Why Your German Social Security Contributions Are Probably Too High (And What Locals Won’t Tell You About Slashing Them Legally)

For middle-income earners in Germany, the real tax monster isn’t the Finanzamt (Tax Office), it’s the Sozialabgaben (Social Security Contributions). A software developer earning €65,000 annually pays roughly €13,500 in income tax but nearly €14,000 in social contributions. That 21% bite out of your gross salary often exceeds what lands in your bank account after taxes. The frustration is palpable among international residents who discover that German social insurance isn’t just expensive, it’s mandatory, inflexible, and until recently, seemed impossible to optimize.

But here’s what German financial forums won’t openly discuss: there are legitimate, legal strategies to significantly reduce these contributions without moving to Switzerland or becoming a digital nomad. The catch? Most require planning, precise timing, and understanding obscure regulations that even some Steuerberater (Tax Advisors) overlook.

The PKV Decision Point: When Private Insurance Obliterates Public Costs

The most powerful lever for contribution reduction is opting out of the Gesetzliche Krankenversicherung (GKV – Statutory Health Insurance) into a Private Krankenversicherung (PKV – Private Health Insurance). This isn’t available to everyone, you need to earn above the Jahresarbeitsentgeltgrenze (JAEG – Annual Income Threshold) of €77,400 in 2026, be self-employed, or be a Beamter (Civil Servant).

The math is stark. In the GKV, you pay 14.6% of your gross income plus a Zusatzbeitrag (Additional Contribution) averaging 2.9%. On a €80,000 salary, that’s €13,920 annually. In a PKV, your premium depends on entry age, health status, and chosen tariff, not your income. A healthy 35-year-old might pay €400 monthly (€4,800 annually), saving over €9,000 per year.

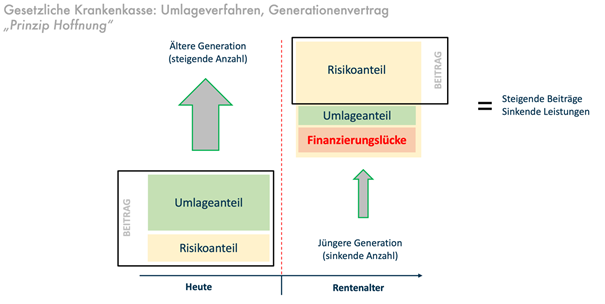

The fundamental difference lies in the financing systems. GKV operates on Umlageverfahren (Pay-As-You-Go), where current contributions fund current healthcare costs. PKV uses Kapitaldeckungsverfahren (Capital Funding), building Alterungsrückstellungen (Age Reserves) that stabilize premiums in retirement. Roughly 30-40% of PKV contributions flow into these reserves, creating a shock absorber that GKV simply lacks.

Critical warning: PKV becomes expensive if you develop chronic conditions or if you can’t maintain payments. The Basistarif (Basic Tariff) caps costs at €1,017 monthly, but that’s still a heavy burden. And once you’re in PKV, returning to GKV after age 55 is nearly impossible due to §6 Abs. 3a SGB V.

The Mini-Job Maneuver: Working Less to Keep More

Here’s where it gets spicy. One finance-savvy engineer discovered that dropping from 100% to 50% employment and adding a €450 Mini-Job (Mini-Job) created a net monthly loss of only €400, but freed up 20+ hours weekly. The trick? Mini-Jobs are social security-free for employees and taxed at just 2% flat rate.

The numbers work because Germany’s social contributions are regressive up to the Beitragsbemessungsgrenze (Contribution Assessment Ceiling). By splitting income between a primary job (where you pay full contributions) and a mini-job (where you pay almost nothing), you optimize the total burden.

This strategy connects directly to staying below full-time income thresholds to optimize net savings and social insurance costs. Many professionals find that the additional free time outweighs the marginal income loss, especially when considering effective hourly rates after contributions.

Implementation detail: The €450 limit is strict. Earn €451 and you’re suddenly liable for full social contributions on the entire amount. The Übungsleiterpauschale (Instructor’s Allowance) offers another €3,300 annually for teaching courses, completely social security and tax-free.

The Cross-Border Maneuver: EU Law as Your Friend

EU Regulation 883/2004 contains a provision that few Germans exploit: if you work in multiple EU/EEA countries, you can choose which social security system to join. A software developer living in Berlin but taking a second contract in Mallorca could opt into Spain’s lower-contribution system.

The most powerful combination? Working in Germany while being socially insured in Switzerland or Denmark. Swiss social contributions are lower for high earners, Denmark charges a flat €3,000 annually regardless of income. The catch: you must genuinely work across borders. Faking this constitutes Sozialversicherungsbetrug (Social Insurance Fraud), with severe penalties.

