realize they can demand a complete data dump from these providers, just as they can from credit bureaus. In fact, protecting personal data when filing taxes should be part of your annual financial hygiene routine.

Elster, as a government system, operates under stricter data protection protocols. Your information never leaves official servers, which for privacy-conscious filers is a decisive advantage.

The AI Wildcard: When Bots Give Tax Advice

WISO’s SteuerGPT and similar features represent uncharted territory. These AI assistants can explain what “Werbungskosten” (income-related expenses) means or calculate your home office deduction. But they cannot, legally or practically, take responsibility for your filing decisions.

The risk isn’t that the AI will deliberately mislead you. It’s that you’ll trust its guidance without understanding the underlying principle. If the Finanzamt questions your return, “the AI told me to” holds zero legal weight. The Haftung (liability) remains entirely yours.

One-Click Filing: Convenience vs. Optimization

Elster’s upcoming one-click feature epitomizes the core dilemma. For a single employee with no extraordinary expenses, clicking “accept” on a pre-filled return is perfectly rational. The Finanzamt already has your income data, the standard deduction applies automatically, the result is legally sound.

But what if you bought a €2,000 laptop for work? Or paid €500 for a professional certification? These expenses might push you over the Pauschale threshold, but the one-click system won’t ask. You’ll get your refund in record time, but it might be €600 less than you deserve.

The Lohnsteuerhilfevereine (wage tax assistance associations) have already warned members about potential financial losses from over-simplified filing. Their business model depends on finding these optimization opportunities, and they’re not wrong, manual review often uncovers legitimate deductions that automated systems skip.

Decision Framework: Who Should Use What?

Use Elster (Free) If:

- You’re a single employee with standard expenses

- Your total work-related costs are clearly under €1,230

- You enjoy understanding the tax system

- Data privacy is your top priority

- You have time to learn the interface

Use Budget Software (€5-15) If:

- You’re comfortable with German tax basics

- You want guided questions without hand-holding

- You need to file for multiple people (partner, children)

- The standard deduction is close to your actual expenses

Use Premium Software (€35-40) If:

- You have rental income or are self-employed

- Your family situation is complex (multiple incomes, children, special expenses)

- You value AI explanations and cross-device sync

- The potential €500+ refund increase justifies the cost

Use Zasta or Tax Advisor (€100-300) If:

- You’re self-employed with significant revenue

- You have complex investment or international income

- You’ve received a tax audit notice before

- The cost is tax-deductible as business expense

The Verdict: Price Is the Wrong Metric

The tax software debate fixates on upfront cost, but the real question is: What’s your time and attention worth? A €35 program that saves you six hours of confusion is cheap. A €0 solution that leaves you uncertain for weeks is expensive.

For 2025 returns due July 31, 2026, the smartest move is to start with Elster’s pre-filled return. Review it critically. If you see obvious missing deductions and feel overwhelmed, upgrade to a guided solution. If it looks complete and your situation is standard, submit and move on.

The controversy isn’t which software is “best.” It’s that the German system is so complex we’ve created a €200 million industry to navigate what should be a simple process. Until tax reform arrives, your best defense is understanding your own situation, then picking the tool that matches, not the one with the flashiest ads.

The refund difference between software winners and losers isn’t in the code. It’s in the user’s willingness to learn which rules apply to them.