One entrepreneur legally structured his situation: majority shareholder-Geschäftsführer (Managing Director) in Germany while employed in Switzerland. Despite his primary residence being in Germany, he paid Swiss social contributions on both incomes, still cheaper than German contributions on the combined amount.

The Retirement Contribution Trap: Why GKV Becomes a Nightmare

Here’s what terrifies financially independent retirees: in GKV, capital income, rental profits, and private pensions become beitragspflichtig (contribution-liable). The PKV-Verband calculated that a retiree with €1,887 monthly pension and €1,291 rental income would see their GKV contribution jump from €167 to €380 monthly, a 128% increase.

In PKV, your premium remains independent of retirement income. At age 67, typical PKV costs drop because:

– The 10% statutory surcharge disappears at 60

– Krankentagegeld (Sick Pay) coverage ends at retirement

– Age reserves kick in, guaranteeing €200+ monthly reductions

A retiree with €3,500 monthly pension might pay €165 out-of-pocket for PKV after subsidies, versus €601 for GKV if they have additional income sources.

The subsidy mechanism: Rentenversicherung (Pension Insurance) reimburses 8.75% of your statutory pension (7.3% base + half the Zusatzbeitrag) for health insurance, capped at 50% of your actual premium. You must actively apply for this, it’s not automatic.

The Self-Employed Superpower: Opting Out Entirely

Self-employed individuals hold the ultimate trump card: they can opt out of pension insurance entirely. While employees are trapped paying 18.6% of income into Deutsche Rentenversicherung (German Pension Insurance), freelancers can choose private retirement products with lower fees and better returns.

The trade-off is complex. Opting out means losing disability protection and guaranteed pension adjustments. But for high-earning consultants or IT freelancers, the savings can fund a robust private portfolio. One developer reported saving €1,200 monthly by opting out, investing it in ETFs instead.

GmbH-Geschäftsführer face a hybrid situation: they pay social contributions on their salary but can optimize through dividend distributions, which aren’t subject to social insurance. The Körperschaftsteuer (Corporate Tax) reduction to 15% makes this increasingly attractive.

Practical Implementation: Timing and Pitfalls

For employees eyeing PKV: Switch during stable health periods. Pre-existing conditions trigger Riskozuschläge (Risk Surcharges) or rejection. The Gesundheitsprüfung (Health Check) is rigorous, insurers demand full medical history.

For mini-job strategies: Ensure your primary employer agrees to reduced hours. The Arbeitsvertrag (Employment Contract) must reflect the new reality, or the Finanzamt may reclassify your mini-job as regular employment, demanding back payments.

For cross-border arrangements: Document everything. Keep flight tickets, meeting minutes, and contracts proving genuine cross-border activity. The Deutsche Rentenversicherung audits these arrangements aggressively.

For retirees: Apply for the Rentenzuschuss (Pension Subsidy) simultaneously with your pension application. Delaying can mean months of missed subsidies.

When Reduction Strategies Backfire

A Munich engineer switched to PKV at 40, saved €150,000 over 25 years, then developed a chronic illness. His PKV premium stayed stable, but he couldn’t return to GKV when he wanted family coverage for his children. He hadn’t anticipated that PKV requires separate, full-price policies for each family member.

Another freelancer optimized contributions through a Danish entity, but failed to maintain proper documentation. The Finanzamt ruled it tax avoidance, imposing €40,000 in back payments and penalties.

The most common mistake? Focusing solely on contribution reduction without considering long-term healthcare needs, family planning, or retirement income structure. Reducing working hours or exiting employment works brilliantly for singles without dependents but becomes problematic for families.

Bottom Line: Your Personalized Reduction Strategy

-

Calculate your break-even: If earning above €77,400, compare PKV quotes against current GKV contributions. Factor in family size and health status.

-

Model mini-job scenarios: Use the official Minijob-Zentrale calculator to see how reduced hours affect net income and free time.

-

Audit your retirement income: Project capital income, rentals, and private pensions. If significant, PKV’s income-independent premiums offer massive savings.

-

Check EU mobility: Genuine cross-border work opens system arbitrage opportunities, but requires professional structuring.

-

Consult a Fachberater: Sozialversicherungsrecht (Social Insurance Law) specialists cost €200-500 hourly but can save tens of thousands when structuring complex situations.

The German social security system operates with the same efficiency as a Deutsche Bahn train, usually impeccable, until there’s construction on the line. Understanding these legal optimization strategies is your ticket to bypassing the delays and arriving at your financial destination with more money in your pocket.